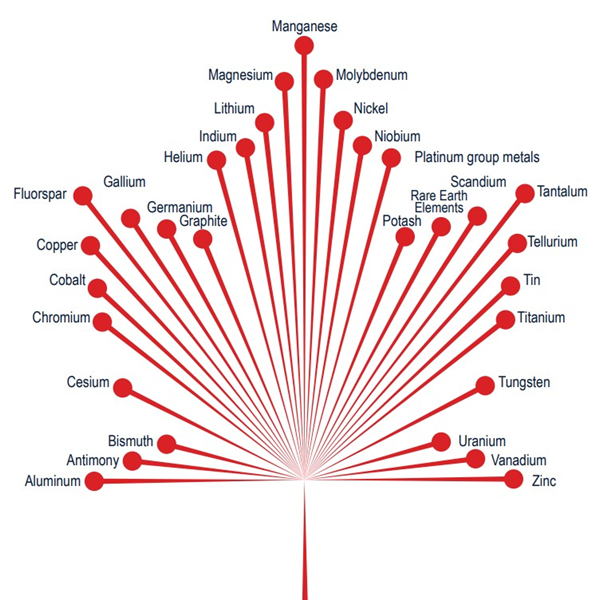

(Canadian Critical Minerals List)

(Canadian Critical Minerals List)

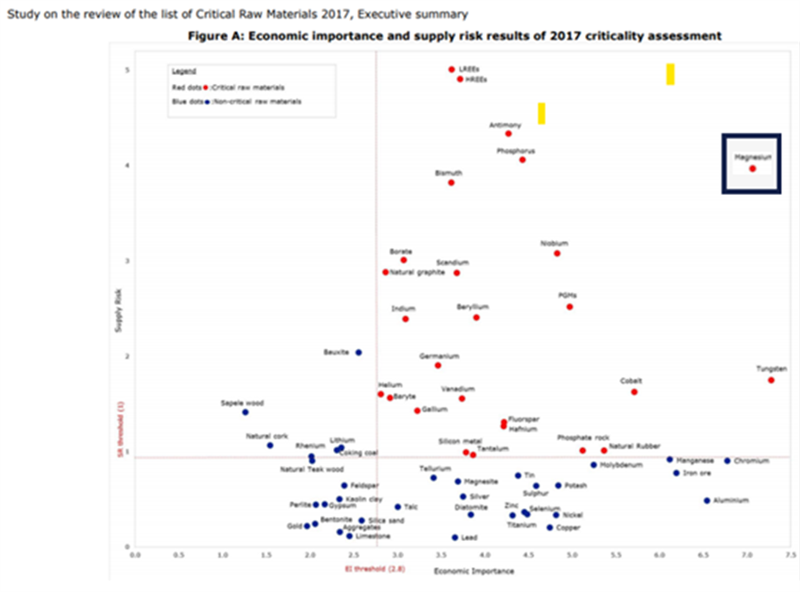

(EU Study on review of list of critical raw materials 2017, Executive summary)

Currently, lithium-ion (Li-Ion) batteries are the leading Electric Vehicle (EV) power source for the battery world, but many experts expect magnesium-ion batteries to steal that crown in the very near future….

(EU Study on review of list of critical raw materials 2017, Executive summary)

Currently, lithium-ion (Li-Ion) batteries are the leading Electric Vehicle (EV) power source for the battery world, but many experts expect magnesium-ion batteries to steal that crown in the very near future….

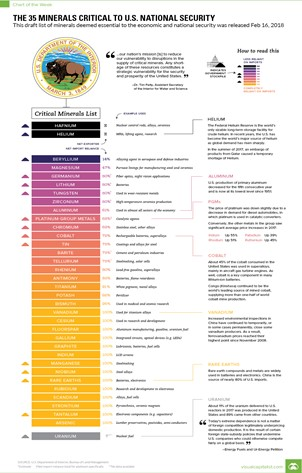

With a higher charging capacity than lithium, magnesium (Mg) is considered as one of the 35 strategic/critical minerals for the US economic and national security with an Executive order to stockpile. The US has announced the Energy Resource Governance Initiative (ERGI) in 2019 to support initiatives with member countries to develop strategic minerals projects. There has also been a recent announcement from the Canadian government with the same focus to develop the critical minerals as both the US and the EU have identified.

Current global annual market for all Mg products exceeds 29 million tonnes. Rare earth compounds and metals are widely used in batteries and electronics. The source of nearly 80% of US imports comes from China.

