“Canada is poised to be a world capital of crypto mining.”

Those words are from Dan Reitzik, CEO of diversified blockchain and cryptocurrency Company DMG Blockchain Solutions Inc. (TSX: V.DMGI, OTC: DMGGF, Forum). He sat down with Stockhouse Editorial to discuss the Company’s growth strategy in a competitive field. DMG’s goal is an ambitious one – to build a diversified crypto and blockchain company, deploying the industry’s largest and best managed mining facilities, the leading blockchain based supply chain management platforms, and a forensic and data analytics division working with trusted brand name clients. The Company plans to accomplish this goal through its unique business model wherein it plans to grow diverse revenue streams led by an experienced management team.

DMG boasts several prerequisites investors will need to look for when investing in a blockchain company.

- Experienced management

- Diversified beyond cryptocurrency mining

- Well capitalized (More than $35M raised to date)

- Already in revenue

Based out of British Columbia, DMG formed in 2016 and began its business mining bitcoin but has since evolved into a full-service blockchain operation with four revenue streams: bitcoin mining, mining as a service (MaaS), blockchain platform development, and forensic/data analytics. We will get into each of these later.

The genesis of the company dates back to when Dan Reitzik got in touch with blockchain pioneer Chris Filiatrault, who had been living in Japan for over 25 years, touting the benefits of Bitcoin since its inception. “He made tens of thousands of people there very wealthy,” CEO Reitzik added.

They then teamed up with a pair of executives from Bitfury, one of the world’s largest bitcoin mining and blockchain companies. Steven Eliscu, who spent nine years as a semiconductor analyst with UBS Investment Bank on Wall Street prior to Bitfury, and Sheldon Bennett, who was instrumental in setting up a 58-megawatt facility outside of Calgary when he was with Bitfury, incorporating thousands of servers, making it the largest in North America and second largest in the world, as far as we know. Before Bitfury, he also served several years as Chief Operating Officer for Cisco Systems in Russia. For a pilot, DMG set up about 300 mining servers in Edmonton prior to securing its new flagship facility, and it realized early on that to truly succeed in the Blockchain space, it must diversify.

A software team was then established in Vancouver, and in Q1 2018 the Company also acquired Blockseer, a leading Silicon Valley based blockchain technology company, led by Danny Yang. The US team is made of up Stanford, Harvard, Chicago, Columbia and Carnegie Mellon educated developers, with deep knowledge in blockchain technology and data science. Blockseer’s key shareholders include Litecoin founder Charlie Lee and legendary tech investor Bill Tai, both major blockchain and crypto leaders.

Bitcoin mining and mining as a service (MaaS)

For investors unfamiliar with blockchain technology, or for those who need a refresher, BlockchainHub, has a concise infographic that explains some of the ways DMG uses this technology.

The Company has recently begun to energize its flagship industrial mining facility, with a potential of 85 megawatts - capable of hosting approximately 50,000 mining units - which uses a similar amount of power as the City of Kelowna.

In addition to mining its own bitcoin, MaaS is one of the ways DMG provides recurring revenue, largely independent of Bitcoin’s market performance. The Company provides access to mining hardware, hosting and management services to clients who want to become bitcoin miners. DMG is paid upfront for the mining hardware and then receives monthly hosting revenues for operating the hardware. The resulting bitcoins generated are distributed to clients.

DMG has already closed deals with two Japanese clients (approximately $7 million in upfront revenue and approximately $250,000 in monthly recurring revenue), as well as a strategic joint venture with Mogo Finance Technology that will involve potentially thousands of additional miners.

The Company has access to a large installed customer base through its marketing and sales partnership agreement with Bitmasters in Japan. With 50% of global Bitcoin trading, Japan is the world’s largest bitcoin trading market and the first government regulated cryptocurrency market. When DMG recently presented at the Bitmasters’ conference in Kobe, it announced its MaaS model. Bitmasters was so impressed, its owners and investors ordered $3 million (CAD) worth of hardware in addition to committing to recurring hosting fees. Through this relationship, DMG has access to a network marketing group with tens of thousands of bitcoin buying members.

DMG’s crypto mining facilities will be used for its Mining-as-a-Service (MaaS) clients and for DMG’s own use. This blended approach allows DMG to scale at a faster pace than a pure mining model, optimizing the use of its recently raised capital - it balances the capital requirements and high returns of the traditional mining model with the low capital intensity and calculable revenue generation of the MaaS model.

Blockchain Platform Development

“We build our blockchain platforms in partnership with key customers to solve for them compelling commercial problems. We are combining our technology expertise with our customer’s deep domain knowledge to both increase operating efficiencies and wring out fraud.”

Such is Dan Reitzik’s motto on DMG’s key to growth and strategy – strategic partnerships.

The blockchain framework is especially suited for supply chain management. In January 2018, DMG signed a letter of intent (LOI) with Emerald Health Therapeutics Inc. (TSX: V.EMH, OTCQB: EMHTF, Forum) to develop a blockchain-based supply management system and e-commerce platform for cannabis. DMG will build a blockchain based supply chain management platform in order to provide an immutable record of provenance at each step through the supply chain. Payment for products and services, inventory management and regulatory/tax reporting can all be automated through the power of smart contracts. For this and other projects, the Company generates revenue from the initial software development as well as recurring revenue based on the value of the product that transits through the blockchain platform.

