Every business has a target market, but the winning ones know which market to choose.

It’s one of the most common stories you hear about failed enterprises: they chose a target market that was too narrow and unprofitable, or too wide and hard to capture. There’s a fine line to thread and competitors are usually vying for the same piece of the pie.

But it’s also one of the most well-known success stories: business innovators that were the first to harness a large target market that everyone else had overlooked. Sometimes it’s a simple matter of perspective that allows you to figure out a new solution to an old problem. Other times, it’s a matter of chance. But a business model that can capitalize on the opportunity always profits.

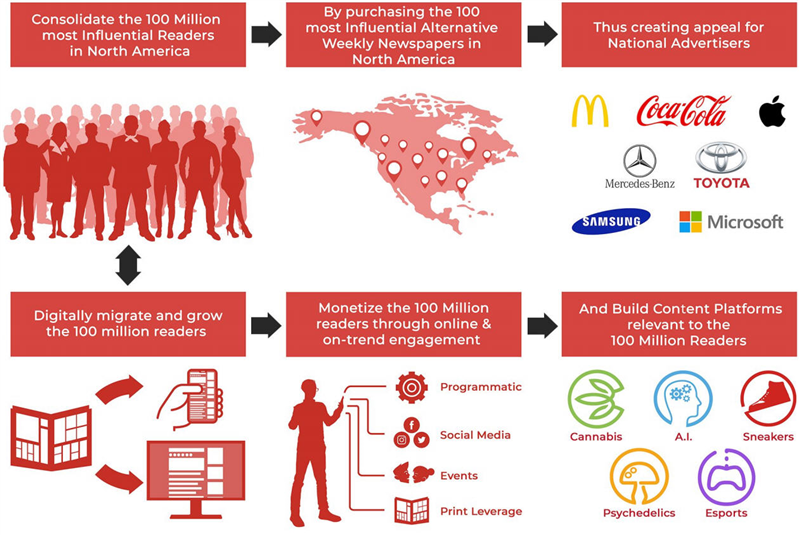

When Brian Kalish realized there was a massive untapped media market in North America, he knew there was a prospect at play. Scattered across cities in Canada and the US were a 100 million premium consumers of alternative weekly newspapers. On their own, each weekly newspaper was reaching a relatively small market that was difficult to monetize. Kalish, however, saw that the papers could be consolidated and synergized with digital media, offering one of the most attractive media consumer groups in

the $300 billion digital publishing market.

(Image via MediaCentral)

Media Central Corporation Inc.

(Image via MediaCentral)

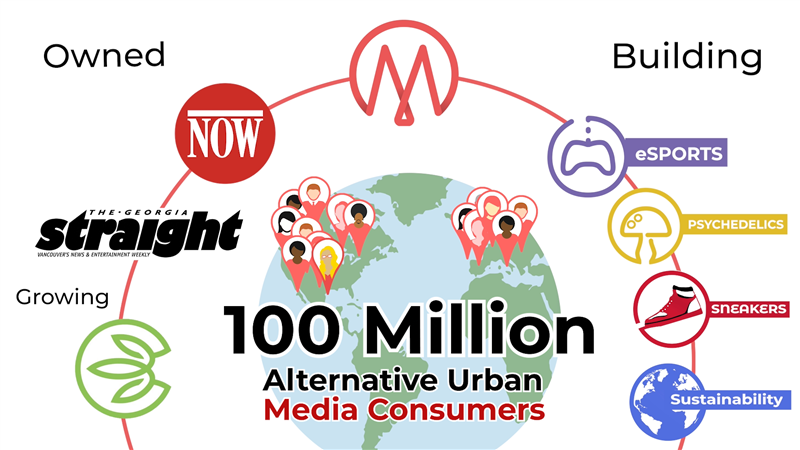

Media Central Corporation Inc. (

CSE:FLYY,

Forum), of which Kalish is CEO, is off to a fast start in capturing the market. The alternative media Company has been busy launching and acquiring urban media channels, recently

completing the purchase of

Vancouver Free Press Corp. and its renowned publication

Georgia Straight. Combined with Toronto’s iconic NOW Magazine which it purchased in November of 2019 and its other holdings,

MediaCentral has emerged the largest publisher of alternative urban media in Canada, reaching 6.5 million monthly readers in just 90 days.

