Copper is the most important metal behind global decarbonization thanks to its superior conductivity, ductility, efficiency and 100 per cent recyclability, making it ideal for energy storage and electrical propulsion.

Electric vehicles (EVs) alone require up to four times more copper than gasoline-powered vehicles for everything from motors to batteries to charging infrastructure. This includes approximately 83 kg per battery-based EV, 59 kg for a plug-in hybrid EV, and 369 kg for a battery electric bus.

In addition to EV demand, the rising need for copper in solar, wind, bioenergy and electricity networks can require up to 12 times more copper than traditional energy systems, with exponential demand growth expected through 2050.

According to estimates by Energy Minute, copper demand through 2050 will require twice the amount of copper the world has produced over the past 3,000 years. BloombergNEF, for its part, sees demand for refined copper growing by 53 per cent by 2040, with supply climbing by only 16 per cent. A separate study by Wood Mackenzie takes us through the present decade, estimating that, by 2030, the world will be short by about 6 million tonnes of copper to keep pace with net-zero goals.

This dynamic sets the stage for investors to capitalize on prospective junior copper stocks garnering attention in the hot copper M&A market, as major players seek to expand production capacity to better meet global demand.

Building the next world-class copper district

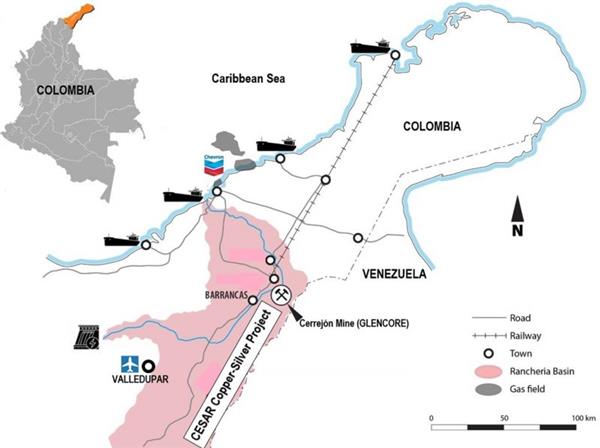

Enter Max Resource (TSXV:MAX), market capitalization C$19.36 million, a junior miner exploring its 100-per-cent-owned CESAR copper-silver project in mining-friendly northeastern Colombia. CESAR sits along the Andean belt, the world’s largest producing copper belt, which has the potential to yield billions of pounds of copper and hundreds of millions of ounces of silver over the coming decades.

Fortified by ready access to infrastructure thanks to the nearby presence of Chevron oil and gas operations and Glencore’s Cerrejon, the largest coal mine in Latin America, CESAR is positioned to further propel Colombia’s leadership position in the energy transition, and 7x growth in copper production from 2011 to 2022, with its multitude of high-grade results and clear momentum towards identifying a world-class resource.

(Source: Max Resource)

(Source: Max Resource)

The CESAR project lies along the richly mineralized 220-kilometre-long Cesar Basin. It’s the only unexplored sedimentary copper-silver basin in the world, despite vast porphyry copper-molybdenum-gold and related vein systems in its upper portion, and sediment-hosted copper-silver deposits in its lower portion.

Sedimentary copper deposits are found in ocean basins, where porous seabed materials provide access to copper and other minerals nestled in layers of rock. Copper porphyry deposits, for their part, are formed during the cooling of molten-rock magma, which leads to zones of dissolved metals, such as copper, molybdenum, gold, tin, zinc and lead.

Max’s sampling, surveying and mapping to date make a strong case for CESAR hosting economical copper-silver mineralization over a large area, as highlighted by three 100 per-cent-owned mineralized districts within a 120 km by 20 km zone, backed by:

Let’s look further into these three districts underpinning Max’s first-mover advantage in the Cesar Basin, beginning with the most prospective, to understand the robust upside shareholders are positioned to reap.

