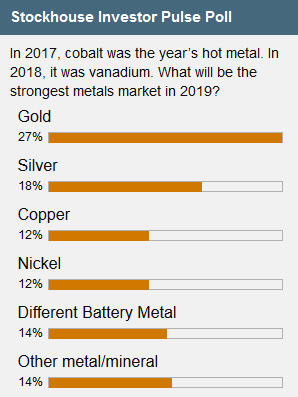

In a recent Stockhouse Investor Pulse Poll, we asked mining investors to tell us where they saw the best investment opportunities as we head into 2019.

As noted above, we excluded two metals that have already had spectacular run-ups in price: cobalt and vanadium. Even so, many mining investors will be surprised to see silver ranked in second place, the Forgotten Precious Metal.

In recent years, many people now exclusively associate the term “precious metal” with gold, because

only gold is discussed in terms of being a precious metal by the mainstream media. This is unfortunate and inaccurate.

Precious metals are a very specific group of metals that all meet two important standards: (relative) scarcity and aesthetic appeal. The aesthetic appeal is the natural brilliance of these metals, which is why they are the source metals for all jewelry and decorative applications. While gold and silver are distributed broadly around much of the world, the quantities of these metals are relatively modest, with silver being roughly 17 times as plentiful as gold.

That’s the underground ratio of these two metals, in terms of their natural occurrence in the Earth’s crust. Above ground, the story with respect to these precious metals is much different. But first, it’s also necessary to discuss the silver/gold price ratio.

These two metals have been mined for well over 4,000 years. For almost our entire history, the price ratio between these silver and gold has gravitated around 15:1, very close to the supply ratio, but with humanity demonstrating a small (relative)

preference for silver. In fact, silver is more brilliant than gold. Throughout most of History, gold’s higher price has been purely a reflection of its greater scarcity.

Here is where the story on silver gets especially interesting for astute investors. The vast majority of all the silver ever mined has literally been “consumed”. Because silver is such a useful, valuable metal, it has been used in small quantities in countless consumer products.

Billions of ounces of silver (somewhere around 90% of all the silver ever mined) is now strewn across landfills around the world in billions of discarded consumer products. Because silver has been so grossly under-priced in recent decades, it wasn’t economical to recycle these billions of ounces of silver.

This makes silver more “precious” (more valuable) than ever. Its supply ratio to gold – above ground – is no longer 17:1. It isn’t 10:1. It probably isn’t even 5:1. Indeed some analysts with considerable familiarity with this market are suggesting there is more gold in the world today than silver.

Let’s review this. For over 4,000 years, relative to supply, humanity has always had a slight preference for silver. Today,

with the supply of the two metals roughly parallel, the silver/gold price ratio isn’t 17:1 or 15:1, or 10:1, or 5:1.

It’s over 80:1.

(click to enlarge)

(click to enlarge)

This is arguably the biggest disconnect between price and value in the history of commodity markets. Indeed, this market has been so badly distorted by grossly excessive shorting that in real dollars the price of silver has been pushed to a 600-year low.

Making the price of silver even more irrational, gold itself is significantly under-priced, well below the minimum price level necessary to sustain this industry. This under-pricing of gold and silver is part of the reason why most gold and silver mining companies are currently trading at Depression-level valuations.

With this context as background, let’s have a closer look at data from this market.

(click to enlarge)

(click to enlarge)

With the current price of silver not far off its 600-year low, we see that mine production has plateaued and is now falling. This is despite the fact that stockpiles of silver accumulated over 1,000’s of years have now been nearly completely exhausted and this is a market in a

permanent supply deficit.

(click to enlarge)

(click to enlarge)

Here is more evidence of the radical under-pricing of silver. For more than 4,000 years, humanity obtained the vast majority of its silver from primary silver mines. It’s only in recent decades (after the price was crashed to a 600-year low) that the vast majority of our silver has been coming as a byproduct of other mining – especially lead/zinc mining.

(click to enlarge)

(click to enlarge)

Today, Mexico leads the world in annual silver production. Peru and China are a strong second and third, respectively. For investors looking for (now) rare primary silver companies in which to invest, those are the first jurisdictions in which to look for strong opportunities.

Silver has been under-priced for decades, resulting in the cannibalization of silver inventories and stockpiles around the world. And it’s completely unsustainable. This is why a significant percentage of Stockhouse’s (astute) community of mining investors are especially bullish on this metals market.

For mining investors looking for the best value opportunities today, you might want to consider the "silver lining" of precious metals.