(via Thenewswire.ca)

Vancouver, BC, Canada / TheNewswire / August 4, 2016 – Pacific North West Capital Corp.

(“PFN”, the “Company”) (TSXV: PFN; OTCQB: PAWEF; FSE: P7J; announces that it has signed an agreement

with Mustang Minerals Corp. (TSXV: MUM) to acquire 100% interest in 6, Strategic, Mineralized Claims, of Mustang’s River Valley

Platinum Group Metal (PGM) property, near Sudbury, Ontario (Figure 1).

The River Valley PGM Extension Claims are adjacent to, and south of, PFN’s current River Valley PGM

Project mining leases. The acquisition increases the size of PFN’s project footprint to more than 64 km2 (16,000 acres), mainly on the highly PGM mineralized River Valley Intrusion.

The six acquired claims overlay a 4 km long PGM mineralized trend, which is the southward

continuation of the River Valley PGM Deposit, on PFN’s mining leases to the north. With the

acquisition, the total strike length of the River Valley PGM Deposit increases to 16 km, on PFN’s property. Mustang’s work on

the property included Mapping, Prospecting, Geophysical Surveys and Diamond Drilling. Surface grab samples returned assays of

up to 10 g/t PGM. A total of 57 diamond holes were drilled, for

more than 16,000m. Highlights of the drilling include: 1.42 g/t PGM

over 9.0m in hole MR02-59, 4.0 g/t PGM over 2.1m in hole MR02-62, and 2.2 g/t PGM over 4.5m in hole MR02-64.

The Main Mineralized Zone remains open at depth. Ground Geophysical Survey Results and

Structural Geology Interpretation of the property, reveal Priority Exploration Targets, in under-explored areas, which resemble the

high-grade T2 Discovery and other similar targets on the adjacent PFN mining leases (Figures 2 & 3) (see PFN press release dated

March 11, 2015).

-PFN’s property acquisition increases strike length of mineralization from 12 km to 16

km

-Mineralized drill core, surface grab samples and historic showings

-Surface grab samples grading up to 10 g/t Platinum Group Metals (PGM)

-Drill core samples grading up to 2.2 g/t PGM over 4.5m from 60.5m downhole

-PFN’s property position at River Valley increased to a total of 64

km2 or 16,000 acres

-Summer Surface Exploration Program underway to guide planned Fall Drill

Program

-PFN’s River Valley Project is Canada’s Largest Undeveloped Primary Platinum Group

Metal Project, with 2.5 Moz PGM, in near-surface Measured and Indicated Resources, within 100 km of Sudbury

-Excellent Infrastructure Support, with Year-Round Road Access and nearby Rail, Power

and Communities and 100 km from Sudbury Metallurgical Complex

-New 100% owned Lithium Division, with Pegmatite Projects in Manitoba and Brine

Projects in Nevada and Summer/Fall Exploration Programs In Progress

The recently announced Surface Exploration Program for PFN’s River Valley PGM Project

(see PFN press release dated June 15th, 2016), will be expanded to cover the newly acquired claims from Mustang Minerals Corp.

The six claims were acquired from Mustang Minerals Corp., for $50,000 cash and shares of

PFN.

The shares are subject to a regulatory hold of 4 months and 1 day, and TSX Venture Exchange

approval of the Transaction. Mustang Minerals Corp. retains a 1% Net Smelter Return (NSR) on any production from the six

claims. The NSR can be purchased by PFN at any time for $500,000. The six claims were acquired from Mustang Minerals

Corp. for $50,000 cash and shares of PFN.

