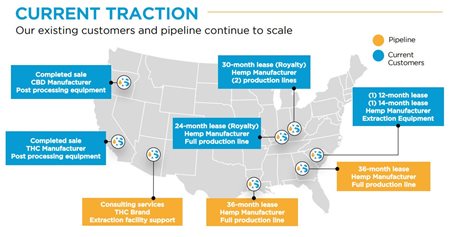

(Image via Xtraction Services. Click image to enlarge)

The cannabis market isn’t as new to investors as it was a few years ago. Most big players and personal investors see how much money has been raised in the growing industry, and many companies have tried to make their own success story.

As the industry has grown, however, there has been a lack of attention on the businesses

around cannabis. Big analysts and industry names like Bruce Linton

have made it clear that they’re looking at the big market that works alongside cannabis as the next play. To them, there’s just as much money in “plant-touching” businesses as there is in those that don’t.

Ancillary service providers are huge factors in every industry and cannabis looks to be no different. The still-new and still-attractive market will continue to draw fresh companies and existing operators looking to ramp up their productions. Naturally, that creates a need for experienced providers of services and financing.

Xtraction Services Holdings Corp.(CSE:XS, Forum) saw that opportunity and quickly recognized that all of the companies in this industry need capital for expensive equipment.

The Company recognised that the industry needed a dedicated platform for equipment leasing. In an interview with Stockhouse Editorial, David Kivitz, the CEO of Xtraction Services says that the Company’s view was that equipment leasing is the norm in most industries and cannabis was due to be next.

“A lot of cannabis companies are considering alternatives to the sources of capital that they have been using. Most industries, especially those utilizing industrial equipment, lease it. There's no reason why in this industry the same option should not exist. But, due to the nature of restrictions on US equipment leasing firms, we believed that there was a huge opportunity to fill that void.”

As an ancillary business, Xtraction is able to participate in the cannabis market without being subject to the 280E US Tax Code that bars companies operating with illegal substances from taking deductions. That market is projected to exponentially grow over the next few years, but as cannabis gets closer to a

$160-billion-dollar industry, the amount of equipment needed to cultivate, extract, and test are substantial.

A Welcome Business Model

One of the key messages Xtraction has received from their equipment manufacturing partners is how necessary their business model is for them and their customers. In the current market, a lot of them are struggling to sell to their clients and looking for ways to provide leasing options, which Xtraction is happy to provide.

Leasing is a tried-and-true practice for a reason: the business model generates very high margins. On 12-36 month leases with down payments and the ability to upgrade,

Xtraction sees an IRR greater than 50%, and direct leasing is only one of the high return options that the Company offers.

The latest product, which is quickly becoming one of the most popular, is a

sale-leaseback. Companies that already own equipment will sell it to Xtraction and then lease it back via monthly payments. This provides them with working capital, lets them continue to use the equipment, and provides Xtraction a consistent revenue stream.

Sales-leaseback are an industry standard in many fields, especially in real estate and heavy machinery. For the relatively nascent cannabis industry, the fit is uncanny

. The quick growth of the market saw hundreds of companies invest heavily in equipment, especially in the absence of alternatives. As capital becomes harder to acquire, Xtraction’s sale-leaseback solution looks more and more attractive.

(Image via Xtraction Services. Click image to enlarge)

(Image via Xtraction Services. Click image to enlarge)

Cannabis companies have limited access to traditional funding sources and many already spent a large portion of their capital on equipment. The Company’s sale-leaseback offers them an alternative.

And by its nature, a sale-leaseback allows the Company to work closely with established businesses. During the interview with Stockhouse Editorial, Xtraction’s Chief Marketing Officer Antony Radbod pointed out that as lessors, Xtraction wants to avoid providing leases to start-ups and that diversifying into sale-leasebacks allows us to work with more mature operators.

“We felt that the sale-leaseback would create a more specified funnel of customers focused towards mature operators, and gives us products for all businesses in the space, from start-ups to large-scale MSOs. If a company has already purchased, it is more likely that they are generating revenue. There's a higher degree of likelihood that those we're targeting are further along in their operations history, which reduces our risk exposure on a lease.”

Turning Expertise Into Opportunities

In order to participate in the space, Xtraction needs to have a deep understanding of the cannabis and hemp businesses. Vetting potential lessees in other industries involves checking a lot of previous performance metrics, but a newer industry like cannabis often lacks these relied-upon metrics.

For the Company, that means having an amazing amount of expertise. The underwriting process involves having a thorough understanding of a business, its plans and feasibility, and its management team, all of which require a high-level of industry experience.

The Xtraction team was built with this experience in mind, and it’s allowed for further product offerings. Not only can the team identify reputable operators, they can capitalize on that expertise directly by offering consulting services to companies that assistance with equipment procurement or operations.

(Image via Xtraction Services. Click image to enlarge)

(Image via Xtraction Services. Click image to enlarge)

Combining Xtraction’s offerings together has led the Company to create a complete product ecosystem for potential customers. From assistance in choosing equipment and operating facilities to leasing the equipment and eventually a sale-leaseback, the Company has an avenue to fully support a customer, understand their business, and capitalize on that knowledge.

The diversity of solutions also gives Xtraction a major edge over other companies in the cannabis industry. Shifting market conditions have been putting a burden on many operators, and Xtraction is well positioned to help. When sentiment is high, clients are lining up to lease equipment and get started. When capital is tight, clients look for alternative solutions and the Xtraction Services products speak volumes to them.

(Image via Xtraction Services. Click image to enlarge)

(Image via Xtraction Services. Click image to enlarge)

In his interview with Stockhouse Editorial, CEO Kivitz circled back to why companies like Xtraction do well in other industries.

“What's great for us is in periods like now where equity capital is really hard to come by, those are actually the best times for us. This is a necessity, it's a lifeline for a lot of these businesses. And you can make the argument that anytime is a good time. When companies are raising a lot of equity, there's more equity beneath us supporting these businesses to make sure we're getting repaid. If equity capital is harder to come by, we can dictate our terms.”

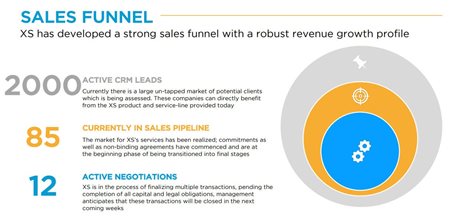

As far as growth trajectories go, Xtraction has a straightforward path to follow. The Company

completed its RTO on Sept. 12 and started trading on the CSE the following day. Now, it works to expand its operations and client base simultaneously, with numerous contracts already in its sales funnel.

(Image via Xtraction Services. Click image to enlarge)

(Image via Xtraction Services. Click image to enlarge)

The other thing Xtraction is excited to do is to further expand the Company’s consulting and equipment distribution practices. The relationships Xtraction has managed to build with vendors has greatly incentivized the team to help them expand by selling more of their products. Of course, that goes hand in hand with the consulting division and expertise in setting up facilities.

When Xtraction thinks about the importance of ancillary services to the cannabis industry, it’s hard not to think of something like the beverage industry. The biggest household brands in beverages are supported by industries that most people don’t know about, investors included, but they’re vital to the industry and profitable alongside it.

From tech services, to alternative financing, to marketing agencies, there’s always a place for ancillary services. Even as the cannabis industry continues to grow and expand in the US, Canada, and around the world, and the entire landscape of established companies and winners changes, they’ll still need to be supported by businesses that don’t touch the plant directly.

Companies like Xtraction Services exist for a reason. Looking at the Company and the playing field as a whole, it’s clear that it’s not just a necessity for the cannabis industry, it’s also an opportunity.

FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.