Khiron cannabis cultivation in Ibague, Colombia

Whenever sector-wide selling pressure ends, we have every reason to expect

Khiron Life Sciences Corp. (TSX-V:KHRN) to rebound strongly based on rock solid corporate fundamentals

, including a large corporate treasury and steadily growing revenues.

Furthermore,

the company’s business model is thriving, having established Khiron as the standout medical cannabis industry leader in Latin America. More on this in a moment.

Similarly, Khiron is making powerful inroads into the US market via key strategic alliances. This will also prove to be a valuable level to higher share price multiples.

All told, there are four primary near-term catalysts that are primed to benefit Khiron in the coming months. They are summarized as follows:

- Final green light to sell medical cannabis to patients in Colombia

- Strategic US roll-out of a high-profile JV with ediblepowerhouse Dixie Brands

- Key first-mover expansions in Mexico, Uruguay, and Brazil

- Insider buying speaks to management’s well-placed confidence

Based on Khiron’s excellent track record of execution, we expect that the first two catalysts will start to significantly impact revenues by the first quarter of next fiscal year.

The third catalyst and fourth catalysts speak to Khiron’s confidence that it will achieve exponential sales growth in medical cannabis and CBD cosmeceuticals during 2020.

The company’s overall strategy therefore looks about ready to pay off as these four major value drivers come into play. They are explained in more detail as follows:

1) Medical Sales Licence in Colombia is Within Reach

Khiron has completed its state-of-the-art medical cannabis production facilities with an ultra low-cost profile combining ideal Equatorial growing conditions with a skilled, low-cost labour force.

Khiron cultivation and production facilities in Ibague, Colombia

Khiron cultivation and production facilities in Ibague, Colombia

There’s also a key differentiator that separates Khiron from other rival growers that are trying to play catch-up in Colombia: these completed facilities represent only a small fraction of Khiron’s available licenced production potential and attest to the company’s commitment to a scalable, low-risk growth profile.

Yet there is plenty enough production capacity to meet the needs of the current marketplace – but not so much that construction costs would weigh the company down if new markets and revenues are slow to develop. Khiron can accommodate as many 100,000 patients so far, based on current production capacity.

By focusing on demand creation before construction commitments, Khiron has also shrewdly set itself apart from competitors by forging important inroads into Colombia’s medical community. To this point, the company has built an unparalleled network of medical association endorsements, affiliations, and clinical outreach programs in Colombia and elsewhere in Latin America.

This includes Khiron’s ownership of a network of ILANS (Latin American Institute of Neurology and Nervous System) clinics, with 120,000 patients in the system. In total, these relationships offer Khiron exposure to around 5 million potential medical consumers nationwide in Colombia.

Only one final piece of regulatory red tape remains. Khiron is waiting for final government authorization to start selling medical products to patients across the healthcare spectrum in Colombia. This green light is expected by the end of Q3 or early Q4 2019.

So far, Khiron’s annualized revenue for fiscal 2019 of around CDN $9 million is attributable to its ILANS clinics and Kuida product sales, alone. With so much pent-up sales potential once other key revenue verticals come on-stream, Khiron is still considerably undervalued when compared to its big-league peers.

2) Leveraging the Khiron/Dixie Brands Power Play

Khiron’s expanding lineup of Kuida cannabis cosmeceuticals

Khiron continues to expand its line of CBD-based cosmeceutical products under the Kuida brand, with three new products recently approved for sale in addition to seven SKUs already on the market. Plus, Khiron recently received US federal government approval to import its fast-growing suite of Kuida products to the US.

The Kuida brand will be launched in the US through Dixie Brand’s well-established marketing channels, beginning in early 2020. This one catalyst alone, involving one of the leading CPG players in the cannabis industry, has the potential to double Kuida’s addressable market involving an estimated 60 million Hispanic consumers in the US, alone

Additionally, this strategic alliance with this cannabis edibles powerhouse should bolster Khiron’s product portfolio immeasurably. It adds a further 100+ cannabis and CBD products in the food and beverage, supplements, and pets’ categories to Khiron’s revenue streams. And this should have a big impact on sales in Latin America in particular, beginning in early 2020. This even includes a prospective joint venture with CPG giant Arizona Iced Tea to produce and distribute THC-infused tea beverages.

Some of Dixie Brands various cannabis THC and CBD infused edibles

This future cross-continental market penetration has the potential to produce exponential revenue growth for Khiron over an extended roll-out period. This outcome offers yet another value driver towards higher share prices.

