(Image via Electric Royalties)

*This article has been edited since it was originally published on July 20th, 2020.

(Image via Electric Royalties)

*This article has been edited since it was originally published on July 20th, 2020.

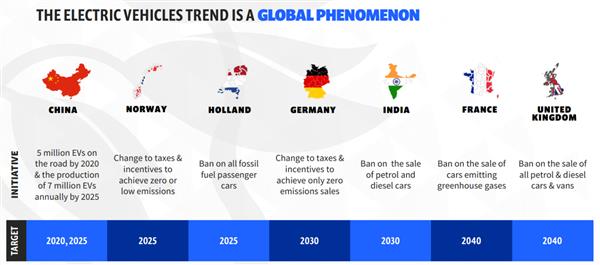

The push for global electrification isn’t a question of if, it’s a question of when.

The push for global electrification isn’t a question of

if, it’s a question of

when.

All demand forecasts and breakdowns point to a drive to electrification that has already started and will only continue to accelerate. From higher electric vehicle sales to an increased need for rechargeable batteries, large scale energy storage and renewable energy generation, countries around the world are making their plans for greater electrification crystal clear.

For investors, electrification is one of the most sure-fire long-term plays. Unfortunately, many investors jumped on the electric vehicle bandwagon long before the driving fundamentals of lower costs and widespread utility were correctly positioned, and were disappointed.

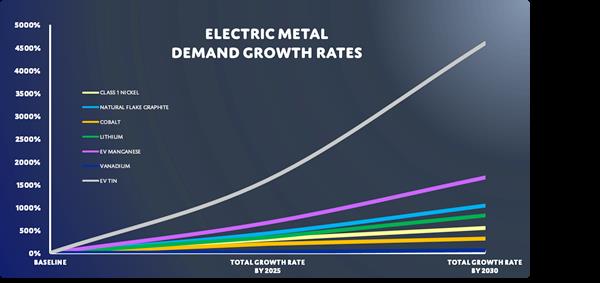

What early investors should have anticipated is a slow but certain rise in demand for certain metals, causing pressure over time on limited supplies that are not ramping up fast enough. Today, global electric vehicles number approximately 2 million. By 2030, that number is

forecasted to increase by 7,000% to over 140 million. A wide range of requisite commodities, including well-known battery metals like lithium, graphite, cobalt, manganese, and vanadium, as well as base metals like nickel, copper and tin, see forecasted demand growth rates well above 250% over the next ten years.

(Image via Electric Royalties)

(Image via Electric Royalties)

(Source: Cobalt 27 PPT, Canaccord Genuity, International Copper Association, BMO Capital Markets, Rio Tinto Battery Metals Conference 2018 PPT, Benchmark Mineral Intelligence, Bloomberg, RBC Capital Markets, SNL Mine Economics, Euro Manganese PPT, Reuters Jan 2019, EV-Volumes, Sherritt International PPT, CRU, Wood Mackenzie, Nemaska Lithium PPT, International Tin Association, AfriTin Mining PPT, NBF Estimates, GigaMetals Corp PPT, Largo Resources PPT, Lithium Americas PPT, Roskill, Western Areas PPT, International Lithium Corp PPT, Mason Graphite PPT)

But with today’s mining market focused on the far-shinier gold, battery metal projects have fallen by the wayside after having experienced a short bullish market. As investors saw a supply side that was well-stocked, with increasing supply for the then current demand, the short-term hype for batteries faded and so too did many of the underlying commodity prices. What they overlooked was the looming supply crunch on the horizon.

The resulting situation is a unique investment opportunity for investors that are paying attention. Explorers and developers with battery metals know that their projects will be in demand in the future but have difficulties in securing financing today. And producers have warned that the current supply outputs won’t be able to meet demand for very long, necessitating new projects.

Fortunately, not everyone has overlooked this incredible opportunity. For Brendan Yurik and his team at

Electric Royalties Ltd., it’s a chance too good to pass up.

The newly publicly trading company (TSX.V ELEC) is utilizing a business model that has been tried, true, and profitable many times over and bringing it to electrification: investing in and acquiring royalties over the mining projects that will feed the metal demand of the impending electric revolution.

As the Electric Royalties team has quickly figured out, the time to invest in these battery metals projects is right now. More impressively, however, is the fact that the Company won’t have to wait long to see results. Stockhouse Editorial recently spoke with Brendan Yurik, the CEO of Electric Royalties, about the Company’s unique spot in the market, and it became clear that they’re generating good interest and strong deal flows from the get-go.

“The market timing is perfect. I looked at doing this a couple of years ago, but right now we’re very much in an in-demand financing source for this niche. Cobalt, graphite, tin, nickel, vanadium, and lithium metal prices and company share prices are down across the board and these companies have been struggling. It’s not like gold where there’s always someone keen to invest even in a down market. Every single group we talked to at PDAC and other conferences was looking to do a deal. We’ve got a pipeline of opportunities and we get to pick.”

(Image via Electric Royalties)

By taking advantage of the current lack of appetite for mining financing, Electric Royalties has many different entry points to consider. Production stage projects need start up or overhead capital, construction stage projects require capital, and feasibility stage projects or earlier have many requisite studies that need to be financed. In addition to the potential for new royalties born from funding existing producers, Electric Royalties will be looking to acquire existing royalties from 3rd parties and create new royalties through financing developers and explorers in need of capital.