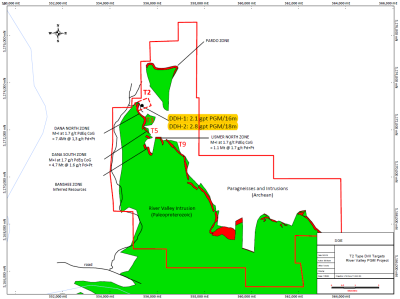

Figure 1: Geological map showing the location of the

PGM exploration property acquired from Mustang Minerals Corp. The acquired property is south and adjacent to PFN’s Mining

Leases, covering the River Valley PGM Project. The acquisition increases the strike length of the PGM deposit, to 16 km, 64

km2, or 16,000 acres, on PFN

property.

Figure 2: River Valley location (inset) and Property Geology Maps, showing the position of the Target T2 Discovery, at the

north end of the PGM Deposit, between the Dana North Zone to the east and the Pardo Zone to the north. Note location of the

Spade Zone, discovered in 2012 but never followed up.

Click Image To View Full Size

Figure 3: Map showing location of three T2-like Drill Targets, at the

north end of the River Valley PGM Deposit, on PFN’s Mining Leases.

About PFN’s Platinum Group Metals Division

River Valley is Canada’s Largest Undeveloped Primary PGM Deposit.

Achievements to date and Future Plans for River Valley are outlined below as

follows:

-

1.PFN currently has 100% ownership

in the River Valley Project, subject to a 3% NSR, with Options to Buy Down

-

2.Completed Exploration and

Development Programs, on the River Valley Property:

Include more than 600 holes drilled, since year 2000, and several Mineral Resource Estimates and

Metallurgical Studies;

-

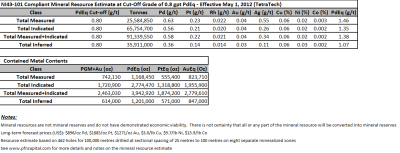

3.Results for the current (2012) Mineral

Resource Estimate are below;

-

4.2015 Drill Program confirms New

High Grade T2 Discovery

-

5.Exploration and Development Plans outlined

for 2016

-

6.Ongoing Strategic Partner Search

for River Valley Project

-

7.Results for the most recent

Mineral Resource Estimate are summarized below:

- Prepared by Tetra Tech (Wardrop)

- High Confidence: Measured plus

Indicated = 72% of total

- Reported on PdEq basis: Pd=40% & Pt=20% of the payable metals

- Pd to Pt ratio = 2.5:1; Cu to Ni ratio = 3:1

- High Grade Potential: particularly in the north part of River Valley Deposit

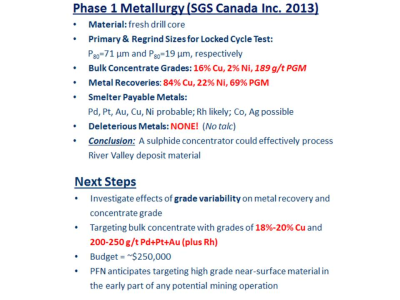

Click Image To View Full Size

- Resources under Evaluation for Development Potential, as Open Pit Mining

Operation

Click Image To View Full Size

-

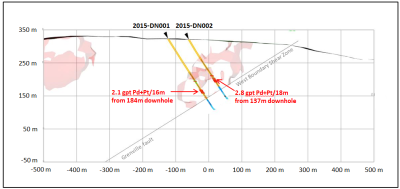

8.Results for the 2015 Discovery

Drill Program on the T2 Target are as follows:

-Drill hole intercepts much higher than the average grade, of current Mineral Resource

Estimate

-Possible New Mineralized Zone at the north end of the River Valley Deposit

-Show potential to take the River Valley PGM Project in a New Direction

-More drilling required

Click Image To View Full Size

-

9. Exploration and Development

Plans for 2016

-Mineral Prospecting and Geological Mapping on surface: In Progress

-Drill Programs targeted to add more higher grade: Drilling

Slated for Fall 2016

-Geological Interpretation and 2D/3D Modelling of all Drill and Surface Results

-Ongoing Strategic Partner Search for River Valley

About PFN’s Lithium Division

The company’s Lithium Division will focus on the Discovery,

Acquisition, Exploration and Development of Lithium Projects in Canada. In the United States, the company will use its wholly owned

U.S.A subsidiary to Acquire and Develop Projects, in Active Mining Camps, in Nevada, Arizona and California.

