Stockhouse metal & mining investors know that the market for gold stocks has been gaining momentum in recent months.

While finding new, economically-viable gold deposits can be difficult, savvy investors know there is significant value – and risk mitigation – in previously mined areas that have proven high-grade deposits in mining-friendly jurisdictions. One such opportunity involves a past-producing gold mine and significant infrastructure, with high-grade gold exploration potential in the prolific Flin Flon Greenstone Belt – home to some of the world’s most historically rich ore-bearing deposits of copper and nickel.

An advanced-stage exploration company believes they will continue to strike gold in the corridor.

Toronto ON-based

Satori Resources Inc. (BUD) (

TSX-V.BUD,

OTCMKTS: STRRF,

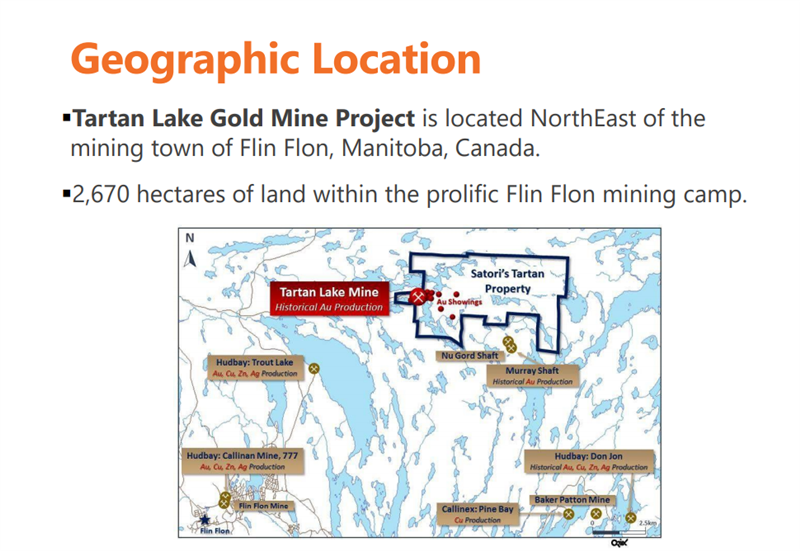

Forum) is an advanced mining exploration company operating in Canada. The Company has, at different times in its history, evaluated other business opportunities to try and create shareholder value. The Company’s management recently made the decision that the best opportunity for shareholders is in mining, and is firmly focused on the exploration, evaluation, and development of current and future mineral properties. The company holds a 100% interest in the Tartan Lake Gold Mine Project and is targeting expansion of its high-grade gold resource. The majority of Flin Flon’s surface topology is exposed Canadian Shield bedrock, hence the nickname "the city built on rock".

About the Tartan Lake Project: An Historic Gold Producer

Satori holds a 100% interest in the Tartan Lake Gold Mine Project which produced 36,000 ounces of gold, from portions of the Main Zone and the South Zone, between 1987 and 1989 when it was previously operated by Granges Inc. The property is approximately 2,670 hectares in area and consists of 20 mineral claims. The Project consists of a 450 mt/day processing plant, related infrastructure, and a decline providing access to developed mining blocks within the Main and South Zones to a vertical depth of 320 metres. The property is road accessible from the nearby mining town of Flin Flon and is hydro connected.

An independent NI 43-101 resource estimate was recently completed with an indicated mineral resource of 1,180,000 tonnes @ 6.32 g/tonne gold (240,000 ounces) and an additional inferred mineral resource of 240,000 tonnes @ 4.89g/tonne gold (37,000 ounces), using a 3.0 g/t cut-off. The high grade nature of the deposit is evidenced by a 169,000 ounce resource having an average grade of 8.68 g/t using a 5 g/t cut-off.

For those familiar with the history of production at Tartan Lake, it is common knowledge that gold was approximately $460 per ounce when the mine started production and USD$375 when production ceased in November 1989. The plant was poorly designed, and was missing a gravity circuit, both of which contributed to lower recoveries for the (uncomplicated) ore that was being produced/processed. As well, oversized and improper equipment was used to mine high-grade narrow veins, which contributed to excessive waste rock (dilution) and the need to re-design a 250 t/d concentrator to accommodate throughput of 450 t/d. By mid-1989 a re-grind mill was added to the back-end of the circuit, and with further mechanical failure and depressed gold prices the mine was put into care and maintenance.

