There are rules in the mining industry. And there are Legends in the mining industry. When one of these (living) Legends chooses to break some of mining’s most basis rules, you don’t ask questions. Just listen – and learn.

There are rules in the mining industry. And there are Legends in the mining industry. When one of these (living) Legends chooses to break some of mining’s most basis rules, you don’t ask questions. Just listen – and learn.

Chester Millar is such a mining Legend. For gold mining investors needing an introduction to this icon, it’s a pretty simple process.

Heard of Glamis Gold (acquired by Goldcorp for $8.6 billion)? Chester Millar built Glamis Gold.

How about Eldorado Gold ($1.9 billion market cap)? He built that company too.

Alamos Gold ($2.3 billion market cap)? Chester Millar rides again.

Along with transforming these small gold mining companies into large gold mining companies, Millar has been instrumental in helping to launch numerous other gold mining juniors. So what is the newest venture for this Hall of Fame mining icon?

Corex Gold Corp. (TSX: V.CGE, OTCQB: CGEKF, Forum).

Corex Gold is not a new junior mining company. This Canadian junior gold miner has been in business for 13 years, with no roll-backs or consolidation., and a very respectable share count of 133 million shares (149.5 million fully diluted).

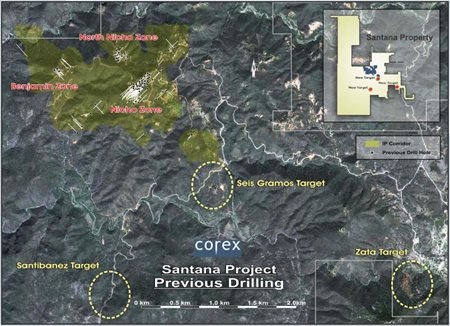

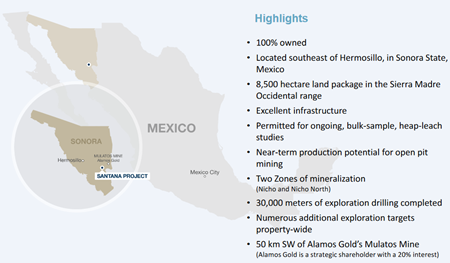

The Company’s flagship project is the Santana Property, an 8,500 hectare land package based in Sonora State, Mexico. CGE’s strategy has been to prudently advance development of this heap leach gold project, focusing on conserving shareholder capital – through some very difficult years for the gold-mining industry.

Corex has conducted more than 30,000 meters of drilling at Santana. Initial exploration focused on the Nicho Zone. Drilling results were very encouraging and put the project and Company on Chester Millar’s radar. Now Corex is shippinggold for sale, but more on that later.

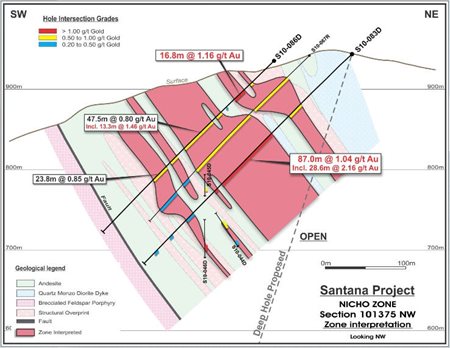

(click to enlarge)

Highlights of past drilling at Nicho include: 1.04 g/t Au over 87.0 meters, and 47.5 meters of 0.80 g/t Au. Less experienced mining investors may require some further clarification – especially for those used to viewing “high grade” gold numbers.

As noted, the ore at Santana is suitable for heap leach processing. What does that mean? Heap leaching is a gold mining technique for extracting gold from mining-friendly ore, in the most-economical manner possible.

Because of this low-cost extraction technique, heap leach gold mining is especially suitable for projects which fit a particular profile:

- Lower grade, but with broad bands of mineralization

- Near-surface deposits suitable for open pit mining

- Oxide-rich ore

Santana is strongly suited to heap leach gold mining. For heap leach, open pit projects, generally grades anywhere in excess of 0.5 g/t gold can be commercially mined at a profit – even given the current depressed price for the yellow metal.

