When the management team of Durango Resources Inc. (TSX: V.DGO, OTCQB: ATOXF, Forum) sat down in the Stockhouse boardroom for a meeting with Stockhouse Editorial, two phrases cropped up again and again: “getting busy” and “drill ready”. Experienced mining investors will already like the sound of that.

When the management team of Durango Resources Inc. (TSX: V.DGO, OTCQB: ATOXF, Forum) sat down in the Stockhouse boardroom for a meeting with Stockhouse Editorial, two phrases cropped up again and again: “getting busy” and “drill ready”. Experienced mining investors will already like the sound of that.

Early-stage mining exploration can tax the patience of investors. This is a function of several factors in the mining industry. Such exploration requires that a mining company engage in a number of preliminary activities prior to beginning actual drilling on a project – or else have the benefit of extensive historical work and data.

Why? There is an old adage in the world of mining exploration.

Nothing can ruin a good project like drilling it.

While mining executives often use this expression somewhat tongue-in-cheek, there is an underlying wisdom here. Drilling out projects is expensive. Conduct a drilling campaign and obtain mediocre results (or miss completely), and not only does a company fail to get a good return on capital, it can ruin investor sentiment for a particular property.

Veteran management personnel understand this reality. They methodically conduct preliminary exploration activities and gather data, in several forms. Geochemical and geomagnetic surveys. Soil sampling. Trench and rock samples. “Till” samples.

It’s only after all of the useful (and cost-effective) preliminary work has been done that such mining companies will bring in a drill rig for actual drilling. Maximize the probability of drilling success and then start drilling.

This has been the approach of DGO’s CEO and President, Marcy Kiesman. But Kiesman also has her own mantra for mining exploration.

Stay busy, stay new, and stay relevant.

Those aren’t just words. When Stockhouse Editorial began delving into the Company’s operations, one fact became immediately apparent. This will be the busiest year in DGO’s nine-year history, with Durango’s current market cap still hovering around $3 million.

Stay new? Durango Resources is a project generator. Such companies are regularly acquiring new projects and/or farming out existing properties as joint ventures or straight sales.

Stay relevant? This isn’t a Company that is targeting only a single metal or mining sub-sector. Durango’s portfolio of properties encompasses metals like gold, lithium, copper, cobalt and silver. DGO also holds properties with prospective potential for minerals like graphite and limestone. With diversified holdings that span several sub-sectors, Durango’s activities always remain relevant.

The difficult part for mining investors in 2018 will be keeping up with all of those exploration activities – including new drilling on several properties. The immediate focus for management is on three Quebec projects as well as a property in northern Saskatchewan.

Découverte Gold Project: “drill ready” (James Bay, Quebec)

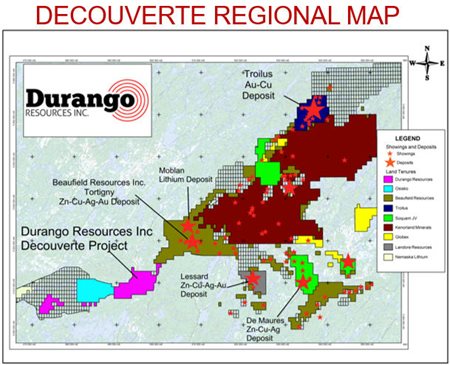

- Located 100 km north of Chibougamau, Quebec; 5,700 hectares, 100% owned

- 10 km from all-weather highway (Route Nord)

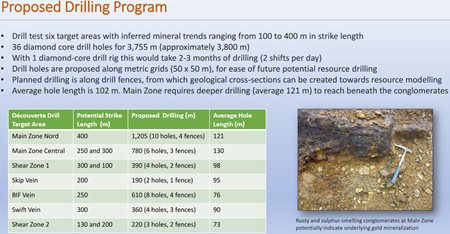

- 3,800-meter drill campaign scheduled for 2018, spread across six target areas

- New gold camp already boasts several multi-million ounce deposits (Troilus – Troilus Gold, Éléonore – Goldcorp, Clearwater – Eastmain Resources)

- Previous work: airborne surveys (Magnetic, EM, and Resistivity), soil sampling, rock sampling, humus sampling, a geophysical ground survey, a 2017 geophysical report, 2018 geological review and drill plan

