Verde AgriTech shows how ESG can be profitable and with triple-digit growth.

(Image via Shutterstock.)

The number one issue facing humanity:

(Image via Shutterstock.)

The number one issue facing humanity:

Climate change is front and centre among people’s concerns as hurricanes and wildfires of unprecedented scales ravage the

globe over. Gradually, a variety of sectors in the stock markets have seen “green” initiative-based companies, with a significant leap this year.

It is not just fossil fuels that are killing our planet, but global agricultural practices have been damaging the soil for decades, releasing CO

2 back into the atmosphere. To help heal the climate, we must work to cure the soil, change how food is grown, raised, and produced.

To help end the climate crisis, agriculture will play a key role. We cannot live without food and we need a safe, sustainable future without carbon pollution. The world’s population has boomed to more than 7.8 billion people and they need fresh, healthy food grown in sustainable soil ecosystems.

This is the message behind a Netflix documentary starred by Woody Harrelson,

“Kiss the Ground,” which connects land use, soil degradation, and the ongoing climate crisis. It declares that through regenerating the Earth’s soils, we can balance the climate, replenish the water supply, keep species off the extinction list, and better feed the world.

“We should be thriving, the planet booming with life and abundance and the healthiest generation walking the earth. Instead, we’re facing extreme weather and a food system in desperate need of change. The Netflix documentary, Kiss the Ground, lays out a path forward to a measurable drawdown of carbon from the atmosphere, increasing food security for future generations, and generating new economic opportunities and entrepreneurial activity.” Executive Producer Nicole Shanahan

Looking for a solution? A way you could contribute to the battle against climate change and fulfill Netflix’ documentary’s ambitions?

Agriculture technology (agri-tech) Company

Verde AgriTech PLC (TSX: NPK, OTCQB: AMHPF, Forum) has an answer. The profitable Company is out to make the world a healthier place and is doing so by capturing carbon into the soil.

People need to care about what is put into the soil if we are to see future generations thrive on a healthy planet and Verde has targeted one of the most efficient solutions for global warming that lies right under our feet.

Investor interest in companies that adhere to environmental, social, and corporate governance (ESG) practices are growing and Verde AgriTech is one such business with one of the most important applications in this regard.

“It is undeniable that modern agriculture is a source of global warming, not only because of its carbon footprint associated to global logistics for fertilizers and produce but also because of the billions of soil microorganisms that are exterminated with the use of chemical fertilizers and pesticides. The pressure for agriculture to reduce its contribution to global warming, however, is unfairly placing strain on the very food producing system that has raised millions out of poverty and contributed to near eradication of global starvation. At Verde, we believe industrial scale agriculture can reduce its carbon footprint and actually contribute to carbon capture.” - Verde Agritch CEO Cristiano Veloso.

To solve this climate crisis, business as usual will not cut it:

(Image via kissthegroundmovie.com.)

(Image via kissthegroundmovie.com.)

The means to uncover a simple solution to fight the issue of climate change may lie under our feet: the soil microbiome.

NPK’s flagship is the multinutrient potassium fertilizer marketed in Brazil under the brand K Forte and internationally as Super Greensand, one of Verde’s sustainable products from which the nature-driven technology company helps to improve the soil microbiome.

CO

2 emissions are not the only problem leaking from our soils either. The industrial standard of adding concentrated potassium chloride (KCI) into the ground, as the source of K that all plants need, corrupts the soil and contaminates where the food we eat is grown because of the Cl that is inextricably linked to it.

It is a common practice since KCI is relatively inexpensive and has become an industry standard for soil, being widely used from Saskatchewan to Brazil. As it is so concentrated, it has the potential to be a harmful contaminant through the chloride also present. Basically, KCl it is good because of pricing and ease of transport, but it is bad for soil microbiomes and the environment.

Potassium chloride contributes to the intensification of global warming because it kills the microorganisms responsible for the microbial assimilation of atmospheric CO

2, which are essential in capturing carbon. Verde has begun doing its part to fight this crisis by replacing the use of KCI into its own product, sold in Brazil as K Forte and internationally as Super Greensand

, which is produced with cost-competitive innovative technologies that focus on sustainable technological products.

K Forte is sustainable, chloride free, and costs the same as the common fertilizer containing potassium chloride, essentially replacing it. Most of the chloride free alternative products similar to Verde’s have traditionally cost 50% or more, which is clearly uneconomic for a lot of farmers when a cheaper (if worse for the environment) solution exists.

This Company works as an agent of transformation in this climate change situation, utilizing methods such as regenerative agriculture and bio-sequestration, which is the storage and removal of carbon from the atmosphere by photosynthetic plants and bacteria (through techniques of farming, for example). Carbon monoxide is a positive part of the life cycle of plants since we consume it.

To date, Verde has saved soils from a dose equivalent to 290.8 million litres of Clorox. Over the next 36 years, the Company intends to have avoided at least 957.8 billion litres from being dumped into agricultural soils in the guise of KCl.

A deeper look into Verde’s operations:

Boasting a 229% a Compound Annual Growth Rate (CAGR) for product sales from the first half of 2019 to the first half of this year, Verde AgriTech is growing as strongly as soil enriched with its proprietary nutrients. The Company delivered product sales targeting a growth rate for the fiscal year 2019 to 2020 of 85%. Since production began in 2018, the Company has clocked in an average gross margin of 46%.

