One of the largest gold discoveries in Ghana in recent years has put Cardinal Resources Ltd (TSX: T.CDV, Forum) high up on investor radar screens, proving that its commitment to exploration in West Africa is paying off.

Ranking high among the more politically stable countries on the African continent, Ghana has been a happy hunting ground for gold explorers, developers and producers for over 100 years.

Most of that activity has centered on southern Ghana, which remains one of the world’s most prolific areas for gold exploration and production, producing 4.13 million ounces of gold in 2016, up from 2.8 million ounces the previous year.

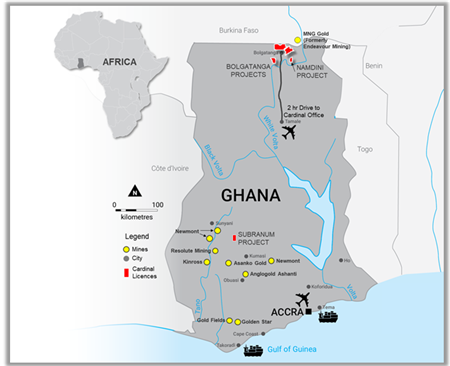

Namdini Location Map

According to the resource update which was announced on September 18, 2017, Namdini has an indicated mineral resource of 4.3 million ounces of gold and an inferred resource of 3.1 million ounces at a 0.5 gram per tonne cut-off grade.

That marks a four-fold increase from 931,000 ounces in the indicated mineral resource category in the April 2017 resource update. Mineral resources are categorized in order of increasing geological confidence as inferred, indicated or measured.

From September 18, the stock has rallied. An impressive move that rewarded a roster of high profile investors, including Bank of Nova Scotia’s Dynamic Funds, RBC, US Global, Sprott Asset Management, Australia’s Commonwealth and Macquarie banks, Switzerland’s Aga Nola fund and South Africa’s Gold Fields Ltd.

In an interview with Stockhouse, Cardinal Resources Chief Executive Officer Archie Koimtsidis described Namdini as a “brand new discovery,’’ and said it ranks as one of the largest West African gold discoveries in the past decade.

“Indeed, there is clear potential for an interim resource in excess of six million ounces”, according to the analysts at Clarus Securities Inc. and Hartleys Ltd., both highly regarded research firms from Toronto, Canada and Perth, Australia prior to the resource upgrade - Cardinal has proven that both firms were conservative.

It was a just reward for Cardinal’s commitment, both to the project and to Ghana.

That commitment is reflected in the fact that Cardinal has been running 11 drill rigs at the project site. For any junior exploration company that marks a very high level of activity.

Since the deposit was discovered in 2014, Cardinal has drilled a total of 275 holes, bringing the total to 67,122 meters of which 134 holes totaling 45,233 meters are with HQ diamond core.

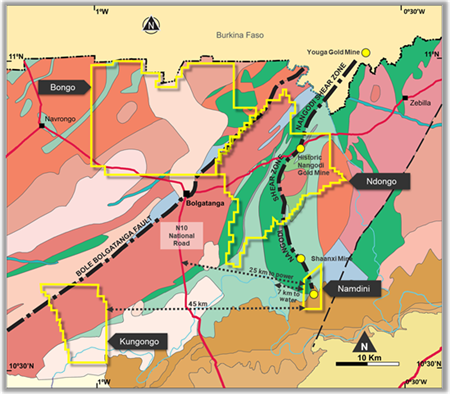

The Namdini deposit is a structurally controlled orogenic deposit with numerous features similar to deposits found elsewhere in late Proterozoic Birimian terranes of West Africa.

The property on which it is located is in the upper east region of Ghana, approximately 30 kilometers southeast of the regional center of Bolgatanga.

LONG SECTION – Indicated and Inferred

Optimism is predicated on the fact that most of the indicated resource is continuous from the surface to a depth of about 350 meters, making it highly amenable to a simple, large-scale open-pit with a targeted low strip ratio.

As of writing, Life of Mine metallurgical test work has indicated that in a production scenario, the company can achieve gold recoveries in the 86 percent range, by deploying a conventional CIL circuit that would form a key part of the processing operation. Note that optimisation to further improve recoveries beyond 86 percent is ongoing.

