Moody’s Analytics, a leading independent provider of economic

forecasting and stress testing solutions, has analyzed the Federal

Reserve’s Comprehensive Capital Analysis and Review (CCAR) scenarios for

2014 and has developed detailed economic scenarios for more than 50

countries including the U.S. and its states and metropolitan areas.

Moody’s Analytics senior economists also considered possible narratives

driving the CCAR scenarios, their likelihood of occurring and the

severity of the scenarios.

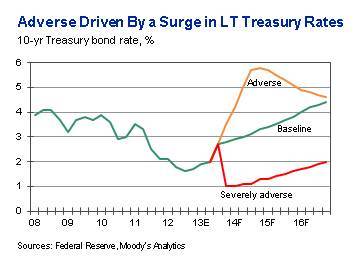

2014 Adverse Scenario Driven By a Surge in Long-Term Treasury Rates (Graphic: Business Wire)

Among the scenarios to be considered by financial institutions, the one

labeled “Severely Adverse” envisions conditions similar to those of the

Great Recession, with unemployment rising to a post-World War II high.

The hypothetical downturn is driven by sharp declines in Europe and in

emerging markets, as well as a new U.S. housing crash. The “Adverse”

scenario assumes that global bond investors lose faith in the Federal

Reserve’s efforts to normalize monetary policy, causing long-term

interest rates to rise sharply. These higher rates derail recoveries in

the housing and commercial property markets, resulting in a new

recession.

“The CCAR’s adverse scenario realistically represents market concerns

that long-term interest rates will surge and short-circuit the economic

recovery as the Federal Reserve winds down its bond-buying program and

normalizes short-term interest rates,” said Mark Zandi, Chief Economist

of Moody’s Analytics.

Expanding beyond the 26 variables provided by the Federal Reserve,

projections are available for more than 1,800 variables at the national

and regional level, including unemployment insurance claims, consumer

credit debt outstanding, auto sales volumes, oil prices, used car

prices, ABA/MBA delinquency rates and personal savings rates. The

projections include forecasts for the Case-Shiller Home Price Indexes as

well as for U.S. consumer credit conditions as detailed by

CreditForecast.com.

“These scenarios will help banks and other financial institutions more

accurately assess the risks in their consumer credit portfolios,” said

Cristian deRitis, Director of Moody’s Analytics Credit Analytics group.

“For example, credit card and other consumer credit providers will want

to incorporate expanded data on unemployment insurance claims, income

and savings rates in forecasting future losses and loan origination

volumes.”

CCAR scenarios are available through several of Moody’s Analytics

forecasting services, including the Global Macro, U.S. Macro, State and

Metro Forecast Databases, Case-Shiller Home Price Index Forecasts, and

CreditForecast.com.

A detailed overview of the 2014 CCAR scenarios, examining the severity

and probability of each one, will be presented by Moody’s Analytics in

an interactive, one-hour webinar on November 5 at 11a.m. EST. Interested

parties are welcome to attend and can register via the following link: www.economy.com/ccar/webinar.

For more information, visit http://economy.com/ccar.

About Moody’s Analytics

Moody’s Analytics helps capital markets and risk management

professionals worldwide respond to an evolving marketplace with

confidence. The company offers unique tools and best practices for

measuring and managing risk through expertise and experience in credit

analysis, economic research and financial risk management. By providing

leading-edge software, advisory services and research, including

proprietary analyses from Moody’s Investors Service, Moody’s Analytics

integrates and customizes its offerings to address specific business

challenges. Moody's Analytics is a subsidiary of Moody's Corporation

(NYSE:MCO), which reported revenue of $2.3 billion in 2011, employs

approximately 7,200 people worldwide and has a presence in 29 countries.

Further information is available at www.moodysanalytics.com.

Photos/Multimedia Gallery Available: http://www.businesswire.com/multimedia/home/20131105006098/en/

Copyright Business Wire 2013