The AM discovery

The AM discovery, reported in January 2020, is a 32-km-long Kupferschiefer-type copper system featuring 15 mining concessions covering 114 square km and 14 highly prospective targets with mineralization beginning at surface. Highlight samples to date in the property’s sedimentary red bed sequences include 34.4 per cent copper and 305 g/t silver.

The Kupferschiefer district is the world’s largest silver producer and Europe’s largest copper resource, generating 3 metric tonnes of copper in 2018 and 40 million ounces of silver in 2019 from an ore body grading 1.49 per cent copper and 48.6 g/t silver starting 500 metres below surface.

(Source: Max Resource)

(Source: Max Resource)

AM, for its part, backs up its district-scale prospects with a lengthy history of exploration milestones, including:

- Two scout drill holes reported in April 2023 confirming the continuity of stratiform mineralization at depth.

- The May 2023 discovery of the AM-7 target, a significant copper-silver system that ranges from 0.3-3.8 m in width, extends more than 2 km along strike, and is open in all directions. Subsequent channel samples reported in June feature high grades, including nine samples of at least 4 per cent copper and 24 samples of at least 10 g/t silver, with highs of 18.3 per cent copper and 138 g/t silver.

- A high-resolution airborne magnetic and radiometric survey over the entire AM district initiated in August 2023, the first in the history of the Cesar Basin, to develop and refine drill targets.

- The AM-08 discovery, just 7 km southeast of AM-07, reported in September 2023, featuring a significant mineralized outcrop spanning 10 m in width before disappearing underground. AM-08 went on to yield high-grade rock chip channel samples in November 2023, including 2.6 per cent copper and 58 g/t silver over 15 m, including 3.5 per cent copper and 77 g/t silver over 10 m.

- The discovery of targets AM-09 through AM-12 in October 2023 based on preliminary airborne magnetic and radiometric survey data, demonstrating a reliable correlation between known mineralization and the survey. The strength of the data at AM led management to extend the survey to cover CESAR’s other two main districts, Conejo and URU – which we’ll discuss later on – with eyes on honing in on new targets and those meriting follow-up exploration.

- The identification of five mineralized outcrops covering 1,000 square m, collectively known as AM-14, in February 2024, including exposure up to 285 m along strike and up to 4 m thick, and strong evidence of 1.5 km of mineralized continuity with AM-07. The junior copper stock discovered two more mineralized outcrops on AM-14 in February, showing the target to reside along a 15-km corridor of high-grade copper-silver mineralization, including highlight grades of 24.8 per cent copper and 230 g/t silver. High-grade rock chip assays reported in March 2024 reached as high as 2.2 per cent copper and 12.8 g/t silver over 5.2 m, and 4.8 per cent copper and 53.6 g/t silver over 2.2 m, confirming Kupferschiefer-style mineralization and demonstrating the potential of the 15-km mineralized corridor to host a significant deposit.

Results to date support Max Resource’s thesis that the Cesar Basin is host to multiple large-scale copper-silver deposits, with a new drilling program at AM slated for Q4 2024 to put this thesis to the test.

The Conejo discovery

The Conejo discovery, reported in March 2021, is a copper-silver system boasting multiple mineralized outcrops, each of them open in all directions and located only 30 km south of the AM discovery. Highlight assays from rock panel samples delineating an initial 1.6 km by 0.6 km zone include:

- 12.5 per cent copper and 83.5 g/t silver over 5 m by 5 m

- 10.4 per cent copper and 95 g/t silver over 5 m by 5 m

- 9.5 per cent copper and 120 g/t silver over 1 m by 1 m

A few months later, in May 2021, the junior copper stock expanded Conejo by 500 per cent to 3.2 km by 1.6 km thanks to additional rock panel assays, most notably 3 per cent copper and 22.6 g/t silver over multiple 1 m by 1 m intervals. Max followed this up with continued expansion in October 2021 to 3.2 km by 1.9 km backed by reconnaissance sampling grading up to 3.3 per cent copper and 54 g/t silver.

