In the wake of the COVID-19 pandemic, the demand for the U.S. dollar as a safe haven asset has decreased and gold continues to trade near recent highs as some investors hedge against the potential equity market sell-off.

But it’s gold’s “little brother” that may actually hold the most lustre.

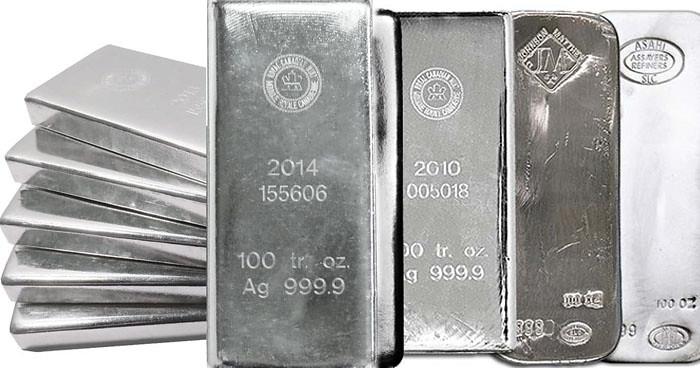

Over the past millennia, the world’s lowest priced precious metal, silver, has been coveted by humans for adornment and as money itself. But today, silver holds even more worth in scientific, military, and industrial applications than merely as a long-term monetary metal or store of value.

Recently, silver has made a significant move – up about 20 percent in the last month – and

trading just below USD$18 per ounce at press time. Simultaneously, investment in physical silver, in the form of silver bullion coins and bars, is expected to climb for a third consecutive year,

But here’s the conundrum for investors – the U.S. Federal Reserve just announced industrial production had declined by 11.2 percent in April in the United States – the world’s largest economy. This marked the sharpest drop in the index’s 101-year history, as hundreds of factories had to slowdown or suspend operations due to the coronavirus pandemic. So, while governments, retail and institutional investors are gobbling up silver as a safe-haven asset during COVID-19, global industrial production is down dramatically, thus inhibiting demand for the precious metal (approximately 60 percent of silver production is used in industrial applications fueled by new applications like 5G infrastructure, electric vehicles (EVs), and smart electronics.

But, it’s the massive switch to off-the-grid solar energy panels and cells where silver is really expected to shine. Silver plays a vital role in the production of these panels and cells that produce electricity – an industrial sector that is rising rapidly as part of the New Green Revolution.

In a recent Stockhouse article, we detailed how one Canadian company is playing an important part as a solutions provider in the revolution.

EnerDynamic Hybrid Technologies Corp. (EHT) (

TSX-V.EHT.

USOTC:EDYYF,

Forum) is a Niagara Falls ON-based firm has been building state-of-the-art global energy solutions since 2014. The Company delivers clean and renewable energy solutions having easy deployment and customization options. EHT offers the ability to combine and integrate solar energy, wind energy, battery storage technology, and energy efficient structures in a modular and customized solution.

All that Glitters is Not Gold

Silver has many unique properties – it is the most reflective plus electrically and thermally conductive of all known metals. Solar energy wouldn’t perform the same way if it wasn’t for silver’s natural properties and its contribution to photovoltaic (PV) solar cells.

A type of paste containing silver is a critical application in solar cells and panels. As the planet pursues more sustainable, less CO2 emitting power sources – other than fossil fuels and coal – the future for solar power and solar cell production shines brightly indeed.

Mexico – the world’s largest silver producer – churns out nearly 23 percent of world production of the white metal. About 80 percent of Mexico’s mining sector has now restarted, as the country continues to ease restrictions on miners. Peru, which comes second, is also allowing miners to resume production.

And when the industrial engines that drive the global economy reignite post COVID-19, a new voracious appetite for silver will need to be satiated.

FULL DISCLOSURE: EnerDynamic Hybrid Technologies Corp. is a client of Stockhouse Publishing.

New to investing in Metals & Mining? Check out Stockhouse tips on How to Invest in Metals & Mining Stocks and some of our Top Metals & Mining Stocks.

For more of the latest info on Metals & Mining stocks, check out the Metals & Mining Trending News hub on Stockhouse.