Kalish recently sat down with Stockhouse Editorial to talk about carrying out MediaCentral’s strategy and the key success factors driving the business. The experienced entrepreneur is already well-known in business circles for co-leading the acquisition and redevelopment of the

Toronto Argonauts CFL franchise in 2003, alongside a host of experience in media, health care and specialty finance. During his interview, the MediaCentral CEO made it clear that target is on the market, not the medium.

“This isn't a story about how we are going to go out and consolidate the alternative urban media landscape. Not at all. Instead, it’s a story about how we're going to consolidate the hundred million consumers of this alternative urban media landscape, and do it profitably. Every business that we acquire from here, and everything that we layer in, is going to be completely synergistic. Even with the Georgia Straight for example, we're going to be able to squeeze out synergies and drive profitability where they didn't exist. From an operating standpoint, the principles of our business model are clearly there. We’re going after an audience that everyone wants to capture, but is struggling to figure out how, and where. Our strategy ensures that we realize efficiencies in a severely fragmented market, and ultimately will have us capturing the single most coveted group of consumers in North America.”

(Image via MediaCentral)

(Image via MediaCentral)

What is so attractive about the alternative urban media consumption demographic? For starters, the income and spending habits, with a $100,000 median household income for readers of the

Georgia Straight and most other alternative urban titles. Then, factor in an average age of 39 and the fact that 40% of readers are working in “creative class” jobs including jobs in S.T.E.M., education, media, and entertainment. These consumers are the quintessential influencers of everything social, political and cultural.

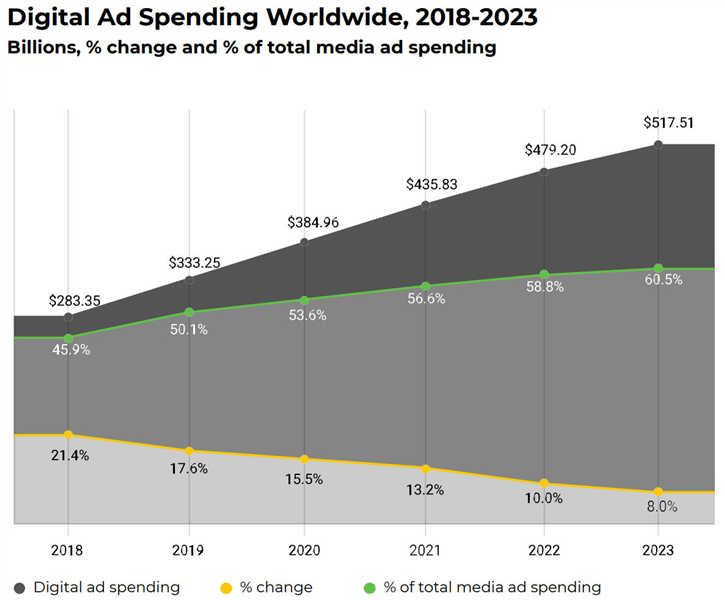

But Kalish and the MediaCentral team know that the big opportunity for the market lies in digital spending. 2019 was the first year that digital ad spending accounted for roughly half of the $590 billion global ad market, and it’s only expected to keep growing in size and percentage. Marketers are seeing big returns by focusing on digital advertising and targeting a demographic that is constantly online. The more MediaCentral consolidates that demographic, the more attractive the advertising opportunity.

(Image via MediaCentral | Source: eMarketer)

(Image via MediaCentral | Source: eMarketer)

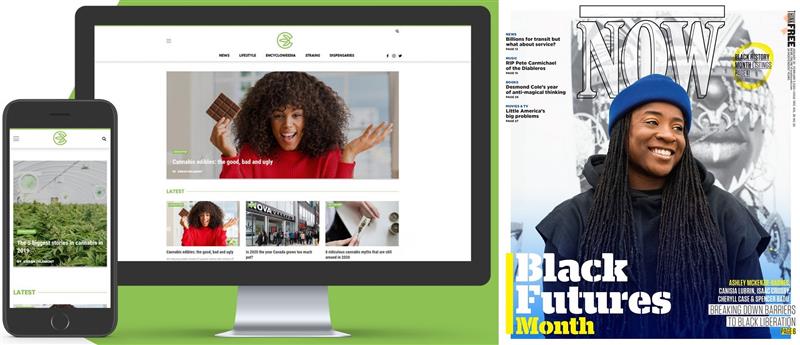

While the Georgia Straight acquisition serves as MediaCentral’s entry into the Vancouver market, its other current holdings demonstrate its growing footprint in Toronto, North America’s fifth largest media market, and the global cannabis market. In Dec. 2019, the Company

announced the acquisition of

Now Magazine, Toronto’s oldest alternative urban weekly dating back to 1981 with an annual readership of 25 million. Earlier in Sept. 2019, Media Central launched the digital publication