The estimated Net Present Value (NPV) after tax is $1.99 billion (USD), with an 8% discount rate and Internal Rate of Return (IRR) of 287% (The NPV per share is $38.65 (CAD)). (Reference: NI 43-101 Pre-Feasibility Technical Report Cerrado Verde Project, MG, Brazil). Based on $1,81 billion (CAD) NPV after tax divided by 46,928,766 shares outstanding as of June 30th, 2020.

Verde released its Q2 2020 financial highlights this past summer and reported that its revenue increased by 87% from Q2 2019 to $2,492,586. This news also included a sales increase of 202% with a total of 71,183 tonnes compared to 23,600 in Q2 2019, as well as a 139% increase in production with a total of 80,490 tonnes mined, compared to 33,671 tonnes in Q2 2019.

More information on these results can be found

here.

The Company also noted in its pre-feasibility study that it could supply 40% of the Brazilian potash market, which could yield annual sales of $628 million (USD) in revenue and gives roughly $2 billion in net present value.

This project therefore represents an opportunity with scalable potential. Verde AgriTech intends to achieve annual revenue upward of $628 million via a successful combination of debt and accumulated cash flow stemming from its production.

Brazil’s National Mining Agency (ANM) approved Verde’s mine’s pit 2 25 million tonne-per-year (tpy) feasibility study in March 2020. In the same month the Company also filed a 2.5 million tpy Mining Concession Application for its mine’s pit 3 and a 2.5 million tpy Environmental License Application the mine’s pit 2.

In

August 2020, the Company received the full environmental license for mining up to 233,000 tpy of its multi-nutrient potassium fertilizer and filed a 2.5 million tpy Environmental License Application for the mine’s pit 3.

With its latest License and Applications, today the Company is fully permitted to mine 432,800 tpy (i.e. Verde can produce such amount because it holds both a mining Concession/Permit and Environmental Licenses) and has submitted joint mining and environmental applications for an additional 5,000,000 tpy.

“With the market’s and plant’s need for Verde’s K Forte, we have navigated the government’s licensing requirements with increasing speed and efficiency. In the near future Verde will be approved to produce volumes that significantly start to improve our environment without sacrificing agricultural productivity.” - Verde Agritch CEO Cristiano Veloso.

It has been scientifically proven that the natural option that Verde AgriTech provides can increase crop yields and it is even further supported by the Company’s technological advancements. Now more than ever, it makes sense to abandon potassium chloride and return to more natural solutions such as Verde’s K Forte/Super Greensand, to preserve the soil microbiome.

A solution as old as dirt:

(Image via Shutterstock.)

(Image via Shutterstock.)

One of the biggest sources of CO

2 is the Agricultural Sector and greenhouse gas emissions are the most responsible for changes to our climate, yet it is also one of the most important factors that can help us fight this crisis.

“Leveraging the mitigation potential in the [Agriculture, Forestry and Other Land Use] sector is extremely important in meeting emission reduction targets” , as stated by the

Intergovernmental Panel on Climate Change (IPCC).

Regenerative agriculture is essentially a system of farming principles and practices that can rehabilitate and enhance an entire ecosystem of a farm by placing a heavy premium on soil health with attention also paid to water management, fertilizer use, and more. According to the

Rodale Institute, a non-profit organization that supports research into organic farming, it is a method of farming that “improves the resources it uses, rather than destroying or depleting them.”

"Verde has already had a positive impact in hundreds of Brazilian farmers who understood, tested and proved that production yields can be boosted while still reversing the damage caused by years of compounded use of KCl. These real world results are what lead us to believe that agriculture can shift from being a culprit of global warming to a hero of carbon capture through the rich microbiome found in soils." - Verde Agritch CEO Cristiano Veloso.

Expectations for Q3 2020:

Q3 2020 results are important for Verde in terms of continuous growth. It will be interesting to see what Verde will deliver when it releases its report and investors will have much to digest come November 17th. Will this ESG agri-tech Company be able to keep up with its neck-breaking growth rate?

Verde AgriTech’s leadership has declared its financial independence, which can be a benefit turned towards shareholders. The Company has proven that it can achieve this, from its financial reports released this year and last, which show growing revenue numbers.

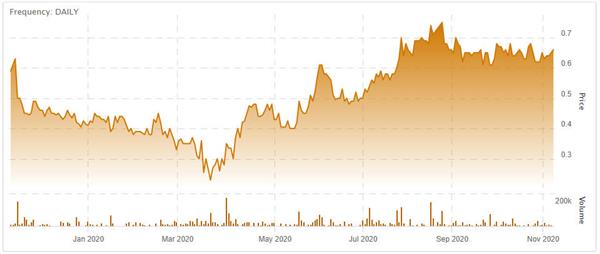

The Company’s stock has gradually bounced back from the depths experience by many businesses across the globe in the wake of COVID-19’s economic impact. NPK shares are in a better position now than they were this time, last year.

(Verde Agritech Stock Chart – Nov 2019 – nov 2020. Click to enlarge.)

(Verde Agritech Stock Chart – Nov 2019 – nov 2020. Click to enlarge.)

This is one Company that investors might one to keep on their radar as it continues to grow its potash mining project, to deliver much needed product with the potential to transform agricultural practices in a way that can feed the world for years to come.

To find out more about Verde AgriTech, visit their website -

investor.verde.ag.

FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.