(Click image to enlarge)

(Click image to enlarge)

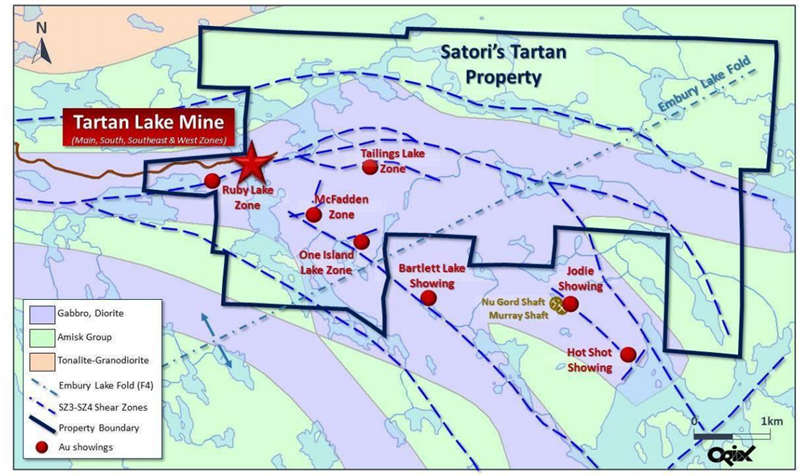

The Property is located in the western part of the Flin Flon greenstone belt in northwestern Manitoba, approximately 12 kilometres northeast of the town of Flin Flon, and includes 10 documented mineral occurrences within the Property boundaries – the exposed portion of which has an apparent elongate easterly trend, approximately 250 kilometres long by 75 kilometres wide.

Records of exploration work carried out on the Tartan Lake site dates to the 1920’s, and work by a number of exploration companies up to 1980 included trenching, diamond drilling, and small test mining batches. Exploration by previous operators identified several shear related gold mineral occurrences within the Tartan Lake property boundaries.

Tartan Lake Reserves

The mine includes historic mineral resources, and a number of known exploration targets. At the time of its closure, the mine contained an estimated 375,000Mt of gold resources graded at 6.27g/t of Au to a depth of 500 metres. Gold resources developed to a depth of 300m at closure have been estimated at 129,660Mt graded at 6.25g/t of Au.

(Click image to enlarge)

Construction and Production of the Tartan Lake Mine

(Click image to enlarge)

Construction and Production of the Tartan Lake Mine

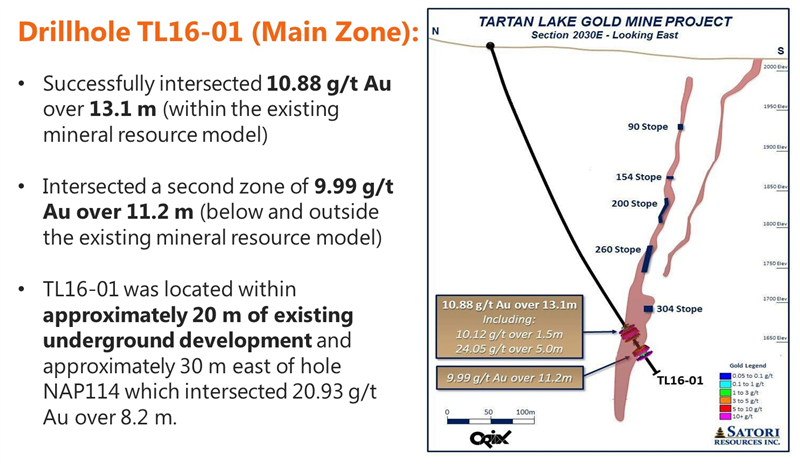

When the mine went into production, mineable reserves were estimated to be about 620,000 tonnes grading 8.5 g/t. Road access, underground access by decline, and concentrator construction commenced in 1986. The mine is trackless. It is accessed by a 4.3m high by 4.54m wide decline. The decline ramp has a slope of 15% and development is down to about 300 metres with developed tonnage on the 90, 154, 200, 260, and 304 levels. Stopes were developed from a series of crosscuts off the decline. Stoping was achieved by mechanized undercut and fill.