Management believes that these New Age Metals, Lithium, PGMs and Rare Earths, have

robust macro trends with surging demands and limited supply. Going forward, this New Division will

Explore for the Minerals needed to fuel the demand for Energy Storage and other core 21st Century Technologies.

The company has a growing portfolio of Lithium Projects: The Clayton Valley Forks Li Project, in Nevada, is a recent Lithium Brine Project acquired by the company

(see PFN News Releases:

April 25th, 2016 and May 9th, 2016).

The company also has several Hard Rock Lithium Projects in Canada: To date the company has Acquired 4 Hard Rock Lithium Projects, in the Winnipeg River Pegmatite Field, in

southeast Manitoba (see PFN News

Releases: April 21st 2016, May24th, 2016,

June 15th, 2016 and

July 5th, 2016). This

Pegmatite Field hosts the giant Tanco Pegmatite that has been mined for Tantalum, Cesium and Spodumene (one of the primary Lithium

ore minerals) in varying capacities, since 1969. Today, the Tanco Mine is focused on the Mining and Production of Cesium Formate, a

completion fluid for the petroleum industry. PFN’s Li Projects are strategically situated to further Explore this Pegmatite

Field. Presently, the company is the Largest Claim Holder in the Winnipeg River Pegmatite

Field.

Lithium and Platinum Group Metal prices have improved drastically in recent months.

Lithium supplies remain in deficit relative to their demand. Both Metals

Groups are used for the expanding worldwide automobile industry (conventional and electric). In the case of PGMs, demand is

increasing for Autocatalysts, a key component for reducing toxic emissions, for automotive,

gasoline and diesel engines. Regarding to Lithium, there is an ever

increasing demand for batteries in cellphones, laptops, electric cars, solar storage, wireless charging and renewable energy

products.

QUALIFIED PERSON

The contents contained herein that relates to Exploration Results or Mineral Resources, is based

on information compiled, reviewed or prepared by Dr. Bill Stone, Principal Consulting Geoscientist for Pacific North West Capital.

Dr. Stone is the Qualified Person, as defined by National Instrument 43-101 and has reviewed and approved the technical

content.

On behalf of the Board of Directors

“ Harry Barr “

Harry Barr

Chairman and CEO

Neither the TSX Venture Exchange nor its Regulation Services Provider

(as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this

release.

Cautionary Note Regarding Forward Looking Statements. This release

contains forward-looking statements that involve risks and uncertainties. These statements may differ materially from actual

future events or results and are based on current expectations or beliefs. For this purpose, statements of historical fact

may be deemed to be forward-looking statements. In addition, forward-looking statements include statements in which the

Company uses words such as “continue”, “efforts”, “expect”, “believe”, “anticipate”, “confident”, “intend”, “strategy”, “plan”,

“will”, “estimate”, “project”, “goal”, “target”, “prospects”, “optimistic” or similar expressions. These statements by their

nature involve risks and uncertainties, and actual results may differ materially depending on a variety of important factors,

including, among others, the Company’s ability and continuation of efforts to timely and completely make available adequate current

public information, additional or different regulatory and legal requirements and restrictions that may be imposed, and other

factors as may be discussed in the documents filed by the Company on SEDAR (www.sedar.com), including the most recent reports that

identify important risk factors that could cause actual results to differ from those contained in the forward-looking statements.

The Company does not undertake any obligation to review or confirm analysts’ expectations or estimates or to release publicly

any revisions to any forward-looking statements to reflect events or circumstances after the date hereof or to reflect the

occurrence of unanticipated events. Investors should not place undue reliance on forward-looking statements.

Copyright (c) 2016 TheNewswire - All rights reserved.