(via Thenewswire.ca)

Vancouver, BC / TNW-ACCESSWIRE / July 24, 2014 / Golden Arrow Resources Corporation (TSX-V: GRG, FRA: GAC (WKN: A0B6XQ), "Golden Arrow" or the "Company") is pleased to announce the results from the final drill holes of the 9,000 metre Phase III drill program at the Chinchillas Silver Project in Argentina. Drill holes CGA-127 and CGA-129 demonstrate the expansion of known mineralization to the northwest of the existing Chinchillas resource and the direction remains open for continued expansion. In addition, drill hole CGA-126 is expected to add to the Chinchillas resources at depth. Highlights from the drill holes include:

-

- 31 metres averaging 186 g/t silver, 2.4% lead and 2.2% zinc, (334 g/t silver equivalent) at 165 metres depth in CGA-126

- 34 metres averaging 209 g/t silver and 1.2% lead (248g/t silver equivalent) at 118 metres depth in CGA-127, including 5 metres averaging 1,091 g/t silver and 3% lead (1,188 g/t silver equivalent)

- 22 metres averaging 212 g/t silver and 2.6% lead (296g/t silver equivalent) at 91 metres depth in CGA-129, including 7 metres averaging 515 g/t silver and 5.7% lead (699 g/t silver equivalent)

"The extent, grade and continuity of these results exemplify the Chinchillas project," commented Golden Arrow VP Exploration and Development, Brian McEwen. "These holes provide an excellent ending to a very successful drill program and we are now looking forward to updating the resource and moving the project towards feasibility."

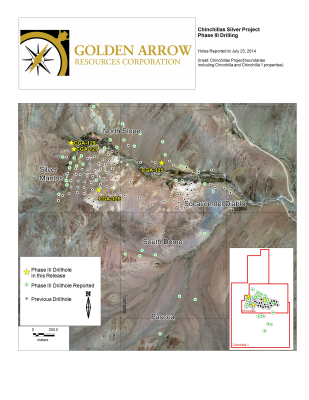

The Phase III drill program was designed to increase the existing resources at the Chinchillas deposit through exploration proximal to the deposit and in new areas of the properties. Drilling is now complete, for a total of 8,985 metres. Table 1 below includes the results of 1,042 metres of drilling from four holes. Corebox(R) interactive 3-D models of the deposit and drill holes can also be found on the website, here and will be updated with these new intercepts. A map of the drill hole locations will also be posted to the Chinchillas map page on the Golden Arrow website at http://www.goldenarrowresources.com/i/maps/Phase-III-NRV6.jpg.

Click Image To View Full Size

Drilling Details

Mineralized intercepts for four drill holes are reported in Table 1. The Silver Mantos zone comprises the western portion of the deposit, while the Socavon del Diablo comprises the eastern portion. The Mantos Basement Zone is situated approximately below the Silver Mantos Zone. These zones were described in detail as part of the NI 43-101 Technical Report and resource estimate1. The North Slope is a newer target area along the slope of the basin to the north of both the Silver Mantos and Socavon Zones.

CGA-125 is on the North Slope and targeted the extension of mineralization in previously reported hole CGA-107, located 70 metres to the north (see news release dated May 22nd, 2014). CGA-105 did return some mineralized intervals however it had only a very short interval of basement-style rocks, with no intercalated dacites, a combination believed to be responsible for the higher grade silver-zinc mineralization seen in CGA-107.

Drill hole CGA-126 is situated adjacent to the previously reported hole CGA-96 in the centre of the Silver Mantos area (see news release dated April 24th, 2013). The purpose of the hole was to drill deeper to test the depth extent of mineralization seen at the bottom of hole CGA-96, which ended in mantos-style tuffs but was terminated early due to issues with drilling. The new hole encountered a longer interval with higher grades of silver, lead and zinc than the previous hole, at a similar depth, in the Silver Mantos-style tuffs. This interval is adjacent to a dacite body that was previously unknown and appears to lie at the contact between the mantos and basement rocks. The basement was intersected at approximately 233 metres to the end of the hole at 302 metres, with three intervals of moderate grade mineralization.

