When it comes to benefitting from the full spectrum of the best Canadian penny stocks, it can pay to be open to unproven but promising businesses, but that level of risk isn’t for everybody.

Imagine a retail investor stumbles upon a small or micro-cap stock with a novel therapeutic for a disease with an unmet need, or a revolutionary way to cut costs from a legacy industrial process, and allocates a meaningful percentage of their portfolio into it despite a lack of financial results to support the decision.

If the investor ends up reaping outsized returns after, say, a five-year holding period, it will be because the stock’s innovative offering managed to gain market share with enough of a profit margin to keep shareholders pouring in.

If the investor ends up losing all or a significant portion of their money, they shouldn’t be surprised to have struck out on a hunch, given the lack of tangible evidence to hang their conviction on the winning scenario.

To avoid this yolo-type strategy, and in the interest of ushering TMH readers into the high-return penny stock space, we’ll be profiling top companies whose compelling assets are backed by favorable financial results that either a) substantiate recent and continued share-price momentum, or b) raise the probability of it in the near future.

The 5 Best Canadian Penny Stocks to Buy

After screening the small and micro-cap Canadian penny stock universe for high YoY earnings per share (EPS), attractive valuations based on cash flows, as well as quality operations – see our stock-picking method at the end of this article – we came up with the following five stocks:

- Thor Explorations (TSXV:THX), C$190 million market cap, 795% YoY EPS growth, up by 34% over the past year and up by 121% over the past five years

- AirIQ (TSXV:IQ), C$12 million market cap, 587% YoY EPS growth, up by 53% over the past year and up by 135% over the past five years

- Zedcor (TSXV:ZDC), C$48 million market cap, 200% YoY EPS growth, up by 55% over the past year and up by 346% over the past five years

- NTG Clarity Networks (TSXV:NCI), C$5 million market cap, 174% YoY EPS growth, down by 12.5% over the past year and over the past five years

- Appulse (TSXV:APL), C$6.8 million market cap, 178% YoY EPS growth, up by 96% over the past year and up by 226% over the past five years

This quintet relies on qualitative narratives to establish their value propositions, as do most of their competitors, but they differentiate themselves by backing these stories up with hard numbers you can access today, saving you the hopes and prayers required to soften volatile holding periods and nurse expectations of satisfactory returns from the average small or micro-cap stock.

Let’s get into the first in our list of best Canadian penny stocks and examine why it deserves a place in your portfolio.

Thor Explorations (TSXV:THX)

Thor Explorations is a gold producer focused on West Africa. The company is producing gold from its 100 per cent owned Segilola gold project in south-west Nigeria at a projected rate of 100,000 ounces per year for the first five years.

Segilola boasts a total probable reserve of 517,800 ounces of gold grading at 4.02 g/t as of March 2021, while its 2023 all-in sustaining cost guidance is between US$1,150 – US$1,250 per ounce, leaving a healthy margin compared to gold’s price of roughly US$1,882 per ounce as of September 28, 2023.

Thor also owns 70 per cent of the Douta gold project in south-eastern Senegal, whose Makosa gold deposit contains 1.78 million ounces (Moz) of gold, consisting of indicated resources of 20.2 million tonnes (Mt) grading 1.3 g/t gold for 874,900 ounces and inferred resources of 24.1 Mt grading 1.2 g/t gold for 909,400 ounces.

Douta is located within the Kénéiba Inlier, where significant gold resources have attracted several major international mining companies.

Management intends to develop the project into its second mine, with recent drilling discovering significant gold mineralization and a new prospect.

As the owner and operator of Nigeria’s only large-scale commercial gold mine, as well as a 1,300 km2 prospective gold exploration portfolio, the company holds a prime position in the country, which is largely unexplored in spite of its prospective geology and significant artisanal and small-scale gold mining.

The standout performance of THX shares is motivated by a turn to positive net income following the beginning of gold production in 2021.

Thor reported net income of US$24.50 million in 2022, up from -US$2.07 million in 2021, and its experienced management has followed this trajectory with net income of US$4.33 million in Q1 2023 and US$7.91 million in Q2 2023.

Click here to read Thor Explorations’ latest investor presentation.

AirIQ

AirIQ, established in 1997 in Pickering, Ontario, is one of the earliest providers of wireless asset management and location services.

The company’s end-to-end wireless GPS solutions are used to track trucks, equipment, containers, livestock, and more, using the field of telematics, which refers to technologies that transmit real-time use and maintenance data back to a given user.

These solutions include everything from a 4.25-inch battery powered tracker to ensure a discrete touch, to integrations with leading fleet software, to an AI-powered dash cam setup, to fleet management, compliance, safety and analytics software that maximizes vehicle performance in line with U.S. and Canadian regulations.

On the compliance hardware side, AirIQ will even outfit fleets with electronic logging devices, or ELDs, that are registered with the Federal Motor Carrier Safety Administration so you can reduce human error and expedite inspections.

