There’s an advantage to coming first. In the case of Red Eagle Mining, there’s an advantage to having built Colombia’s first modern permitted gold mine. Red Eagle Exploration Ltd (TSX: V.XR, OTCQB: XRELF, Forum), a spin-off of the parent company, wants to build on that reputational success, as it assembles a strategic land position in a country with prolific, historic production but limited modern exploration.

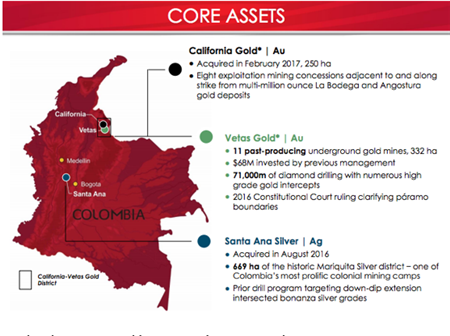

XR is a junior precious metals company with three prospective gold and silver assets in Colombia. XR is the exploration arm of miner Red Eagle Mining, which brought its Santa Rosa gold asset from discovery to production in six years. XR is the 100 per cent owner of two land packages in northern Colombia’s hot California-Vetas gold belt as well as a silver project at Santa Ana, close to the Colombian capital Bogota.

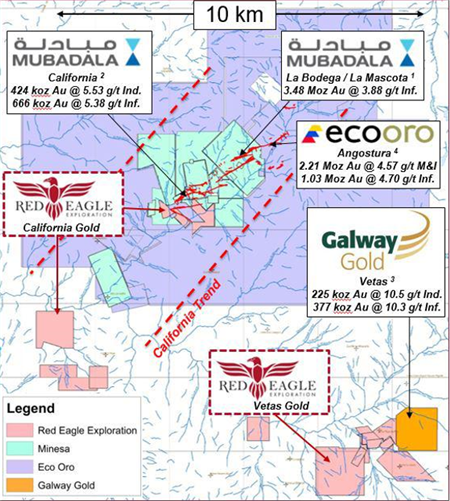

In February 2017, XR acquired six concessions in the prolific California-Vetas gold district. Located 450 km. northeast of Bogota, the district is home to the multi-million ounce La Mascota, La Bodega, and Angostura gold deposits. XR’s package, which returned chip samples with an average grade of 32.19 g/t Au, is perhaps most notable because of its immediate neighbours. A mere 300 meters from Red Eagle’s claim at Machuca sits a series of properties owned by the Mubadala Development Company, Abu Dhabi’s sovereign wealth fund. That claim, Pie de Gallo, has an inferred mineral resource of 3.85 Mt grading 5.4 g/t Au containing 670,000 oz. of gold.

“This is one of the best known gold districts in Colombia: it’s had a lot of work and a lot of money poured into it,” says Patrick Balit, Vice President Corporate Development at Red Eagle Mining, “And we’re the only public vehicle to allow an investor to play up in this district.”

XR’s opportunity to make a move on its concessions at California followed a saga of exploration. California-Vetas has a long history as a premier gold-mining jurisdiction, going back to its exploitation by the Spanish in the 1590s. Mining in the district ebbed and flowed over time, and by the 19th century, Colombia was the largest producer of gold in the world. The outbreak of civil war in the mid-1960s –- a conflict that would continue to simmer for decades — stifled exploration activity.

That began to change in the early 2000s. -With the arrival of political stability and an upswing in precious metals prices, junior miners rushed into Colombia. One of those, Ventana Gold, eventually sold its package at La Bodega for $1.5 billion to AUX Group, a mining arm of Brazilian billionaire Eike Batista’s sprawling, hard commodity empire. AUX muscled its way into the district, picking up the concessions of Galway Gold, another junior in the area, for $250 million in 2012 and also acquired Calvista.

Batista’s company poured resources into his concessions. In its tenure at California-Vetas, AUX conducted 1000 km. [double-check “1000 km” – that’s 1 MILLION meters of drilling] worth of drilling and established a proven resource of 15 million oz. at 6 g/t. That flurry of activity, however, would be short lived.

In 2013, Batista’s empire imploded. Highly leveraged and staring down a bear cycle, his spectacular fall from grace opened up his positions in Colombia. AUX Group was awarded to Mubadala Development Co., Abu Dhabi’s sovereign wealth fund in 2015. “During bankruptcy, those properties were left with nobody driving the ship,” says Balit.

Mubadala’s actions over the next year left AUX’s concessions ripe for the taking. With no entity making payments to the underlying owners of the land, licenses reverted to their original Colombian owners, providing an opening for XR — which was active in the Vetas side of the district 10 km. south. The deal for XR’s California Gold Project in February, $9.4m in cash and 11.3 million in shares payable for the concessions, put XR at the center of the district.

A look at the different players in the California-Vetas Gold District

XR’s big advantage is its proximity to Mubadala’s properties. Mubadala is looking at 450,000 oz. per year from 2021, with a total cost of $550 per ounce, according to Colombia Gold Letter. The capital expenditure could be as high as the $700 to $800 million range. A mere 300 meters away, sits XR’s concession in the Machuca zone, where drilling results from the previous owner (Galway Gold) specified a length-weighted average grade of 32.19 g/t Au.

