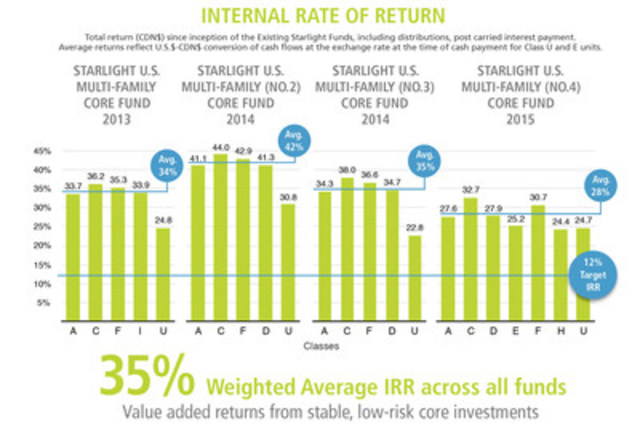

- Led by experienced management team that delivered a weighted average internal rate of return of 35% across Existing

Starlight Funds

- Unitholders to benefit from significantly increased and stable cash distributions and opportunity to participate in a

larger, more geographically diversified fund with further upside potential

- Portfolio to be comprised of 23 properties across 10 metropolitan U.S. sun-belt markets

/NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED

STATES/

TORONTO, Sept. 6, 2016 /CNW/ - Starlight U.S. Multi-Family

Core Fund (TSX.V: UMF.A, UMF.U), Starlight U.S. Multi-Family (No. 2) Core Fund (TSX.V: SUD.A, SUD. U), Starlight U.S. Multi-Family

(No. 3) Core Fund (TSX.V: SUS.A, SUS.U) and Starlight U.S. Multi-Family (No. 4) Core Fund (TSX.V: SUF.A, SUF.U) (collectively, the

"Existing Starlight Funds"), Campar Capital Corporation (TSXV:CHK.P) ("Campar") and Starlight Investments Ltd.

("Starlight"), today announced the entering into of an agreement to consolidate the assets of the Existing Starlight Funds

by way of a plan of arrangement (the "Arrangement") to create Starlight U.S. Multi-Family (No. 5) Core Fund ("Fund

5") and enlarge the combined real estate portfolio of Fund 5 further with the addition of a property located in an attractive

U.S. sun-belt market as well as a minimum of three additional properties also located in attractive sun-belt markets following the

successful completion of a planned public offering (the "Offering").

"Under Starlight's management, the income and value of the underlying assets in the Existing Starlight Funds have increased

significantly, with each Existing Starlight Fund outperforming the targeted 12% internal rate of return considerably and delivering

a weighted average internal rate of return of 35%1 while producing stable distributions," said Evan Kirsh, President, Starlight U.S. Multi-Family. "The combination of the Existing Starlight Funds is a

compelling opportunity for Existing Starlight Fund unitholders to substantially increase cash distributions and provide an

exceptional yield on the cost of their initial investment."

Mr. Kirsh continued, "Fund 5 is a superior investment opportunity for a number of reasons. It is a larger and more

geographically diversified investment vehicle with properties that exhibit further upside potential. We believe in our proven

strategy and are delighted to invest alongside fellow unitholders. Management of Starlight will continue to be a significant

investor in Fund 5, with an existing investment of over CDN$100 million, and Starlight's principal

has committed to invest up to an additional CDN$5 million in the Offering."

|

_______________________________

1 Estimated total return in CDN$, including distributions, post carried interest payment.

|

|

|

Benefits to the Fund 5 Unitholders

-

Increased cash distributions – Starlight expects Fund 5 unitholders to earn an attractive, increased cash

distribution while participating in the potential future growth in value of Fund 5's real estate assets. Fund 5 will target an

annual pre-tax distribution yield of 6.5% per unit, with each of its units initially priced at CDN$10 or US$10. Existing Starlight Fund units ("Existing Units") will

be exchanged for the Fund 5 units, with unitholders receiving more of the Fund 5 units than Existing Units on exchange as a

result of the substantial asset value appreciation in each of the Existing Starlight Funds. The result will be a greater

total distribution than was received from a current investment in each Existing Unit. For more details on the increase in total

distribution, see the Exchange Values and Total Distribution Increase table at the end of this news release and also

visit www.starlightus.com to calculate the total

distribution increase for an Existing Starlight Fund unitholder based on their current investment.

