With inflation dipping to 2.8 per cent in February, marking a second consecutive month of softer-than-expected figures, and analysts predicting that the Bank of Canada will begin to cut rates in June, investors should consider cheap stocks positioned to benefit from the risk-on sentiment of lower borrowing costs.

Under generationally high interest rates, like the present moment, investors tend to have higher expectations for stock returns, given that they could earn 3-5 per cent by parking their money in a savings account or guaranteed investment certificate. This macroeconomic climate makes small-cap and micro-cap stocks seem unappealing, despite owning high-potential technologies, as many of them have little revenue or profits to show investors and convince them to hold on for the long term.

However, as rates trickle down, and banks start to squeeze what they pay for your cash, investors will be forced to move further down the risk spectrum for a satisfactory return, eventually bringing smaller-cap stocks back into their universe of potential allocations.

With this thesis in mind, consider the following trio of cheap tech stocks solving multi-billion-dollar problems across waste management, gambling and skin cancer.

CHAR Technologies

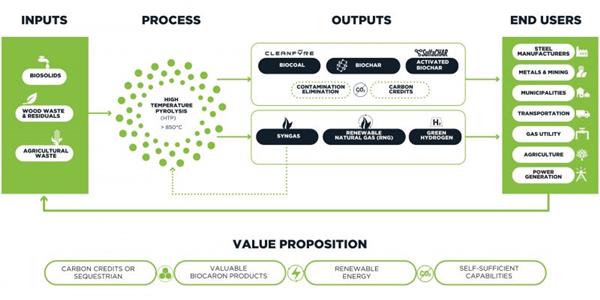

CHAR Technologies (TSXV:YES) is a cleantech and environmental services company focused on biocarbon and renewable energy solutions. CHAR specialize in pyrolysis, a process that transforms woody materials and organic waste into renewable energy, including renewable natural gas (RNG) and green hydrogen, while also yielding biocarbon for use as a filtration medium.

(Source: CHAR Technologies)

(Source: CHAR Technologies)

The company’s technology allows clients from a diversity of industries to turn low-value biomass, biosolids and agricultural residue into high-value carbon products, and reduce total feedstock mass by up to 90 per cent, resulting in significant greenhouse gas reductions.

With the trillion-dollar coal market losing ground to renewable energy with each passing year, and a management team steeped in environmental and energy sector experience, CHAR Technologies is on the verge of commercial biocarbon and RNG production, backed by multiple investments from the Government of Canada and ArcelorMittal.

Long-term shareholders have been rewarded for their conviction in CHAR’s value proposition, gaining 120 per cent since 2019.

Andrew White, CHAR Technologies’ chief executive officer, spoke with Stockhouse’s Brieanna McCutcheon this past week about the company’s C$5.2 million award from the Government of Canada’s Clean Fuels Fund.

Jackpot Digital

Our second cheap stock pick this week is Jackpot Digital (TSXV:JJ), the global leader in dealerless electronic gaming tables. The company’s flagship product, the Jackpot Blitz, offers three popular versions of poker – Texas Hold ’em, Omaha and Five-card Omaha – as well as a growing selection of side games and bets to keep players engaged between, and even during, poker hands.

Faced with a need to appeal to younger, tech-savvy gamblers, given their aging middle-aged clientele, casinos are rapidly realizing the cost and efficiency advantages of automation technology are the only way forward.

The Jackpot Blitz in action. (Source: Jackpot Digital)

The Jackpot Blitz in action. (Source: Jackpot Digital)

Instead of relying on human dealers to shuffle cards or spin roulette tables, casinos can save on staff expenditures and benefit from more plays per hour with dealerless machines such as the Jackpot Blitz, which also record customer game play and demographic information to help operators make more data-driven and value-accretive decisions.

With the US$150 billion casino gambling market expected to grow steadily through this decade, Jackpot Digital is actively riding this tailwind, having tripled annual revenue and announcing 25 Blitz deals since 2021, with many others in the pipeline across Canada, Asia, Europe and the United States.

Despite the stock’s differentiated tech and encouraging growth trajectory, not to mention its potential to go from 3 to 2,000 active Blitz tables in the market over the next three to five years, shares of Jackpot Digital have given back 93.37 per cent since 2019.

Mathieu McDonald, Jackpot Digital’s vice president of corporate development, spoke with Stockhouse’s Brieanna McCutcheon this past week about the company’s first Blitz installation in the land-based casino market.

Medicus Pharma

Our final cheap stock to keep on your radar is Medicus Pharma (TSXV:MDCX), a biotech and life sciences company focused on acquiring and developing disruptive assets. The company’s management team includes former executives at Amgen, Wyeth, and GlaxoSmithKline, including chief medical officer Edward J. Brennan, who has led clinical development programs that resulted in 10 U.S. FDA drug approvals.

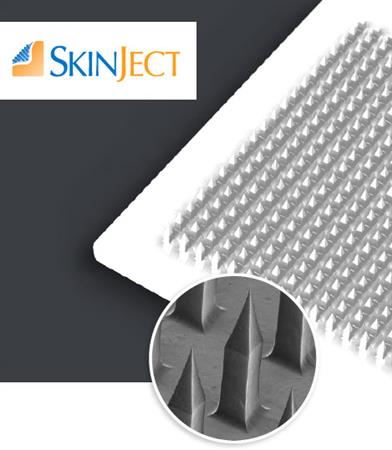

Medicus’ main holding, Skinject, is a development-stage biotech and life sciences company advancing a novel treatment for non-melanoma skin cancer, especially basal cell carcinoma (BCC), using a patented dissolvable microneedle patch to deliver doxorubicin, a chemotherapeutic agent, under the skin.

(Source: Medicus Pharma)

(Source: Medicus Pharma)

The licensed technology, patented by the University of Pittsburgh and Carnegie Mellon University in 2018, provides a relatively painless alternative to Mohs surgery, an excruciating and invasive, but highly effective procedure that involves meticulously removing layers of skin.

Medicus is looking to claim its share of a US$2 billion market opportunity (slide 6) by ushering Skinject through clinical development to demonstrate its doxorubicin-containing microneedle arrays can produce an immune response and kill cancer cells.

The portfolio company completed a successful phase-I safety and tolerability study in March 2021 for patients with superficial and nodular BCC. Then, in January 2024, it submitted a phase-II investigational new drug clinical protocol to the FDA for a randomized, controlled, double-blind, multicentre study.

As SkinJect works through comments from the FDA towards a phase-II trial, it’s important to note that its microneedle solution is multiple years away from being cleared for sale – based on typical clinical trial phases – and that Medicus Pharma is in its infancy as a public company, having gained 27.89 per cent since inception in October 2023. These two factors are likely to keep the broader market away from the stock until it establishes a longer track record, leaving investors who recognize Medicus’ value-add to take advantage of excessive volatility and build a position.

Raza Bokhari, Medicus Pharma’s chairman and chief executive officer, recently spoke with Stockhouse’s Brieanna McCutcheon about the FDA’s comments on Skinject’s phase-II study protocol.

Join the discussion: Find out what everybody’s saying about these cheap tech stocks on the CHAR Technologies, Jackpot Digital and Medicus Pharma Bullboards, and check out Stockhouse’s stock forums and message boards.

This is sponsored content issued on behalf of CHAR Technologies, Jackpot Digital and Medicus Pharma, please see full disclaimer here.