Report #23

According to John Moody from FoxNews, Republican member of the US House of Representatives, Duncan Hunter, plans to introduce legislation this month to require the US military to obtain rare earth elements (“REEs“) that are produced in the US, even if it means subsidizing those industries. More specifically, he said:

“This is of critical importance to our national security and ability to stay ahead of everyone else. Rare earth metals are crucial. We’ve closed down mines in my own state of California, which is the leading edge of stupid. We need to have our own rare earths. The big sticking part of the bill is this. You have to put money in to subsidize our own product to create a market, because now there’s no market. We’ve got to put American manufacturing back in competition.”

However, as Moody asserts correctly:

“The problem is that US production capacity in this area has been allowed to wither to almost nothing, due to plentiful supplies from China that can be produced at a lower price than US made rare earths.“

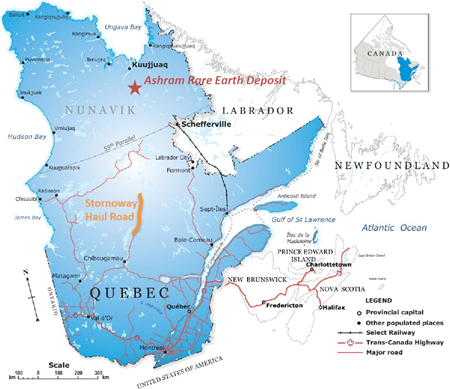

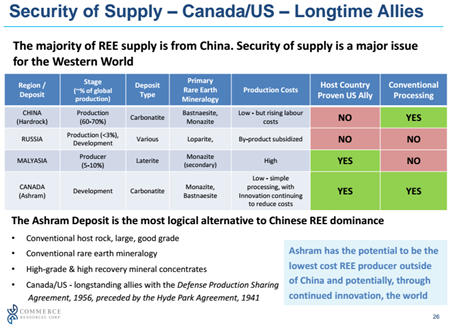

Commerce Resources Corp.’s Ashram Rare Earth Project in Québec is firmly in the mainstream of the majority of REE producing mines in the world in that it is a carbonatite hosted project with monazite and bastnaesite as the dominant REE bearing minerals. The importance of this must be stressed in that Commerce is not looking for, nor does it need to find, a new processing technique to concentrate the REEs contained in its Ashram Deposit.

.png)

I think the history of the company is a compelling story and in my recent interview with President Chris Grove he outlined how he and the former President Dave Hodge were educated on REEs.

“Commerce Resources was created around a set of claims in British Columbia in the Blue River area that Dave’s son, my nephew, Mike Hodge hand staked in the winter of 1999 with Ruben Verzosa. We were looking for, and found, several deposits with good grades of tantalum and niobium. We still own these claims and we are looking for a joint venture partner for the Upper Fir Project, which is the largest production scenario for tantalum currently.

Geologically, this set of claims is very notable because there are about 30 mineralized carbonatites we have found and worked on. In the summer of 2005 I received a call from a Texas-based magnet manufacturer who said “You guys need to go out and re-assay all of your drill core for REE’s“. I said to him “why would we want to do that?“ And he answered because you must know that a) China has put export duties on the REEs and b) that all of the world’s REEs are from carbonatite hosted deposits, and c) you must know that your Blue River claims are carbonatite hosted.“

I did answer that I knew we had carbonatite hosted deposits at Blue River, but the rest of what he had said was a very quick and informative education as to what is the norm for the majority of REE production in the world.

From that point on, we looked at, sampled and drilled many showings on our claim groups although we did not find anything that was, in our opinion, world-class.

However in late 2006, the price of niobium quadrupled, and so we started looking for a primary niobium deposit and that is how we ended up staking the Eldor Carbonatite in Québec in early 2007.

It should be noted that all of the world’s niobium comes from carbonatite hosted deposits as well, and as soon as we began our first program at Eldor in the summer of 2007, after having raised $32.7 million CAD, we were looking for both a world-class niobium deposit and at the same time a world-class REE project. We did release some spectacular grades for niobium, tantalum, phosphate and fluorspar in the year’s following, but on the last day of the 2009 summer program, Ashram Project Manager Darren Smith directed Ashley Peter-Rennick (Ash) and Rameses D’Souza (Ram) to sample what was to become the Ashram Rare Earth Deposit. The rest you might say is history.