IQ shares have been on a steady journey upwards thanks to consistent net income over the past five years.

This is highlighted by fiscal 2023 net income of C$3.69 million, an over 16x increase from 2019 and 551 per cent increase YoY, thanks to management’s astute deferred tax recovery of C$2,830,204 in fiscal 2023.

Management has also succeeded in growing recurring revenue by over 100 per cent since 2017, freeing up company bandwidth to pursue accretive expansion opportunities, such as a customer acquisition from a former reseller that recently added C$325,000 in annual recurring revenue.

The company’s fiscal Q1 2024 results mark its continued focus on cash generation, with record net income of C$349,399, which is up by 34 per cent YoY.

The most obvious explanation for why AirIQ stock has room to run stems from the boring nature of the business.

GPS is the definition of unsexy, a quality that allows investors in the know to take advantage of volatility, buy shares at a cheap price, and wait for the company’s consistent value creation to push the stock higher.

At a price-to-earnings ratio of just 3.1x as of September 25, 2023, with aligned insider ownership of 17.4 per cent, and trading volume below 10,000 shares more often than not, there is clearly still time to allocate to this sleeping giant of a tech stock.

Click here to read AirIQ’s latest investor presentation.

Zedcor

Zedcor specializes in low and zero-emission surveillance solutions with 24/7 live monitoring and security guard services from ex-law enforcement personnel.

The company’s MobileyeZ surveillance towers use high-resolution, AI-enabled cameras and wireless sensors to provide real-time alerts to protect workers, equipment and materials. Zedcor’s disturbance sensors operate at an up to 500 m range with available applications covering the detection of heat, moisture, vibration and gas leaks.

There are over 600 MobileyeZ tower installation in the field as of April 2023, with notable clients including Schlumberger, Tidewater Midstream and Infrastructure, Whitecap Resources, TC Energy and International Petroleum.

Revenue flows through three main steams – equipment rentals and services, fixed-site monitoring contracts, and security guard contracts – across a diversified addressable market that spans mining, energy, commercial offices, industrial factories and warehouses, and auto dealerships.

Thanks to Zedcor’s established customer relationships, and the tailwind of the post-pandemic return to the office, the company has managed to increase net income from -C$20.16 million in 2017 to a C$6 million profit in 2022, with continued positive net income of C$750,000 in Q1 2023 and C$2.47 million in Q2 2023 on the back of an expected almost 100 per cent increase in MobileyeZ tower installations by end of year.

This momentum is behind the stock’s over 50 per cent gain in 2023 and our expectations of continued performance over the long term, guided by 35.2 per cent insider ownership, as the global video surveillance-as-a-service market grows from US$28.4 billion in 2020 to US$83.1 billion by 2030.

Zedcor’s seasoned management is eyeing U.S. expansion beginning this year, with 8-10 branches by the end of 2026. The company currently operates six branches across major Canadian markets.

Click here to read Zedcor’s latest investor presentation.

NTG Clarity Networks

NTG Clarity Networks has an over 20 year history in the delivery of network, telecom, IT and infrastructure solutions to network service providers and enterprises of all sizes.

The company maintains a presence in Toronto, Egypt, Saudi Arabia, Qatar and Oman with a staff of over 400 people among the top ranks in the telecom industry.

NTG’s suite of solutions spans custom digital app templates, ecommerce, WiFi, Internet of Things, last-mile delivery, and the management of project portfolios, workflows, inventory, assets, and customer and partner relationships.

As a provider of behind-the-scenes equipment and services that help businesses run, NTG does not garner the kind of media attention that leads to immediate value recognition.

Case in point, it turned to profitability in 2021 with net income of C$1.37 million and hasn’t stopped since, taking home C$1.25 million in 2022, C$1.09 million in Q1 2023, and C$870,000 in Q2 2023, while consistently increasing revenue over the past three years and keeping debt well-covered by operating cash flow.

However, NCI shares, for their part, have not rewarded investors for holding a well-run business, having endured a 12.5 per cent loss since 2018.

This mismatch between strong financials and market recognition sits at the core of what it means to be a value investor, who must be willing to put their chips on favorable metrics over present-day sentiment to achieve worthwhile returns.

Judging by NTG’s record Q1 and Q2 2023 revenue, its increasingly large-scale contracts, and increasing demand in the Gulf Region because of high oil prices, the company’s future is looking like one of shareholder value creation, despite recent share performance.

Appulse

Appulse is an expert in oilfield and refinery waste management, full-service industrial machining, and the sale, servicing and refurbishing of centrifuge equipment.

Its Rolyn Oilfield Services subsidiary offers an economical, ESG-compliant and field-proven process to collect oilfield and refinery waste.

Its Centrifuges Unlimited subsidiary has been operating for over 30 years as a one-stop shop for separation equipment with customers in Canada, the United States, Mexico, Europe and Asia.

The subsidiary carries one of North America’s largest inventories of new and refurbished centrifuge parts.

