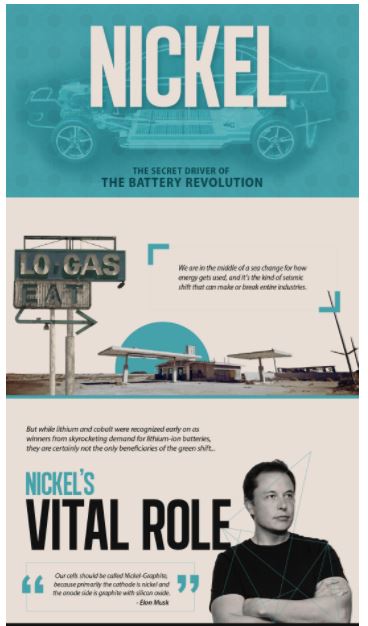

Nickel: The dark horse in the EV battery race

Without a doubt, the barn door that has been cracked open on electric vehicles (EVs) is only going to swing further. One recent projection puts EVs at 16% market penetration by 2030 and 51% by 2040. Several countries including China, France and the UK have signalled they will eventually ban gas-powered vehicles, and one automaker, Volvo, recently announced that starting in 2019, all models will be hybrids or electrics.

This has investors flocking to companies that mine lithium and cobalt – two key ingredients of batteries used in EVs. But it’s a lesser-known fact that nickel, a cheaper, up-to-now industrial metal used primarily in stainless steel, will also be needed for EV batteries. In fact, so much nickel could be demanded in the next few years that analysts are predicting a shortage of battery-grade nickel. Investors who can identify companies with properties that contain this type of nickel stand to make a bundle, especially those in the early exploration stages.

Why is nickel important?

Because more nickel in the battery solves the two major impediments to mass adoption of EVs, which are range and cost. Nickel cathodes (the part through which electrons enter the battery) intrinsically have a higher energy density. The more nickel content, the longer distance you can travel and it also brings down costs. Right now the demand (a large part of it being speculation) for cobalt and lithium has spiked the prices of these two metals considerably, which ironically has made EV batteries more expensive to produce and therefore dampens EV market growth. Since 2008 the price of lithium carbonate has doubled from around $4,500 a tonne to $9,000, while cobalt has tripled from $20,000 a tonne to $60,000 just in the last year.

Michael Fetcenko of BASF Battery Materials said during the Benchmark Minerals Cathode Conference: “You can get higher energy in two ways: you can take your existing cathode material and you can widen the operating voltage, or you can use higher nickel content.”

Rising demand for battery-grade nickel

The increased input costs of lithium and cobalt has battery and electric car manufacturers wanting to shift their current mix of materials to using less cobalt or lithium and more nickel, which is currently just under $12,000 a tonne.

According to a recent report from UBS, if 15 million EVs are produced in 2025, it would mean an additional 300,000 to 900,000 tonnes per annum of incremental demand. Ie. that much new demand each year until 2025.

However, it is important to note that the 300 to 900 ktpa figure depends on the chemistry of EV batteries changing from the current 1:1:1 ratio of nickel-manganese-cobalt (NMC) batteries used for example in the Chevy Bolt, to 8:1:1 (eight times more nickel). UBS says the drivers for nickel are cobalt’s expected price surge, and the security of cobalt supply (65% of cobalt comes from the DRC, an unstable mining jurisdiction).

Another report from Wood Mackenzie confirms the UBS findings. Except the consultancy is more conservative than UBS, predicting that nickel uptake in all batteries including EVs “will be considerable, typically exceeding 200 kt by 2025.” Wood Mackenzie also confirms that NMC batteries will be a key driver of battery-grade nickel:

“The current consensus is that NCM is likely to be the dominant battery type over the next ten years, signalling that a substantial boost to nickel demand is possible.”

To envision what would happen to battery metals demand should the world suddenly switch from gas-powered vehicles to EVs, UBS extrapolated data for a fictitious scenario where 100% of the world’s automobile demand came from Chevy Bolts instead of the current auto mix.