Enter:

West High Yield (WHY) Resources Ltd. (TSX-V: WHY, OTC: WHYRF, Forum) a publicly traded junior mining exploration Company focused on the acquisition, exploration and development of mineral resource properties in Canada with a primary objective to locate and develop economic gold, nickel, and Mg properties.

WHY commits to developing the Record Ridge Project in an environmentally, socially, economically, and culturally safe manner to the benefit of North America at large.

The Company operates multiple potential cash flow generating projects, chief among them is its advanced magnesium project with robust Preliminary Economic Assessment (PEA) - its 100% owned Record Ridge deposits.

One of West High Yield’s Directors, Barry Baim, explained in an interview with Stockhouse Editorial that operations at the Company’s Record Ridge mine will be a green process with no waste and little to no emissions during the extraction process. This 8,972 contiguous hectare property will support open pit mine and processing facility, with over a billion dollars of infrastructure in place bringing huge savings in project capital.

Located two kilometers north of Washington State in the well-established mining region of Rossland, British Columbia, Canada, Record Ridge is an intermediate-advanced stage magnesium exploration project and is considered to be a world class magnesium mine by the Company, given discoveries of global significance, due to its high tonnage and Mg-grade.

Several successful explorations, intensive metallurgical, and processing test works are underway to help validate the project, with a positive NI 43-101 PEA completed reflecting a resource estimate of 43 million metric tonnes at 24.3% Mg grade ore.

Having seen more than 10,000 metres drilling with 77 holes, all mineralized, the Record Ridge resource remains open along strike and depth covering an area of 600 meters by 1 kilometer of mineralization inside a 7.5 square kilometer ultramafic outcrop discovery.

Measured and Indicated Mineral Resources include 43 million tonnes averaging 24.6% Mg, using a 21.9% cut-off, totaling 10.6 million tonnes contained Mg. Further drilling is required to validate what appears to be an inexhaustible resource.

On February 14th, 2019, WHY also submitted the mine permit application, as well as the supporting Environmental Assessment and Environmental baseline report.

Existing infrastructure for this asset includes:

- Roadways

- Power

- Water

- Local workforce

- Proximate CP Rail Hub

This makes it all the better to enable the Company to fill North America’s global demand efficiently and economically for ecofriendly materials for generations to come.

WHY had developed a proprietary hydrometallurgical process to produce over 99% purity MgCl

2 / MgO / Mg(OH)

2 products, in addition to added values of Ni and Si by-products. A key feature of the HCl acid-based process is efficient recycling of the principal reagent, HCl, using commercially proven technology. This reduces the overall level waste products from the process and the remaining waste streams could be treated using standard chloride processing industry practice.

The magnesium market at large:

(Image via West High Yield Resources. Click to enlarge.)

“ … our nation’s mission [is] to reduce our vulnerability to disruptions in the supply of critical minerals. Any shortage of these resources constitutes a strategic vulnerability for the security and prosperity of the United States.”

(Image via West High Yield Resources. Click to enlarge.)

“ … our nation’s mission [is] to reduce our vulnerability to disruptions in the supply of critical minerals. Any shortage of these resources constitutes a strategic vulnerability for the security and prosperity of the United States.” – Dr. Tim Petty, Assistant Secretary of the Interior for Water and Science.

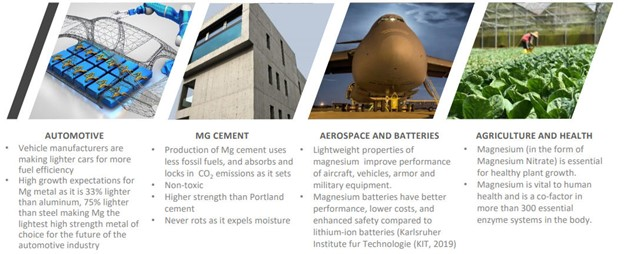

The EV battery market is the biggest and most demanding segment for these elements. Rare earth consumption in North America is entirely dependent on imports and there is a serious growing demand around the world for high grade purity magnesium, with an US executive order to stockpile. Current global annual market for all Mg products exceeds 29 million tonnes. The precursor to produce high-quality, high-purity (99%) Mg metal, is to produce high-quality MgO/MgCl2 (>99%) products.

There is a very wide array of industries and practices that call for MgO products in its purest form, with the pharmaceutical industries calling for it.

The needs do not stop there, food grade supplements also have many uses for MgO products, well as greener fields and pastures, (including lighter and stronger construction materials and vehicles) Magnesium Oxide is fulfilling government and public demand for Eco-Friendly products, healthier food grade materials and cleaner environment.

