The name “Osisko” is very familiar to Canadian mining investors, especially those investors interested in the precious metals sector. Osisko Mining Corporation explored, developed, and put into production the famous Canadian Malartic gold mine, currently the largest Canadian gold producer.

The name “Osisko” is very familiar to Canadian mining investors, especially those investors interested in the precious metals sector. Osisko Mining Corporation explored, developed, and put into production the famous Canadian Malartic gold mine, currently the largest Canadian gold producer.

One of the world’s largest pure gold producers, this 55,000 tonne/day mine was sold jointly to Yamana Gold and Agnico Eagle Mines in 2014, for an eye-popping price of $4.4 billion. In 2015; the mine produced a record 571,618 ounces of gold.

Osisko Mining’s shareholders were rewarded for their support of the original company in the sale of Canadian Malartic. The question for the experienced management team of Osisko Mining was “what next?” The answer to that question, at least in part, was Osisko Gold Royalties Ltd. (TSX: OR, OTCQB: OSKGF, NYSE: OR, Forum).

Most precious metals investors are familiar with the basic royalty business model, as it has been applied to the precious metals sector. Companies like Franco Nevada, Silver Wheaton, and (more recently) Sandstorm Gold have produced solid long-term gains for investors, while omitting something which is normally seen in conventional mining operations: risk.

Precious metal royalty companies provide badly needed financing for precious metals mining companies. As the name implies, in return these financial companies take a royalty interest and/or production stream from the mining company receiving this financial infusion. The royalty/production stream that is taken as quid pro quo in the transaction is a net interest.

What this means is that the precious metal royalty company receives its ounces of production or revenue stream with zero (or very little) costs attached. Conventional gold mining companies produce gold, but most of their revenues are eaten up in the production costs of extracting and processing the ore which yields this gold.

This distinction is of enormous importance in volatile metals markets where prices see-saw higher and lower. A conventional gold mining company, even a profitable one, could see its margins evaporate in the face of falling gold prices, to the point where a profitable mine can become a money-loser.

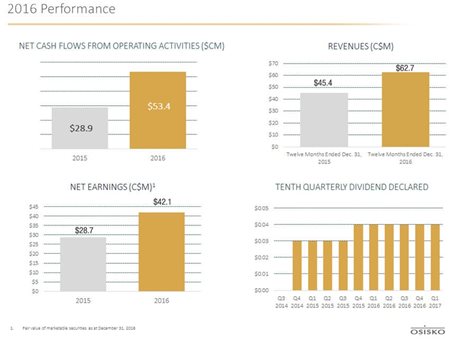

In contrast, as the royalties and production streams mature for a royalty company, shareholders are assured of profitability. Indeed, this guaranteed profitability leads to another feature of these royalty companies which is seldom seen with conventional miners: dividends.

Profits. Dividends. Zero risk. Investors looking at that trifecta may ask themselves what’s not to like about gold royalty companies?

Mining investors familiar with the high-risk/high-reward model of junior miners would volunteer an answer: long-term growth potential. The seasoned management team of Osisko Gold Royalties know mining investors almost as well as they know mining. Their response to the quest for growth potential among mining investors was simple: let’s give them growth, as well.

This is the mission of OR, building a better gold royalty company: profits, dividends, and growth. How does a royalty company add a substantial growth component to its business model, to go along with the profits and dividends?

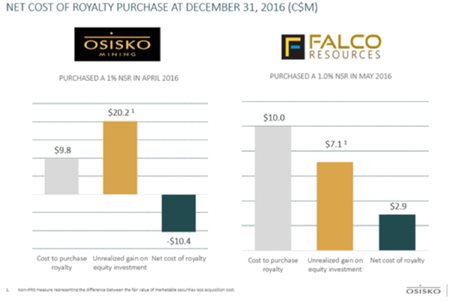

Also simple. Along with negotiating a royalty interest with its mining partners, the Company is very happy to take a block of shares from the mining company receiving financial assistance. How does this additional wrinkle affect the royalty business model?

