With gold prices soaring, savvy investors are eyeing high-grade gold mining projects at shallow depths in prime locations, promising lucrative returns and minimal extraction costs.

Many Stockhouse readers are already well familiar with Viva Gold (TSXV:VAU)(OTCQB:VAUCF), but for those new to the company’s story, the Vancouver-based miner has been making significant strides at its Tonopah Gold Project in Nevada, with a new drilling program set to commence in late September 2024.

This latest initiative will involve 2,000 to 2,500 metres of reverse circulation drilling across 15 to 20 drillholes, aiming to further delineate the resource and enhance the project’s economic potential.

Latest drilling program

The upcoming drill program is a critical component of Viva Gold’s strategy to expand and upgrade the Tonopah resource. By targeting key areas within the project, the company aims to gather valuable data that will feed into an updated preliminary economic assessment (PEA). This drilling effort is expected to provide insights into high-grade and low-grade zones, optimizing the project’s design for maximum economic return.

The company’s president and CEO, James Hesketh, explained in a news release on these results that the focus of the program has been the delineation of poorly drilled areas within the known gold resource model area and to test further step-out potential of the project.

“The updated geologic modelling work with the inclusion of geophysical data is also providing a valuable tool for outlining additional exploration potential on the property beyond the known resource areas. Our work on updating the PEA is focused on helping to scope out the parameters needed to develop future feasibility study work on the project,” Hesketh said.

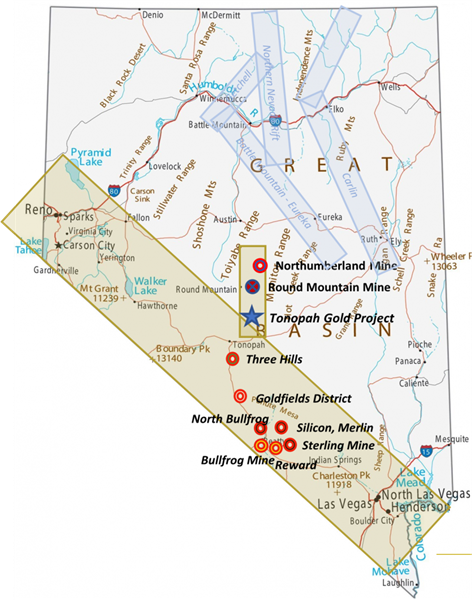

Tonopah Gold Project. (Source: Viva Gold Corp.)

Tonopah Gold Project. (Source: Viva Gold Corp.)

Updated PEA

Viva Gold has initiated an updated PEA for the Tonopah project, focusing on its potential as an open-pit heap leach gold recovery operation. The assessment will also explore the feasibility of incorporating a high-grade mill circuit alongside the low-grade heap leach process. This dual approach could significantly enhance the project’s overall economics.

The updated PEA will integrate data from 50 drillholes completed since 2022, along with additional geologic structure information. The results from the September 2024 drill program will be included as they become available. The company aims to complete the PEA by the end of this year.

Previous PEA highlights

The previous PEA, conducted in 2022, used a gold price of $1,400 per ounce and demonstrated a robust 22 per cent after-tax internal rate of return (IRR), with a 2.9-year payback period and all-in sustaining costs (AISC) of $1,075 per ounce. These figures underscore the project’s strong economic potential, even at conservative gold price assumptions.

Geophysical data integration

Viva Gold has also incorporated geophysical data, including gravity and controlled source audio-frequency magnetotellurics (CSAMT) surveys, into the geologic resource model. This data has proven invaluable in modeling faults and structures, aiding in the identification of additional resource extensions and future exploration targets within the claim block.

Ongoing and future work

The company has submitted a work plan to the U.S. Bureau of Land Management for approval to drill up to 23 additional drill pad locations at Tonopah. A quarterly groundwater sampling baseline study is also ongoing, which will help ensure environmental compliance and sustainability.

The investment corner

Given the high-grade nature of the Tonopah resource, its shallow depths, and the current favourable gold price environment, Viva Gold presents a compelling investment opportunity. The upcoming drill program and updated PEA are poised to significantly enhance the project’s value, potentially leading to a substantial re-rating of the company’s share price. Investors should keep a close eye on the drill results expected in the coming weeks, as they could unlock considerable upside potential.

In summary, Viva Gold’s proactive approach to advancing the Tonopah Gold Project, coupled with its strategic drilling and updated economic assessments, positions the company for significant growth. The project’s robust economics and exploration upside make it an attractive proposition for investors seeking exposure to the gold sector.

Join the discussion: Learn what other investors are saying about this Nevada gold stock on the Viva Gold Corp. Bullboard, and check out Stockhouse’s stock forums and message boards.

This is sponsored content issued on behalf of Viva Gold please see the full disclaimer here.