We knew what to look for, we found what we were looking for, and the fact that the Ashram can be processed by the standard techniques that the majority of REE producers worldwide employ, is just at the end of the day, the most logical thing“.

The Ashram Deposit also has a unique and well-balanced REE distribution which affords greater market flexibility, anchored by those rare earths that have the strongest market fundamentals over the near, mid, and long-term, being the magnet feed REEs. The Project is also located in a great jurisdiction, is large, of good grade, and hosts the simple rare earth mineralogy that has been demonstrated upgradeable into high-grade mineral concentrate (>45% REO) with high recoveries (>75%); which means it is comparable to producers.

No other rare earth project in development can process their material as effectively as that done with Ashram. In other words, Ashram has the ingredients to compete with Chinese supplies. Which other REE project in North America can say that?

When Commerce Resources was awarded a $300,000 grant from the Québec Government for environmental work in mid-2016, Rockstone quoted Vincent van Gogh‘s “Great things are not done by impulse but by a series of small things brought together“. Last Friday, Commerce Resources completed a $1.7 million CAD financing led by the $1 million investment from Ressources Québec, a subsidiary of the provincial government corporation Investissement Québec that focuses on “projects that have good return prospects and foster Québec‘s economic development.“ Commerce Resources‘ President, Chris Grove, commented:

”We are excited to have the support of the Quebec government with this investment from Ressources Québec. The Province of Quebec continues to prove that it is one of the most attractive jurisdictions to develop a mineral project. We are excited to be advancing our Ashram Project with this financing.”

Ressources Québec has capitalization of more than $500 million for investments in these industries and also manages the Capital Mines Hydrocarbures Fund, which has a $1 billion funding envelope, which includes $500 million for projects carried out on the Plan Nord territory and $500 million for Québec as a whole. This fund will enable the Québec government to acquire share positions in mining and oil and gas companies that exploit and process minerals in Québec.

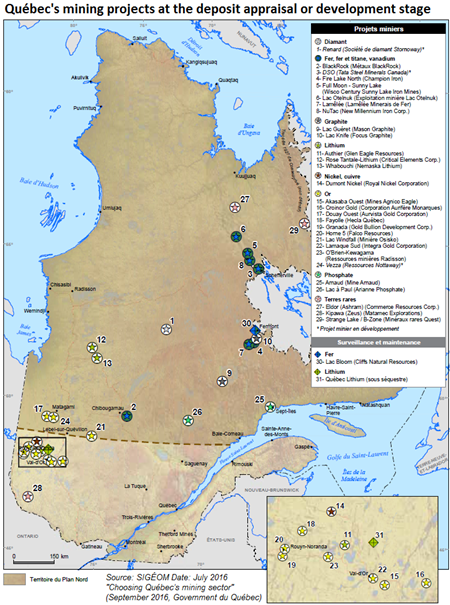

International mining companies have chosen to invest in Québec:

• Some 23 active mines are located in Québec.

• Glencore now has 4 underground mines in operation in Québec, and a 5th one under construction.

• Until 2014, Goldcorp built one of the biggest gold mines in Canada, the $1.8 billion Eleonore Mine in the James Bay region of northern Québec, which is expected to eventually become Canada‘s largest gold producing mine with an annual output of >300,000 oz of gold.

• Osisko Gold Royalties, a major player in Québec‘s mining industry, received a $50 million convertible debenture from Ressources Québec in 2016.

• In March 2016, Nemaska Lithium received a $13 million investment from Ressources Québec. In July, Nemaska completed a $69 million financing and was upgraded to trade on the TSX.

• Tata Steel Minerals Canada, a joint venture of India’s Tata Steel (94%) and Calgary’s New Millennium Iron Corp. (6%), is carrying out a $1.5 billion direct shipping iron ore mining project near Schefferville in northern Québec. In November 2016, Ressources Québec granted the company a $50 million loan and took a $125 million equity stake to support this project. Minister Lise Thériault explained: “Support for this major project confirms our commitment to stimulating the growth of Québec’s mining industry, particularly in northern Québec, and to encouraging responsible development of our resources.“ The DSO project will produce 6 million tonnes of iron ore annually during seasonal operation. The ore is expected to be railed to the port of Sept-Iles.