Nickel demand would more than double, by 105%, lithium would take off by 2,898%, the need for cobalt would rise by 1,928%, rare earths demand would spike by 655%, and graphite by 524%, to name just the top five metals. The only metals that would drop are platinum and palladium, used in catalytic converters of gas- and diesel-powered engines; demand for PGMs would fall by 53%.

In this scenario, even more nickel would be demanded for Teslas, whose nickel-cobalt-aluminum (NCA) cathodes made by Panasonic are 80% nickel, versus the Bolt’s NMC batteries which use equal parts nickel, manganese and cobalt.

According to Elon Musk, Tesla's batteries should be called “nickel-graphite” because the cathode is nickel and the anode is made of graphite and silicone oxide. In fact, nickel is the most important metal by mass for lithium-ion batteries (see infographic below).

[click on image above to view full infographic from The Visual Capitalist]

Indeed the future chemistry of EV batteries will play an important role in the story of how important nickel could become in this “green” auto shift.

There are four criteria that battery makers use to determine the best mix of materials: stability, energy capacity, energy density, and cost. The more cobalt and nickel that is added to a battery, the higher the density, but these materials are also less stable and more expensive than the competing lithium-iron-phosphate battery currently most popular in China. LFPs do not use any nickel in the cathode.

According to UBS, Korea’s Samsung SDI and LG Chem are developing an NMC battery with six times more nickel than currently, starting in the first half of 2018, then moving up to 8 times more nickel (an 8:1:1 combination). SK Innovation, another Korean battery maker, is also going for an 8:1:1 split. Meanwhile Tesla and Panasonic are planning on upping their NCA battery cathode to 85% nickel from its current 80%.

The loser in this changing battery chemistry will be cobalt, according to UBS. “The shift to lower cobalt NMC cathodes will reduce cobalt use by up to 70% by early next decade (holding prices equal).”

Not all nickel will do

Even without EVs, nickel – used mostly to produce stainless steel - is already one of the world’s most important metals with a market value around $20 billion. How much EVs affect nickel depends on their market penetration. EVs currently only account for 3% of nickel usage. But if they were to grow from 1% penetration to 6% that would result in 167,000 more tonnes of nickel demand according to Cairn Energy Research Advisors. Push that to 10% market penetration, and the demand for nickel rises to 400,000 tonnes, an amount that would trigger a nickel supply deficit, Ivan Glasenberg, the CEO of Glencore, one of the world’s largest nickel producers, has said.

But there is a problem supplying all that nickel. Two-thirds (62.4%) of the earths’ nickel supply is found in nickel laterite deposits, while only a third (37.5%) is contained in nickel sulphide deposits which have nickel grades high enough to be used in batteries. The nickel from laterite deposits is typically used to make nickel pig iron and ferronickel, while sulphide deposits can be mined to make nickel sulphate, which is appropriate for EV cathodes.

The nickel market has long been oversupplied by the big producers – Indonesia and the Philippines – that supply cheap nickel pig iron (NPI) to China, thus keeping a lid on prices. At around $4.36 a pound, 40% of nickel miners are losing money. Switching up the mix so that more companies mine higher-grade nickel for batteries is a way out of the price conundrum, states UBS:

“The battery opportunity offers a renaissance for long suffering producers of high grade nickel products which have lost market share to NPI & FeNi.”

However, UBS notes it will take a few more years for the loose nickel market to tighten up, predicting that EV demand is not likely to have any impact until 2020.

Prepping for more nickel

Korea’s top two battery makers SDI and LG Chem have already been mentioned as companies looking to build more nickel into their EV battery composites; other firms are moving in that direction as well.

Wood Mackenzie notes that Umicore, of Belgium, is predicting a 60% increase in its market for cathode materials through 2020, with two-thirds of that market expected to be nickel. In June BASF signed an MOU with Russian nickel and palladium miner Norilsk to supply nickel for lithium-ion batteries. BASF plans to invest $456 million to build new cathode materials production plants in Europe.

In China, the world’s largest producer of EVs, battery manufacturers are looking to migrate to nickel-containing batteries with several including Shanshan, Nichia, L&F & Reshine producing them, according to Wood Mackenzie. CALB & Sinopoly are also starting to produce NMC batteries.