Grades at Nicho were (are) more than adequate for heap leach mining. But the Company wanted to identify additional gold mineralization. With the property’s 8,500 hectare size, there were plenty of additional areas to target.

(click to enlarge)

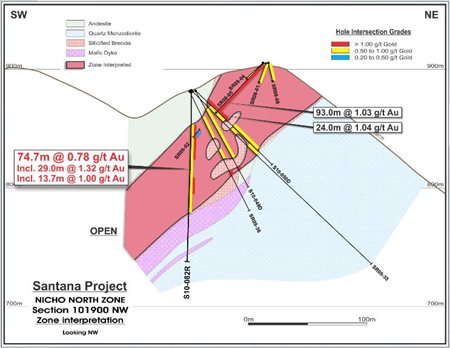

The Company chose the North Nicho Zone as the next area to drill out. Here results have also been encouraging. Highlights of drilling to date include 1.03 g/t Au over 93 meters and 0.78 g/t over 74.7 meters (including 1.32 g/t over 29.0 meters and 1.00 g/t over 13.7 meters).

(click to enlarge)

With additional, robust mineralization also identified at North Nicho, management decided that it was time to speed up the pace of project development. They decided to bring in some “new blood”: hello Chester Millar.

Chester Millar has a different way of doing things. He doesn’t like to mess around.

Chester Millar has a different way of doing things. He doesn’t like to mess around.

When Millar took a look at the exploration data on Santana, his mind was made up: it was time to go to production. This would come as a shock to many experienced mining investors. The Project doesn’t yet have a pre-feasibility study to support the economics, nor does it have a NI 43-101 resource estimate for Santana.

For Millar, these are unnecessary formalities.

“You should be in the gold mining business [not exploration], you should be earning a profit, and you gotta show growth.”

For many mining investors, that’s music to their ears. In today’s tough environment, financing resource estimates and a PEA can eat up considerable capital – and that spells dilution. Millar is adamant.

“My way of doing things is generally speaking not acceptable by the Toronto Stock Exchange. I have enough experience, and I don’t want to pay somebody $500 a day to tell me what I already know.”

Skeptics may remain unconvinced. Mining companies need such reports in order to advance a project to production, don’t they? Not according to Millar.

“My Feasibility Study is done by doing things. I will actually mine and produce gold. That to me is better than any Feasibility Study because it isn’t a study, it’s a proven fact.”

Chester Millar wanted to start mining operations at Santana. The Company’s new President and CEO, Doug Ramshaw, didn’t want to contradict a half-century of mining experience. Just added to the management team on July 19, 2017; Ramshaw explains what he brings to the table as the new head of operations.

“I had been working closely with the Corex team for the best part of a year before being approached my Management to expand my role. It really didn’t take much thought to accept the opportunity that would allow me to work side by side with an industry legend like Chester. He is probably one of very few in the industry who has successfully boot-strapped operations on numerous occasions to build out an incremental production profile from humble beginnings. I am looking forward to working with him as he seeks to replicate that same success with the same approach at Santana.”

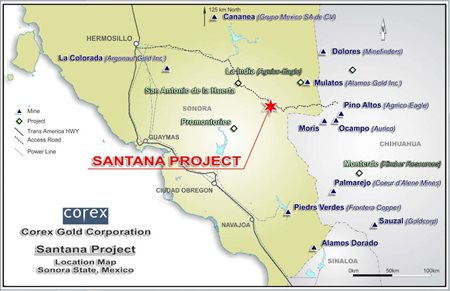

Experienced mining investors know that Mexico is a premier mining jurisdiction. Not just silver mining (where Mexico leads the world in production), but also gold mining. And Chester Millar knows Mexico.

(click to enlarge)

Millar was still with Alamos when it acquired the Mulatos project for just $10 million in 2003, which became the Mulatos Mine – pouring its first gold for Alamos in 2005. But this mining Legend’s expertise goes beyond companies and jurisdictions.

