SAN FRANCISCO, Oct. 26, 2015 /PRNewswire/ -- According to the inaugural Capital One Growth Ventures Startup Barometer survey, seven in ten (70.8 percent) startup owners in the tech industry believe practical advice and mentorship would be the most valuable resource to help take their companies to the next level. The Startup Barometer is a semi-annual survey of technology startup business owners that highlights key questions and challenges facing many entrepreneurs today. The survey, conducted in September 2015, showed that entrepreneurs are most interested mentorship, incubation and networking opportunities (20.5 percent), along with marketing advice and counsel (20.5 percent).

The Startup Barometer examines how startup companies are growing and what they need most from their strategic partners and investors. In its initial study, the Capital One Growth Ventures team also looked at how startups view the future of payment technology. Capital One Growth Ventures has also launched a new website – http://growthventures.capitalone.com/ – that provides access to advice and insights from the Ventures team and the full Barometer results.

"Our findings show that, in addition to financing, tech startups need practical advice to help them grow and evolve their concepts," said Jaidev Shergill, Managing Partner at Capital One Growth Ventures. "While tech startups are initially driven by the product innovation itself – the new platform, technology, or app they've dedicated their business to – it doesn't take long for them to realize that 'making it' for the long term requires more than just a great idea. That's where finding the right strategic investor comes in. For us, investing goes well beyond funding. We approach every new engagement with a fintech company as an opportunity to explore the possibilities, learn side by side, and unleash the potential of exciting new digital innovations."

Most Tech Startups Planning for Full-Time Hires

Among the tech startup owners surveyed, nearly half (44.4 percent) report that they are in the Series B stage of funding, meaning that they are in the midst of scaling the business, building awareness and gaining traction with users. When asked about hiring plans, the vast majority (85.4 percent) reported that they plan to hire new talent in the next six months. Of those startups planning to hire, 77.5 percent will hire full-time employees, 48.8 percent will hire part-time employees, and roughly one third will hire contractors and interns.

Working with Strategic Investors

As tech startup owners grow their businesses, they must determine the type of relationship they will establish with investors – whether it is an institutional investor who provides only financial support or a strategic or corporate investor that adds value to a company through a combination of funding and additional resources such as market knowledge, experience, and industry contacts. The Startup Barometer Survey found that three in ten (29.1 percent) tech startups surveyed currently work with corporate investors, while 37.1 percent partner with strategic investors who are not from large corporations.

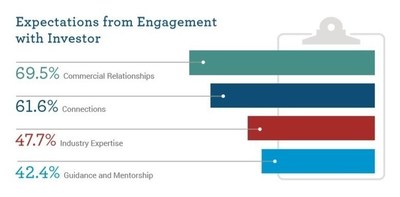

When asked about their expectations of investors, most tech startup owners reported that they expect commercial relationships (69.5 percent) and connections (61.6 percent) to a broader network of industry and subject-matter experts. Beyond relationships, tech startups also expect industry expertise (47.7 percent) and guidance and mentorship (42.4 percent). In return for these resources, the survey found that the most common benefits provided to strategic investors include performance-based financial benefits (70 percent), board representation (49 percent) and decision-making power, particularly in regards to acquisitions (47 percent).

"There is no single formula for how we engage with fintech startups," said Shergill. "Before we invest in a company, we look at the opportunity and say 'What could be?' We look at the concept, the culture, the team and the value proposition of the companies we're considering for our portfolio and focus our efforts on finding companies where we truly believe our team – and Capital One – can bring strategic value to the relationship."

What Tech Startups Need Most

The Startup Barometer Survey found that one in five (20.6 percent) tech startups surveyed does not yet have a fully defined business plan or economic model for their company. When it comes to time management, nearly half of tech startup owners (49 percent) report that – in addition to developing their company's product or service – the majority of their time is dedicated to day-to-day business operations such as HR and accounting.

"We work closely with businesses to ensure that they are also paying attention to day-to-day business operations and finding the right talent to help them bring their products to market," said Shergill. "Mastering some core execution fundamentals can mean the difference between success and failure for a tech startup."

Tech Startups Prioritize Security in Payment Technologies

The payment technology landscape is continually changing, requiring entrepreneurs at every stage to make important decisions about how their company will send and receive payments to and from customers. While the majority (58.9 percent) of tech startups believe traditional credit and debit cards will continue to dominate, four in ten (41.1 percent) also believe other payment devices, including Near Field Communication (33.1 percent) and Chip technology (37.1 percent), will continue to be significant players in the payments space.

The survey asked tech startups to weigh in on what they believe is the most important feature of a payment provider and found the following results:

- Security (44.4 percent)

- Ability to accept multiple forms of payment (25.8 percent)

- Brand and trust (15.9 percent)

- Connectivity to existing platforms (9.9 percent)

"The pace of innovation in the fintech space is incredibly exciting, and it affects businesses of every industry and size," said Capital One Growth Ventures Venture Partner Lauren Connolley. "The evolution of payment technologies and particularly the growing focus on mobile technologies is a perfect example. The increasing desire for convenience and 'seamlessness' among customers, along with the growing need for privacy and data security creates a really interesting friction that is spurring exciting new payment technologies."

Survey Methodology

The findings reported in this release are from a survey conducted by the opinion research firm, Survey Sampling International (SSI), global provider of data solutions and technology. SSI interviewed a sample of 151 decision-makers (including CEOs, CIOs, COOs, owners and presidents) from for-profit technology startups in the U.S. Technology startups are defined as those that have been in business for 5 years or less and meet a set of industry- and product-specific criteria. The survey was conducted online and through computer assisted telephone interviewing (CATI) from September 1, 2015 – September 28, 2015. CATI sampling for this study was conducted using a sample of businesses drawn from InfoUSA, while online surveying was conducted using SSI's online sample.

About Capital One Growth Ventures:

The Capital One Growth Ventures team creates unique learning and commercial opportunities for Capital One, bringing insights and new capabilities to help drive and enrich the bank's digital transformation through venture investments and acquisitions. Areas of focus include big data technologies, payments & commerce, and security & authentication. Capital One Growth Ventures' goal is to help startups gain traction, evolve and test disruptive new concepts and, at the same time, deliver breakthrough experiences for Capital One customers. For more information, visit http://growthventures.capitalone.com

Logo- http://photos.prnewswire.com/prnh/20141030/155590LOGO

Photo- http://photos.prnewswire.com/prnh/20151026/280317

To view the original version on PR Newswire, visit:http://www.prnewswire.com/news-releases/tech-startups-seek-mentorship-and-counsel-as-they-grow-their-businesses-300165923.html

SOURCE Capital One Financial Corporation