TORONTO, July 2, 2014 /CNW/ - The RBC Canadian Manufacturing Purchasing Managers' Index™ (RBC PMI™) pointed to a solid rebound in the performance of the manufacturing

sector in June, as output and new business growth picked up to the

strongest recorded so far in 2014. A monthly survey, conducted in

association with Markit, a leading global financial information

services company, and the Supply Chain Management Association (SCMA),

the RBC PMI offers a comprehensive and early indicator of trends in the Canadian

manufacturing sector.

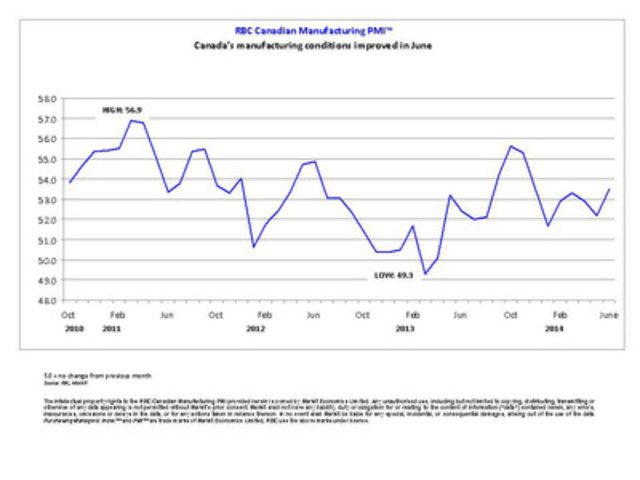

Adjusted for seasonal influences, the headline RBC Canadian

Manufacturing PMI registered 53.5 in June, up from 52.2 in May, to

signal the sharpest overall improvement in business conditions since

December 2013. The rise in the headline index was mainly driven by

stronger rates of output and new business expansion.

"The latest RBC PMI data indicates that in June, Canada's manufacturers

experienced the best conditions for growth in half a year," said Craig Wright, senior vice-president and chief economist, RBC. "We expect that those conditions will further improve going forward

supported by a strengthening global economy, increases in external

demand for domestic goods and a depreciating Canadian dollar."

The headline RBC PMI reflects changes in output, new orders, employment, inventories and

supplier delivery times.

Key findings from the June survey include:

-

Output and new orders rose at sharpest pace in 2014 to date

-

Job creation strengthened

-

Input cost inflation eased for the third month running

Manufacturing output growth picked up markedly from the nine-month low

registered in May. The current period of rising production volumes

stretches back to May 2013, with survey respondents attributing the

latest expansion to greater client spending and new product launches.

In line with the trend for output, new business growth rebounded in June

and reached a six-month high. Manufacturers mainly cited stronger

domestic demand, as new export order growth remained only marginal,

despite accelerating from the 14-month low registered in May. When a

rise in new work from abroad was reported, survey respondents generally

pointed to improved demand from clients in the United States.

Staffing levels increased at a solid pace in June, thereby extending the

current period of manufacturing job creation to five months. Despite an

upturn in payroll numbers, stronger demand resulted in the fastest rise

in backlogs of work since March.

Greater production requirements boosted input buying across the

manufacturing sector in June, with the latest expansion of purchasing

activity the fastest seen in 2014 to date. Stocks of purchases

nonetheless dipped slightly in June, which contrasted with a marginal

rise in post-production inventory levels.

Canadian manufacturers indicated that input prices increased for the

twenty-third consecutive month in June. The latest survey pointed to a

sharp rise in average cost burdens, but the rate of inflation was the

lowest since the start of the year. A number of firms cited exchange

rate depreciation against the U.S. dollar as having pushed up prices

for imported raw materials. There were also reports of rising

oil-related costs in June. Meanwhile, factory gate price inflation

eased for the second time in the past three months and was the lowest

since December 2013.

Regional highlights include:

-

Quebec posted the fastest overall improvement in business conditions...

-

...followed by Alberta & British Columbia

-

All four regions registered a rise in new export orders

-

Employment growth was strongest in Quebec and Ontario

"The second quarter of 2014 ended on a positive note for the Canadian

manufacturing sector," said Cheryl Paradowski, president and chief executive officer, SCMA. "Stronger business conditions were underlined by the fastest expansion

of output so far this year, alongside a solid rebound in client

spending. Manufacturers are continuing to recruit additional staff at a

solid place, highlighting strong confidence about the outlook for

production volumes over the months ahead."

The report is available at www.rbc.com/newsroom/pmi.

Notes to Editors:

The RBC Canadian Manufacturing PMI™ Report is based on data compiled from monthly replies to questionnaires

sent to purchasing executives in over 400 industrial companies. The

panel is stratified geographically and by Standard Industrial

Classification (SIC) group, based on industry contribution to Canadian

GDP.

Survey responses reflect the change, if any, in the current month

compared to the previous month based on data collected mid-month. For

each of the indicators the 'Report' shows the percentage reporting each

response, the net difference between the number of higher/better

responses and lower/worse responses, and the 'diffusion' index. This

index is the sum of the positive responses plus a half of those

responding 'the same'.