Chester Millar helped to pioneer heap leach gold mining. When it comes to putting gold projects into production, quickly and cheaply, Millar practically wrote the book. Why heap leach mining for gold?

“Heap leaching is very cheap because you can use contractor’s machinery. You don’t have to build mills or do expensive capital investment. You just have to put a piece of plastic on the ground [the leach pad], and start putting crushed rock on it, and have a couple of pumps with water and a little bit of cyanide going around. A dollar goes a long way in this type of operation."

With today’s difficult conditions, junior gold mining companies need to stretch their dollars further than ever. Millar’s approach to gold mining doesn’t make him a relic. Rather, his mining philosophy is ideally suited to the present environment for gold mining.

The Mulatos Mine, located just 50 km northeast of Santana, is a classic heap leach gold mining operation. Throughput for the open-pit operation is 18,000 tpd’s. In 2012; Mulatos poured its one millionth ounce for Alamos. With annual production of approximately 200,000 oz’s of gold, Mulatos is now nearing its two millionth ounce of production.

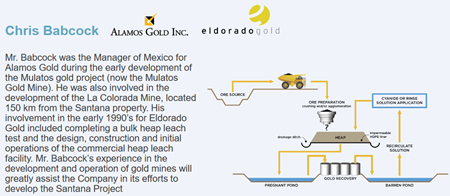

Chester Millar isn’t the only member of CGE’s operations team who has both extensive experience with heap leach gold mining and intimate familiarity with the Mulatos Mine. Chris Babcock also adds invaluable expertise to the Company.

(click to enlarge)

Of note, in 2014 Alamos added an underground mining operation to the Mulatos Mine. Higher grade gold was discovered at greater depths at the San Carlos deposit, something not unusual from a geological standpoint. While CGE’s operations are currently focused exclusively on near-surface mineralization, given the proximity to Mulatos, it would not be surprising if Santana also demonstrated underground potential in the future.

Corex is currently in the “cash-generating development phase” for the Santana Project. That means learning-by-mining. That’s the Chester Millar way.

“I like to make little mistakes. I like to start small and then expand once we are on firm ground with our technology and our machinery and the methods we are using.”

This is the game plan now being implemented by Corex. In August; the Company began processing a 25,000-tonne bulk sample from North Nicho, on the heap leach pad already in place. That gold was shipped in mid-October, and this week Corex announced receipt of US$278,685.67. While other juniors would still just be doing exploratory drilling, CGE is already generating revenues, to offset development costs.

After this, Corex is planning a sample twice as large – 50,000 tonnes – with the gold yield estimated to double. After this learning-by-mining, generating approximately $1million in revenues, the Company will make a production decision in 2018 in terms of future operations.

(click to enlarge)

Many mining investors invest in this industry because of its relative simplicity: dig ore out of the ground; process it as efficiently as possible; make a profit doing so. Chester Millar makes mining even simpler.

“I don’t want to know what the tonnage is because I don’t want to spend a lot of money when money is hard to come by, when stock is cheap, finding something that is maybe ten years away in time. Nobody knows what the price of gold is going to be ten years from now.” [emphasis mine]

For someone who is 89 years old, that’s a very 21st century perspective on gold mining. Produce gold as quickly as possible and as cheaply as possible. Many analysts would argue that this should be the game plan of every gold mining company.

The principals here aren’t merely talking about the potential of Santana – they’re putting their money where their mouth is. Management holds about 10% of the Company. Via H Morgan & Co; Chester Millar holds another 15% block.

Perhaps of even greater interest, Alamos Gold (with its 18,000 tpd heap leach mine 50 km away) has acquired a 20% strategic interest in Corex. That’s a strong endorsement of a junior gold mining company with (at the moment) a $15 million market cap.

For gold mining investors who like projects with big resources and who like to spend time pouring over the technical details in Feasibility studies, Corex Gold may not be the Company for you. On the other hand, for mining investors who are big on efficient gold production that conserves capital and minimizes dilution, CGE may be exactly what you’re looking for.

FULL DISCLOSURE: Corex Gold Corp is a paid client of Stockhouse Publishing.