Listed (TSX:LAM; ASX:LAM)

ARBN 154 146 755

TORONTO, April 21, 2016 /CNW/ - Laramide Resources Ltd. ("Laramide" or the "Company") (LAM: TSX/ ASX) is pleased to announce results from the Company's updated Preliminary Economic Assessment ("PEA") for the Westmoreland Uranium Project, located in the North West Queensland Mineral Province, Australia. The independent study was completed by Lycopodium Minerals Pty Ltd. A copy of the PEA has been filed and available for viewing and download at www.sedar.com and the Company's website www.laramide.com.

Key Highlights of the PEA (at US$65/lb U3O8 life of mine price)

- Initial capital expenditures ("CAPEX") of US$268M plus US$49M contingency are estimated to construct the mine and a 2M tonne per annum (tpa) mill with a nameplate capacity of 4Mlb U3O8 per annum;

- Total sustaining capital of US$58M over the Life of Mine ("LOM");

- Cash operating cost to average US$21.00/lb U3O8 for the first five years of operation and US$23.20/lb U3O8 LOM;

- Net Present Value ("NPV") at a 10% discount rate of US$598M pre-tax and US$400M post tax.

- Internal Rate of Return ("IRR") of 45.4% pre-tax and 35.8% post tax with a capital payback estimated at 2.5 years post-tax.

- Low 2.3:1 strip ratio for the first 5 years of operation and 4:1 LOM. Simple, open cut mining operation.

- Mine scheduling allows best practice in-pit tailings storage to be employed without the requirement for a temporary tailings storage facility;

- Opportunities have been identified to further reduce operating cost through reagent recycling. Further testwork is required to confirm this assumption before incorporating it into the process model.

Marc Henderson, President and Chief Executive Officer, commented, "The PEA on Westmoreland demonstrates the Project to be one of the best in Australia with attractive economics. The PEA and the Churchrock acquisition reiterates Laramide's strategy of growing a portfolio of lower technical risk, low-cost uranium projects in stable political environments."

Chief Operating Officer, Bryn Jones, said, "Westmoreland has always been a beacon in the Australian uranium project pipeline for me and this PEA has highlighted the low technical risk and robust nature of the project. The PEA has highlighted multiple opportunities to further improve the Project through process optimization and additional resource drilling which I look forward to investigating as the Project moves towards a Pre-Feasibility Study."

PEA Study Details

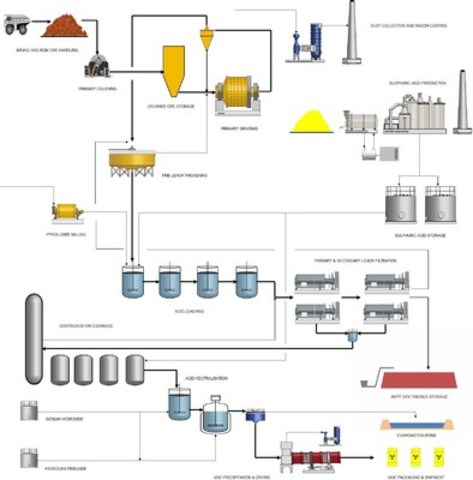

The PEA contemplates a conventional open pit mining operation with a processing facility operating over a 13 year life at a throughput of 5,500 tonnes per day ("tpd"). The planned processing route consists of milling followed by conventional agitated tank leach with sulphuric acid with Continuous Ion Exchange ("CIX") employed for uranium recovery from the leach solution as represented in the Simplified Overall Treatment Flowsheet below.

|

Key Production and Financial Parameters

|

|

Mine life

|

13 years

|

|

Average annual throughput

|

2 million tonnes

|

|

Processing methodology

|

Tank Leach – CIX

|

|

Overall process recovery

|

95%

|

|

Open pit strip ratio (LOM)

|

4.0:1

|

|

Average diluted feed grade

|

840 ppm U3O8

|

|

Average annual production

|

3.52 million lbs U3O8

|

|

Total uranium recovered (LOM)

|

45.8 million lbs U3O8

|

|

Financial Parameters

|

|

Uranium price

|

US$65 / lb U3O8

|

|

USD:AUD exchange rate

|

0.70

|

|

Average operating cost

|

US$23.30 / lb U3O8

|

|

Initial CAPEX (including contingency)

|

US$316 million

|

|

Sustaining CAPEX (LOM)

|

US$58 million

|

|

Corporate tax rate

|

30%

|

|

Royalties

|

|

|

Qld State Government

|

5%

|

|

IRC

|

1% (capped at $10m indexed)

|

|

Inflation

|

Not included

|

|

Pre-tax

|

Post-tax

|

|

NPV (10% discount Rate)

|

US$598 M

|

US$400 M

|

|

IRR

|

45.4%

|

35.8%

|

|

Payback period

|

|

2.5 years

|

The previous PEA from 2007 was based largely on information acquired from Rio Tinto following the Westmoreland asset purchase. Since this time Laramide has completed several drilling campaigns, re-estimated the resource and has an improved knowledge of the metallurgical conditions required for cost effective uranium extraction on the Project. The PEA reflects current inputs including currencies, commodity price forecasts, fuel costs and other input costs.

