There is a Power Revolution occurring in the world as the global community shifts from primary reliance on fossil fuels for power generation to cleaner, “greener” energy sources. This Revolution is coming from several different angles.

Renewable power sources like wind and solar power have finally become cost-competitive with fossil fuel power generation. While the incremental growth of these renewable power sources is a gradual process, there is unlimited potential for adopting these emerging clean technologies.

Then there is the electric vehicle sector and the lithium-ion batteries that power these EV’s. Diesel- and gasoline-powered automobiles are a major source of pollution and a major contributor to serious health problems. The

“Diesel-gate” scandal involving multinational automaker, Volkswagen (as well as other manufacturers) is connected to thousands of extra deaths in Germany alone as a consequence of excessive use of diesel fuel (and excessive toxic emissions).

Beyond the obvious and immediate health issues involving the use of fossil fuels is climate change. As the climate change Obstructionists have finally been silenced, an international consensus to implement change has emerged. However, delays in tackling CO

2 emissions (seriously) mean that the need for significant near-term changes in the global economy are now an even greater imperative.

This leads to vanadium and the market for this relatively scarce metal. In order for the world to significantly increase its reliance on wind and solar power, we need more vanadium. In order to accelerate the shift from fossil fuel-powered cars to EV’s, we need more vanadium.

This is true despite the fact that vanadium is

not an input in the production of wind or solar power. It’s

not an input in the production of EV’s or lithium-ion batteries. Nevertheless, without dramatically increasing vanadium production, the Power Revolution cannot succeed.

This is because there is one enormously important additional factor that is necessary in order for the global economy to “go green” with respect to power generation: a gigantic increase in energy storage capacity. This is where vanadium enters the picture.

