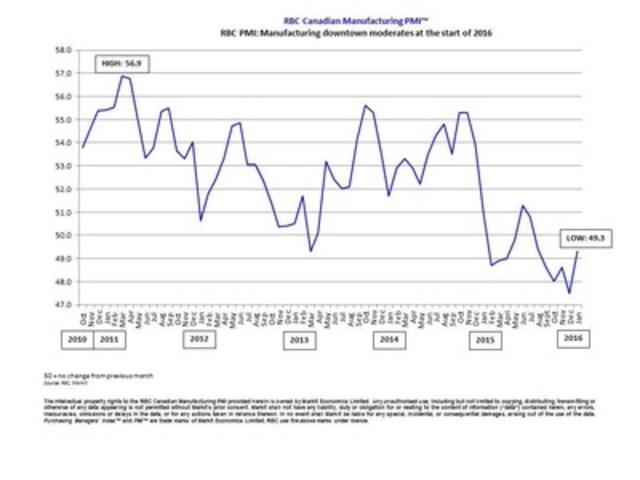

TORONTO, Feb. 1st, 2016 /CNW/ - The RBC Canadian Manufacturing PMI moved closer to stabilization in January, following a survey-record low at the end of 2015. Measured overall, business conditions deteriorated to the lowest degree for five months, reflecting softer falls in output, new business and employment.

The main bright spot was a solid rebound in export sales, which helped offset some of the downturn in domestic demand. A number of manufacturers noted that the weaker loonie had contributed to rising new business wins from U.S. clients. At the same time, exchange rate depreciation also led to a strong and accelerated increase in average cost burdens, with input price inflation hitting an 18-month high in January.

A monthly survey, conducted in association with Markit, a leading global financial information services company, and the Supply Chain Management Association (SCMA), the RBC PMI offers a comprehensive and early indicator of trends in the Canadian manufacturing sector.

At 49.3 in January, the seasonally adjusted RBC Canadian Manufacturing PMI recovered from December's survey-record low of 47.5, but remained below the neutral 50.0 threshold for the sixth consecutive month. The current period of decline is the longest since the survey began in late-2010, although the latest reading was the highest since last August.

"While Canadian business conditions continued to deteriorate in January, we saw signs of stabilization in the manufacturing industry supported by strong export sales alongside a pick up in the US economy and a weakening Canadian dollar," said Craig Wright, senior vice-president and chief economist, RBC. "Ontario manufacturing continues to be the bright spot, while the sharp drop in performance in Alberta and B.C. suggests that heightened economic uncertainty and ongoing declines in capital spending are weighing on the economy."

The headline RBC PMI reflects changes in output, new orders, employment, inventories and supplier delivery times.

Key findings from the January survey included:

- Manufacturing PMI picks up from December's survey-record low

- Slower declines in output, new orders and employment

- New export work increases at strongest pace since November 2014

January data signalled a slower reduction in output volumes than that recorded in December. Moreover, the rate of decline was only marginal and the least marked for five months. Anecdotal evidence suggested that improving export demand had supported production levels in January. At the same time, heightened economic uncertainty and ongoing declines in capital spending by energy sector clients was cited as a brake on manufacturing output.

Mirroring the trend for production, the latest data pointed to a considerably slower fall in new business volumes than seen at the end of 2015. Moreover, the rate of decline in overall new orders was marginal and the slowest since the current downturn began last September. There were widespread reports that greater demand from abroad had helped to stabilize new business levels in January. Reflecting this, latest data pointed to the strongest rise in new export orders since November 2014.

Job shedding moderated across the manufacturing sector at the start of 2016, following the survey-record fall seen during December. In contrast, the rate of decline in staffing numbers was the slowest for six months during January. A number of firms noted that the uncertain business outlook had led to the non-replacement of voluntary leavers. Moreover, backlogs of work dropped for the fourteenth month running, suggesting a sustained lack of pressure on operating capacity.

January data suggested only a slight squeeze on suppliers' delivery times, while input buying fell over the month. Moreover, manufacturers continued to lower their inventories at the start of 2016. However, upward pressure on costs persisted, with overall input prices rising at the fastest pace since July 2014. This in turn contributed to the sharpest increase in factory gate charges for over a year-and-a-half.

Regional highlights include:

- Ontario saw another improvement in manufacturing conditions, while Alberta and B.C. continued to record the fastest decline in performance

- New export sales increased in three of the four monitored regions, with Alberta and B.C. the exception

- Strong rises in average cost burdens were registered across all areas monitored by the survey in January

"After December's record low Canada's manufacturing sector was close to stabilizing in January, with improving exports a key ingredient at the start of 2016," said Cheryl Paradowski, president and chief executive officer, SCMA. "Manufacturers saw a solid upturn in new work from abroad, which helped support production levels but didn't quite offset sustained weak domestic sales. The figure for Canada as a whole continued to mask diverging fortunes provincially, notably between the export-led manufacturing rebound in Ontario and the oil-related downturn faced by a large proportion of manufacturers in Alberta & British Columbia."

The report is available at www.rbc.com/newsroom/pmi.

Notes to Editors:

The RBC Canadian Manufacturing PMI™ Report is based on data compiled from monthly replies to questionnaires sent to purchasing executives in over 400 industrial companies. The panel is stratified by company workforce size and by Standard Industrial Classification (SIC) group, based on industry contribution to Canadian GDP.