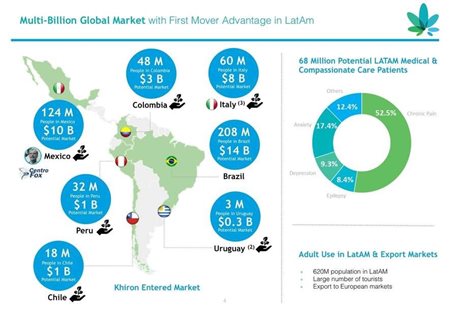

3) Conquering Latin America

Khiron has an enviable record of establishing itself as a first-mover in strategic markets across Latin America. Mexico is no exception. This is where Khiron benefits from the political and commercial influence of board member Vicente Fox, former President of Mexico and ex-CEO of Coca-Cola LATAM.

Recent news reports indicate the Mexican Senate is reviewing cannabis legalization proposals, which could lead to draft legislation before the end of October. Any positive news that emerges should reflect well on Khiron’s position in this market.

Uruguay was the first country in the world to legalize both recreational and medical cannabis. This is where Khiron has 105,485 square feet of growing and processing facilities under construction, using the same scalable/modular build-out that the company is deploying in Colombia.

These facilities also offer Khiron access to Brazilian markets through the free-trade Mercosur Trade Bloc. Notably, momentum is building in Brazil toward legalizing medical cannabis on a much wider scale than exists now. Again, positive news from Brazil should add value to Khiron’s prospects in this massive new market. It also represents a staging ground for exporting cannabis to Europe thanks to Brazil’s free trade agreement with the EU.

4)Khiron Insiders are Voting with Their Wallets

Company directors and senior executives have been steadily buying shares of their own company in 2019, while selling none. The total value of shares purchased by insiders so far this year comes to more than CDN $4.5 million.

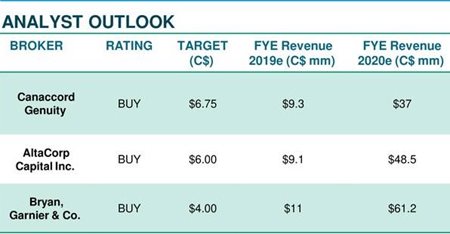

Insider transactions of this nature are a favourite indicator among retail investors, and for good reason. There is one main reason insiders buy: they foresee higher share prices on the horizon. And investment analysts agree (as the table below illustrates).

All by itself, insider buying may not be a sufficient reason to win over new investors or to even reassure existing investors in a falling market. However, when combined with Khiron’s track record of nearly flawless execution of all phases of corporate development thus far

, this insider buying speaks to the credibility and conviction of Khiron’s management team. In essence, it represents a resounding endorsement of the company’s stand-out business model.

Investment Summary

With integrated, scalable operations in multiple Latin American jurisdictions where medical cannabis markets are just beginning to open up, the future looks very bright for Khiron.

Unlike most of its peers, the company has negligible debt and has plenty of money in the bank to finance its aggressive expansion across the Americas, and eventually in Europe, too. With a war chest of approximately $55 million in the bank as of last August, the ramping-up of new income flows promises to further strengthen Khiron’s much-envied balance sheet. This makes for a powerful differentiator at a time when many other cannabis companies are running out of operating capital for build-outs and working capital, alike.

Simply stated, Khiron is still on-track to become the dominant seed-to-sale medical cannabis leader in Latin America. In this regard, the company has executed on promised deliverables along an expedited timeline.

Remember that the Latin American markets for medical cannabis and cosmeceuticals, along with infused , represent multi-billion-dollar verticals. Investors should realize that an oversold industry front-runner like Khiron has all the right dynamics to rebound with a vengeance from the current market sell-off, unlike most of its peers.

ABOUT THE AUTHORS: Daniel Brooks is Senior Editor of CannabisCapitalist. Marc Davis has a deep background in the capital markets spanning 30 years, having mostly worked as an analyst and stock market commentator. He is also a longstanding financial journalist. Over the years, his articles have also appeared in dozens of digital publications worldwide. They include USA Today, CBS Money Watch, Investors’ Business Daily, the Financial Post, Reuters, National Post, Google News, Barron’s, China Daily, Huffington Post and AOL.

FULL DISCLOSURE: Khiron Life Sciences Corp. is a client of Stockhouse Publishing.