Full size / "Petcoke resembles large grains of sand and is slightly sticky to the touch." (Source)

Today, MGX Minerals Inc. provided an important update on the recently announced partnership with Highbury Energy Inc. to make petroleum coke ("petcoke") more environmentally friendly. MGX has chosen to proceed with the partnership and to develop a detailed thermochemical gasification process to extract battery metals, such as nickel, vanadium and cobalt, from petcoke.

This is increasingly turning out as another genius move by MGX, taking a huge negative and turning it into a positive. MGX is now looking to produce battery metals from an oil production waste product that poses tremendous environmental threats in North America and globally.

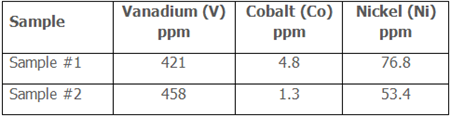

MGX and Highbury have receivedinitial assay results from petcoke samples obtained from Alberta oil sands (Sample #1) and refinery (Sample #2) sales stockpiles:

Further analysis of concentrate post-gasification ash samples is now underway with ash amounting to 3% of oil sands petcoke by weight and less than 1% of the refinery petcoke sample.

It is expected that the concentrations of metals will directly correspond with the reduction in material, approximately 30x for oil sands petcoke and over 100x for refinery petcoke.

So after usage of Highbury´s hydrogen gasification process, the concentrations in the ash are expected to be approximately 1.26% vanadium, 0.14% cobalt and 2.3% nickel for the oil sands sample, and 45.8% vanadium, 0.13% cobalt and 5.3% nickel for the refinery petcoke.

That´s some pretty high-grade numbers and a great place for MGX to start with its metals extraction technology.

What makes Highbury´s gasification process so interesting is that the metals do not get combusted during the process. Analyses of the ash concentrate is expected shortly and may confirm the above expectations, which would clearly be a landmark announcement in this multi-billion-dollar petcoke industry.

A Phase II study is currently being completed by Highbury and will include analyses of potential site locations, inclusion of pilot scale gasification, advanced metals extraction process design and initial plant design parameters.

Competitive Edge

Hydrogen is also a valueable byproduct from Highbury´s gasification process. Hydrogen is widely used by petroleum refineries in upgrading processes (necessary to facilitate the hydrotreating/catalytic hydrocracking of heavy hydrocarbon molecules and reduction of sulfur content). As such, hydrogen is also heavily used in Alberta´s oil sands and petrochemical industry, so it brings "built-in customers" for this byproduct (i.e. petcoke suppliers would be MGX´s hydrogen customers), which makes this all the more interesting. The key would be to process the feedstock at the source and produce hydrogen to be used on site. Much of the burdensome cost of petcoke is caused by transportation, which would be eliminated with local processing. Highbury´s gasification process is a much cleaner way of getting the thermal energy out of the petcoke instead of just burning it.

While concentrations of individual metals are low in raw petcoke, Highbury is utilizing its advanced knowledge of the thermochemical gasification process and existing large-scale pilot plant experience to assist MGX in designing a process to generate hydrogen gas and concentrate metals in the form of ash byproduct, so that MGX can deploy its metal extraction technology. MGX President and CEO, Jared Lazerson, commented on January 16, 2018, when announcing the partnership with Highbury:

“Similar to advancements made by the Company over the last year in treating wastewater brine and recovering minerals, MGX and Highbury will look to develop a process that utilizes gasification methods to concentrate metals from petcoke. We believe entry into an untapped market of this magnitude aligns perfectly with our business strategy of creating innovative processes and technology to shape the new energy economy.”

Development of the detailed process will be spearheaded by Dr. Paul Watkinson, a Professor Emeritus in the Department of Chemical and Biological Engineering at the University of British Columbia and a co-founder of Highbury. Dr. Watkinson is a published expert in the field of gasification and oversaw early work on related oil sand gasification in the early 1990’s. He is also a registered Professional Engineer, Fellow of the Chemical Institute of Canada and Fellow of the Canadian Academy of Engineering. Dr. Watkinson is also an active participant in the Canadian Society for Chemical Engineering as well as Engineering Conferences International. He has received numerous awards for his research and has published multiple articles in scientific journals on pilot-scale investigations of conversion of carbonaceous solids, such as coal, shale and biomass, into gaseous and liquid fuels.

Highbury Energy Inc. is an innovative energy company dedicated to the development and utilization of renewable energy resources through the procurement and conversion of biomass. Highbury has developed a proprietary dual-bed steam gasification technology and patented gas cleanup system that converts biomass into high-grade synthesis or fuel gas. This robust process produces a medium calorific value gas from most types of organic matter, such as wood or agricultural wastes, without need of tonnage oxygen.

