(via Thenewswire.ca)

Cut Bank, Montana / TNW-ACCESSWIRE / August 29, 2014 / Mountainview Energy Ltd. ("Mountainview" or the "Company") (TSXV: MVW) is pleased to announce its operating and financial results for the quarter ended June 30, 2014. The Company also announces that its reviewed financial statements and management's discussion and analysis for the quarter ended June 30, 2014, are available on SEDAR at www.sedar.com, and on Mountainview's website at www.mountainviewenergy.com.

Highlights of Mountainview's successful Q2 2014 are as follows:

-

-- Optimized the downhole assembly for initial fluid production on new wells and completed a workover program on three existing wells to move them to Rotoflex pumping units more suited to the stabilized ongoing production levels.

-- Despite production interruptions, average Q2 production was 915 boe/d, an increase of 30% over the average of 703 boe/d for Q2 2013.

-- Factoring in production outages, the average daily Q2 production rate per producing day was 1,056 boe/d.

-- Generated operating netbacks of $35.42 per boe in Q2 2014, an increase of 42% when compared to $24.98 per boe in Q2 2013.

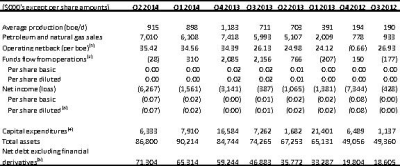

Certain selected quarterly financial and operational information is outlined below and should be read in conjunction with Mountainview's reviewed financial statements for the three and six months ended June 30, 2014 and the audited financial statements for the years ended December 31, 2013 and 2012 and the accompanying management discussion and analysis filed with the Canadian securities regulatory authorities which may be accessed through the SEDAR website (www.sedar.com) and also on the Company's website: www.mountainviewenergy.com.

Click Image To View Full Size

-

(1)Operating netback is a non-GAAP measure calculated as the average per boe of the Company's oil and gas sales plus realized gains on derivatives, less royalties, operating and transportation expenses.

-

(2)Funds flow from operations should not be considered an alternative to, or more meaningful than, cash flow from operating activities as determined in accordance with International Financial Reporting Standards as an indicator of Mountainview's performance. Funds flow from operations represents cash flow from operating activities prior to changes in non-cash working capital, transaction costs and decommissioning provision expenditures incurred. Mountainview also presents funds flow from operations per share whereby per share amounts are calculated using weighted average shares outstanding consistent with the calculation of earnings per share.

-

(3)Due to the anti-dilutive effect of Mountainview's net loss for the three months and year ended December 31, 2013 and 2012, the diluted number of shares is equal to the basic number of shares. Therefore, diluted per share amounts of the net loss are equivalent to basic per share amounts.

-

(4)Capital expenditures are a non-GAAP measure, calculated as the purchase or sale price of an asset, plus development capital expenditures added to PP&E. Corporate acquisitions are excluded from this measure.

-

(5)Net debt is a non-GAAP measure representing the total of bank indebtedness, accounts payables and accrued liabilities, less accounts receivables, deposits and prepaid expenses.

Corporate

Mountainview exited the quarter with increased average production, offsetting production outages from seasonal road restrictions experienced in Divide County, N.D. In addition, optimizing the downhole pump resulted in less downtime and an increase in average production on a quarter over quarter basis which produced a 2% increase in oil and natural gas sales. In addition, the Company generated higher netbacks per boe in Q2 2014 compared to the prior period quarter. Lease expiries of $4.4 million in a non-core area and financing expenses of $2.1 million were main drivers in the overall net loss of $6.3 million. The continued optimization of the production operations is expected to continue to increase netbacks generated from the 12 Gage area, supporting the Company's belief in the asset. Mountainview anticipates continuing the development of the infill drilling inventory, benefitting from capital efficiencies associated with pad drilling.

Mountainview's strategic shift to drilling higher working interest wells in 2013 will continue in 2014.

Financial

At quarter-end, Company net debt was $71.3 million and the Company had $46.5 million drawn on its available credit facility of $51.2 million. Funds flow from operations for Q2 2014 decreased from Q2 2013, mainly due to increased operating expenditures.

Exposure to volatility of differentials from WTI and industry concerns with respect to transportation restrictions in the Williston Basin translated into realized prices ranging from $73.72 per barrel of oil in Q2 2013, to $84.12 per barrel of oil in Q2, 2014. In response to this price volatility, the Company has entered into a financial hedging program which commenced in January, 2014. Mountainview had 32% of its production hedged for Q2, 2014, with a floor of $85.00 and a ceiling of $97.70. The Company plans to actively manage its hedging program as its production base grows.