• Stornoway Diamonds built a mine in central Québec, which came online 2 months early in October 2016 and under budget, costing just $775 million to complete. In 2014, Stornoway completed $944 million in financing transactions: $220 million in funding through the province-run Investissement Québec, $105 million from the Caisse de Dépôt et Placement du Québec Pension Managers and $360 million from the privately-owned Orion Mine Finance. Although Stornoway notes that financial assistance was crucial in getting Renard operational, it was actually the 240 km extension of Route 167, constructed with the help of a $77 million loan from the province, that was the most beneficial contribution from Plan Nord. The road will open access to other mining projects in the area. For the Quebec government, the symbolism of Stornoway’s launch goes beyond opening a new mine with a new resource. It represents the first project to be completed under the auspices of the Plan Nord. “Stornoway is an extraordinary example of the vision we had as a government,” said Pierre Arcand, Quebec’s Minister of Energy and Natural Resources, who is also responsible for overseeing Plan Nord.

.jpg)

According to “Choosing Québec‘s mining sector“ (by Gouvernement du Québec, 2016):

“Rare earth elements constitute a global-scale strategic resource. Forecasts call for rising demand due to their applications in the high-tech and clean technology sectors, particularly in the hybrid and electric vehicle industry.

Québec has never been a rare earth producer, but may become one in the near future thanks to its promising potential, particularly for heavy rare earths. Three projects have reached the deposit appraisal stage and may someday supply rare earth oxide concentrates.

In Nunavik, 130 kilometres south of Kuujjuaq, the aim of the Ashram (Eldor) project of Commerce Resources Corp. is to extract rare earths from a carbonatite. The project involves the mining and on-site concentration of the rare earth ore followed by off-site processing at a hydrometallurgical plant in southern Québec to produce a mixed rare earth carbonate concentrate. Work in support of a prefeasibility study is already underway...“

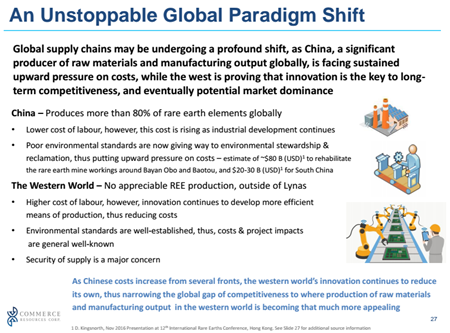

Security of REE Supply and an Unstoppable Paradigm Shift in the Western World

.png)

Competing Claims In The South China And East China Seas. These are the approximate claims by China and other countries. In many cases, countries are intentionally vague about the extent of their claims.(Source: NPR.org; Credit: Katie Park / NPR

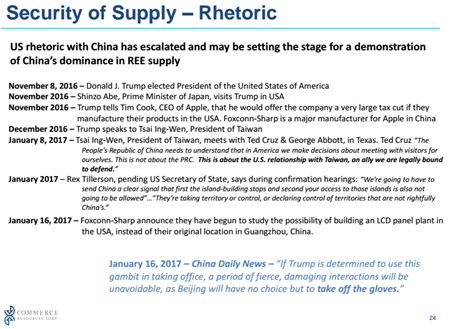

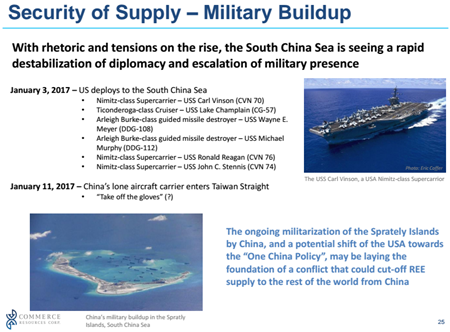

A corporate presentation from Commerce Resources Corp. had been prepared for the Trump-focussed conference “Investing in Mining & Metals: A Paradigm Shift in the Trump Era“ (January 19, 2017 at the Union League Club in New York hosted by Murdock Capital Partners).

PDF

See pages 23-29 specifically made for the NY conference and arguably very relevant to the current geopolitical issues happening these days.

The potential for some kind of reaction from China could effect a range of metals, including cobalt, REEs, iron ore, etc.