An undercut was developed along the strike of the deposit. Ore was mined using a 1 or 2-boom jumbo drills and was mucked using scoop trams. 32-tonne trucks hauled ore from the underground ore pass system to the surface stockpile. The mine began with a production capacity of 87,500 tonnes per year (350 t/d, 250 day year) and when it ceased production it had a capacity of 450 t/day.

The mill employed a combination of gravity separation, flotation and cyanide leaching (Merrill-Crowe Process). When the mine ceased production historical reserves were estimated to be about 375,000 tonnes grading 6.27 g/t (top cut 30 g/t, cut-off grade 4.5 g/t, minimum mining width 2.6m with 0.35m of dilution on either side of the structure). The estimate is historical and is not NI 43-101 compliant.

Area Geology: The Prolific Flin Flon Greenstone Belt

The gold mineralization is hosted by steeply dipping east-west shear zones with a trend and plunge about 70° to the northwest. Located in the Flin Flon greenstone belt, the Tartan Lake Property is an easterly-trending Lower Paleozoic volcanic arc complex. The complex is a collage of tectono-stratigraphic assemblages that was tectonically assembled at an early stage in the evolution of the Paleoproterozoic Trans-Hudson Orogen.

The local geology has a generally east-west fabric. To the north of the mine, across Tartan lake is a unit of felsic to intermediate lapilli-bomb volcanic tuffs. South of this unit and still north of the Mine are intermediate ash-crystal tuffs and segments of gabbroic rocks. Shearing intensity increases near the Main Zone through to the Baseline Zone. Shearing is east-west with the rock on the north side of the shear being transported to the west.

In the News

On

July 14th, 2020 Satori announces that it has closed its private placement offering for gross proceeds of $420,000, by the issuance of 1,790,000 flow through shares at a price per share of $0.08, and the issuance of 4,258,461 non-flow-through common shares at a price of $0.065 per share.

A detailed site evaluation report was presented by Global Resource Engineering Ltd. in

October, 2019 that concluded, “the mine site and infrastructure remains in reasonable condition, particularly given the length of time that the project has been on care and maintenance.”

Investor Update

In the short time following the private placement, investors have taken note of what they believe is an undervalued asset in an increasingly attractive market. With the price of gold hovering around the $USD2000 mark at press time, retail and institutional investors know the potential ROI right now in being able to extract gold out of the ground and into the mills and smelters has never been better.

(Click image to link to chart)

(Click image to link to chart)

Satori has approximately 51 million shares outstanding, and currently trades at $0.15, giving it only a $7.6 million market cap.

From the CEO

In conversation with Stockhouse Editorial, CEO Jennifer Boyle – a mining industry veteran and legal advisor with more than 20 years experience founding or re-organizing early-stage junior resource issuers – discusses the potential of the Tartan Lake project and what news investors and shareholders can expect from the Tartan Lake project moving forward.

SH: Things are starting to heat up in the Flin Flon mining corridor, specifically the gold sector. Can you tell, us a bit about your Tartan Lake Gold Mine Project and what makes this project unique?

JB: We’re certainly coming out of a difficult period for gold companies, and juniors in particular. We’ve always believed in the merits of the Tartan Lake Gold Mine Project, however the environment has just not been supportive until now.

Prior to Satori controlling the Tartan Lake Project, we feel that Tartan was perpetually owned by companies where it didn’t get enough attention for one reason or another.

In our efforts in the last few months we have spoken to many people who have experience with the project going back 30 years, and have a really good understanding of what worked and what didn’t – beyond the gold price – in the 1980s when Tartan produced gold for a short period of time.

Due to the historical work done on the property, as well as the evidence of high grades, we believe that we are in a great position to meaningfully increase the current resource.

Flin Flon is a prolific mining area with excellent infrastructure, access to lots of labour, and Manitoba is ranked among the friendliest districts in the World for mining.

SH: Can you discuss the long-term strategy for the company moving forward and how do you see the gold exploration sector evolving in this part of Canada?