- No previous drilling or trenching conducted on the property

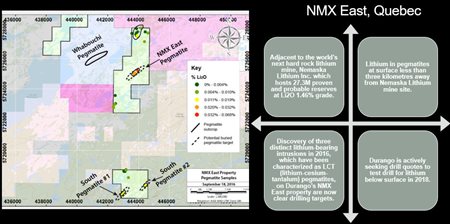

NMX East Lithium Project: “drill ready” (Quebec)

- 200 km from Découverte Project along Route Nord, 100% owned

- Adjacent to Whabouchi Lithium Deposit (Nemaska Lithium);

- Lithium in pegmatites at surface

- Whabouchi mineralization already tested to 500 meters

- 1000-meter drill program for 2018 (5 X 200 meters)

Windfall Lake Gold Project: (Urban Barry greenstone belt, Quebec)

- Active and prolific gold district

- Trove Property (part of Windfall Lake) optioned to Bonterra Resources

- Significant drilling planned in region in 2018 by Bonterra and Osisko Mining

- More till sampling for 2018, possible drilling

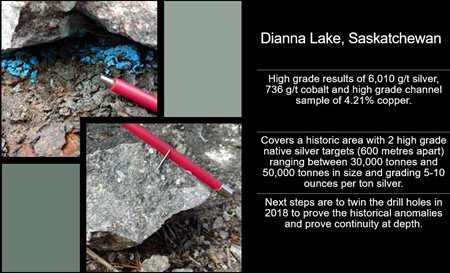

Dianna Lake silver/copper/cobalt property: “drill ready” (Uranium City, Saskatchewan)

- 17 km from Uranium City, Saskatchewan; 100% owned

- Grab samples of up to 6,010 g/t silver, 736 g/t cobalt

- Channel sample: 4.21% copper

- Covers historic non-compliant 43-101 report of 2 silver bearing exploration targets of 30,000 – 50,000 tonnes grading 5-10 oz per ton silver

- “Twinning” of historic holes planned for 2018

Those properties only represent Durango's current drilling plans. As an active project generator, DGO has several other properties in its portfolio. With approximately $1 million cash and an additional cash and share payment received last week (under the terms of a JV), the Company's operations are fully funded for 2018.

For investors, the three Projects that will likely generate the most immediate enthusiasm are Découverte, NMX East, and Windfall Lake. The Découverte Project is in the James Bay region, a district that is rapidly heating up for mining activity. While the focus of Durango (and several other companies) is on gold, the region boasts mineralization of several other metals as well. Several multi-million ounce gold deposits have already been established, with the closest being Troilus (60 km to the northeast).

(click to enlarge)

DGO originally acquired the Decouverte Project in 2010. Since that time, the Company has identified six high-priority target areas for gold mineralization, with the 3,800-meter 2018 drill program to be spread across these targets.

The property is centered over the Frotet-Evans Break. This is a “thrust fault” geological formation, with robust potential for gold mineralization, especially in the footwall on the north side of the Break. With Durango's previous sampling showing near-surface mineralization, the Company is planning on a total of 36 drill holes, averaging a depth of just over 100 meters. [detailed Appendix below]

(click to enlarge)

Durango's NMX East Project practically screams “value”. It's all in the numbers. As the property's name implies, DGO's next-door neighbor is Nemaska Lithium Inc., symbol NMX. Nemaska's Whabouchi Lithium deposit currently hosts 27,300,00 tonnes of Proven and Probable lithium reserves at a grade of 1.46% Li2O.

Based on that deposit, NMX has a current market cap of $520 million. Three kilometers east of this deposit is Durango's NMX East. DGO's current market cap is approximately $3 million. Even after it became a ten-bagger, Durango's market cap would only be about 5% of that of Nemaska Lithium.

A field reconnaissance survey completed in August 2016 identified three, distinct lithium-bearing intrusions, providing several clear drilling targets. The limited outcrop reduces the opportunities to conduct soil sampling. In between Nemaska Lithium and NMX East is Spodumene Lake, earnings its name from the lithium known to have leached into this body of water.