(Image via Electric Royalties)

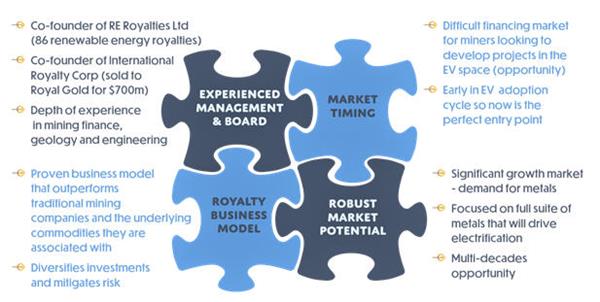

The royalty business model has been successfully deployed in the mining space and has outperformed both traditional mining companies and their underlying commodities, the strengths of a royalty business model fit perfectly for a mining market that is slated for continuous growth. There is no need for large specialized teams or the difficulties of operating a mine, the royalties are typically revenue-based and don’t rely on underlying profitability, and funding further capital expenditure isn’t required.

When you have an experienced due diligence team and well-chosen royalty opportunities, you are rewarded with a diversified and low-risk investment that sees returns a mining company could rarely imagine. Diversified mining majors have seen valuation multiples of 6-to-7 times cash flow, while royalty companies have historically traded at 20 to 25 times cash flow.

If the fundamentals are so strong (and they are), why aren’t more investors getting into royalties on the suite of metals? As Yurik pointed out, a few have, but they tend to be focused only on massive projects and on a few metals. With the team that Electric Royalties has assembled, they’re comfortable doing deals with junior companies as well, creating more royalty opportunities at a lower cost.

At the helm is Yurik, who was previously the founder and CEO of Evenor Investments Ltd., a financial advisory group to junior mining companies with experience in more than $2 billion in mining financial transactions. Joining him are Marchand Snyman and Luqman Khan, the Chairman and CFO, respectively, of renewable energy royalty company RE Royalties Ltd., as well as Robert Schafer, the co-founding director of mining royalty company International Royalty Corp. that sold for $800 million in 2009.

And bringing more than 60 years of combined mining expertise are advisors Rod Cooper and Darcy Marud, both former senior executives at mining majors. Cooper is a professional mining engineer well-known in mining circles as the former VP Technical Services and go-to guy at Kinross Gold Corp. (TSX:K), while Marud is a professional mining geologist specializing in the Americas and the former Senior VP Exploration at Yamana Gold Inc. (TSX:YRI).

(Image via Electric Royalties)

The key to Electric Royalties is the same as for most businesses: a rare combination of an experienced team, solid business model, and market potential and timing. Even though the Company is a newer venture, those factors have allowed the business to get a fast start, a bonus especially given the fortuitous market timing. With cash royalty acquisition payments of just $1.15 million, Electric Royalties already has a portfolio of 11 royalties under letter agreements, subject to certain conditions.

The Company has already secured royalty interests over lithium, vanadium, manganese, cobalt and graphite projects. Next, Yurik wants to add exposure to copper and nickel, with royalty opportunities in each currently undergoing due diligence. In his interview with Stockhouse Editorial, he reiterated just how unique and timely of a position Electric Royalties was in, which is letting everything line up nicely and quickly for the Company.

“I don’t think we’ve ever seen a situation quite like this in history. We have a new wave of demand going to hit all of these commodities in a serious way in the future, and you’re going to see those metals prices rise. Everyone got hyped up on lithium, cobalt and graphite a couple of years back, but if you look at where EV production and capacity is today, we’re just at day one. It takes time for Gigafactories to be engineered, planned out, financed and built and then they actually require these metals to produce electric vehicles and batteries and those plants, in the pipelines for years, are just coming online now. Forecasting demand growth of 100-400% in these commodities over the next decade, you just don’t see that.

People also really misunderstand the inelasticity of this sector, they don’t teach it Economics 101 in university, it takes on average more than 15 years from a discovery drill hole to take a project to production. You can actually look at the supply side for all these metals and tell within a five-year frame which projects will be able to meet that gap. These are all fairly small sectors in terms of the individual supply demand across each commodity, with not many operating projects, so the exploration and development projects are going to start being in demand sooner than we think.”

So while everyone is hot on gold, Electric Royalties is looking to the inevitable future of electrification. Right now, the Company is just getting started, and the excitement comes from the deals it has been able to secure in a down commodities market.

(Image via Electric Royalties)

But when the drive for electrification picks up steam in the coming years, the Company will already be in the perfect position to capitalize. Before coming to market, the team took time to analyse which commodities were going to grow, and they also took care to diversify. Yurik knows that battery production and technology can change on a dime and that other metals like manganese and zinc might start to become bigger factors, so the Company is playing a diversified field of metals.

Royalty companies have been making fortunes in mining for a long time. For experienced investors, history has shown the benefits of direct exposure to a growing market without the operating constraints. Returns that outpace some of the biggest operators speak for themselves, and as a diversified low risk play, rarely come as attractive.

Factor in a commodities market that is currently down and a drive to electrification that isn’t changing anytime soon, and Electric Royalties stands out as one of the best ways to get diversified exposure to a global demand trend.

FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.