Rex Tillerson, the former Exxon Mobil CEO nominated to lead the US State Department, told the Senate Foreign Relations Committee that China´s actions in the South China Sea were “extremely worrisome“ and compared them to Russia´s annexation of Crimea. Tillerson said the situation was a potential “threat to the entire global economy.“

.png)

We have a national security crisis: Let‘s do nothing

By John Moody of FoxNews.com on February 8, 2017

.jpg)

Click here to watch video from FoxNews

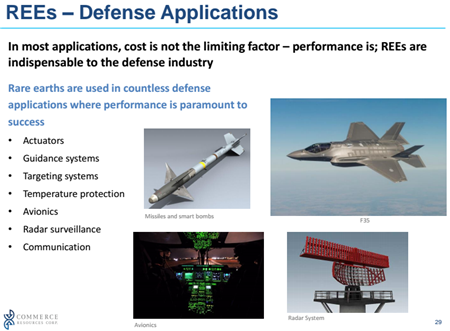

Can the United States do anything to reverse a dangerous dependence on crucial mineral supplies that put our future military security in the hands of China? We may be about to find out.

The challenge to our future security was outlined in a grim, largely overlooked report from the U.S. Geological Survey. In stark terms, it demonstrated that the U.S. is 100 percent reliant on foreign producers for at least 20 elements and minerals, some of them of strategic importance to our military. The most common source: China.

As Bellwether noted last week, a group of 17 materials, known collectively as rare earths, are produced almost exclusively by China. That’s the country President Trump has labelled a currency manipulator and trade cheat and which he has vowed to bring to heel in future bilateral negotiations.

The USGS report, points out other metal deficiencies, and raises serious questions about how much leverage the U.S. will have over China. Almost all the minerals in question are essential components needed for advanced fighter bombers, satellite guided missiles and catapults that launch planes from the decks of aircraft carriers.

“That 2017 USGS report is not fake news,” says George Byers, a 40-year mining industry veteran and rare earth expert. “You have 29 or 30 studies on critical materials, including rare earths that go back to the early ‘90s. The outcome of each study is to declare ‘we have a crisis, let’s do something about it.’ But all they do about it, is to ask for another study.”

Rep. Duncan Hunter (R-Calif.), plans to introduce legislation this month to require the U.S. military to obtain rare earths that are produced in America, even if it means subsidizing those industries.

“This is of critical importance to our national security and ability to stay ahead of everyone else,” Hunter told me. “Rare earth metals are crucial. We’ve closed down mines in my own state of California, which is the leading edge of stupid.We need to have our own rare earths. The big sticking part of the bill is this. You have to put money in to subsidize our own product to create a market, because now there’s no market. We’ve got to put American manufacturing back in competition.”

The problem, these analysts note, is that U.S. production capacity in this area has been allowed to wither to almost nothing, due to plentiful supplies from China that can be produced at a lower price than U.S. made rare earths.

Even more perilous, China’s own rapacious demand for rare earths is outstripping its ability to supply domestic consumers as well as the U.S., meaning it may be unable to ship goods to the U.S. even if it wants to.

In addition to rare earths, which are vital components of high-grade permanent magnets used in military aircraft and missile systems, the United States, according to the USGS report, is now 100 percent reliant on foreign countries for supplies of manganese, which is used to make impact resistant steel, among other things. Though readily available in mines in Arizona, Arkansas and Minnesota, it can be imported more cheaply. The USGS study lists American production of manganese last year as: zero.

Hunter’s legislation aims to put an end to that. The bill would divert funds from military aircraft and missile weapons systems to support domestic production rare earths and other vital materials. It would also provide five-year interest free loans to U.S. producers, giving them time to ramp up abandoned and neglected facilities.

That may be just in time to prevent further foreign encroachment on our manufacturing base. Peg Brickley of The Wall Street Journal reported this week that Vladimir Iorich, a Russian-born billionaire with German nationality, is trying to take control of Mountain Pass mine in California, once the largest domestic source of rare earths.

That mine was once the production facility for Molycorp, the only significant American producer of rare earth metals. Molycorp went bankrupt in 2015, partly due to the Obama administration’s refusal to help bail it out of its $1.4 billion debt.

Instead, the previous administration sank hundreds of millions of dollars in Solyndra, a solar power company that comported with the former president’s advocacy for renewable energy. The problem was, solar energy panels also use rare earth metals. Solyndra, which also went belly-up, ended up importing the solar cells it needed – from China.

China‘s secret Trump card: Could Beijing deprive our military of critical defense components?