Diffusion indexes have the properties of leading indicators and are

convenient summary measures showing the prevailing direction of change.

An index reading above 50 indicates an overall increase in that

variable, below 50 an overall decrease.

The RBC Canadian Manufacturing Purchasing Managers' Index™ (RBC PMI™) is a composite index based on five of the individual indexes with the

following weights: New Orders - 0.3, Output - 0.25, Employment - 0.2,

Suppliers' Delivery Times - 0.15, Stock of Items Purchased - 0.1, with

the Delivery Times Index inverted so that it moves in a comparable

direction.

The Purchasing Managers' Index (PMI) survey methodology has developed an outstanding reputation for

providing the most up-to-date possible indication of what is really

happening in the private sector economy by tracking variables such as

sales, employment, inventories and prices. The indices are widely used

by businesses, governments and economic analysts in financial

institutions to help better understand business conditions and guide

corporate and investment strategy. In particular, central banks in many

countries (including the European Central Bank) use the data to help

make interest rate decisions. PMI surveys are the first indicators of

economic conditions published each month and are therefore available

well ahead of comparable data produced by government bodies.

Markit does not revise underlying survey data after first publication,

but seasonal adjustment factors may be revised from time to time as

appropriate which will affect the seasonally adjusted data series.

Historical data relating to the underlying (unadjusted) numbers, first

published seasonally adjusted series and subsequently revised data are

available to subscribers from Markit. Please contact economics@markit.com.

ABOUT RBC

Royal Bank of Canada is Canada's largest bank, and one of the largest

banks in the world, based on market capitalization. We are one of North

America's leading diversified financial services companies, and provide

personal and commercial banking, wealth management services, insurance,

investor services and capital markets products and services on a global

basis. We employ approximately 79,000 full- and part-time employees who

serve more than 16 million personal, business, public sector and

institutional clients through offices in Canada, the U.S. and 42 other

countries. For more information, please visit rbc.com.

RBC supports a broad range of community initiatives through donations,

sponsorships and employee volunteer activities. In 2013, we contributed

more than $104 million to causes worldwide, including donations and

community investments of more than $69 million and $35 million in

sponsorships. Learn more at www.rbc.com/community-sustainability.

About Supply Chain Management Association

As the leading and largest association in Canada for supply chain

management professionals, the Supply Chain Management Association

(SCMA) is the national voice for advancing and promoting the

profession. SCMA sets the standard of excellence for professional

skills, knowledge and integrity and was the first supply chain

association in the world to require that all members adhere to a Code

of Ethics.

With nearly 8000 members working across the private and public sectors,

SCMA is the principal source of supply chain training, education and

professional development in the country. Through its 10 Provincial and

Territorial Institutes, SCMA grants the Supply Chain Management

Professional (SCMP) designation, the highest achievement in the field

and the mark of strategic supply chain leadership.

SCMA was formed in 2013 through the amalgamation of the Purchasing

Management Association of Canada and Supply Chain and Logistics

Association of Canada. With a combined history of more than 140 years,

today the association embraces all aspects of strategic supply chain

management, including: purchasing/procurement, strategic sourcing,

contract management, materials/inventory management, and logistics and

transportation. For more information, please visit scmanational.ca.

About Markit

Markit is a leading global diversified provider of financial information

services. We provide products that enhance transparency, reduce risk

and improve operational efficiency. Our customers include banks, hedge

funds, asset managers, central banks, regulators, auditors, fund

administrators and insurance companies. Founded in 2003, we employ over

3,000 people in 11 countries. For more information, please see www.markit.com

About PMI

Purchasing Managers' Index™ (PMI™) surveys are now available for 32 countries and also for key regions

including the Eurozone. They are the most closely-watched business

surveys in the world, favoured by central banks, financial markets and

business decision makers for their ability to provide up-to-date,

accurate and often unique monthly indicators of economic trends. To

learn more go to markit.com/economics.

The intellectual property rights to the RBC Canadian Manufacturing PMI

provided herein are owned by or licensed to Markit Economics Limited.

Any unauthorised use, including but not limited to copying,

distributing, transmitting or otherwise of any data appearing is not

permitted without Markit's prior consent. Markit shall not have any

liability, duty or obligation for or relating to the content or

information ("data") contained herein, any errors, inaccuracies,

omissions or delays in the data, or for any actions taken in reliance

thereon. In no event shall Markit be liable for any special,

incidental, or consequential damages, arising out of the use of the

data. Purchasing Managers' Index™ and PMI™ are either registered trade marks of Markit Economics Limited or are

licensed to Markit Economics Limited. RBC uses the above marks under

licence. Markit is a registered trade mark of Markit Group Limited.

SOURCE RBC

Image with caption: "Canada's manufacturing conditions improved in June (CNW Group/RBC)". Image available at: http://photos.newswire.ca/images/download/20140702_C9280_PHOTO_EN_41807.jpg