Operations

The Company's Q2 2014 capital plan on its core 12 Gage asset in Divide County, N.D. was limited in Q2, 2014. The $6.3 million capital program in the quarter included finalizing the completion and clean out of 2 wells (1.9 net), with a 100% success rate. At year-end 2013, these 2 wells (1.9 net) had been drilled and were awaiting completion. Production equipment was also installed in the second quarter. Mountainview has determined that an electronic submersible pump ("ESP") is the optimal pump to produce the higher fluid levels experienced in the initial six months of production in the 12 Gage area. Beyond the first six to eight months, the Rotoflex pump has proven to be the optimal pump for the expected long term fluid levels. The Company is changing pumps from ESP to Rotoflex as the ESP reaches the end of its useful life.

The Company has selectively increased its working interest in its assets whenever appropriate as it has become more experienced operationally. This experience has resulted in decreased capital costs on a per well basis from $8.3 million per well to $6.3 million per well.

Outlook

Mountainview has continued to deliver on its strategy of production and reserve growth. Utilizing funds flow from operations and available credit on its existing credit facility, Mountainview will continue to focus on the development of its core 12 Gage asset in Divide County, N.D.

The Company will continue to pursue an aggressive growth strategy using a combination of cash flow and available credit. Continued strong oil pricing and WTI differentials, combined with the Company's hedge position, allow Mountainview to remain confident in the long term sustainability of the 2014 capital plan.

Mountainview is planning to drill three additional Three Forks (Torquay) wells in the third quarter of 2014. This drilling program will be financed through the sale of non-core, non-operated assets. Further development of the 12 Gage project may be accelerated through an equity financing and/or the refinancing of the existing line of credit. Any equity financing or debt refinancing would be dependent on capital requirements and market conditions, and subject to management and board approval.

About Mountainview

Mountainview Energy Ltd. is a public oil and gas company listed on the TSX Venture Exchange, with a primary focus on the exploration, production and development of the Bakken and Three Forks Shale in the Williston Basin and the South Alberta Bakken.

For further information, please contact:

Patrick M. Montalban, President & Chief Executive Officer

E-Mail: mvw@bresnan.net

Fax: (406) 873-2835

Brent Osmond, Vice President Finance & Chief Financial Officer

E-Mail: brento@mountainviewenergy.com

Phone: (403) 999-8511

Forward-Looking Statements

Certain information contained in this press release constitutes forward-looking statements. Statements relating to "reserves" are deemed to be forward-looking statements as they involve the implied assessment, based on certain estimates and assumptions, that the reserves described exist in the quantities predicted or estimated and can be profitably produced in the future. By their nature, forward-looking statements are subject to numerous risks and uncertainties, some of which are beyond the Company's control including the impact of general economic conditions, industry conditions, volatility of commodity prices, currency fluctuations, environmental risks, competition from other industry participants, the lack of availability of qualified service providers, personnel or management, stock market volatility and ability to access sufficient capital from internal and external sources, inability to meet or continue to meet listing requirements, the inability to obtain required consents, permits or approvals and the risk that actual results will vary from the results forecasted and such variations may be material. Readers are cautioned that the assumptions used in the preparation of such information, although considered reasonable at the time of preparation may prove to be imprecise and, as such, undue reliance should not be placed on forward-looking statements. The Company's actual results, performance or achievement could differ materially from those expressed in or implied by, these forward-looking statements and, accordingly, no assurance can be given that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do so, what benefits the Company will derive therefrom.

The forward-looking statements contained in this press release are made as of the date of this press release. Mountainview disclaims any intention and assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable securities laws. Additionally, Mountainview undertakes no obligation to comment on the expectations of, or statements made by, third parties in respect of the matters discussed above.

Barrels of Oil Equivalent

The term barrels of oil equivalent ("boe") may be misleading, particularly if used in isolation. A boe conversion ratio of six thousand cubic feet of natural gas to one barrel of oil equivalent (6 mcf/bbl) is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. Given that the value ratio based on the current price of crude oil as compared to natural gas is significantly different from the energy equivalency of 6:1, utilizing a conversion on a 6:1 basis may be misleading as an indication of value. All boe conversions in this report are derived from converting gas to oil in the ratio of six thousand cubic feet of gas to one barrel of oil.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Copyright (c) 2014 TheNewswire - All rights reserved.