The key differences between the 2007 PEA and the 2016 revised PEA are, as follows:

|

Parameter

|

2007 PEA

|

2016 PEA

|

|

Resource Size

|

48.5 Mlb

|

51.9 Mlb

|

|

Mill Design Tonnage

|

1.5 Mtpa

|

2 Mtpa

|

|

Overall Uranium Recovery

|

90.6%

|

95%

|

|

Namplate Prodution Capacity

|

3 Mlb/a

|

4 Mlb/a

|

|

Mine Life

|

12 years

|

13 years

|

|

Uranium Capture Technology

|

Solvent Extraction

|

Continuous Ion Exchange

|

|

Tailings Storage Technology

|

Traditional Tailings Dam

|

In-pit, dry stacked

|

The Project is located in the North West Queensland Mineral Province, an area impacted by the closure of the Century Zinc mine. The total direct employment generated by the Project will be in the order of 220 to 250 for the 13 year mine life.

Mineral Resource Estimates

The May 2009 Mineral Resource estimate for Westmoreland has been reviewed to ensure compliance with JORC 2012 and is restated as the 2016 Mineral Resource. The mineral resource estimate has been classified under the Canadian Institute of Mining, Metallurgy and Petroleum's (CIM) code of mineral classification and complies with National Instrument NI 43-101. The 2016 mineral resource estimate for Westmoreland is outlined in the following tables (refer to notes and other details in Section 14 of the NI43-101 report).

Westmoreland Mineral Resource Estimates - Indicated Category,2016

|

|

|

|

|

|

Resource Category

|

Deposit

|

Tonnes

|

Grade %

(U3O8)

|

M lbs U3O8

|

|

Indicated

cut-off 0.02% U3O8

|

Redtree (Garee)

|

12,858,750

|

0.09

|

25.5

|

|

Huarabagoo

|

1,462,000

|

0.08

|

2.7

|

|

Junnagunna

|

4,364,750

|

0.08

|

7.8

|

|

Subtotal

|

18,685,500

|

0.09

|

36.0

|

|

Note: reported tonnage and grade figures have been rounded off from raw estimates to the appropriate number of significant figures to reflect the order of accuracy of the estimate. Minor variations may occur during the addition of rounded numbers.

|

Westmoreland Mineral Resource Estimates - Inferred Category,2016

|

|

|

|

|

|

Resource Category

|

Deposit

|

Tonnes

|

Grade %

(U3O8)

|

M lbs U3O8

|

|

Inferred

cut-off 0.02% U3O8

|

Redtree (Garee)

|

4,466,750

|

0.07

|

6.6

|

|

Huarabagoo

|

2,406,000

|

0.11

|

5.8

|

|

Junnagunna

|

2,149,500

|

0.08

|

3.6

|

|

Subtotal

|

9,022,250

|

0.08

|

15.9

|

|

Note: reported tonnage and grade figures have been rounded off from raw estimates to the appropriate number of significant figures to reflect the order of accuracy of the estimate. Minor variations may occur during the addition of rounded numbers.

|

The LOM production targets are based on approximately 70% indicated resources and 30% inferred resources. The inferred resources are predominantly scheduled in the latter stages of the mine life and have had mining factors applied. No reserves for this project have been stated at this time.

PEA Cautionary Statement

The preliminary economic assessment is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the preliminary economic assessment will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

Qualified Person

The technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in NI 43-101. The information has been reviewed and approved by Bryn Jones, MMinEng, FAusIMM a Qualified Person under the definition established by National Instrument 43 101 and JORC. Mr. Jones is the Chief Operating Officer of the Company and a Fellow of the Australasian Institute of Mining and Metallurgy.

The estimated mineral resources underpinning the production target are prepared by competent person in accordance with the requirements in Appendix 5A (JORC Code 2012). The information in this report that relates to Exploration Results, Mineral Resources or Ore Reserves is based on information compiled by Mr. Andrew Vigar, a Competent Person who is a Fellow of the Australasian Institute of Mining and Metallurgy. Mr. Vigar is a full time employee of Mining Associates Limited and is a consultant to Laramide Resources Ltd. Mr. Vigar has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity he is undertaking to qualify as a Competent Person as defined in the 2012 Edition of the 'Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves'. Mr. Vigar consents to the inclusion in this report of the matters based on his information in the form and context in which it appears.

To learn more about Laramide, please visit the Company's website at www.laramide.com.

About Laramide

Laramide is engaged in the exploration and development of high-quality uranium assets. Its wholly owned uranium assets are in Australia and the United States. Laramide's portfolio of advanced uranium projects have been chosen for their production potential. Its flagship project, Westmoreland, in Queensland, Australia, is one of the largest projects currently held by a junior mining company. Its U.S. assets include La Jara Mesa in Grants, New Mexico, and La Sal in the Lisbon Valley district of Utah. Its portfolio also includes joint venture, strategic equity positions and royalty participation in uranium development and exploration companies that provide additional geographic diversification and uranium exposure for shareholders.

Forward-looking Statements and Cautionary Language

This News Release contains forward looking statements which are subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward looking statements. The Company does not intend to update this information and disclaims any legal liability to the contrary.

SOURCE Laramide Resources Ltd.

Image with caption: "Simplified Overall Treatment Flowsheet (CNW Group/Laramide Resources Ltd.)". Image available at: http://photos.newswire.ca/images/download/20160421_C2472_PHOTO_EN_671502.jpg

PDF available at: http://stream1.newswire.ca/media/2016/04/21/20160421_C2472_PDF_EN_671504.pdf

Marc Henderson, President and Chief Executive Officer, Toronto, Canada +1 (416) 599 7363; Bryn Jones, Chief Operating Officer, Brisbane, Australia, P: (07) 3831 3407; Greg Ferron, Vice-President, Investor Relations, Toronto, Canada +1 (416) 599 7363Copyright CNW Group 2016