(Image via DGTL Holdings)

(Image via DGTL Holdings)

One unexpected consequence of the COVID-19 pandemic? The acceleration of specific market trends and massive growth

of the technology sector.

Nowhere is more apparent than the massive growth within the online marketing advertising sector. The effects of lockdowns and quarantines forcing companies to operate remotely and keeping people at home shone a light on increased software use, digital reliance, and online advertising.

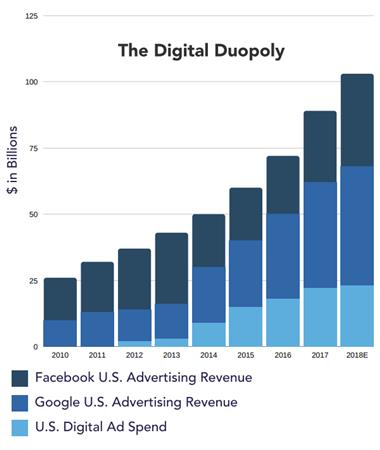

Before the pandemic, the largest companies in the world were already tech giants. All of the big five have fought for and earned revenue from software services, but the growing advertising slice of the pie had become dominated by the duopoly of

Facebook (

NASDAQ:FB) and

Alphabet (

NASDAQ:GOOG). Now, that media advertising market has grown to US $100 billion largely on advertising revenue and digital ad spending that are both forecasted to keep increasing.

Success in the technology sector, however, is born from innovation. While the existing digital media market grew on the backs of innovations from Facebook and Google that have matured and been monetized, the next wave of innovations is already upon us. Many competing start-ups today focus on Advertising Technologies (Adtech), and the ones powered by Artificial Intelligence (AI) are making the biggest headway.

(Image via DGTL Holdings)

(Image via DGTL Holdings)

This week, investors now have the opportunity to participate in this exploding AI-Adtech space in the public markets. The recently listed

DGTL Holdings Inc. (TSX-V:DGTL, Forum), a venture capital investment company building a portfolio of innovative and disruptive AI-Adtech companies, an early mover on AI-Adtech in the public markets.

DGTL is a company born out of astute analysis of the AI technology space. Particularly as it pertains to the disruptive nature of AI to the giants of digital marketing and advertising. One of the prevailing trends of the last few years has been the explosion of the gig economy, with social influencers and gig-content marketing now accounting for more than US $12 billion in yearly spend and the total creative advertising ecosystem quickly growing to US $200 billion per year. It is a market grown from first-party user data becoming universally accessible, with anyone able to create and monetize scalable and persistent open networks. The result is a distributed workforce focused on targeted DTC engagement and conversion from within, one which

the current offerings of the digital duopoly can’t service well. And due to the COVID pandemic this new gig-economy has now become the new normal – as media consumption and ecommerce transactions have skyrocketed in the past few months.

That’s why DGTL, which stands for “Digital Growth Technologies and Licensing,” has quickly stepped up with an investment model that combines analytical evaluation and M&A structures to maximize short-term impact and long-term growth. The Company specializes in incubating and capitalizing on fully commercialized B2B enterprise SaaS companies, and the diversified portfolio model has already been kicked off with the acquisition of #

Hashoff.

DGTL recently acquired the Adtech SaaS company, which provides a full-service turnkey gig content management platform and works with numerous Fortune 100 brands and content creators on marketing campaigns, content creation, and analytics. The transaction highlights the creative capital structures from the DGTL management deal desk team, and sets the stage for DGTL to continue to acquire and grow. #Hashoff was acquired for $3.5 million in preferred shares and $1.5 million in cash

only paid out in full if #hashoff achieves a US $10 million in annual revenue within 36 months.

(Video via DGTL Holdings)

(Video via DGTL Holdings)

It’s a fantastic start for DGTL, and its shareholders, but it’s just an example of what the Company is setting up. The acquisition provides access to a market of Fortune 100 companies and influencers that can leveraged for cross-selling and quick incubations for future acquisitions, and DGTL knows what to look for.

The management team has more than US $1 billion in combined Adtech sales and over a century of experience in Adtech and capital markets, with CEO Michael Racic a 20-year digital media executive veteran.

DGTL as an exciting holdings company in a rapidly-developing sector, but they know the foundations of successful business. The Company has a tight structure and strong financial position, with only 25 million common shares outstanding, and 60% restricted, and is already generating impressive cashflow, all of which allow it to approach new enterprise-level Adtech business with strong acquisition proposals for future M&A and investment.

It’s also a model that the Company isn’t looking to sacrifice. In assembling a diverse portfolio of AI-Adtech innovators that have already started to disrupt the digital duopoly’s control of advertising media, the goal has remained to focus on a cashflow-positive companies that can be further incubated and grown. That means acquiring companies across all three core verticals of the Adtech industry: Content, Distribution, and Measurement/Analytics with a goal of acquiring multiple AI-Adtech companies in the near term, and stacking revenue streams by focusing on fully commercialized high margin enterprise SaaS companies entering a rapid growth stage.

And even though DGTL is off to a hot start with this week’s listing and the completed acquisition of #hashoff, the AI-Adtech holdings company is just getting started. With a strong and proven portfolio model, and a solid base of operations, management, share structure, the foundations are well established. Factor in the forecasted growth of the global digital media industry, made all the timelier by the COVID-19 pandemic, and DGTL Holdings is set up as one of the clearest opportunities to invest in the market.

For more on this Company, visit

dgtlinc.com.

FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.