(click to enlarge)

As Osisko’s equity interest in its mining partner appreciates, the effective cost of the Company’s royalty interest moves below zero if/when the shares appreciate significantly. But this is only one of the innovations which Osisko Gold Royalties is bringing to the gold royalty business model.

Obviously OR has a vested interest in seeing these mining partners move to production as quickly as possible. Equally, it is in the best interests of the Company to see the shares of its mining partners appreciate as rapidly as possible.

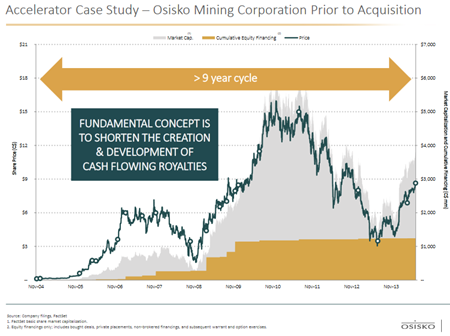

How do you develop an even better gold royalty business model? Accelerate the path to production for its mining partners, and thus accelerate the appreciation in the share price of these companies. Introducing the Osisko Gold Royalties “accelerator model”:

(click to enlarge)

It’s tough being a junior mining company in the 21st century. It’s even tougher to try to bring a project to production, and the task becomes more difficult each year in the face of soaring cap-ex costs. OR is the “big brother” which is lending a helping hand to these juniors.

The Company takes all of the expertise it acquired in putting Canadian Malartic into production and it gives its junior mining partners the benefit of this experience. It does this because it’s the fastest way for Osisko to help its royalty interests mature, and the fastest way to boost the value of the equity interests it holds.

Win/win.

This general philosophy is known as “enlightened self-interest”. You go out of your way to help your business partners prosper, and in doing so you prosper as well. Osisko Gold Royalties has brought enlightened self-interest to the gold royalty business model. In doing so, it is not only putting a smile on the face of its mining partners, it is doing the same thing for its own shareholders.

The strategy was/is impeccable. It only remained for Osisko’s management team to execute on that strategy. Executing a business plan is an area where this management team already has a track record of success. Who are the principals of that team?

The Company is led by its Chairman and CEO Sean Roosen. Roosen was a co-founder of Osisko Mining, and the driving force in transforming that junior mining company into a leading intermediate gold producer. He has help – lots of it.

Bryan Coates is the President of Osisko Gold Royalties. Also part of the original team that put Canadian Malartic into production, Coates has more than 30 years of experience in the mining industry.

Handling much of the business end of OR’s operations is Elif Levesque. She has 18 years of experience in finance, including expertise in treasury and financial reporting.

The Company’s VP of Corporate Development is Joseph de la Plante. He has 10 years of mining experience in corporate development, mining investment, and banking.

One of the first decisions of this management team when OR was formed was to add even more talent to its operations. Supporting the Company’s operations is the Osisko Technical Team.

Having a strong business strategy was a great first step for Osisko Gold Royalties. However, in order to translate that strategy into the sort of corporate success which management expects of itself requires more than a good plan. It is necessary for OR to be able to identify the best projects and the best companies in which to invest – to accelerate its own profitability.

This is the responsibility of the Technical Team, and as with management, it is a deep team. Luc Lessard is the Senior Vice President of Technical Services. Lessard made a name for himself as the Vice President of Construction for Osisko Mining, and was instrumental in the construction (and subsequent success) of the Canadian Malartic Mine.

Robert Wares was another co-founder of Osisko Mining, and another important member of the original Osisko team. He is now a Geology Consultant for the Technical Team.

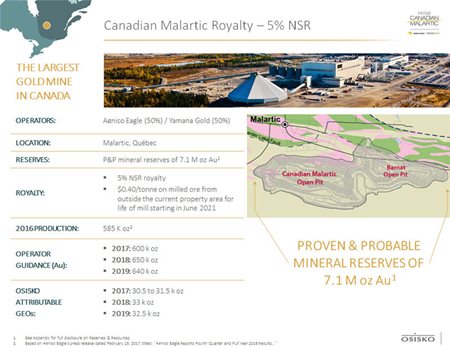

The initial building block for Osisko Gold Royalties as it amasses a portfolio of premium gold royalties was naturally Canadian Malartic itself. As part of the terms of sale for the Mine, Osisko Mining kept a 5% NSR royalty on the project, which was then transferred to OR. But there is more.