MgO can also be used for Magnesium wallboard instead of conventional plywood with the added benefits of being fire, smoke, mold, and waterproof. Having a high thermal conductivity with a low electrical conductivity, it also has some key properties that make it ideal for a wide range of refractory and electrical applications, as it is also resistant to corrosion.

The demo plant:

With a budget of $15 to $20 million and a potential 75% federal / provincial government funding, along with a further 25% funding internally, West High Yield is developing a semi-commercial demonstration plant (pictured below).

Operating at 2 total petroleum hydrocarbons (tph, and at 10% of commercial scale), this marks the next step in the Company’s project development, which is seen as an essential risk mitigation step that includes:

- Producing over 5000 tonnes a year of high purity MgO/Mg(OH)2 product and creating a positive cash flow Producing large samples of products for customer evaluation

- Collaborating with end users to design magnesium products to meet the industry needs and requirements

- Mitigating technological and R&D risks

- Providing training for key operating

- personnel to facilitate smooth commissioning of a commercial plant. In addition, the company expects saleable, in demand high grade silica and nickel as by-products.

As the team works to mitigate the risks associated with the scale-up to the commercial facility, it is achieving all technical objectives and generating enough engineering data for a full Feasibility Study, which would include a comprehensive technology overview and operational engineering factors.

The semi-commercial demo plant has the potential of generating cash flow with gross annual revenues of more than $11 million, with an EBITDA of $6.45 million.

This project will continue until the successful commissioning of the first commercial plant and that means the Company is out to hire 15 to 20 full-time employees during the operation stage.

High grade gold projects:

(Image via West High Yield Resources. Click to enlarge.)

(Image via West High Yield Resources. Click to enlarge.)

Even with the focus being magnesium, it is no surprise that WHY has also set its sights on gold.

Another near-term project under the Company’s potential generating strong cash flows in parallel with its magnesium projects are its Midnight Gold Project and Gold Rejects Project.

Midnight Gold:

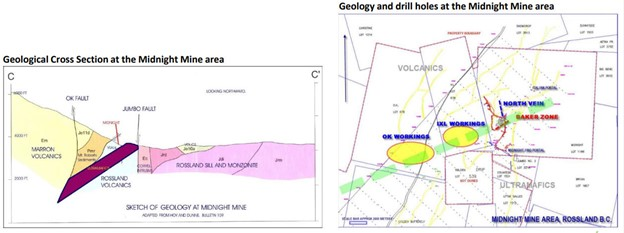

The Company's approved drilling program on the Midnight Gold Claim is located in the Rossland Gold Camp in British Columbia which historically produced over 2.76 million ounces of recovered Gold, and 3.52 million ounces of recovered Silver. The Midnight area contains primarily narrow and erratic but high-grade quartz –carbonate veins with native gold and minor silver and sparse sulphides.

Located in the Rossland Gold Camp, Past production of about 33,500 ounces of gold at 101.5 Au g/t average from the combined WHY Resources’ properties up to 1941.

The Company supports the theory given by many of its senior geology consultants that the series of gold-enriched quartz veins and gold bearing serpentinites identified by the drill holes to date, have been enriched from a contained deeper source. The BC Ministry of Mines has granted a Permit for a 22-hole drill program totaling 20,000 meters on the Midnight claim at 600 meters per hole in an attempt to reach the mother load The company plans to further define the gold mineralization on its Midnight Claim to proceed with NI 43-101 Resource Estimate.

Gold rejects:

At the end of 2020, West High Yield began a joint venture with EnviroGold Global to unlock the mine’s reject rocks value stockpiled from the historic mining operations.

In

a media release outlining this news for investors, WHY’s President and Chief Executive Officer, Frank Marasco Jr. described the transaction as “win-win” for both parties.

The permit ready project boasts more than 225,000 metric tons grading at average 2.5 ppm Au, for a total of more than 18,000 ounces of gold, greater than $30 million in value.

“We are excited to partner with EnviroGold to extract the value from our rejects stockpile and use the proceeds to advance our business plan. EnviroGold's team and experience will assist our Company in unlocking the value in this ready to process asset.”

EnviroGold’s CEO, James Canning-Ure added that the opportunity to work with West High Yield meant that they could create value from a previously mined resource.

“For mine owners like West High Yield, we not only create an otherwise unavailable passive income stream from waste, but we dramatically reduce a mine's environmental footprint, mine site maintenance costs, risk and rehabilitation commitment.”