CGA-127 is situated approximately 100 metres northwest of the existing Silver Mantos/Mantos Basement resource areas, and CGA-129 lies a further 60 metres north-northwest. CGA-127 encountered the basement contact at approximately 80 metres depth with multiple mineralized intercepts in this unit, including 34 metres averaging 209 g/t silver and 1.2% lead. CGA-129 tested the continuity of CGA-127 and successfully encountered the basement contact at 55 metres depth, with a similar interval of 22 metres averaging 212 g/t silver and 2.6% lead in that unit. Preliminary modeling of other Phase III drill holes CGA-93, -94, -108, -121, and -122 in this northwest area of the deposit shows that mineralization occurs at similar depths with similar intervals and grades in all holes, indicating very good continuity that is expected to aid to a expansion of the resource in this area (see news releases dated April 24th and June 23rd, 2014 for results of the earlier holes).

Table 1. Drill Intercepts >20g/t for Ag and >0.5% for Pb and Zn

|

TARGET/ZONE

|

HOLE ID

|

NOTES

|

FROM (metres)

|

TO (metres)

|

Interval (metres)

|

Ag

(g/t)

|

Pb

(%)

|

Zn

(%)

|

Ag Eq. (g/t)

|

|

NORTH SLOPE

|

CGA-125

|

|

53

|

54

|

1

|

56

|

0.6

|

|

75

|

| |

56

|

57

|

1

|

24

|

0.6

|

|

43

|

| |

57

|

70

|

13

|

|

|

0.5

|

16

|

| |

118

|

122

|

4

|

|

|

0.8

|

26

|

| |

130

|

131

|

1

|

|

|

1

|

32

|

| |

167

|

168

|

1

|

82

|

|

2.3

|

156

|

| |

168

|

170

|

2

|

|

|

1

|

32

|

| |

179

|

180

|

1

|

22

|

|

1.1

|

57

|

| |

225

|

226

|

1

|

24

|

|

|

24

|

|

SILVER MANTOS

|

CGA-126

|

|

15

|

21

|

6

|

|

|

0.7

|

23

|

| |

21

|

43

|

22

|

34

|

0.5

|

1.2

|

89

|

| |

48

|

50

|

2

|

|

|

0.5

|

16

|

| |

70

|

71

|

1

|

36

|

|

|

36

|

| |

74

|

76

|

2

|

44

|

|

|

44

|

| |

79

|

80

|

1

|

42

|

|

|

42

|

| |

87

|

88

|

1

|

21

|

|

|

21

|

| |

90

|

91

|

1

|

30

|

|

|

30

|

| |

93

|

95

|

2

|

|

|

0.6

|

19

|

| |

165

|

196

|

31

|

186

|

2.4

|

2.2

|

334

|

| |

226

|

228

|

2

|

185

|

|

|

185

|

|

MANTOS BASEMENT

|

|

248

|

250

|

2

|

|

|

0.7

|

23

|

| |

270

|

271

|

1

|

54

|

|

|

54

|

| |

297

|

300

|

3

|

36

|

0.6

|

|

55

|

|

MANTOS BASEMENT

|

CGA-127

|

|

89

|

112

|

23

|

85

|

0.7

|

|

108

|

| |

118

|

152

|

34

|

209

|

1.2

|

|

248

|

|

Including

|

130

|

135

|

5

|

1091

|

3

|

|

1188

|

| |

154

|

156

|

2

|

23

|

|

|

23

|

| |

160

|

162

|

2

|

36

|

|

|

36

|

| |

165

|

169

|

4

|

60

|

0.5

|

|

76

|

| |

172

|

179

|

7

|

27

|

|

|

27

|

| |

181

|

183

|

2

|

70

|

2.2

|

|

141

|

| |

185

|

186

|

1

|

61

|

|

|

61

|

| |

198

|

199

|

1

|

21

|

|

|

21

|

|

MANTOS BASEMENT

|

CGA-129

|

|

49

|

50

|

1

|

|

|

1.4

|

45

|

| |

80

|

85

|

5

|

48

|

1.2

|

|

87

|

| |

91

|

113

|

22

|

212

|

2.6

|

|

296

|

|

Including

|

95

|

102

|

7

|

515

|

5.7

|

|

699

|

| |

134

|

140

|

6

|

30

|

|

|

30

|

| |

142

|

143

|

1

|

52

|

|

|

52

|

| |

146

|

147

|

1

|

21

|

|

|

21

|

| |

150

|

151

|

1

|

53

|

|

|

53

|

| |

154

|

157

|

3

|

134

|

0.7

|

|

157

|

The reported intervals are believed to approximate true width and will be confirmed with geologic modeling.