(click to enlarge)

OR also reserves a fee on any/all toll milling operations undertaken by the Canadian Malartic processing facility: $0.40/tonne on all milled ore from outside of the current property for the life of the mill, with the fee kicking in as of June 2021. Then there is the exploration upside for Canadian Malartic.

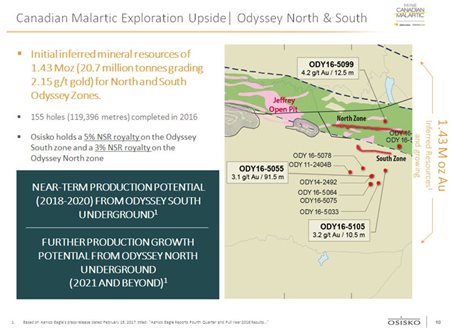

At the time of the Canadian Malartic sale, Osisko Mining knew that the land package had considerable exploration potential beyond the current 7.72 million ounces of gold reserves. The Odyssey North and Odyssey South Zones of the Malartic property are highly prospective. Geologically, the Zones bear strong similarity to the nearby Goldex mine deposit, in terms of grade and the amenability of the ore body to underground mining. The Company holds additional NSR interests on these Zones.

(click to enlarge)

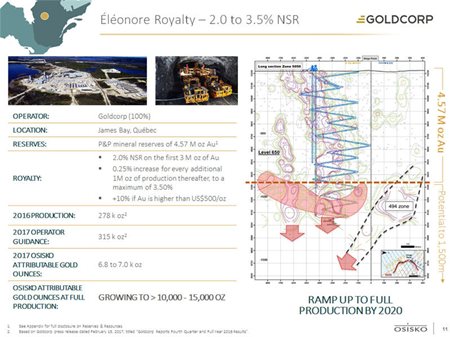

The next key asset in OR’s royalty portfolio is its 2.0 – 3.5% NSR on Goldcorp Inc.’s Eleonore Mine. The lower royalty is on the first 3 million ounces of production, with a sliding scale up to the 3.5% maximum as more ounces are produced.

(click to enlarge)

These are just two of more than 50 gold projects in which OR holds a royalty interest. Most of these projects are still at the exploration-and-development stage. This means that investors taking a position in Osisko Gold Royalties today will be able to capitalize on the Company’s full growth potential as this portfolio of royalty and equity interests mature.

Most recently, OR has closed on its latest deal, acquiring a silver stream from Taseko Mining Limited’s Gibraltar copper mine, located in British Columbia. Osisko provided Taseko with $33 million in financing as consideration for the transaction. In return, Taseko contracts to deliver its next 5.9 million ounces of silver to OR. After that, the Company is entitled to 35% of all payable silver production for the life of the mine – estimated at another 23 years.

(click to enlarge)

As already noted, other companies operating in the precious metal royalty space take royalties and/or production streams from the mining partners in which they invest. In contrast, Osisko Gold Royalties has a preference for royalties over streams. Why?

It’s a legal detail, and the management team of OR are focused on details. A production stream is a contractual interest. A royalty, on the other hand, is a proprietary interest.

The distinction here is that a proprietary royalty interest is attached to the property (and project) itself, and remains in effect in perpetuity. In contrast, a contractual production stream is merely a contract between the two corporate entities. Should some catastrophe befall a mining company which grants a production stream, that production stream could potentially be extinguished. Focusing on royalties is an additional element of security which the Company’s management provides for its shareholders as OR works to perfect the gold royalty business model.

Profits. Dividends. Zero risk. This would constitute a wish-list for most investors. Osisko Gold Royalties has dedicated itself to making this wish-list a reality.

(click to enlarge)

Growth. Innovation. Security. This is how OR intends to meet the expectations of its shareholders as well as the high expectations of management itself. In doing so, it has become a gold royalty company in a class of its own.

FULL DISCLOSURE: Osisko Gold Royalties Ltd. is a paid client of Stockhouse Publishing.