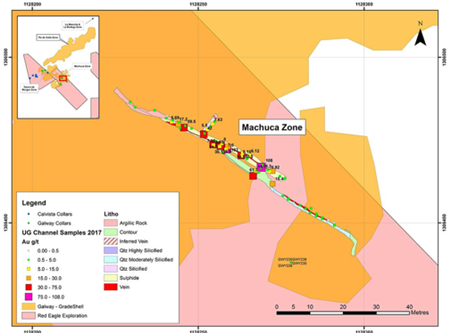

XR’s claim at Machuca sits in close proximity to Mubadala’s property at Pie de Gallo

That claim, says Balit, leaves Red Eagle exceptionally well positioned. “Think of us as the holdout in the Rainy River-New Gold transaction: a smaller company with concessions strategically located, that can derive value from the assets and plans of companies near them. Another more recent example of deriving strategic value from proximity of large projects is Regulus – Buenaventura in Peru” says Balit.

Otherwise, the company is working to advance toward economic feasibility by delineation of high-grade vein resources (using underground mining methods) as well as underground mapping underway, in the hopes of prioritizing targets for underground diamond drilling.

XR elsewhere: Vetas Gold Project and Santa Ana Silver Project

Ten kilometres to the south of the California Gold Project lies XR’s package at the Vetas Gold Project, which consists of eleven mining titles totalling an area of 352 hectares. The deposits at the Vetas Gold Project comprise several systems of narrow high-grade gold veins striking northeast and northwest. Like the California Gold Project to the northwest, the area has a long history of gold mining dating back to at least the seventeenth century, however there was no modern exploration at Vetas prior to that commenced by XR’s predecessor, CB Gold, in September 2009.

Between November 2010 and November 2013, XR’s predecessor completed a total of 71,035 metres of diamond drilling in 162 holes from surface platforms. The results included 177 intersections with grades in excess of 5 g/t (0.15 oz/t) Au and 100 intersections with grades in excess of 10 g/t (0.3 oz/t)

Further afield is XR’s Santa Ana Silver project, a 669-hectare land package in one of the country’s most prolific colonial silver mining camps, which was acquired by the company in August 2016.

Colombia: an underrated gold producer

An under-explored jurisdiction, Colombia has long been neglected by mining investors, in part due to its history of political instability. Thanks to a peace accord that has brought an end to the country’s decades-long civil war, a good mining-rights environment, and a $25 billion investment package in the country’s infrastructure, it’s emerging as a premier mining jurisdiction. The country has also seen an influx of investment in the past six months, including Newmont Mining’s CAD$134 million investment in Continental Gold.

XR is also well positioned to avoid missteps that juniors and majors alike have made in Colombia, says Balit. Those fumbles, he says, have given Colombia an unfair characterization. In the Middle Cauca belt, a highly prospective exploration area just outside of Medellin that drew companies like Batero Gold, Sunward and Seafield Resources, the opposition of local elites made open pit activity unfeasible. It didn’t help that the area was a sort of Muskoka for Colombia’s elite. “You have to understand the dynamics on a micro-level,” says Balit, “We permitted within a year, and we have fantastic collaborations from the central government down to the locals.”

As for the tricky issue of the Páramo –- a protected ecological area established in 2016 in a court decision that nixed 347 mining claims within its reaches —all of XR’s existing claims lie outside the Páramo and are allowed to be mined.

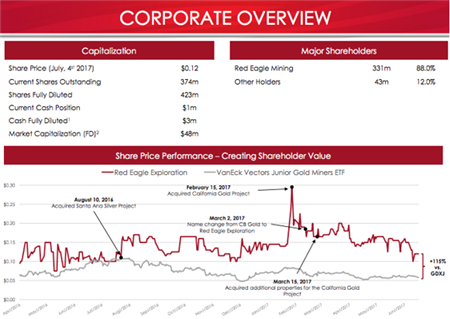

Poised for success: XR’s management team

XR’s management team, led by CEO Ian Slater, has significant in-country experience developing gold assets. A former managing partner at EY’s Canadian mining practice, Slater is a 20-year veteran of the mining industry and a Chartered Accountant. Slater’s company Red Eagle Mining is an 88 per cent owner of the XR—and the two companies share costs on back office and personnel. Red Eagle Mining is perhaps best known for its discovery of the Santa Rosa gold project in Colombia, which scaled up to production in a rapid six years. It also has experience with shepherding projects through financing, having raised $191 million in its quest to finance Santa Rosa.

XR’s board includes experienced geologists who have a deep understanding of de-risking high grade vein deposits. Leo Hathaway, was instrumental as a senior technical advisor to Ventana Gold on the La Bodega and La Mascota deposits in California and knows the district intimately. Mr. Hathaway is currently Senior Vice President for Exploration at Lumina Gold, Chief Geological Officer for Anfield Gold and Executive Vice President Exploration for Libero Mining. Ben Pullinger is VP Exploration at Excellon Resource and until recently was VP Exploration at Roxgold.

As for XR’s next steps, its overall strategy is to keep growing the portfolio, while advancing the California Gold, Vetas Gold and Santa Ana Silver Projects toward economic feasibility. The 2017 work program also includes drifting, bulk sampling and underground diamond drilling. The leadership team will also continue to seek opportunities for acquisitions.

“We have a tremendous first mover advantage. We’ve been able to leverage that reputation, those relationships in order to acquire highly prospective high grade gold and silver projects across Colombia,” says Balit.

FULL DISCLOSURE: Red Eagle Exploration Ltd is a paid client of Stockhouse Publishing.