News of further progress hit the wires in November 2021, expanding Conejo to more than 3.7 km averaging 4.9 per cent copper, while remaining open in all directions, further substantiating the property’s scalable potential into a standalone copper project.

Management is confident that Conejo’s copper-silver mineralization is analogous to the Central African Copper Belt (CACB), which accounts for approximately one-fifth of the world’s copper production, including Ivanhoe Mines’ (TSX:IVN) 95-billion-pound Kamoa-Kakula copper deposits in the Congo.

Conejo’s history marks it as a key source of shareholder value, which management intends to unlock through further sampling sometime between Q4 2024 and Q1 2025, after it finalizes work at AM.

The URU discovery

The URU discovery, reported in April 2021, is part of a 20-km-long, 2-km-wide CACB-type system residing only 30 km south of Conejo.

Max initially delineated copper mineralization over 4 km of strike, with highs of 5.7 per cent copper and 14 g/t silver, but promptly tripled this figure to 12 km in July thanks to additional rock chip samples. More high grades in October 2021 quadrupled the property to 48 square km, with a standout assay of 14.8 per cent copper and 132 g/t silver in outcrop over 1.5 m by 0.8 m.

(Source: Max Resource)

(Source: Max Resource)

The junior copper stock then proceeded to drill target definition from December 2021 (9.6 per cent copper and 70 g/t silver over 1 m by 1 m) through April 2022 (16.8 m at 8.3 per cent copper and 146 g/t silver), followed by an expansion of the main URU discovery in June, setting the stage for a maiden 2,200-m drill program.

Assays from URU released in January 2023 confirmed high-grade copper-silver in the Cesar Basin, marking the first successful test for mineral continuity at depth in the basin, as evidenced by:

- 9 m of 7 per cent copper and 115 g/t silver from surface, as well as 0.8 m of 18.5 per cent copper and 292 g/t silver, at URU-C

- 19 m of 1.3 per cent copper at URU-CE

- 12 holes intersecting mineralized zones, six intersecting significant copper-silver mineralization, and all holes yielding considerable alteration associated with a district-scale hydrothermal system

With 74 square km in approved mining concessions, and more drilling planned to expand mineral continuity and target higher-grade zones, the URU district offers exposure to proven promise for an economically extractable copper-silver deposit.

More than 150 years of mining and finance expertise

Behind CESAR’s strong indications of a world-class resource is a management team with a long track record of mineral discoveries, representing a value-add in excess of C$2 billion.

Brett Matich – who has served as Max Resource’s chief executive officer since 2018, in addition to serving as president and director – is a 25-year mining industry veteran who has held CEO positions in public companies listed in Australia, London and Toronto. These include:

- Aztec Resources, where he led the development of the Koolan DSO hematite deposit, and grew the company from A$1 million in market capitalization to a A$300 million merger with Mount Gibson Iron (ASX: MGX)

- Fox Resources, where he reactivated the Karratha nickel-copper mine in just two years, including reserve estimate and bankable feasibility study

- Cap-Ex Ventures, where he developed an un-drilled magnetite prospect into a compliant 7.8-billion-tonne resource at 29 per cent iron ore, achieving TSX Venture 50 status in 2012.

Matich’s extensive and diversified mining expertise is complemented by executives of equal calibre across M&A, capital markets, geology and exploration and development. Meet them below:

- Alex Helmel, chief financial officer, specializes in early-stage venture companies in Canadian capital markets, specifically private-to-public market transitions, corporate governance, senior management development and corporate growth strategy. He has served as a director or officer for numerous private, CSE- and TSXV-listed companies.

- Bruce Counts, senior technical consultant, has built a more than 30-year career in international mineral exploration, project development and deposit evaluation across copper, gold and diamonds. Counts, a registered professional geoscientist, has also founded and served as director and/or executive for numerous publicly listed companies.