By John Moody of FoxNews.com on February 3, 2017

Jan. 17, 2017: China’s President Xi Jinping speaks at the World Economic Forum in Davos, Switzerland. (AP Photo/Michel Euler)

Candidate Donald Trump promised to bring jobs back to America, rebuild our military, and on trade get tough with China, which he said was “raping” our economy. President Trump may find his administration the victim of exactly the job-exporting policies he railed against and face the very real possibility that China could cut off U.S. access to 17 rare materials vital to our advanced aircraft and guided missile systems.

Among major U.S. military projects imperiled by a potential China squeeze play is a $340 billion Navy program to create new, Columbia-class nuclear submarines, and a new electro-magnetic aircraft launch (EMAL) system, which the Navy hopes to use for catapults that launch planes from aircraft carriers.

The 17 materials, known as rare earth elements (REE), are essential to the production of the high-performance permanent magnets used in both those systems, as well as in motors and missiles, GPS systems, satellite imaging, night vision goggles, and consumer products like smartphones and flat television screens. And for precisely the reasons Candidate Trump cited for the decline of American manufacturing and the loss of U.S. jobs, China is now in a position to cut off our supply of processed rare earth elements if it feels Trump is pushing too hard on trade and economic issues—or anything else.

“Absolutely, China could cut off the supply,” said Jeff Green, a defense industry analyst in Washington, D.C. “Processing rare earths is the end of the hose. China controls the spigot the hose is attached to.”

This dire situation came about largely as a result of a U.S. decision to rely on China, which is estimated to produce 90 percent of all processed rare earth elements sold to U.S. consumers, including the Pentagon. In 1995, the Clinton administration allowed two U.S. rare earth producers, in North Carolina and Indiana (the home state of Vice President Mike Pence) to go out of business. They transferred their production capacity to China, leaving it as the world’s only large-scale REE supplier.

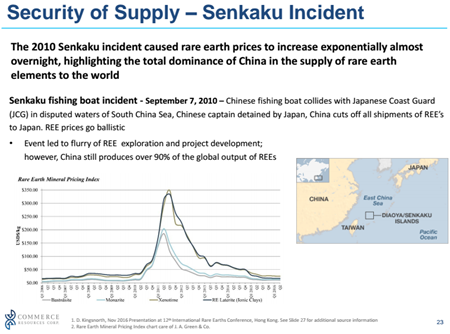

The supply chain worked smoothly until 2010, when the Japanese navy detained a Chinese fishing boat as part of a territorial dispute. China promptly choked off REE sales to Japan, and imposed worldwide supply quotas. Almost overnight, the price of REEs soared 4,000 per cent worldwide, demonstrating China’s ability to control the market at will.

Sensing an opportunity, a Colorado-based company called Molycorp tried to ramp up American REE production, using a mine and plant in southeastern California known as Mountain Pass. When China lost a World Trade Organization challenge and revoked its production quotas, the price of REEs tumbled and Molycorp found itself refining a product that could be made much more cheaply, and of higher quality, in China.

The Obama administration, determined to support renewable sources of energy, declined to bail out Molycorp, even while pumping hundreds of millions of dollars into a solar panel company known as Solyndra. Solar cells also use REEs. Solyndra ended up importing solar cells from China. The company went bankrupt, as did Molycorp in 2015.

It is unclear what the Trump administration can do to eliminate U.S. reliance on China for REEs, at least in the short term. Later this month, a court in Delaware is expected to authorize an auction to bring Molycorp out of bankruptcy, and, potentially revive REE processing in California.

The problem is that REE production technology was transferred to China during the Clinton administration, and the Chinese are now thought to have an insurmountable advantage.

In 1992, Chinese leader Deng Xiaoping, said, “The Middle East has oil. China has rare earth.”

The implications of that remark are now being felt. They may include profoundly challenging a U.S. president who came to power promising to bring China to heel.

John Moody is Executive Vice President, Executive Editor for Fox News. A former Vatican correspondent and Rome bureau chief for Time magazine, he is the author of four books, including “Pope John Paul II : Biography.“

The Ashram advantage: Commerce Resources prepares for a rare earths paradigm shift

By Greg Klein of ResourceClips on January 30, 2017

The appeal to Western markets is obvious—an advanced, low-cost rare earths project in a friendly jurisdiction. So even before the recent military build-up in the South China Sea, Commerce Resources TSXV:CCE experienced an increase in American requests for concentrate samples from its northern Quebec Ashram deposit. With the U.S. Navy now challenging Chinese territorial aggression, the confrontation seems to pit two superpowers against each other. But what does that really indicate?