The cleaned synthesis gas can readily replace natural gas in industrial kilns and furnaces in the mineral, pulp & paper, glass, and cement industries. Alternately, the syngas can fuel an internal combustion engine to make electricity, with waste heat used for refrigeration, or district heating. Syngas can also be converted to high value low carbon liquid fuels such as diesel or jet fuel, or into chemicals such as methanol or ethanol.

Syncrude upgrader in Alberta (source: Petroleum Coke: The Coal Hiding in the Tar Sands)

Petcoke: Big Problems = Big Opportunities

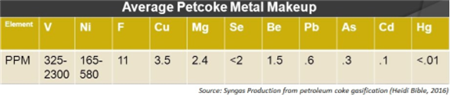

Petcoke is the bottom-of-the-barrel leftovers from the refining of Canadian oilsands crude oil and other heavy oils. It´s basically what´s left when gasoline gets taken out of raw oil. Every barrel of crude that comes out of the Alberta tar sands throws off between 60-130 lbs of petcoke. Made up of almost pure carbon, petcoke contains more carbon than coal and thus burns hotter. However, it´s much cheaper than coal because when burned, petcoke is one hell of a potent source of planet-warming carbon dioxide including an array of pollutants such as sulfur that pose serious health and environmental risks.

Most power plants in North America and Europe will not burn petcoke for fuel because it´s so polluting. It is a waste product that is almost free for the taking. Not only Alberta itself but also cities like Detroit and Chicago, where large US refineries are located, are literally drowning in petcoke due to expanded production from Alberta´s tar sands.

Refineries that are unable to sell this dirty fuel waste product are exporting vast quantities of it to energy-hungry, third-world countries like India. Based on a recent Associated Press investigation, the US sent more than 8 million tons of petcoke to India in 2016. That´s about 20 times more than in 2010. This news, in turn, prompted India´s court-appointed Environmental Pollution Control Authority to run laboratory tests on the imported pet coke and it was found to have 17 times more sulfur than the limit set for coal, and a staggering 1,380 times more than for diesel. Now, India is fighting back. The government is planning to curb the imports of petroleum coke.

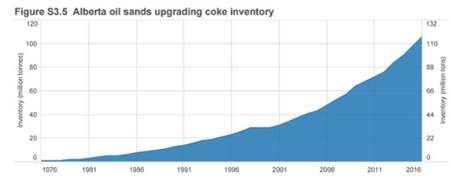

According to the Alberta Energy Regulator, pet-coke inventories reached 106 million tonnes in 2016. Suncor, Syncrude, and CNRL operate oil sands mines near Fort McMurray that use upgrading processes that produce petcoke. Approximately half of all coke produced in 2016 came from Suncor’s operations. Suncor has burned small amounts of coke in its boilers for decades at its mine near Fort McMurray, with about 11 per cent of its annual coke production used for site fuel in 2016. Syncrude, which produced 20 per cent of all coke output in 2016, reported that about 21 per cent of its coke production was used as site fuel, similar to 2015. At CNRL’s Horizon project, all coke produced is stockpiled, accounting for just under 10 per cent of total coke inventories in 2016.

Full version / Suncor Oil Sands Project in Alberta. Piles of uncovered petrolum coke, a byproduct of upgrading tar sands oil to synthetic crude. "Petcoke" is between 30-80% more carbon intense than coal per unit of weight. (Source)

Company Details

MGX Minerals Inc.

#303 - 1080 Howe Street

Vancouver, BC, Canada V6C 2T1

Phone: +1 604 681 7735

Email: jared@mgxminerals.com

www.mgxminerals.com

Shares Issued & Outstanding: 99,758,991

Chart

Canadian Symbol (CSE): XMG

Current Price: $1.52 CAD (02/22/2018)

Market Capitalization: $152 Million CAD

Chart

German Symbol / WKN (Tradegate): 1MG / A12E3P

Current Price: €0.977 EUR (02/22/2018)

Market Capitalization: €98 Million EUR

Previous Coverage

Report #46 “Big Times Ahead For Several Joint Ventures from MGX Minerals“

Report #45 “MGX Partner Broadcasting on US Television“

Report #44 “The Big Rethinking Begins: Multiple Lithium Projects in Chile Test the Rapid Lithium Extraction Technology from MGX“

Report #43 “Global Lithium Dominance? MGX Doubles Performance of Lithium Extraction Filters“

