Investor sentiment at its lowest level since the financial crisis: Manulife poll

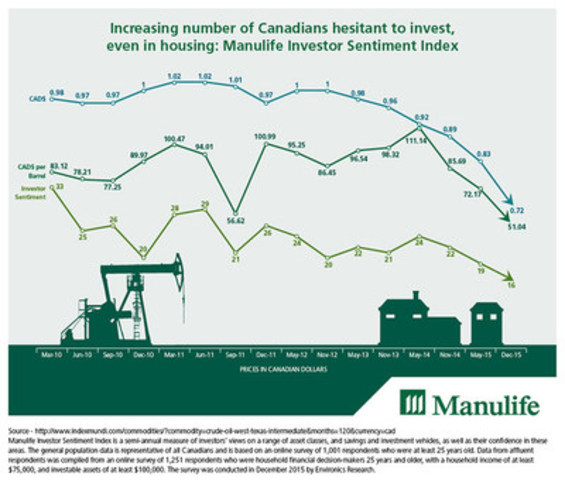

TORONTO, Feb. 15, 2016 /CNW/ - Manulife's Investor Sentiment Index has dropped to +16, the lowest point since the financial crisis when the index hit +11; the all-time high was +34 reached in 2006. Along with eroding investor sentiment is the feeling among Canadians that they are in a worse financial position than they were two years ago (26 per cent).

Canadians are increasingly viewing housing as a less attractive investment having dropped three points in the last year. The two largest drops were in British Columbia (13 point decrease since November 2014) and Ontario (decreased six points in the same time period). Canadians are also less likely to prioritize investing in their home in the near future (falling five per cent in the last six months).

"Canadian investors are facing a long list of uncertainties, including tremendous volatility in both oil prices and the value of the Canadian dollar. The outlook should become more clear over the course of 2016," said Frances Donald, Senior Economist, Manulife Asset Management. "What is most interesting from the survey is the ongoing decline in the Canadian appetite to invest in their own home."

In the last six months, Canadian investors lost confidence in mutual funds (down eight points), ETFs (down seven points), and balanced mutual funds (down seven points, the lowest it's been since 2011). Fixed income stayed the same (+3 on the index).

Index Ranking Across Canada

Investors in Ontario and the Atlantic provinces were the most optimistic ranking +20 on the index. Quebec ranked lowest at +9 and Alberta ranked second lowest at +14 (dropping five points since May 2015 and 11 points since November 2014).

Cash Preference by Province

Investors in Ontario (+20 points), Atlantic Provinces (+18 points), and British Columbia (+10 points) prefer cash. Albertans are focusing on their homes and then cash for investment purposes. While Investors in Quebec (-5 points) believe that now is a bad time for cash.

Interest Rates

Almost half (48 per cent) of Canadians believe that interest rates will stay the same for the next 12 months. While 77 per cent of Canadians say interest rates will not have an impact on their investment strategy.

"The Bank of Canada has been suggesting that interest rates are on hold or may even fall further over the coming year," said Donald. "Yet, interestingly, 40 per cent of Canadian investors still expect interest rates to rise, highlighting the ongoing uncertainty around the interest rate outlook."

Online banking activities

In a new line of survey questions, 82 per cent of Canadians used an online channel to manage their finances. And affluent investors are more likely to go online to access financial services and look after their finances (94 per cent). Desktop and laptop are still the most common tools to manage finances online (90 per cent of Canadians on average); however Canadians are more likely to use a smartphone to deposit funds to their accounts (36 per cent). Just under half of Canadians (47 per cent) still feel it is unsafe to bank on their smartphones.

The most common online financial activity for investors is checking the performance of their investments, 75 per cent doing so at least once a month or 34 per cent doing so weekly.

For more information and historical data, visit Manulife.ca

About the Manulife Investor Sentiment Index

Now in its 16th year, the Manulife Investor Sentiment Index is a semi-annual measure of investors' views on a range of asset classes, and savings and investment vehicles, as well as their confidence in these areas. The general population data is representative of all Canadians and is based on an online survey of 1,001 respondents who were at least 25 years old. Data from affluent respondents was compiled from an online survey of 1,251 respondents who were household financial decision-makers 25 years and older, with a household income of at least $75,000, and investable assets of at least $100,000. The survey was conducted in December 2015 by Environics Research.

About Manulife

Manulife Financial Corporation is a leading international financial services group providing forward-thinking solutions to help people with their big financial decisions. We operate as John Hancock in the United States, and Manulife elsewhere. We provide financial advice, insurance and wealth and asset management solutions for individuals, groups and institutions. At the end of 2015, we had approximately 34,000 employees, 63,000 agents, and thousands of distribution partners, serving 20 million customers. At the end of December 2015, we had $935 billion (US$676 billion) in assets under management and administration, and in the previous 12 months we made more than $24.6 billion in benefits, interest and other payments to our customers. Our principal operations are in Asia, Canada and the United States where we have served customers for more than 100 years. With our global headquarters in Toronto, Canada, we trade as 'MFC' on the Toronto, New York, and the Philippine stock exchanges and under '945' in Hong Kong. Follow Manulife on Twitter @ManulifeNews or visit www.manulife.com or www.johnhancock.com.

SOURCE Manulife Financial Corporation

Image with caption: "Increasing number of Canadians hesitant to invest, even in housing: Manulife Investor Sentiment Index (CNW Group/Manulife Financial Corporation)". Image available at: http://photos.newswire.ca/images/download/20160215_C6374_PHOTO_EN_620433.jpg

Media Contact: Rebecca Freiburger, 519-503-6604, Rebecca_Freiburger@manulife.comCopyright CNW Group 2016