Canada’s cannabis edibles market has grown into its own opportunity avenue for investors, and one of the top companies in this space has grown its share in the business.

Indiva Ltd. (TSXV:NDVA) recently reported its fiscal year 2023 results, showcasing a solid performance across its operations.

With record positive earnings before interest, taxes, depreciation and amortization (EBITDA) and income from operations, the edible cannabis producer continues to solidify its position in the ever-evolving cannabis industry.

Background

Established in 2015 with headquarters in London, Ontario, Indiva has emerged as a prominent player in the cannabis market, specializing in the production of high-quality products including edibles, capsules and pre-rolls.

Financial highlights

These fiscal year 2023 results paint a picture of success for Indiva. One of the standout figures is the gross revenue for Q4 2023, totalling a record C$12.6 million. This represents an impressive15.5 per cent sequential increase from the previous quarter and a substantial 21.9 per cent increase year-over-year from Q4 2022. Such robust growth underscores the company’s ability to capture market share and capitalize on evolving consumer preferences.

Management’s take

In a news release on these results, Indiva’s president and chief executive, Niel Marotta, explained the company’s net income came in just shy of break-even in Q4, which is a testament to the popularity of its products, low-cost production platform and its focus on cost control.

“Our core brands, namely Pearls by Grön, No Future, Bhang Chocolate and Indiva Blips continue to gain market share in Canada, as Indiva continues to hold the No. 1 market share position in edibles nationally,” Marotta said. “More importantly, our revenue mix continues to shift towards brands and products that were developed in-house at Indiva, demonstrating that Indiva’s core competency goes beyond leading the industry as the low-cost producer of edibles, but also as a best-in-class innovator of beloved edible products. Thirty-five per cent of net revenue in Q4 2023 was derived from brands created and owned by Indiva, including Indiva 1432 chocolate, Indiva Blips, Indiva Doppio Sandwich Cookies, and No Future gummies and vapes, up from 20 per cent of net revenue in Q1 2023.

“Further, Indiva achieved 27 new SKU listings in 2023, and has already received 10 additional SKU listings in 2024. 24 of the 27 new SKU introductions in 2023 and nine of 10 new SKUs accepted for listing thus far in 2024 are from in-house innovation and owned brands. We still strongly believe that an increase in allowable THC per pack of edibles would improve public safety, and while we were very disappointed in the results and recommendations from the (Cannabis Act) legislative review published late March, Indiva remains committed to product innovation that will support both industry and edible category growth. Our enthusiasm to continue to delight of-age cannabis enthusiasts in Canada is unwavering, and we have a robust pipeline of new products which will hit market in the second quarter and in the second half of 2024.”

The government’s final report of the legislative review of the Cannabis Act recommends that Health Canada keeps the 10 milligrams per package limit and establishes a definition of higher-potency products and apply additional warnings.

Marotta said he thinks a very compelling argument can be made for increasing those limits, commercially and from a public safety point of view. The belief is that a higher limit would drive fewer people to the illicit market for those higher doses and competitive prices, which would only foster more growth in the legal edible market.

Outlook to the horizon

Looking ahead, Indiva anticipates that its Q1 results may experience a sequential decline compared with the record-setting Q4 performance. However, the overall outlook for 2024 remains robust, fuelled by strategic initiatives, expanding distribution channels, and a growing consumer base. As regulatory landscapes evolve and consumer preferences continue to shift, Indiva is well-positioned to navigate challenges and seize opportunities in the dynamic cannabis market.

In an exclusive interview with The Market Online’s “Watchlist” with Coreena Robertson, Marotta said the team is also focusing on innovating and developing products that are owned and developed in-house.

“In Q4 2023, about 35 per cent of our revenue was from our own products,” he explained. “In 2024, we think that number will be as high as 45 per cent.”

Click the video below to watch the full interview.

The edible cannabis market’s value

The edible cannabis market that Indiva is serving stands to see substantial gains. According to Statista, Canada’s whole cannabis market is expected to experience significant growth in the coming years. Projections indicate that this market’s revenue is set to reach US$5.63 billion this year. An annual growth rate of 3.17 per cent over the next five years is expected, which will result in a market volume of C$8.98 billion by 2029.

Narrowing in on the edibles market, the research team at Headset Insights, owners of the largest cannabis market dataset in the world, reported that edible sales had reached C$180 million by the end of 2021 and reached a quarter billion dollars in sales by the end of 2022.

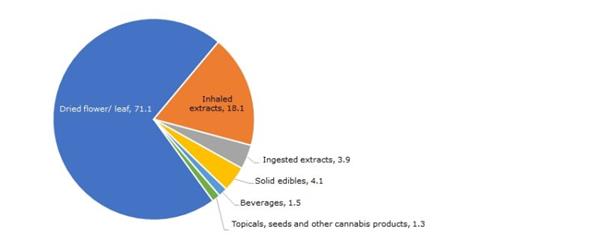

Dried cannabis accounted for 71 per cent of total value of legal, non-medical retail sales in 2021 and 2022. Solid edibles was second, at 4.1 per cent, according to Statistics Canada.

(Source: Statistics Canada.)

(Source: Statistics Canada.)

Market leadership

Indiva’s achievements extend beyond financial performance. The company maintains its position as the national market share leader in the edibles category, a testament to its expertise in crafting delectable and innovative cannabis-infused products. Indiva also ranks No. 2 nationally in unit share across all cannabis categories, showcasing its broad appeal and competitive edge in the market.

Why invest in Indiva?

For investors seeking exposure to the burgeoning cannabis industry, Indiva Ltd. presents an attractive investment opportunity.

With a proven track record of financial success, market leadership in key categories, and a promising outlook for future growth, Indiva offers investors the potential for substantial returns. However, as with any investment, thorough due diligence is crucial. Prospective investors are encouraged to delve deeper into the company’s financials, growth strategies, and competitive positioning before making investment decisions.

Boasting a solid financial performance, market leadership, and promising future prospects, Indiva Ltd. is in a prime position to deliver value for investors in the years to come.

Indiva stock has risen nearly 8 per cent since this time last year and closed Wednesday trading at $0.06 per share.

You can find out more about Indiva Ltd. from their website at indiva.com.

Join the discussion: Find out what everybody’s saying about this stock on the Indiva Ltd. Bullboard investor discussion forum, and check out the rest of Stockhouse’s stock forums and message boards.

This is sponsored content issued on behalf of Indiva Ltd., please see full disclaimer here.