Report #42 “Scores of Tail Winds for MGX becoming a Leader in the New Energy Economy“

Report #41 “MGX Goes Big, Develops Utility-Scale Battery Storage System“

Report #40 “Positioned to Profit from Transition to New Energy Economy“

Report #39 “MGX Assembles Dream Team For California Lithium Strategy“

Report #38 “MGX: The Next GreenTech Energy Giant“

Report #37 “MGX Partners with Highbury Energy to make Petroleum Coke more Clean“

Report #36 “Technological Breakthrough in the Mass Energy Storage Industry“

Report #35 “Eureka! MGX Starts Developing Silica Projects after Acquisition of Mass Storage Battery Technology“

Report #34 “MGX Going Big on Petrolithium: The first large-scale integrated petroleum and lithium project ever developed“

Report #33 “Driving into the Realms of Tesla & Co: MGX Acquires Mass Storage Battery Technology from Teck Resources“

Report #32 “Backed by Private and Institutional Heavyweights: MGX cashes up for Lithium Extraction and Exploration“

Report #31 “MGX Revolutionizes the Lithium World - Commissions First Rapid Lithium Extraction System“

Report #30 “Full Steam Ahead: MGX Engages Senator Polanco (Ret.) to Head California Lithium Brine Strategy“

Report #29 “MGX to Target Geothermal Market for Extraction of Lithium and Gold“

Report #28 “MGX Minerals Commences Development of the World‘s First Petrolithium Field“

Report #27 “Canadian Government Backs MGX Minerals‘ Petrolithium Cleantech“

Report #26 “MGX Minerals Solves the Magnesium Problem of the Lithium Industry“

Report #25 “Hard-Rock Lithium Exposure for MGX“

Report #24 “One of the Largest Initial Oil Estimates in US History“

Report #23 “MGX starts Petrolithium pilot plant to deliver hard facts for strategic partners“

Report #22 “Time to bet: Sprott takes a position in MGX“

Report #21 “Petrolithium: First Come First Served“

Report #20 “Successful Independent Verification of the MGX Lithium Extraction Technology“

Report #19 “MGX to Drill the World‘s First PetroLithium Well in Utah“

Report #18 “MGX Reports Upgrading of Lithium Brine from 67 to 1600 ppm Lithium“

Report #17 “MGX technology nominated for prestigious Katerva Award, the Nobel Prize of Sustainability“

Report #16 “Unconventional oil play legend Marc Bruner to take MGX and PetroLithium to the next level“

Report #15 “Total Conviction: MGX forms PetroLithium Corp. to expand into the US oilfield brine markets“

Report #14: “MGX Extracts Lithium from Oil Wastewater - Begins Monumental Integration with Big Oil“

Report #13 "MGX Partners with Oil Major on Lithium Brine, New Energy Industry Facing Fundamental Shift“

Report #12 "Game Changing Potential: MGX Minerals‘ Pilot Plant for Rapid Production of Lithium Nears Completion“

Report #11 "MGX assays 34 g/t gold from surface sampling in British Columbia“

Report #10 “Official: MGX owns magnesium worth multi-billions of dollars and starts pilot plant shortly“

Report #9 “One of the world‘s largest lithium resources on the horizon?“

Report #8 “Ready for significant lithium brine work in Alberta“

Report #7 “At the forefront of Alberta‘s lithium brine riches“

Report #6 “Pioneering Lithium in Alberta: MGX Minerals Teams Up“

Report #5 “Time to Put a Lithium Production Process in Place“

Report #4 “MGX Minerals Taps Into Canada‘s Potentially Largest High-Grade Lithium Resources“

Report #3 “MGX Minerals Receives Mining Lease for 20 years (in British Columbia!)“

Report #2 “MGX Minerals Accelerates Towards Production“

Report #1 “MGX Minerals Plans To Enter The Magnesium Market“

Disclaimer: Please read the full disclaimer within the full research report as a PDF (here) as fundamental risks and conflicts of interest exist. The author hold a long position in MGX Minerals Inc. and is being paid a monthly retainer from Zimtu Capital Corp., which company also holds a long position in MGX Minerals Inc. The company may decide to advance its petrolithium projects into production without first establishing mineral resources supported by an independent technical report or completing a feasibility study. A production decision without the benefit of a technical report independently establishing mineral resources or reserves and any feasibility study demonstrating economic and technical viability creates increased uncertainty and heightens economic and technical risks of failure. Historically, such projects have a much higher risk of economic or technical failure.