Canncentral.com, a premium cannabis lifestyle outlet that has

quickly achieved triple-digit month-to-month percentage growth in traffic.

In fact, the subsequent growth of both CannCentral and NOW Magazine serve as effective proof for MediaCentral’s

business model. NOW has seen

improved growth for both its print and digital channels during the fourth quarter of 2019, up 12% and 26% respectively, and even reported all-time readership highs of over one million unique users to

nowtoronto.com. A rising and integrated media tide lifts all ships, and by synergizing the separate publications, an impressive amount of CannCentral’s growth can be linked to a 302% increase in referral traffic from NOW.

(Image via MediaCentral)

(Image via MediaCentral)

That’s why the recent Georgia Straight acquisition was attractive from day one. MediaCentral is expecting to realize $1.3 million in immediate accretive synergies across its various platforms, and over the course of the year, the Company expects to profitably generate about $8+ million in revenues. Alone, many of these publications have been operating at a loss, but through a combination of integration and growth, they’re able to turn stand-alone profits while driving cross-channel business.

From the outside looking in, MediaCentral seems like it’s off to a roaring start. But in his interview, CEO Kalish said that the Company knows it can’t rush to acquire the entire 100 million consumer market. What MediaCentral can do instead is maintain a steady growth plan and establish itself as one of the select few media companies able to make acquisitions quickly profitably.

“The plan over the next three to five years is to consolidate at least anywhere from 20 to 30 publications, which will get us between 20-30 million monthly readers. Once we’re fully rolled out you’ll see the true value being built, but first we’ve got to hit the critical mass. We’ve started in Canada, and now we’ll look to the US on a regional basis, because that’s where you start to profitability recognize scale. That way you’re going to get immediately accretive benefit: synergies on sales processes, raw materials and S,G&A, with the ability to vertically integrate the print, digital and social aspects of the entire operation.”

(Image via MediaCentral)

(Image via MediaCentral)

One concern for investors might be that other companies start to clue into the massive market at play and consolidate more quickly. In MediaCentral’s appraisal of the largest alternative urban media titles, it recognized that some of the publications were in fact owned by (competing) groups, but none of them appear to have looked to grow outside of their comfort zones. Kalish, for one, would be happy to see the big private-equity-backed players get into the action, if only to help grow and add value to a market that MediaCentral has the first-mover advantage in.

Right now, it’s a question of building on what MediaCentral has acquired and making the pivot to start capitalizing. Aside from the synergies of growth, sales, and operation that are set to be realized from its existing holdings, the Company is also actively driving growth in the digital channels and starting to

build out its digital ad offerings.

By targeting a lucrative and sustainable media consumer demographic, the Company can also start to asses the potential of the market. One comparison can be made to

AlphabetInc.’s (

NASDAQ:GOOGL) YouTube platform, which recently

revealed advertising figures for the first time. On an annualized basis, one YouTube user in North America is worth nearly US $45 in advertising revenue. Even if you use a conservatively scaled-back figure per user instead (which doesn’t account for the increased advertising potential of publications), MediaCentral is already looking at an audience value well in excess of $10 million/year with just three publications.

It’s that exact scale of realized potential that makes the MediaCentral story unique in the media landscape. The Company is already the largest publisher of alternative urban titles in Canada, but at the same time, they’ve barely scratched the surface. CEO Kalish has seen the massive market waiting to be targeted, and knows that now is the time for a company like MediaCentral to step up and capitalize.

“We’re looking at a very focused and concentrated group of people who are all alike, the only thing that separates them is geography. Even if you go conservative, the value is there. If there’s one take away, it’s that we're looking to consolidate the hundred million consumers of urban media in North America., We’re going to digitize them and monetize them for the 21st century. No one is doing this yet.”

FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.