Silver equivalent grades (Ag Eq) were calculated using US$20/oz for silver, US$0.94/lb for lead and US$0.94/lb for zinc.

Methodology and QA/QC

Analyses of the drill core were performed by Alex Stewart Assayers, in Mendoza, Argentina, an internationally recognized assay service provider. All samples were analyzed by method ICP-MA-39 that consists of a four acid digestion followed by ICP-OES detection. Silver results >200 Ag g/t were re-analyzed by fire assay with a gravimetric finish on 50-gram samples. Lead and zinc results >10,000 ppm were re-analyzed by a 3 acids and ICP-OES detection. The Company followed industry standard procedures for the work carried out on the Chinchillas Project, with a quality assurance/quality control (QA/QC) program. Blank, duplicate and standard samples were inserted into the drill core sample sequence sent to the laboratory for analysis. Golden Arrow detected no significant QA/QC issues during review of the data.

Table 2. Drill hole location and orientation data

|

Hole ID

|

Easting

|

Northing

|

Elevation (m)

|

Azimuth

|

Inclination

|

Length (m)

|

|

CGA-125

|

3473385

|

7512470

|

4089

|

25

|

-80

|

281

|

|

CGA-126

|

3472793

|

7512211

|

4129

|

210

|

-80

|

302

|

|

CGA-127

|

3472556

|

7512601

|

4111

|

0 |

-90

|

217

|

|

CGA-129

|

3472533

|

7512658

|

4115

|

0 |

-90

|

242

|

Next Steps

Golden Arrow is now working to update the resource estimate and PEA for the Chinchillas Project in the next four months. Management is confident that the updated PEA will outline a compelling scenario to move the existing project forward without requiring further exploration. Therefore the Company is laying out plans to advance the project to production within three years, including updating the resource estimate and PEA in the coming months. This will be followed by an infill drilling program in the fourth quarter of 2014 to upgrade the resource categories, and then the commencement of a feasibility study by the end of the year.

A separate stream of exploration work will continue concurrently with mine development. The Chinchillas South area (including the South Dome and Pascua targets) will be the first to have additional exploration, as the recent program indicates the potential for new resources (see news release dated July 22, 2014.) In addition, nearly 70% of the property areas have yet to see detailed exploration, and this will follow in subsequent programs.

About the Chinchillas Silver Project

Golden Arrow is earning a 100% interest in the Chinchillas Silver Project. After less than two years exploration, the Company announced a NI 43-101 resource estimate1 in 2013, including:

-

- 27.4 Moz silver / 32.6 Moz silver equivalent in Indicated Resources (7.2 Mt @ 119g/t silver, 0.57% lead, 0.48% zinc : 141g/t silver equivalent )

- 53 Moz silver / 72.2 Moz silver equivalent in Inferred Resources (21 Mt @ 78.5 g/t silver, 0.69% lead, 0.62% zinc : 107g/t silver equivalent)

The first NI 43-101 preliminary economic assessment2 returned an after-tax NPV 8% of US$98.5M, highlighting the benefits of the project's near-surface mineralization, conventional metallurgy and access to infrastructure. The deposit is open to expansion and Golden Arrow is now working to update the resource estimate and PEA based on the results of the recent drill program. Golden Arrow plans to commence feasibility work on the Project by the end of 2014.

1 "Mineral Resource Estimate for the Chinchillas Silver-Lead-Zinc Project, Jujuy Province, Argentina" filed on SEDAR dated June 20th, 2013.