Ultimately, DMG plans to serve a broad base of use cases to apply blockchain technology across agriculture, pharmaceuticals, transportation, energy, manufacturing and even big data. The Company is one of the first to explore inefficiencies in fleet management (transportation use case), combining artificial intelligence and blockchain technology to track and extend the life cycle of a vehicle. In December 2017, DMG joined with Element Fleet Management Corp. to develop a blockchain platform to help increase fleet efficiencies. Element is an industry leader in fleet management, utilizing database technology to track asset-related life-cycle events - from vehicle procurement through vehicle retirement. Element has a 9.9% ownership stake in DMG.

Forensics and Data Analytics

DMG’s fourth revenue stream involves working with law enforcement and assisting companies with cybercrime investigations via DMG’s proprietary analytics software.

In March 2018, DMG finalized its 100% acquisition of analytics company Blockseer. Blockseer tracks transactions for the most popular cryptocurrencies, including bitcoin and ethereum, to determine if customers are potentially engaging in high-risk illicit activities. Crypto platforms, including wallets, exchanges, banks and consumer brands, are now able to use Blockseer’s technology to calculate a ‘risk score’ on a wallet, and predictive analytics provide assurances that the wallet is safe and not linked to the dark web or other nefarious activities.

DMG’s Blockseer has an extensive list of clients including the U.S. Secret Service, the Federal Bureau of Investigation, and the Internal Revenue Service. The second-largest wallet provider, Blockchain.info, also uses Blockseer’s software.

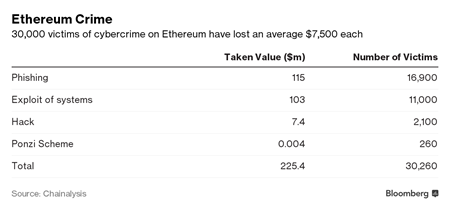

As Bloomberg reported, cryptocurrency cyber crime cost victims $225 million in 2017.

Headquartered in Silicon Valley, California, Blockseer is an especially notable acquisition for DMG, as governments need “know your customer” (KYC) and “anti-money laundering” (AML) practices in place when dealing with cryptocurrencies, and that’s Blockseer’s specialty. DMG’s Japanese influence and reach are key, as Japan is the first country to regulate cryptocurrency, and DMG’s Blockseer tools are an enabling technology for the Japanese government, banks, exchanges, and any other entity involved in paying in or accepting cryptocurrency.

D-Link Partnership

Another big name signed-on to partner with DMG in March 2018. Global leader in networking and communications products, D-Link Canada and DMG jointly announced its partnership to introduce best practices for the cryptocurrency mining industry. Together DMG and D-Link will work toward optimizing crypto mining networking, including hash rate stability, network security and switching performance.

It’s a relationship that is proving to be mutually beneficial. D-Link President Lou Reda stated the following in a news release: “DMG […] has given us the opportunity to really get inside this industry and understand the requirements of a large scale blockchain operation. Together, we’ve been able to meld our knowledge and work towards developing the networking solutions to improve technical operations and therefore increase efficiency within any blockchain application, whether that be for financial, medical or any other industry that uses blockchain distributed ledger as a foundational technology.”

A World Capital

Crypto mining is making headlines around the world, but how will Canada surge ahead to become a leader in this space?

Dan Reitzik points out that being a successful crypto miner isn’t just about having availability of a few megawatts of power but more importantly gaining reliable access to tens or even hundreds of megawatts of low-cost power. Canada has a long history with resource extraction, from mining to forestry. The landscape is peppered with towns that had an industry, which required a source of energy, such as 10 megawatts for a lumber mill or diamond mine. When those industries faded away, the infrastructure remained, and those communities are still hungry for jobs.

The environment is another reason Canada is an ideal place to mine cryptocurrencies. The preferred temperature to mine is between 0 degrees Celsius and 25 Celsius (32 to 77 degrees Fahrenheit); there are just a few weeks out of the year where temperatures rise or fall out of that range. Canada also has rule of law governing the nuances of crypto transactions, which jurisdictions across the globe are still drafting. DMG can also play an active role to assist the Canadian government with its products from Blockseer to help navigate KYC and AML hurdles.

Blockchain Technology is about the Automation of Trust

It’s no secret that the cryptocurrency space is a hotbed right now, but how big will Bitcoin mining be in a few years?

The answer is we don’t know. However, we can point out that even as 59% of ICOs fail, the industry is worth hundreds of billions. Diversification is the key to sustainable growth, and DMG’s experienced management team is capitalizing on the secular growth trends in blockchain and cryptocurrency - from hosting mining machines for third parties to complementing hosting with its own mining operations, to blockchain platform development, to forensic/analytics. Any and all of these four verticals have great potential, and DMG is ready to take off.