In an

August 2019 Stockhouse article, we detailed how a ‘New Gold Rush' has triggered a metals & mining market investment rally so far this year. Now, Goldman Sachs sees the price of gold jumping in the 9 percent neighbourhood to US$1,600 per ounce by the end of March 2020. This, despite the fact gold has fallen more than six percent from the peak to close at $ 1459.30 in the spot market Monday.

The global investment bank stood by its bullish three, six, and 12-month forecasts in a research note last week. It highlighted as factors underpinning the price -- political uncertainty, recession fears, high household savings, low interest rates, an equities selloff, growth of emerging markets, moderate growth in mine output, robust central-bank purchases, and greater discussion of

Modern Monetary Theory (MMT), among others.

The precious metal’s best times often come during times of uncertainty as a safe haven asset and as well as a store of wealth to hedge against inflation during turbulent times.

Goldman's analysts said they "remain optimistic" about gold going into 2020, and say they see upside in gold as late cycle concerns and heightened political uncertainty will likely support investment demand for gold as a defensive asset."

Goldman Sachs' 10 key reasons to expect a higher gold price:

- Political uncertainty resulting from the US-China trade war and other trade disputes, next year's US elections, protests in Hong Kong and elsewhere, and rising concerns about inequality and support for wealth redistribution.

- Recession fears due to record-low US unemployment and an inverted yield curve – a reliable indicator of an upcoming recession.

- greater household savings in developed countries – coupled with lower global investment – has resulted in a savings glut, leaving more people with spare cash to spend on gold.

- Rock-bottom and even negative interest rates could limit the scope for bonds to appreciate, making gold more attractive as it might decouple from rates and outperform them during the next recession.

- Stocks are likely to fall next year due to political uncertainty and weaker consumer confidence. Gold may benefit as it's a common hedge for investors and negatively correlated to equities over time.

- Increased wealth could fuel demand for gold in jewelry, industry, and investment. Goldman's economists expect emerging-market economies, which account for the bulk of global gold purchases, to grow by an average of 7.8 percent annually until 2024.

- Annual mine output is set to grow just two percent annually in the next few years due to limited capital spending.

- The "wealth effect" of GDP growth in emerging markets, offset by yearly growth in mine output, could drive the price of gold up 4.6 percent annually in the coming years, Goldman estimated.

- Central banks are on track to buy a record 750 tonnes of gold this year, and could buy another 650 tonnes next year…supporting a higher gold price.

- More widespread discussion of MMT, which calls for governments to run larger fiscal deficits, could fan fears of currency devaluation and increase demand for gold.

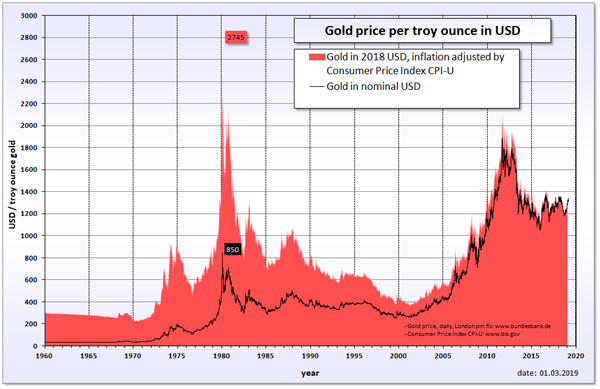

(Click image to enlarge)

(Click image to enlarge)

Then there’s also the matter of the 2020 election, which could see substantial market turbulence as Americans weigh President Donald Trump against his Democratic rival.

Goldman's economists expect emerging-market economies, which account for the bulk of global gold purchases, to grow by an average of 7.8 percent annually until 2024.

Annual mine output is set to grow just 2 percent annually in the next few years due to limited capital spending.

The "wealth effect" of GDP growth in emerging markets, offset by yearly growth in mine output, could drive the price of gold up 4.6 percent annually in the coming years, Goldman estimated.

Central banks are on track to buy a record 750 tonnes of gold this year, and could buy another 650 tonnes next year, supporting a higher gold price.

More widespread discussion of MMT, which calls for governments to run larger fiscal deficits, could fan fears of currency devaluation and increase demand for gold.

Stockhouse metals & mining investors and

Bullboard readers & posters have taken note of Canadian gold junior explorers and miners like

Blue Star Gold Corp. (TSX-V:BAU,Forum), Falcon Gold Corp. (

TSX-V.FG,

Forum),

AEX Gold Inc. (

TSX-V:AEX,

Forum),

Troilus Gold Corp. (

TSX:TLG,

OTCQB: CHXMF,

Forum),

Tembo Gold Corp. (

TSX-V.TEM,

Forum) and

Scorpio Gold Corp. (

TSX-V:SGN,

Forum) as companies to keep an eye as gold continues its upward momentum into 2020.

Stay tuned!

FULL DISCLOSURE: Blue Star Gold Corp., Falcon Gold Corp., AEX Gold Inc., Troilus Gold Corp., Tembo Gold Corp. and Scorpio Gold Corp. are clients of Stockhouse Publishing.