In 2021,

Marvel Discovery Corp. (

TSX-V.MARV,

OTCQX: MARVF,

Forum) grew from a top-20 (gold) claims holder in the province of Newfoundland & Labrador to the eighth largest. With slightly over 100k hectares

(net to Marvel), management is within 10k hectares of ranking #6 on the Island.

Readers may recall how hot Newfoundland was in the first half of 2020. In previous articles I discussed the benefits, blue-sky optionality & relative value of Marvel’s Newfoundland portfolio.

There’s no question,

{in my opinion} that Marvel’s Newfoundland gold prospects alone are worth more than the Company’s entire enterprise value

{market cap + debt – cash} of ~C$7.5M. Yet, the story keeps getting better.

Promising high-grade uranium project added to Marvel’s gold + REE projects

Promising high-grade uranium project added to Marvel’s gold + REE projects

On November 22nd, CEO Karim Rayani announced that Marvel was taking over an option to acquire a 100% interest in the

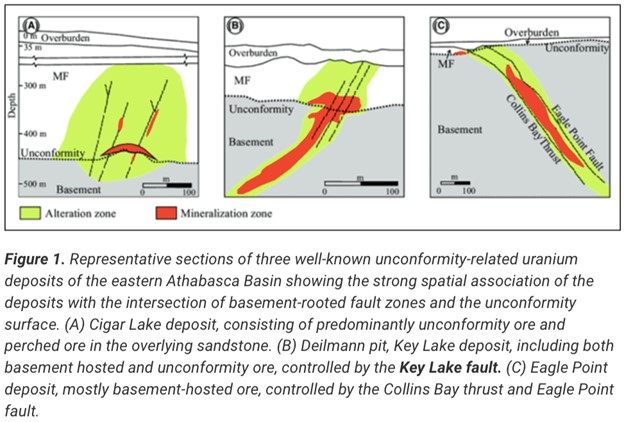

Highway North uranium property just outside the world-famous Athabasca basin in Saskatchewan, Canada. Note:

{not an arm’s length transaction as Mr. Rayani is a large shareholder in the company vending in the uranium asset}

The Property consists of five contiguous claims totaling 2,574 hectares, ~70 km southwest of Key Lake, Saskatchewan. Between 1980 & 2008, 21 holes totaling 3,527 meters were drilled, verifying the presence of high-grade mineralization.

“The Highway North Project is perfectly situated along the Key Lake Shear Zone with power, water and road accessibility. The geological setting is perspective for structurally controlled basement-hosted uranium deposits such as the Millennium Zone & Key Lake deposits of Cameco.”

Grades of up to 2.3% U

3O

8, albeit over a narrow width of 0.3 m, and a few other narrow intervals returning > 1.00% are promising, especially as they were discovered at, or very close, to surface.

Make no mistake, this is an early-stage prospect, but it has drilling on it AND at least some high-grade showings. Plenty of early-stage properties in western Canada have never been drilled or have yet to hit high-grade [> 1.00% U

3O

8].

Highway North may not be the next

Arrow project (NexGen Energy), but in a bull market for uranium, it need not become a big producer. A standalone mine would require $100s of millions in upfront cap-ex and take 10-15 years to develop, permit, fund & construct a

(mine,mill & tailings facility).

As uranium prices move higher, like many believe they will, Highway North has the real potential to become a valuable satellite deposit if not a mine.

Satellite deposits can be highly valuable because they require far less time & money to develop into cash flowing assets. In fact, delineating an Indicated + Inferred resource might be as far as Marvel needs to go to monetize the property in what’s shaping up to be an epic bull market.

Drilling the property to book millions of pounds of U

3O

8 into a resource estimate could be achieved by 2023 or 2024, at which time nearby players should start expressing interest. High-grade uranium can be profitably shipped fairly long distances.

Highway North uranium project could become a valuable satellite deposit….