Survey responses reflect the change, if any, in the current month compared to the previous month based on data collected mid-month. For each of the indicators the 'Report' shows the percentage reporting each response, the net difference between the number of higher/better responses and lower/worse responses, and the 'diffusion' index. This index is the sum of the positive responses plus a half of those responding 'the same'.

Diffusion indexes have the properties of leading indicators and are convenient summary measures showing the prevailing direction of change. An index reading above 50 indicates an overall increase in that variable, below 50 an overall decrease.

The RBC Canadian Manufacturing Purchasing Managers' Index™ (RBC PMI™) is a composite index based on five of the individual indexes with the following weights: New Orders - 0.3, Output - 0.25, Employment - 0.2, Suppliers' Delivery Times - 0.15, Stock of Items Purchased - 0.1, with the Delivery Times Index inverted so that it moves in a comparable direction.

The Purchasing Managers' Index (PMI) survey methodology has developed an outstanding reputation for providing the most up-to-date possible indication of what is really happening in the private sector economy by tracking variables such as sales, employment, inventories and prices. The indices are widely used by businesses, governments and economic analysts in financial institutions to help better understand business conditions and guide corporate and investment strategy. In particular, central banks in many countries (including the European Central Bank) use the data to help make interest rate decisions. PMI surveys are the first indicators of economic conditions published each month and are therefore available well ahead of comparable data produced by government bodies.

Markit does not revise underlying survey data after first publication, but seasonal adjustment factors may be revised from time to time as appropriate which will affect the seasonally adjusted data series. Historical data relating to the underlying (unadjusted) numbers, first published seasonally adjusted series and subsequently revised data are available to subscribers from Markit. Please contact economics@markit.com.

About RBC

Royal Bank of Canada is Canada's largest bank, and one of the largest banks in the world, based on market capitalization. We are one of North America's leading diversified financial services companies, and provide personal and commercial banking, wealth management, insurance, investor services and capital markets products and services on a global basis. We employ approximately 81,000 full- and part-time employees who serve more than 16 million personal, business, public sector and institutional clients through offices in Canada, the U.S. and 37 other countries. For more information, please visit rbc.com.

RBC helps communities prosper, supporting a broad range of community initiatives through donations, sponsorships and employee volunteer activities. In 2015, we contributed more than $100 million to causes around the world.

About Supply Chain Management Association

As the leading and largest association in Canada for supply chain management professionals, the Supply Chain Management Association (SCMA) is the national voice for advancing and promoting the profession. SCMA sets the standard of excellence for professional skills, knowledge and integrity and was the first supply chain association in the world to require that all members adhere to a Code of Ethics.

With nearly 8000 members working across the private and public sectors, SCMA is the principal source of supply chain training, education and professional development in the country. Through its 10 Provincial and Territorial Institutes, SCMA grants the Supply Chain Management Professional (SCMP) designation, the highest achievement in the field and the mark of strategic supply chain leadership.

SCMA was formed in 2013 through the amalgamation of the Purchasing Management Association of Canada and Supply Chain and Logistics Association of Canada. With a combined history of more than 140 years, today the association embraces all aspects of strategic supply chain management, including: purchasing/procurement, strategic sourcing, contract management, materials/inventory management, and logistics and transportation. For more information, please visit scmanational.ca.

About Markit

Markit is a leading global diversified provider of financial information services. We provide products that enhance transparency, reduce risk and improve operational efficiency. Our customers include banks, hedge funds, asset managers, central banks, regulators, auditors, fund administrators and insurance companies. Founded in 2003, we employ approximately 4,000 people in 11 countries. Markit shares are listed on NASDAQ under the symbol MRKT. For more information, please see www.markit.com.

About PMI

Purchasing Managers' Index™ (PMI™) surveys are now available for over 30 countries and also for key regions including the Eurozone. They are the most closely-watched business surveys in the world, favoured by central banks, financial markets and business decision makers for their ability to provide up-to-date, accurate and often unique monthly indicators of economic trends. To learn more go to markit.com/economics.

The intellectual property rights to the RBC Canadian Manufacturing PMI provided herein are owned by or licensed to Markit. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without Markit's prior consent. Markit shall not have any liability, duty or obligation for or relating to the content or information ("data") contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon. In no event shall Markit be liable for any special, incidental, or consequential damages, arising out of the use of the data. Purchasing Managers' Index™ and PMI™ are either registered trade marks of Markit Economics Limited or are licensed to Markit Economics Limited. RBC uses the above marks under licence. Markit is a registered trade mark of Markit Group Limited.

SOURCE RBC

Image with caption: "RBC PMI: Manufacturing downtown moderates at the start of 2016 (CNW Group/RBC)". Image available at: http://photos.newswire.ca/images/download/20160201_C8994_PHOTO_EN_609188.jpg

Royal Bank of Canada, Catherine Hudon, Director, Corporate Communications, Canada, RBC, Telephone: 416-974-5506, Email: catherine.hudon@rbc.com; Supply Chain Management Association: Cheryl Paradowski, President and CEO, Telephone: +001-416-542-9120, Email: cparadowski@scmanational.ca; Amanda Cormier, Director, Public Affairs & Communications, Telephone: +001-416-542-3860, Email: acormier@scmanational.ca; Markit: Tim Moore, Senior Economist, Telephone: +44-1491-461-067, Email: tim.moore@markit.com; Joanna Vickers, Corporate Communications, Telephone: +44-207-260-2234, Email: joanna.vickers@markit.comCopyright CNW Group 2016