JB: We are unique in the sense that this is a past producing mine, with significant infrastructure such as a decline, underground workings, power a tailings pond, among other things, that are in place. We also recognize that to get the market’s attention we need to expand our high grade gold resource.

We are taking a dual track at the moment, which is to increase ounces at the high grade gold deposit, while at the same time working with consultants and the government to complete the permitting and environmental assessments necessary to put this mine back in to production.

SH: What’s next for Satori Resources? What should we be watching for in the upcoming months?

JB: We want the market to know that Tartan Lake is our priority, but that we have also started reviewing other gold and silver projects in Canada that we think would be complementary, and also value creating for our shareholders.

For Tartan, we are in the final stages of compiling and analyzing all the historical data to better understand the deposit. We will do follow up work in the next couple of months and select targets for a subsequent drill program.

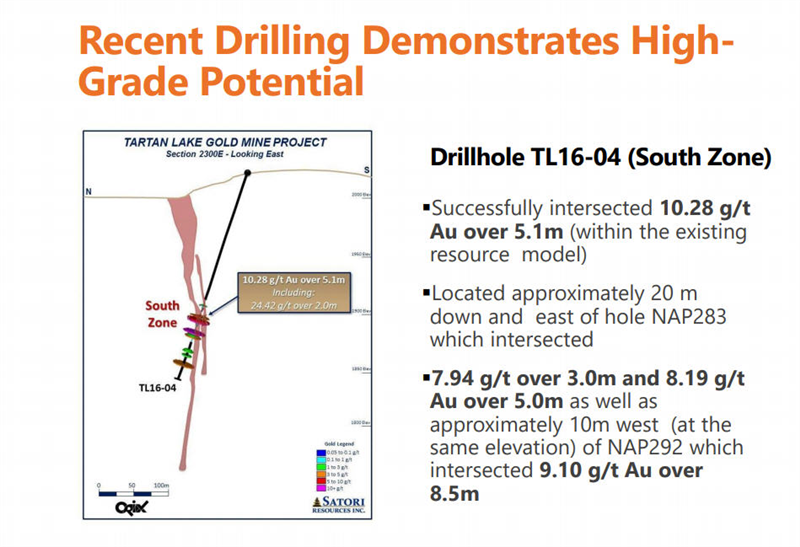

If you look at our historical drill holes, there are significant high grade interceptions such as 13 metres at 10.88 g/ton and 11 metres at 9.99 g/ton. Interestingly, it seems that grades get better at depth, so we feel like there is a significant amount of lower-risk exploration that we can do.

SH: What sets Satori apart from other junior mining companies in this space and what makes your business model attractive to investors?

JB: We offer advanced exploration potential, expansion of a high grade gold resource, infrastructure in place and an attractive valuation.

SH: What can you tell our investor audience regarding the current valuation of your stock and why it’s a good value buy right now?

JB: We haven’t really focused on our stock, and that is going to change. We’ve been very focused on getting organized from a technical perspective, strengthening our Board with the additions of Doug Flegg, former head of institutional equity mining sales at BMO Capital Markets and Wes Hanson, a veteran exploration geologist who worked at Tartan during the time that it was in production.

At 15 cents, our market cap is approximately $7.6 million. If you look at the current high grade gold resource, exploration potential, and the infrastructure in place – which would cost tens of millions in today’s dollars – we think that there really great value for shareholders and significant upside potential.

There’s a saying in mining, that the best place to find gold, is in the shadow of the headframe of a past producing mine. That’s what investors get with Satori Resources.

The Bottom Line

Tartan was a feasible mine in the late 1980’s, when gold hovered around $450 an ounce. Today, with the price is around $2000 an ounce, it looks like a no-brainer for future exploration and development.

The Tartan Deposit demonstrates high-grade potential. It remains open at depth and along strike with an extensive land package underexplored by modern techniques. Low electricity costs, a close proximity to an educated workforce, and a seasoned, experienced management team also bode well for this intriguing blue sky project.

(Click image to enlarge)

(Click image to enlarge)

(Click image to enlarge)

(Click image to enlarge)

For more information on Satori Resources Inc., visit their website at

satoriresources.ca.

FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.