It’s actually “one lonely small old Russian-built carrier against three U.S. Nimitz-class supercarriers,” Commerce president Chris Grove points out. “So when Beijing says it’s going to take off the gloves, I think they’re referring to trade.”

Commerce Resources prepares for a rare earths paradigm shift

That brings to mind the Senkaku incident, a much smaller 2010 confrontation in the same region that prompted China to cut off rare earths exports to Japan, sending global supply chains into turmoil and prices soaring. A possible Senkaku redux is one of a number of aspects to a global paradigm shift that Grove sees coming, to the benefit of Western industry in general and Ashram in particular.

The U.S. might easily outgun China, but China produces about 90% of the world’s rare earths. They’re essential to several defence needs, “a fact that really drives certain people in the U.S. absolutely apoplectic,” says Grove.

While Westerners have struggled to compete with China on costs, prices mean little to the U.S. Department of Defense, which last year began putting money behind potential domestic processors, Grove says. That support complements a multi-faceted advantage that the West is gaining over China, he explains. The latter country struggles with rising labour costs and the need to finally address its environmental woes. Meanwhile Western countries offset their labour costs with technological innovation and maintain the world’s highest environmental standards.

Even putting aside defence, demand for rare earths continues to grow with another global development. The international commitment to address climate change through clean energy, exemplified by the Paris Agreement, increases rare earths demand for numerous applications ranging from EVs to wind turbines.

In a research report last year, Chris Berry noted that “REE usage continues to grow at a pace well above global GDP growth with demand CAGRs growing anywhere from 4% to 8%, with permanent magnet demand forecast to lead this charge to 2020.”

Clearly there’s a market for non-Chinese sources. And Grove sees Ashram uniquely positioned to help serve that market. Certainly others have failed but, he emphasizes, they lacked Ashram’s benefits of mineralogy, metallurgy, grade and jurisdiction—all of which add up to lower costs.

The project reached PEA in 2012, with an amended PEA in 2015. Since then the company’s been busy on multiple fronts as it advances towards pre-feasibility.

Ashram’s advantage begins with its relatively simple mineralogy, with carbonatite host rock and rare earths within the minerals monazite, bastnasite and xenotime, which dominate commercial REE processing.

Pilot plant metallurgical tests have quadrupled the PEA’s concentrate grade, producing 41% total rare earth oxides and 43% TREO, both at 71% recovery. That puts the grade well within the range of commercial producers and does so through a single-leach process that simplifies the flowsheet.

Requests for concentrate samples have come from Solvay, Mitsubishi, Treibacher, BASF, DKK, Albemarle and Blue Line, among others covered by non-disclosure agreements.Metallurgy has also found a potential fluorspar byproduct, offering an advantage to both revenue and opex. Grove credits Glencore Canada’s interest in fluorspar with the willingness of its NorFalco Sales division to supply Commerce with sulphuric acid on highly favourable terms.

Proud as he is of Ashram’s high-grade, near-surface resource, Grove anticipates an even more impressive upgrade. The current estimate uses a 1.25% cutoff to show:

• measured: 1.59 million tonnes averaging 1.77% total rare earth oxides

• indicated: 27.67 million tonnes averaging 1.9% TREO

• inferred: 219.8 million tonnes averaging 1.88% TREO

Ashram has undergone another 9,200 metres since its resource estimate, often hitting even higher grades.

Commerce has since drilled another 9,200 metres, mostly infill but always with some stepout holes as well. “In all those drill programs, we always hit mineralized material in the stepouts, we always encountered less waste rock at surface than was modelled in the resource and we always hit zones that were higher than the average grade,” he says.

Ashram’s magnet feed distribution also has Grove enthused. Overall, the deposit ranks with the largest producers for praseodymium, neodymium, terbium and dysprosium. Ashram’s medium-to-heavy REO resource, moreover, surpasses the producers for those elements. And, as Grove points out, those are critical elements. Efforts to find substitutes for magnet REEs have failed.

Benefiting both Ashram’s opex and the environment would be wind energy, currently being studied for the project.

Commerce’s environmental commitment as well as its community outreach have been recognized by the e3 Plus Award for social responsibility from l’Association de l’exploration minière du Québec.

