(Aerial of Marathon, Ontario. Photo via davestew89 [CC BY 3.0])

Acquiring a property in the mining industry with an existing mineral resource estimate is a sure-fire way to get started in an area. Due diligence still needs to be done, especially when it comes to additional sampling and confirming the estimate, but you’re already starting off on a good foot.

Acquiring a property in the mining industry with an existing mineral resource estimate is a sure-fire way to get started in an area. Due diligence still needs to be done, especially when it comes to additional sampling and confirming the estimate, but you’re already starting off on a good foot.

When that property is in a hot market like palladium, it’s doubly important to get a project rolling sooner rather than later. The previous metal recently hit an all-time high of US $1,621.55 per oz, and with a shortage of supply and demand only set to increase, investors have their eyes on the market.

That’s why the latest news from Generation Mining Ltd.(CSE:GENM, OTC:GENMF, Forum) is not only exciting, but also serves to elevate an already appealing opportunity.

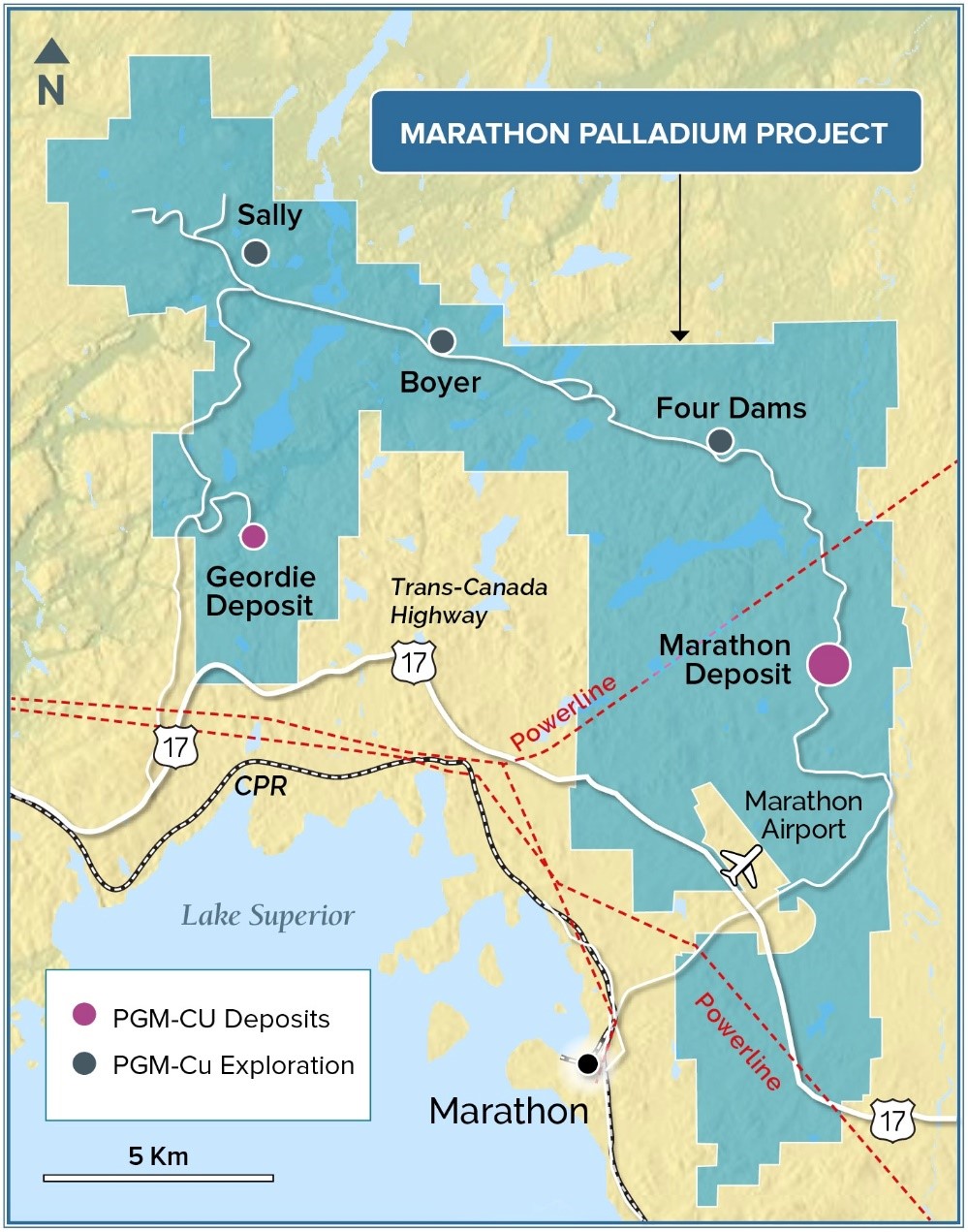

Stockhouse previously covered the Canadian exploration company with an in-depth feature looking at Generation Mining’s prospect in Northern Ontario just over a month ago. At the time, the Company had entered the palladium market by acquiring 51% of the Marathon PGM project, with the option to boost the interest to 80% by spending $10 million within four years of closing.

Despite the property returning some impressive estimates, it hadn’t been fully explored yet. Historical resource estimates billed the Marathon Deposit at 6.5 million oz palladium equivalent (PdEq) at a grade of 1.45 g/t PdEq. But Generation Mining knew the existing estimates were out-of-date and looked to clarify the numbers.

When the results were released on Sept. 9, they were even better than expected. The Marathon Deposit was found to be more bountiful than initially estimated, with measured and indicated resource 7.13 million oz PdEq grading 1.24 g/t PdEq. At a cut-off rate of $13 NSR, the calculated estimate includes 3.24 million oz Pd, 1.06 million oz Pt and 796 million lbs Cu.

Using a higher and more conservative cut-off rate of $25 NSR, the estimate numbers 5.83 million oz PdEq measured and indicated at agrade of 1.56 g/t PdEq. For Generation Mining, the acquisition looks better and better by the day.