Appulse recently signed a definitive agreement to sell Centrifuges Unlimited for 66.6 per cent more than its current C$6 million market cap.

Appulse benefits from a diversified addressable market comprised of any industry requiring the separation of liquids or solids in the manufacturing process.

Industries key to historical revenue generation include food processing – with the company selling, servicing, and consulting with most food processors in Canada – as well as oil and gas, environmental, forestry, marine, mining and fish processing.

This broad customer base, in conjunction with niche focuses and experienced management, has allowed Appulse to post four consecutive years of positive net income, as well as gains in Q1 and Q2 2023, making it and AirIQ the most consistent cash generators among our list of best Canadian penny stocks. Appulse’s stock price has followed in tow, adding over 225 per cent over the past five years.

Management’s track record speaks for itself and lends credence to its expectation of significant expansion in environmental applications as ESG concerns become table stakes for corporate boards.

That said, potential investors should wait for news of the company’s future plans after closing the Centrifuges Unlimited sale before engaging in a due diligence process.

Click here to visit Appulse’s official website.

The Risks of Investing in Penny Stocks

While investing in Canadian penny stocks positions you for outsized returns, these mostly small and micro-cap stocks can also go sour without much notice because of the undifferentiated nature of their operations, which may ultimately end in a change of business, or a delisting and a total loss of capital for shareholders.

This makes it paramount to apply your personal due diligence process to potential stock picks before building positions.

Penny stocks also tend to require long-term holding periods, often longer than a decade, for the underlying businesses to take hold in their respective markets and establish themselves as going concerns, which is a lot better than it sounds.

Accordingly, the money you invest should not be used for emergencies or short-term expenses.

It goes without saying, but if you decide to add penny stocks to your portfolio, you should know your companies thoroughly, such that you’ll feel confident enough to hold on, or even buy more shares, when times get tough and returns turn negative.

How Did we Choose These Stocks?

Our screen delineates a universe of penny stocks with increasing profitability that are nevertheless trading at low cash-flow multiples.

In our view, this approach results in stocks more likely to be experiencing positive, earnings-based momentum, while being underappreciated in terms of the cash-generating potential of the business.

After screening, we conducted fundamental and qualitative analysis of the top results to substantiate the highest EPS with balance sheet, management and asset quality considerations, which you’ll get a sense of by reading the investor presentations linked above.

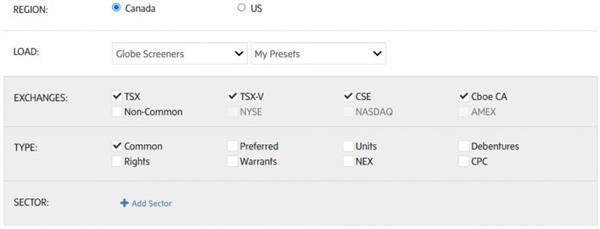

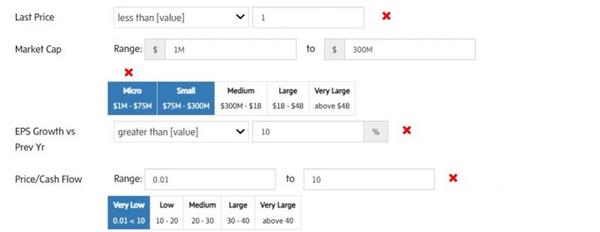

You can view our framework in action by visiting The Globe and Mail’s stock screener and inputting the following settings:

- Choose Last Price under the Price category and set it to less than 1

- Choose Market Cap under the Fundamentals category and set it to C$1 million-C$300 million

- Choose Earnings Per Share Growth vs. Prev Yr under the Per Share Info category and set it to over 10

- Choose Price/Cash Flow under the Ratios category and set it to 0.01-10

See a visual of our stock screener for the best 5 Canadian penny stocks below:

Source: The Globe and Mail.

Source: The Globe and Mail.

Source: The Globe and Mail.

Source: The Globe and Mail.

How to Invest in Penny Stocks

Now that you’ve finalized your thorough assessment of our stock picks, and perhaps added a handful of your own, the time has come to open an investment account and buy shares.

Notable options here include discount brokerages Questrade and Wealthsimple, which are best suited to experienced DIY investors, as well as Canada’s Big Six Banks – Royal Bank of Canada, TD Bank, Bank of Montreal, Scotiabank, National Bank and the Canadian Imperial Bank of Commerce – which offer more expansive educational resources.

Each of these institutions offers taxable, tax-deferred and tax-free investment accounts you may qualify to open depending on your residency and income.

Thanks for reading and for empowering yourself to benefit from the capital markets through penny stocks.

All data is as of Sept. 28, 2023.

Join the discussion: Find out what everybody’s saying about the best Canadian penny stocks on the Thor Explorations, AirIQ, Zedcor, NTG Clarity Networks and Appulse Bullboards, and check out Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.