(click to enlarge)

Should Durango demonstrate any significant success with this initial drilling at NMX East, it's highly unlikely the Company's market cap will remain anywhere near its present level. With Découverte and NMX East alone, mining investors have an excellent opportunity for robust gains.

Management is also very enthusiastic about the potential of both Windfall Lake and Dianna Lake. In 2017 sampling, Dianna Lake yielded extremely robust assays for silver (up to 6,010 g/t Ag), copper (up to 4.21% Cu) and cobalt (up to 736 g/t Co). Investors will be eager to see the results when Durango moves a drill rig onto the property later in 2018.

(click to enlarge)

The Windfall Lake Project is one of the Company’s original holdings. Along with the joint venture with Bonterra, DGO has been continuing its own exploration activities. More till sampling is scheduled for 2018, plus perhaps additional activity as well. Marcy Kiesman elaborates further.

With Osisko conducting the biggest drill program in the world of 800,000 metres it is hard not to be enthusiastic when speaking about properties in the Windfall lake gold camp. Durango has obtained a strategic land position adjoining Osisko with its Trove, East, West and North Blocks of claims. We plan to continue with our till sampling program we initiated in November 2017 which was cut short due to road closures and snow. We are anxious for till results from the 2017 program and are preparing to up the drill priority sequence if we have good results on our North Block as Osisko is drilling next door.

As a project generator, the Company is not only acquiring and developing prospective mining properties, it is doing deals with other mining companies – as the principal way to monetize these assets. A good example of this is Durango's joint venture with Bonterra Resources.

The JV involves DGO's Trove Property, part of the Company's Windfall Lake Properties. Under the terms of the joint venture, Bonterra can earn a 100% interest in Trove via satisfying the following conditions.

- An initial payment upon closing of $150,000 cash and 1.5 million Bonterra shares.

- By 1st anniversary of closing date: another $150,000 and another 1.5 million Bonterra shares.

- By 2nd anniversary of closing date: $200,000 cash + completion of a minimum of $1 million in exploration expenditures.

(click to enlarge)

Durango holds a total of 8,653 hectares of claim blocks at Windfall Lake. With Osisko Mining Inc. as an immediate neighbor, the potential for additional deals here certainly exists.

The Company's share count is a very modest 47.4 million shares, fully diluted. CEO Kiesman is obsessed with stretching each dollar in the corporate treasury as far as possible – to minimize dilution. One example of this is DGO's 2018 drilling initiatives.

With Découverte and NMX East only 200 kilometers apart, by scheduling the drilling of the two properties together, the Company saves considerably on transportation costs. Another example is INRS, the Institut National de la Recherche Scientifique.

This is an internship program sponsored by the Province of Quebec. Durango obtains the services of newly-minted PhD's (in this case, geology grads) at a very low cost. The students obtain valuable field experience. Durango has been utilizing this program since 2015.

While the Company is committed to maximizing efficiency with its exploration activities, management is equally focused on responsible mining practices. CEO Marcy Kiesman grew up along British Columbia's northwest coast.

She understands native communities (and their needs) and is comfortable engaging in dialogues with the aboriginal peoples who co-exist around many of DGO's projects. For this reason, Durango has always enjoyed excellent relations with native communities.

For investors considering acquiring a position in this micro-cap, there are several reasons to be enthused:

a) Efficient, responsible project development.

b) Numerous projects with strong exploration potential.

c) Multiple opportunities to unlock significant value in 2018.

(click to enlarge)

Something else that clearly distinguishes this Company from its peers? An all-female Board of Directors and senior management.

With increasing numbers of women emerging from universities as geology graduates (among many programs), it's inevitable that the mining industry will cease to be seen as “a boy's club”. The girls can conduct mining operations too.

Why buy into Durango Resources? The Company’s CEO has the last word.

Durango offers great value. The Company is almost trading at its Cash & Equivalents after our recent BonTerra payment. The Enterprise Value is nominal so if you purchase Durango shares at current prices you get our strategically positioned properties for free. [emphasis mine]

Appendix 1: Découverte drilling targets, exploration history

Découverte Project presentation

Appendix 2: Aerial footage of NMX East and Dianna Lake

FULL DISCLOSURE: Durango Resources Inc. is a paid client of Stockhouse Publishing.