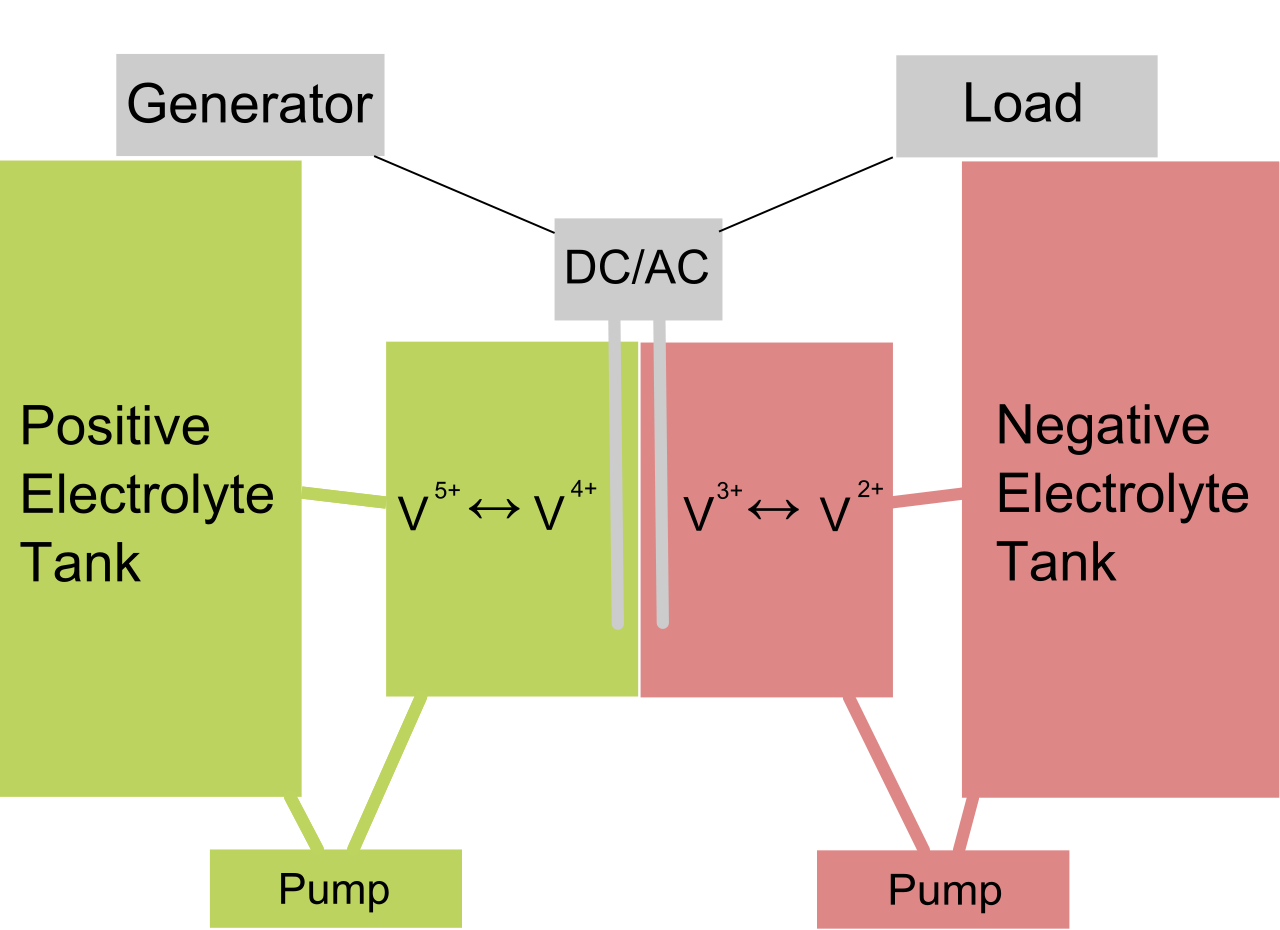

Vanadium is the critical input in the “vanadium redox battery” (energy storage cell) that is the leading technology for the storage of electrical energy. Wind and solar power generate electricity very cleanly – but unevenly. Solar power (naturally) does not generate power at night. Wind power produces minimal power generation in calm conditions.

Energy storage cells are needed to bank excess wind or solar power (efficiently) at times of peak generation so that it can be released/utilized during troughs in power generation.

There is a similar but different dynamic at work in the electric vehicle market. Here the story is not fluctuating power supply but rather fluctuating power

demand. Vehicle use is heaviest during “rush hours”, which is also when the most motorists are refueling their vehicles. Thus, we also need a massive boost to energy storage capacity to be able to meet these peak-demand periods associated with electric vehicle use.

Without embarking on a hardcore chemistry lesson, vanadium is a metal that possesses particularly strong metallurgical properties with respect to both efficiently storing electrical power as well as quickly/efficiently discharging such power.

In terms of price action, as late as the beginning of 2016, vanadium was trading at roughly US$3 per pound on international markets. Then the vanadium market took off. By the second half of 2018, the price of vanadium had exploded to a high of US$34 per pound.

Since then, the vanadium market has cooled considerably, with the price falling by more than half (currently below US$13 per pound). What should investors make of (first) the explosive surge in vanadium prices and (now) a dramatic pullback?

First of all, part of the reason why the price of vanadium went so far, so fast may have had less to do with the emerging demand for vanadium in vanadium redox batteries and more to do with vanadium’s traditional application as an additive to steel to create a stronger alloy.

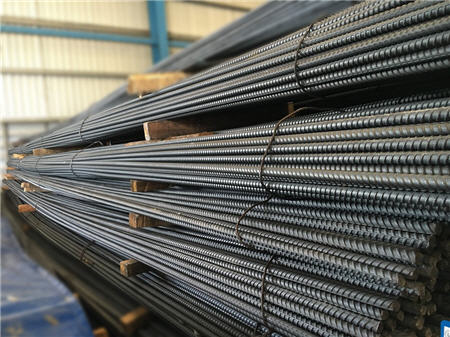

In China, the government has tightened building codes for industrial/commercial buildings. In particular, much more “high-strength rebar” (reinforced steel) will be required. This has been a gradual process that China began back in 2011. At the end of October 2018; the latest code change took effect, meaning that Chinese construction companies would have already been dramatically increasing their inventories of this rebar.

For the use of vanadium in redox batteries alone, the incremental demand could not justify such higher price levels. But higher prices (than the current US$13 per pound) are coming in this market – and future price increases will almost certainly be attributable to greater demand for vanadium redox batteries.

Again, the story here is China. China is currently commissioning the

world’s largest vanadium energy storage cell, a 10MW/40MW vanadium redox battery, with Phase 1 of this project already complete. Already under construction is a gigantic 200MW/800MW project (twenty times as large), expected to come online in 2020. By itself,

this new vanadium redox battery complex would represent a tripling of global vanadium redox battery storage capacity.

In short, mining investors looking at current vanadium prices need have no fear that they have “missed the boat” with respect to the investment opportunity in this mining sector. Rather, the party hasn’t even started (yet). For mining investors wanting to support the global shift to cleaner, greener power generation – and profit while doing so – increasing exposure to the vanadium sector is a great place to start.