Contemporary Amperex Technology Limited (CATL), a private Chinese company, recently entered into a four-year cobalt supply contract with Glencore to allow it to develop NMC cathodes for Volkswagen.

Miners are also getting in on the action. In August BHP, one of the biggest mining companies, announced it would invest $43.2 million to build the world’s largest nickel sulphate plant in Australia. Jinchuan, China’s top nickel producer, said it will start building a project next year in Guangxi that will produce raw materials for the EV battery market. The facility expects to produce 30,000 tonnes of nickel and 3,000 tonnes of cobalt annually. Sherritt, IGO, Western Areas and Vale have all expressed interest in mining more battery-grade nickel.

One of the most exciting nickel sulphide exploration prospects is in Greenland, where North American Nickel (TSXV:NAN) is advancing its Maniitsoq project, which has multiple mineralized targets spread across the 75 by 15 -kilometre Greenland Norite Belt. Norite, is a mafic igneous rock and occurs within intrusions such as the Sudbury Igneous Complex – the second largest nickel complex in the world.

Fresh results from NAN's 2017 drill program have extended the Mikissoq nickel-copper sulphide zone, discovered in 2016, by an additional 60 metres down-dip. Assay highlights from hole MQ-17-135 featured 75.75 metres at 1.10% nickel and 0.43% copper, including 10.25 metres at 2.29% Ni and 1.33% Cu, and 19.25 metres at 1.89% Ni and 0.26% Cu. (A grade higher than 1% over 10m is considered a good sulphide nickel intersection). Two drill holes at the Spotty Hill target also extended the known mineralization and indicate further potential at depth. North American Nickel plans to release additional assay results in the near future.

Battery-grade supply crunch and higher prices

Will there be enough supply? It's a valid question, considering the expected explosion of growth in electric vehicles as the world slowly weans itself off fossil fuels. According to the UBS report, nickel pig iron and ferronickel have dominated market share over the past decade. This type of nickel is typically mined from low-grade laterite ores either from Indonesia or the Philippines and then shipped to China where it is converted into NPI. NPI is preferred by China's stainless industry because of its low cost. Only half of all nickel produced is appropriate for batteries.

It is possible to convert laterite nickel into battery-grade material by high-pressure acid leaching (HPAL), but this process is expensive compared to making NPI.

UBS analyzed a number of high-profile nickel mines around the world and came to the conclusion that currently 949,000 tonnes per annum would be suitable for batteries – either from sulphides or from the HPAL process – while 827,000 tonnes are currently unsuitable.

It adds that producers of high-grade nickel products “could potentially benefit from the emergence of price premiums vs FeNi and NPI products as battery demand increases.”

But given that the market is currently saturated with NPI or ferronickel which is keeping prices at an unsustainably low level – it seems apparent that at least in the next few years - barring a dramatic shift to battery-grade nickel production – there will not be enough battery nickel to go around.

“The key conclusion is that mine supply growth that has occurred & likely to occur for the next few years is in a form that is inadequate to supply the battery supply market,” states UBS.

However longer term (ie. post -2020), the analysts seem to agree that EV demand will start to make a dent in nickel supply and prices could rise further, as the demand for battery-grade nickel increases.

“Although the capacity to produce nickel sulphate (the primary starting material for NCM or NCA) is expanding rapidly, we cannot yet identify enough NiSO4 capacity to feed the projected battery forecasts,” states Wood Mackenzie, adding that even if large producers like BHP switch over, “the question remains as to whether or not there will be enough nickel units left over to feed all the other segments of consumption.

“On that basis it would seem reasonable that the EV revolution could push future nickel prices to higher levels than we currently forecast.”

The conclusion for nickel investors is inescapable. While the market will remain oversupplied likely until 2020, the potential for price increases commensurate with increased EV production and demand for battery metals makes now an ideal time to take a position in an early-stage company. Those companies that are sitting on sulphide nickel deposits have a much higher growth potential than nickel laterite miners, especially the ones with management teams capable of bringing them to production. These will be the companies to watch as the EV shift kicks into high gear.

FULL DISCLOSURE: North American Nickel is a paid client of Stockhouse Publishing.