Meanwhile, the company anticipates continued news flow as it remains focused on the development of Namdini through a resource expansion drilling program, which is targeting further improvements in the resource classification, and to expand the resource.

An important goal of this work is to improve confidence levels in Namdini by moving as much of the 3.1 million ounces of gold, which is currently referred to as “inferred resources,” into the “indicated resources” category. Keeping in mind that the current drill program aims to tighten up the resource to a depth of 400 meters, mineralization also remains open below 600 meters and along strike.

Cardinal expects to submit an updated Environmental Impact Statement during the first quarter of 2018 a move that will put Namdini on the road to development. The project already has a 15-year renewable mining license and the company anticipates that it could have an operating permit by the first half of 2018.

It is a program that is being led by Cardinal’s highly experienced management team including external contractors Lycopodium, Golder Associates and Knight Piésold – all being West African experts.

Koimtsidis has been involved in gold exploration and project development in West Africa for over 20 years. Prior to joining Cardinal, he was Deputy Country Manager in Ghana for PMI Gold Ltd., a company that was bought in February 2014, by Asanko Gold Inc. (TSX: T.AKG, Forum).

LONG SECTION – Gold grade distribution

It is currently envisaged that the higher-grade areas towards the northern part of the resource, close to the surface, may be targeted in the early years of production.

Over the longer term, the company expects gold production to come from a large scale, single open pit.

As a national power grid is located only 30 kilometers from the project site, Namdini benefits from close proximity to key infrastructure, including all year water supply and a national highway.

Early calculations by Clarus and Hartleys analysts, suggest that the mine could cost between $200 million to $400 million (subject to final annual production capacity) to develop with an AISC of approximately $800 per ounce.

The big question now is whether there is another gold deposit waiting to be discovered in the district.

“The size of the Namdini discovery to date is indicating that we could be in a prospective district so the Company has decided to further invest into its regional exploration program,’’ Koimtsidis said.

The other nearby projects within the area are Kungongo, Bongo and Ndongo which may hold the key to making another discovery within the district.

“The challenge is to find other deposits that are large enough to justify their own processing facility or alternatively be hauled to the Namdini processing facility. Furthermore, we know the terrain intimately and have over 20 years of history with the local communities,” Koimtsidis said.

After recently acquiring two large-scale prospecting licenses from Kinross Gold Corp. (TSX: T.K, Stock Forum) earlier this year, the company amalgamated them both into their Ndongo license and now controls approximately 900 km² of prospective ground in Ghana.

“Namdini makes up only 20 km² of the 900 km²” Koimtsidis said.

REGIONAL MAP – Northeast Ghana

“Cardinal is targeting the release of a PEA study during Q1 2018 which will provide baseline economic parameters to be used for financing optionality” Koimtsidis said.

Due to the quality of the Namdini project, Ghana’s track record as a supportive jurisdiction for mining and the fact that a number of high profile companies have developed gold mines in the region, Koimtsidis sees every reason to believe that the project will attract a range of financing options.

After all, Cardinal is following in the footsteps of Asanko Gold Inc (TSX: T.AKG, Forum), which achieved the commercial production milestone in April 2016, a move that helped to drive Ghana’s gold revenues to $5.15 billion, a 55% increase from 2015.

A few of the companies with production in Ghana are Newmont Mining Corp. (NYSE: NEM, Stock Forum), Kinross and Gold Fields (NYSE: GFI, JSE: GFI, Stock Forum) a company that recently emerged as a substantial Cardinal shareholder.

---------

Readers should note that the April 2017 resource estimate for the Namdini Gold Deposit by Roscoe Postle Associates Inc (“RPA”) was incorporated into Cardinals Toronto Stock Exchange (“TSX”) listing in July 2017. The September 2017 resource update for the Namdini Gold Deposit is the second to be prepared according to both Canadian Institute of Mining, Metallurgy and Petroleum CIM Definition Standards for Mineral Resources and Mineral Reserves (CIM, 2014) and the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (the JORC Code 2012).

Full Disclosure: Cardinal Resources Ltd. is a paid client of Stockhouse Publishing.