Generation Mining’s CEO, Jamie Levy, commented on the Company now being able to move to the next stage of the project right away.

“We are pleased to confirm and substantially improve on the historical Mineral Resource Estimates done on this project by previous operators and based on these results we plan to begin a Preliminary Economic Assessment (PEA) immediately.”

(Image via Generation Mining. Click image to enlarge)

One key takeaway is that the estimate only looks at the Marathon Deposit, which was also the primary focus of the past 35 years of exploration on the property. The results of the Marathon Deposit are significant on their own, but Generation Mining has even more deposits on the property to consider.

Two of those deposits, the Geordie Deposit and Sally Deposit, also have planned estimates being conducted. Though they’re smaller and slightly lower grade than the Marathon Deposit, both have also been explored in the past. The Geordie Deposit had a historical estimate conducted in 2010 that the Company is looking to update, while the Sally Deposit already has 56 historical drill holes and is due to get an Initial Mineral Resource.

Overall, the next steps for Generation Mining are clear. Once the estimates are completed for the additional deposits, the company plans to move forward with a PEA. The Marathon Deposit is strong enough on its own, but the additional deposits could serve to elevate the property further.

Over the next few months, Generation Mining will have estimates to look forward to in addition to a 12,000 metre drill program that already commenced on Aug. 14. The program includes 3,000 metres testing an additional target near the main Marathon Deposit, 1,000 metres of confirmation drilling on the main deposit, and 2,700 metres of exploration drilling on Georgie Deposit offsets.

The executives at Generation Mining know that getting good news from a mineral resource estimate means its time to strike. Considering the Marathon project is in a renowned mining area in Northern Ontario, and in one of the hottest commodities today, the Company definitely isn’t going to sit around and wait. That makes Generation Mining and its Marathon PGM project one for investors to watch.

genmining.com

FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.