- Rahim Kassim-Lakha, strategic advisor, is the founder and CEO of Blue Sail Capital, which boasts a track record of more than 28 years in global investing, capital markets and M&A advisory. Kassim-Lakha previously held leadership roles at Fidelity Capital and Toronto-based banks and boutiques, as well as that of portfolio manager at U.S. Global Investors, where he orchestrated and contributed to more than US$5 billion in high-value transactions.

- Chris Grainger, Colombian geology expert, whose 25-year career has focused on grassroots and brownfield exploration, as well as resource definition and development, across numerous geologies and commodities. His previous roles include vice president of exploration at Cordoba Minerals (TSXV:CDB), chief geologist at Colossus Minerals, and founder of Continental Gold, the latter acquired by Zijin for C$1.4 billion.

- Tim Henneberry, advisor and qualified person, who has more than 42 years of experience in domestic and international exploration and production across base metals, precious metals and industrial minerals. He has occupied the roles of founder, director, senior officer, and/or consultant for various CSE- and TSXV-listed companies since 2004, and currently holds board positions with Golden Independence Mining, Hilo Mining, iMetal Resources, J4 Ventures, Silver Sands Resources, Tana Resources and Treviso Capital. He also sits on the advisory boards of Atomic Minerals and Universal Copper.

Backed by heavy-hitting mining professionals, and a high-grade project suggestive of playing a meaningful role in Colombian decarbonization, it is no surprise numerous institutions have already taken positions in the junior copper stock, including Franklin Templeton (5 per cent), Merk Investments (5 per cent), and profitable precious metals producer Endeavour Silver (5 per cent) – the latter having signed a term sheet in March 2022 to help Max expand its land holdings at CESAR. These investments are in addition to a 5 per cent allocation by legendary mining investor Eric Sprott, all of which significantly de-risk the stock for retail investors.

A gem in the bargain bin

Sitting at an irrational 93.45 per cent loss since 2019, shares of Max Resource are currently priced for exponential upside, as more drill targets based on high-resolution magnetic and radiometric survey data, as well as ongoing mapping, sampling and geochemistry, ride the tailwind of copper demand to wider market awareness.

When the junior miner begins drilling later this year – self-funded with almost C$8.7 million in cash as of Q3 2023 – it will do so on concessions that span less than 20 per cent of its 1,000 square km land package, leaving plenty of room for additional copper-silver prospects to be delineated, given prospecting and drilling results to date, propelling CESAR ever closer to identifying an economically extractable deposit.

While the CESAR project is strategically positioned to serve the global copper market, with the United States to the north, and Europe, Africa, and Asia to the east, Kassim-Lakha noted that Max would not have to do business anywhere other than Colombia to generate robust shareholder returns.

“We’re a different type of deposit,” he said in a recent interview with Stockhouse. “We’re a different kind of beast. The Cesar Basin has the potential to become a world-class copper-silver region in Colombia, with only 1 per cent of the country’s land package in the resource space producing something outside of oil and gas, and only 2 per cent having been explored. Colombia is moving towards an energy transition, and Max Resource is positioned to expedite it, with a resource at any one among AM, Conejo or URU capable of becoming a company maker.”

Matich echoed this sentiment, adding that “we’ve had representatives from numerous global miners and institutional investors on site, even before we had a drill hole,” highlighting the appeal Max Resource is building among major players, who will only knock on the junior miner’s door with increasing frequency at it expands mineralization on its 100-per-cent-owned land package.

As Max connects the dots between AM, Conejo and URU, investors looking for undervalued exposure to an expertly managed, potentially district-scale asset, should not hesitate to put the junior copper stock through a full due diligence process.

Join the discussion: Find out what everybody’s saying about this junior copper and silver stock on the Max Resource Bullboard.

This is sponsored content issued on behalf of Max Resource, please see full disclaimer here.