Grade is King. At spot prices, 1% uranium equates to ~18 g/t gold or ~11% copper. If multi-meter intervals of 1%+ U

3O

8 can be delineated, that’s 10-25x higher than grades found almost anywhere else on earth.

Top Athabasca developers NexGen, Denison & Fission trade at an average enterprise value / divided by pound of Measured + Indicated + Inferred resource [EV/lb.] ratio of ~US$5. If uranium prices were to double, that avg. EV/lb. ratio would presumably increase to ~US$10/lb.

A decade ago, Rio Tinto acquired Hathor Resources

(winning a bidding war with Cameco), by paying ~US$9.8/lb. of Indicated + Inferred resource.

We already know that the Athabasca basin will be a prolific uranium district for decades to come. Cameco + NexGen, Orano Canada, Denison Mines, Fission Uranium, UEX, IsoEnergy

(orsome combination of those players) will likely be producing from the mid-to-late 2020s on.

Those seven

(the Big-7) will acquire other promising uranium juniors / projects / deposits along the way. If a relatively modest-sized four-million-pound satellite deposit of high-grade (1.00%+) uranium could be booked at Highway North, I estimate it could be worth ~C$20.5M

, assuming a valuation of US$4/lb.

Since pounds found by Marvel would take a few years to make it into a mineral resource estimate, I discount Highway North’s prospective valuation back three years @ 10%/yr. Under that scenario

(4M pounds @ US$4/lb.), is potentially worth ~C$15.4M today — twice Marvel’s entire enterprise value.

No one knows how many pounds

(if anything meaningful at all) there might be. However, the four largest Athabasca uranium resources

(not incl. Cameco) have an avg. resource

(inclusive of reserves) of 206M pounds.

IsoEnergy’s discoveries have been quite impressive over the past three years. It has an EV of ~C$420M, but has yet to deliver a maiden mineral resource estimate. Any junior that can show line-of-sight to millions of high-grade pounds — available to a nearby mill — will have tangible value.

Good grades in the Athabasca basin are 10x-25x higher than anywhere else

Make no mistake, I’m not suggesting that Highway North will necessarily follow IsoEnergy’s path, only that pounds in the ground near the single best uranium district on the planet will be worth a lot to the Big-7, and companies looking to scale up to attract the attention of the Big-7.

Marvel’s team is tasked with finding additional high-grade mineralization and delivering a maiden mineral resource estimate. Even assuming mgmt. has some nice hits in drill programs this year, it would likely be next year before we see an initial resource.

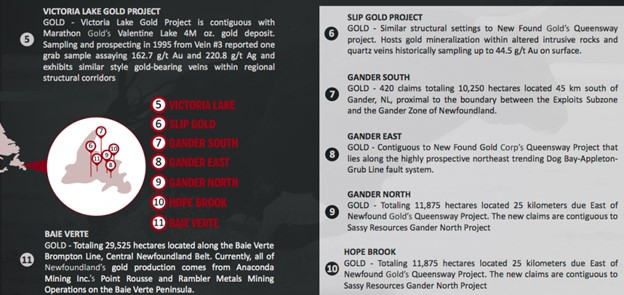

Marvel Discovery now has a uranium asset that could be worth more than its current enterprise value of C$7.5M, a gold Newfoundland gold portfolio of 100k+ ha that I believe is worth well more than C$7.5M, and an early-stage REE property that borders a PEA-staged REE project valued at ~C$20M.

CEO Karim Rayani has strong financial backers ensuring that Marvel’s properties & projects are actively explored & potentially developed. Will 2022 be a blockbuster year for uranium? Will Newfoundland gold projects come back into favor? Will REE price soar even more than they did in 2021?

Any of these reasonably likely events could be a major investment catalyst for Marvel’s stock price.

Disclosures / disclaimers:

The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Marvel Discovery, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance, or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Marvel Discovery are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It’s assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned stock in Marvel Discovery and the Company was a former advertiser on [ER].

While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will be (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover any specific events or news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.