The company has also received a $300,000 provincial grant to optimize tailings management, funding that shows Quebec’s commitment to mining as well as the environment. Grove calls the province “a fantastic jurisdiction,” one that invests directly in companies through Ressources Québec and makes tangible progress on the visionary Plan Nord infrastructure program.

Following a private placement of up to $2.5 million offered last month, Grove looks forward to a number of near-term milestones. Still to come are final assays from last year’s drilling. The agenda also calls for completing the pilot plant and filling requests for REE and fluorspar concentrate samples. The samples, Grove suggests, could spur interest in a JV or offtake agreement.

The Commerce quest for rare metals hasn’t been confined to rare earths. Last September sampling on the company’s property about a kilometre from Ashram found “spectacular” results up to 5.9% niobium pentoxide, described by Grove as “approximately double the grade of the largest and longest-running niobium producer’s head grade, CBMM’s Araxa deposit in Brazil.”

Commerce also holds the Blue River project in southeastern British Columbia. The property’s Upper Fir tantalum-niobium deposit reached PEA in 2011 and a resource update in 2013.

But Commerce remains very much focused on Ashram. Whether events in the South China Sea send RE prices soaring, Grove sees possible increases coming from producers boosting revenues. But, he emphasizes, Ashram doesn’t need higher prices. “Companies with higher operating costs are probably praying for higher prices,” he says. “Commerce Resources doesn’t need them. We still have a margin at today’s prices.”

The NASA model: How the U.S. government might help build a rare earths supply chain

By Greg Klein of ResourceClips on February 14, 2017

The U.S. government shows increasing concern about relying on China for defence needs. (F/A-18 Super Hornet jet fighter photo: Boeing)

The timing seems ominous. As rival American and Chinese warships assert themselves in the disputed South China Sea, the United States Geological Survey reported 20 minerals on which the U.S. imports all of its supply. Included are rare earths—coming almost entirely from China, of course. It was a 2010 conflict in the same troubled waters between Japan and China that caused the latter country to cut off rare earths exports to its adversary. As other supply chains broke apart, REE prices went on an exponential tear. Might China do that again and, this time, are American decision-makers sufficiently concerned?

They should be, say some observers. Additionally, there also looms the possibility of a trade war sparked by U.S. tariffs on Chinese goods. Yet some REEs are necessary not only for consumer electronics and clean energy, but also for military defence.

The 20 entirely foreign-dependent minerals reported by the USGS represent an increase from 19 the previous year and 11 in 1984. The list includes rare earths, scandium and yttrium as three separate categories. In February 2016 Industrial Minerals reported that the U.S. Department of Defense “identified 15 of the 17 rare earths as critical over the last five years.”

Having foreseen as far back as 2009 the possibility of China using REEs as a geopolitical strategy, Jeff Green watches the topic from a defence perspective. “I think about the tools China has to retaliate and rare earths come right to the top of the list,” he says.

Green has recently served on the U.S. House Armed Services Subcommittee on Readiness. He’s a lawyer, a member of the U.S. Magnetic Materials Association and the REE World Advisory Board, a U.S. Air Force Reserve colonel and a former USAF missile combat crew commander. He describes his Washington firm J.A. Green & Company as “primarily a defence lobbying company that’s really interested in the nexus between national resource security and national security.”

He finds the U.S. government’s concern stronger and better informed than previously. That contrasts with events leading to what he calls the “Molycorp fiasco,” a supposed market solution to the 2010 shock and a strategy that he warned against. It went on to “burn the market to the tune of one and a half billion dollars.”

The result? “Today we’re probably in a more dire China-dependent situation than ever before.”

But Green sees hope in a Congressional bill that he anticipates being introduced within a week or so. Rep. Duncan Hunter’s proposal would help American companies develop domestic supplies of REEs and other minerals critical to defence. Assistance could come in the form of no-interest loans, Green says. Additionally the Department of Defense might pay more for American products made from American commodities, with the government reimbursing the difference between domestic and Chinese costs until American companies can compete.

As for the bill’s chances of success, Green’s optimistic. “You’ve got an administration that is very pro Buy American, Hire American. You’ve got a Congress that very much supports manufacturing. It will be much more pro-mining, pro-industry than we’ve seen. It’s not a pure free market economic philosophy but one that will say: ‘If we’ve got a critical supply risk and we’ve got domestic companies that can fill that gap, then let’s invest in America to protect our national security and grow our manufacturing base.’

“It’s a totally different dynamic than Washington’s seen in 40 years.”