2 "Preliminary Economic Assessment for the Chinchillas Silver-Lead-Zinc Project, Jujuy Province, Argentina" filed on SEDAR dated January 20th, 2014.

Qualified Persons

The contents of the news release have been reviewed and approved by Brian McEwen, P.Geol., VP Exploration and Development to the Company, and a Qualified Person as defined in National Instrument 43-101.

About Golden Arrow:

Golden Arrow is a Vancouver-based explorer focused on identifying, acquiring and advancing precious and base metal projects in Argentina with the goal of achieving a world class discovery. The main focus is on advancing the flagship Chinchillas Silver Project located in Jujuy, Argentina. Golden Arrow will continue to execute its strategy to leverage the Company's exploration exposure by attracting partners to fund work on its other high quality mineral projects. Golden Arrow is a member of Grosso Group, a management company specialized in resource exploration, and working in Argentina where it is highly regarded and trusted since 1993.

ON BEHALF OF THE BOARD

"Joseph Grosso"

_______________________________

Mr. Joseph Grosso

Executive Chairman, President, CEO and Director

For further information please contact:

Corporate Communications

Tel: 1-604-687-1828

Toll-Free: 1-800-901-0058

Email: info@goldenarrowresources.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

FORWARD-LOOKING STATEMENTS

This news release contains "forward-looking statements" within the meaning of Canadian securities legislation. Such forward-looking statements concern the Company's anticipated results and developments in the Company's operations in future periods, planned exploration and development of the Chinchillas project, plans related to its business and other matters that may occur in the future. These statements relate to analyses and other information that are based on expectations of future performance as outlined in the PEA, including silver, lead and zinc production and planned work programs at Chinchillas. Statements concerning reserves and mineral resource estimates may also constitute forward-looking statements to the extent that they involve estimates of the mineralization that will be encountered if the Chinchillas property is developed and, in the case of mineral reserves, such statements reflect the conclusion based on certain assumptions that the mineral deposit can be economically exploited.

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation: risks related to precious and base metal price fluctuations; risks related to fluctuations in the currency markets (particularly the Argentinean peso, Canadian dollar and United States dollar); risks related to the inherently dangerous activity of mining, including conditions or events beyond our control, and operating or technical difficulties in mineral exploration, development and mining activities; uncertainty in the Company's ability to raise financing and fund the development of the Chinchillas project pursuant to the PEA; uncertainty as to actual capital costs, operating costs, production and economic returns, and uncertainty that development activities will result in a profitable mining operation at Chinchillas; risks related to mineral resource figures being estimates based on interpretations and assumptions which may result in less mineral production under actual conditions than is currently estimated and to diminishing quantities or grades of mineral resources as properties are mined; risks related to governmental regulations and obtaining necessary licenses and permits; risks related to the business being subject to environmental laws and regulations which may increase costs of doing business and restrict our operations; risks related to the Chinchillas property being subject to prior unregistered agreements, transfers, or claims and other defects in title; risks relating to inadequate insurance or inability to obtain insurance; risks related to potential litigation; risks related to the global economy; risks related to the Chinchillas property being located in Argentina, including political, economic, social and regulatory instability. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in the forward-looking statements. The Company's forward-looking statements are based on beliefs, expectations and opinions of management on the date the statements are made. For the reasons set forth above, investors should not place undue reliance on forward-looking statements.

The information provided in this news release addresses the Chinchillas PEA and is not intended to be a comprehensive review of all matters and developments concerning the Company. It should be read in conjunction with all other disclosure documents of the Company. The information contained herein is not a substitute for detailed investigation or analysis. No securities commission or regulatory authority has reviewed the accuracy or adequacy of the information presented. The Company undertakes no obligation to publicly update or revise any forward-looking statements.

We advise U.S. investors that the SEC's mining guidelines strictly prohibit information of this type in documents filed with the SEC. U.S. investors are cautioned that mineral deposits on adjacent properties are not indicative of mineral deposits on our properties.

Copyright (c) 2014 TheNewswire - All rights reserved.