(Image via Wikimedia:P199 | CC 3.0)

(Image via Wikimedia:P199 | CC 3.0)

The strength of the gold market is no joke, and the gates are finally open for companies to act on it.

Ever since the initial wave of the COVID-19 pandemic brought markets down in March, gold has rebounded and strengthened. Over the last two months, prices have hovered consistently around US $1,700/oz, and experts expect the long-term fundamentals to drive it higher.

But the pandemic also shut down plans to take advantage of that strength. Productions were shuttered, surveying plans were scrapped, and drill programs were delayed around the world.

Now that some jurisdictions are responsibly opening up, however, plans are being put back in action. Ontario, the largest producer of gold in Canada, is one of those jurisdictions, and companies with strong holdings in the province waiting to be explored like

Nexus Gold Corp. (

TSX-V:NXS,

OTC:NXXGF,

Forum) are looking to benefit.

On June 15, Nexus Gold announced the

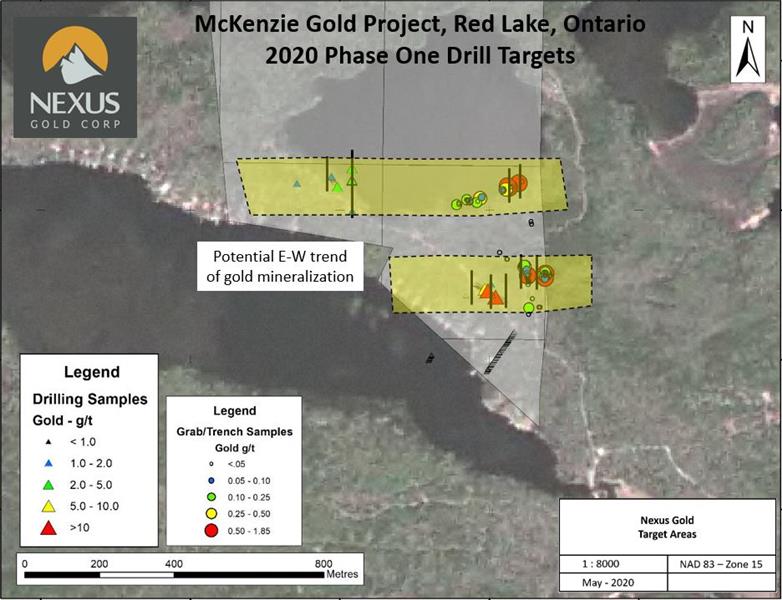

mobilizing of crew and equipment for a drill program on its McKenzie Gold Project in Red Lake, Ontario. The program had been planned for the 100%-owned high-grade gold prospect since the beginning of the year, with a minimum of 1000 metres of diamond drilling to test the mineralization potential of several gold targets, but the pandemic had temporarily halted those plans.

(Image via Nexus Gold)

(Image via Nexus Gold)

Now, the Company is back in action. Just days following the announcement of crew and equipment mobilization, Nexus Gold followed up with an announcement that

drilling on the historically promising property has commenced.

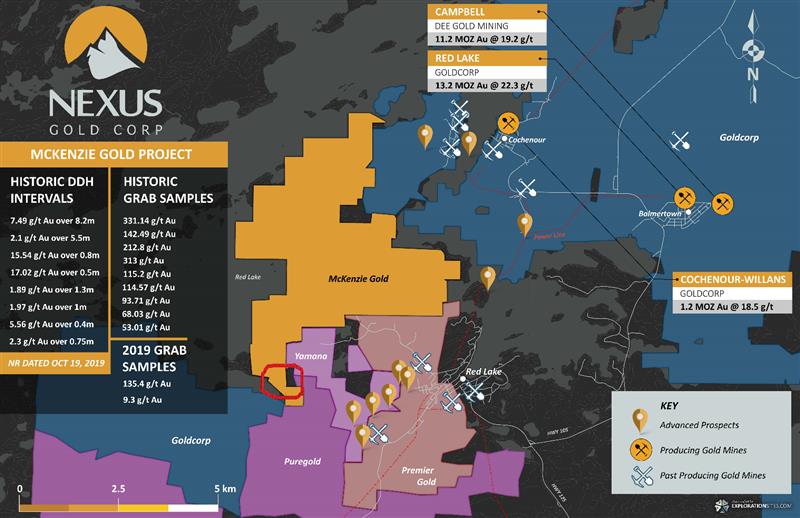

Not only has the corridor targeted by the exploration program had historic drilling conducted, the results showed the type of high-grade mineralization that’s proven strong in the Red Lake greenstone belt. The drill targets are within a corridor along the southern contact of the area’s Dome Stock, with felsic volcanic rocks of the Balmer Assemblage that’s also host to past and currently producing gold mines.

The results themselves were also extraordinary. In 2005, drilling along the corridor returned high-grade values, including 7.49 g/t Au over 8.2 metres, 15.54 g/t Au over 0.8 metres, and 4.47 g/t Au over 1.4 metres alongside other high-grade intercepts. Additional historical grab samples Nexus acquired in 2019 came in as high as 135 g/t Au.

That’s why the latest drill program at McKenzie Gold is designed specifically to expand on that 2005 drilling. In addition, the program is set to follow up on the Company’s 2019 fall prospecting program, which traced the mineralized corridor to McKenzie’s eastern boundary to determine further areas of interest and collected anomalous rock samples in the property’s St. Paul’s Bay area.

(Image via Nexus Gold)

(Image via Nexus Gold)

And considering the McKenzie Project was

recently expanded back in May 20, the timing of the program lines up perfectly with additional exploration potential. The Company added two critical new claim blocks to the western section of the McKenzie Island area of the now-1,400 hectare project, capturing ground adjacent to where some of the most robust historical assays on the property were obtained, including high-grade grab samples of 331.14 g/t Au, 212.8 g/t Au, 142.49 g/t Au, 115.2 g/t Au, and 93.71 g/t Au.

Given the historical precedent at the site, and the strength of the overall gold market, it’s no surprise that Nexus Gold’s drill program plan was made to be expandable. While the program is ongoing, the Company is also reviewing additional targets in the area to test if the phase one program is expanded beyond 1000m.

And with so many strong samples and mineralization trends present on the McKenzie Gold Project, Nexus is right to make that project their current focus. Investors familiar with the Company know their holdings extend across Canada and West Africa, but the proven strength of the Red Lake greenstone belt is hard to pass up in today’s market. It’s definitely the right place to act, and with where the market is heading, it looks like the right time. A good drill hole here, at this time, could have a significant impact.

FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.