Based on independently assayed random 99 bulk samples, the reject rock averaged 2.5 grams per tonne Au. All recoverable saleable minerals and metals will be extracted and marketed including, but not limited to, recoverable gold and silver.

The extraction and reclamation of the reject stockpile, all project costs paid by EnviroGold and then recovered by EnviroGold from the proceeds of sale of the processed reject rock, after which the net proceeds will be split on a 50/50 basis between the project partners. Proceeds from this project will be used by WHY to support advancement of its strategic vision to develop its mineral resource properties in British Columbia.

To help fund the completion of the Company’s approved drilling program at Midnight Gold Claim, WHY has also undertaken a

$2.5 million (CAD) private placement at a price of $0.20 per unit, scheduled to close by March 31st, 2021.

We are likely at the dawn of a new era in Canadian mining, following last summer’s

consultation report released by Ontario’s Capital Markets Modernization taskforce dubbed “Save Canadian Mining”. This advocacy group includes many junior mining companies as well as mining associations and TSX Venture Exchange, who have been calling out predatory short selling, which they claim has disproportionately impacted the junior mining sector for years.

From the news release:

“SCM has been raising awareness for the importance of the tick test (among other regulatory and structural issues within Canada's capital markets) since the advocacy group launched in November of last year. In March 2020 the group published research that revealed a link between the removal of the tick test by IIROC in 2012 and the decrease in valuations of junior mining companies. SCM has also drawn attention to the challenges of multiple marketplaces, of which there are 14 in Canada, and the negative effect that this continues to have on both small cap companies and investors.”

Canadian billionaire businessman Eric Sprott of Eric Sprott Mining Inc., along with Garry Clark, Executive Director of the Ontario Prospectors Association (OPA) and Brady Fletcher, Managing Director & Head of TSX Venture Exchange (TSX-V) have joined SCM in its response to the initial report. Bringing this level of attention is likely to help the cause, which in turn, brings the playing field to a more reasonable level for Companies such as West High Yield Resources.

Investment summary:

The opportunity and implications here are immense, but even better for investors, this is one seriously undervalued stock and when it comes to being an exploration play, this is a solid bet, as there is already a world-class discovery within the Company’s reach and the team is already at the permit stage. With a conservative pre-feasibility study complete and NPV of over $1.3 billion, 95 to 98% of this advanced intermediate project has been de-risked and once the permitting process is complete, the final piece of the puzzle will be in place. The permitting process in BC is extremely comprehensive and historically takes on average 13 years to go from early exploration to final permit. “This should not take long – about 13 years. (that is the average in BC for taking a mining project from discovery to approval and construction in BC. Though things can go quicker if you have local first nations on board.)” Nelson Bennet said in a recent article regarding mining in British Columbia.

WHY is currently at the final step of permitting and when asked consulting Project Director, Shane Uren, from Greenwood Environmental detailed the steps below that need to be completed.

Mr. Uren commented:

1.What are the milestones we need to achieve from now to get the Mining Permit? WHY submitted the industrial mineral mine permit application to the BC Major Mines Office as required for their initial screening review of the application. The screening review step is the second of three steps in the permit review process. We received comments during the screening process that will require a few weeks to address. Following this process is the third and final review stage that will require between six and nine months to complete.

2.Are there risks in obtaining the mining permit from the government? The BC government has established a multi-step permit review process where major issues are identified upfront followed by detailed review. WHY has completed these initial steps; no major issues were identified. Subsequent review steps will focus on the details of environmental monitoring and management. In addition, WHY’s consulting team reached out to BC regulators to engage them in advance of the formal review process to identify and address key information requirements.

3.Can WHY provide documentation to support the permitting process?

Yes. The application that was submitted for screening review is available.

Further to this, the Company supports the movement to save Canadian mining and return market rules to the fair and transparent standard that helped deliver prosperity for over 142 years.

As West High Yield looks to partner with Mg Metal producers, metal die cast and Injection mold manufactures for the aerospace, transportation, and military as well as large format energy storage technologies, as well as companies who use magnesium as a component Pharmaceutical and Nutraceutical companies that are developing enhanced magnesium-based products, as well as specialty products requiring highest purity magnesium feeds.

It seems as if the whole world is going greener all the time, and this is a very green mining opportunity. There is a 43-year abundance of magnesium proven to lie within this Company’s project and the infrastructure is in place to get digging.

For more information on this Company, visit

whyresources.com.

FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.