Chris Berry agrees about the need for subsidies, among other assistance. In a research report last year the president of House Mountain Partners and editor of the Disruptive Discoveries Journal warned of the cost of not creating a supply chain outside China. In an e-mail to ResourceClips.com he notes that the “mine permitting, exploration and building process would all need to be expedited through legislation and through subsidies. This is the only way I see non-Chinese deposits being able to compete with China’s RE production costs. The good news is that as various technologies grow in importance (such as EVs) and existing processes grow as well (fluid cracking catalysts), this implies steady demand for REEs.”

While Berry considers the establishment of new supply chains “a multi-year endeavour,” he adds, “a focus on recycling or funding of materials science to minimize foreign dependence of these materials is a reasonable near-term solution to encourage supply chain development.”

As for the raw materials, Green maintains the U.S. has REE resources sufficient for defence needs, which he says are relatively small. “We’re not trying to compete globally in the automotive, magnet or catalyst markets,” he emphasizes. “We’re trying to protect our national security needs.”

Yet the Congressional bill calls for assistance to all aspects of the supply chain, he says, “whether that’s processing, refinement, separation, beneficiation, metal production, alloy production, magnet production.”

Support for supply chains would benefit other sectors, he points out. “This is the old NASA model. The government for years invested in new technologies and we’ve reaped the benefits in consumer advancements. Just look at the refining industry for petroleum products, at catalysts, phosphors in electronics, magnets for vehicles, battery materials. I think the commercial applications are terrific.

“I believe the president will kind of cheerlead this effort along,” he adds. “That’s really a game-changer. He’s going to take the traditional free trade model and turn it on its head. He’ll say the rest of the world doesn’t play by these rules so we’re going to play smarter—we’re going to treat our industries like the rest of the world treats theirs.”

Company Details

Commerce Resources Corp.

#1450 - 789 West Pender Street

Vancouver, BC, Canada V6C 1H2

Phone: +1 604 484 2700

Email: cgrove@commerceresources.com

www.commerceresources.com

Shares Issued & Outstanding: 293,859,400

.png)

Canadian Symbol (

TSX.V) : CCE

Current Price: $0.08 CAD (02/21/2017)

Market Capitalization: $24 million CAD

German Symbol / WKN (Tradegate): D7H / A0J2Q3

Current Price: €0.057 EUR (02/21/2017)

Market Capitalization: €17 million EUR

Previous Coverage

Report #22 “Security of REE Supply and an Unstoppable Paradigm Shift in the Western World“

Report #21 “Commerce well positioned for robust REE demand growth going forward“

Report #20 “Commerce records highest niobium mineralized sample to date at Miranna“

Report #19 “Carbonatites: The Cornerstones of the Rare Earth Space“

Report #18 “REE Boom 2.0 in the making?“

Report #17 “Quebec Government starts working with Commerce“

Report #16 “Glencore to trade with Commerce Resources“

Report #15 “First Come First Serve“

Report #14 “Q&A Session About My Most Recent Article Shedding Light onto the REE Playing Field“

Report #13 “Shedding Light onto the Rare Earth Playing Field“

Report #12 “Key Milestone Achieved from Ashram’s Pilot Plant Operations“

Report #11 “Rumble in the REE Jungle: Molycorp vs. Commerce Resources – The Mountain Pass Bubble and the Ashram Advantage“

Report #10 “Interview with Darren L. Smith and Chris Grove while the Graveyard of REE Projects Gets Crowded“

Report #9 “The REE Basket Price Deception & the Clarity of OPEX“

Report #8 “A Fundamental Economic Factor in the Rare Earth Space: ACID“

Report #7 “The Rare Earth Mine-to-Market Strategy & the Underlying Motives“

Report #6 “What Does the REE Market Urgently Need? (Besides Economic Sense)“

Report #5 “Putting in Last Pieces Brings Fortunate Surprises“

Report #4 “Ashram – The Next Battle in the REE Space between China & ROW?“

Report #3 “Rare Earth Deposits: A Simple Means of Comparative Evaluation“

Report #2 “Knocking Out Misleading Statements in the Rare Earth Space“

Report #1 “The Knock-Out Criteria for Rare Earth Element Deposits: Cutting the Wheat from the Chaff“

Disclaimer: Please read the full disclaimer within the full research report as a PDF (here) as fundamental risks and conflicts of interest exist.