Fund 5 will target a 12% pre-tax internal rate of return ("IRR") upon disposition either at or before the end of the

targeted three-year investment horizon. The AFFO payout ratio is expected to be approximately 83.2% in the first year.

- Superior investment in a larger, more geographically diversified fund with further upside potential – Fund 5's

portfolio will be comprised of recently constructed properties located in attractive U.S. sun-belt submarkets with favourable

demographic trends including strong employment growth and increasing population, resulting in robust rental growth rates. The

properties will be contributed from each of the Existing Starlight Funds plus an additional property located in San Antonio, Texas (to be contributed, in part, by Campar). Fund 5 also intends to acquire a minimum of

three additional properties in attractive sun-belt markets to provide further diversification and growth potential. These three

properties will be acquired following the successful completion of the Offering.

Upon completion of the Arrangement and following the inclusion of the additional assets,

Fund 5 will have 23 properties comprising 6,792 multi-family units, appraised at approximately CDN$1.4

billion, and is expected to benefit from increased geographical diversification across 10 metropolitan areas in the

southern United States. Management believes that additional growth remains to be realized in the

U.S. sun-belt rental real-estate markets and that further geographical diversification across the property portfolio mitigates

the risk and exposure to any one market.

- Experienced management with track record of value creation – Starlight is comprised of more than 110 experienced real

estate professionals with deep experience in multi-family real estate asset management on both sides of the North American

border. Starlight currently manages CDN$6.4 billion of real estate assets encompassing more than

33,000 multi-family units in over 400 properties across Canada and the southern United States, with approximately 9,000 of those multi-family units in the southern United States. An extensive network of joint venture partners, financial institutions, brokers, property

managers and other real estate professionals allows Starlight to source, structure and execute compelling investment

opportunities. Through its ownership of Existing Units, Starlight has co-invested in each of the Existing Starlight Funds,

creating meaningful alignment with its fellow investors. Starlight's principal and management will maintain a substantial

investment in the outstanding units of Fund 5.

Starlight intends to continue executing its proven investment and asset management strategy to deliver superior performance for

Fund 5, deriving stable returns from attractive assets in target markets that exhibit favourable fundamentals. Investors in the

Existing Starlight Funds have benefitted from this approach.

Fund 5 unitholders will continue to participate in value maximization through: (i) active management of a diversified asset base,

(ii) divestment of assets and the redeployment of capital in new properties in order to further diversify the portfolio and

capitalize on the opportunity to further improve net operating income growth and asset values, and (iii) upside potential in the

value of the properties as investor demand for U.S. multi-family real estate continues to increase.

- Tax deferral for unitholders – Unitholders resident in Canada may be able to

defer capital gains tax as Existing Units can be rolled into Fund 5 without creating a taxable event. Please consult the

management information circular and letter of transmittal for further information. Fund 5 also supports the preservation of value

as U.S. taxes that would have been incurred as a result of the sale of the properties by the Existing Starlight Funds are

deferred by combining the Existing Starlight Funds in Fund 5.

Fund 5 will also have the ability to utilize tax-free rollover strategies for the acquisition of new properties with the proceeds

from divestitures, which will allow Fund 5 to create further geographical diversification and to acquire assets with greater

upside potential while deferring any U.S. tax liability that may otherwise arise on disposition of the divested properties.

For more information on Fund 5 and the Offering, please see Fund 5's news release which is expected to be disseminated on the

date of this news release and available at www.SEDAR.com.

Arrangement Agreement

The arrangement agreement among each of the Existing Starlight Funds, Campar, Starlight and other specified parties includes

customary provisions including non-solicitation provisions, the right to match any superior proposal and expense reimbursement

payable in specified termination circumstances.

Unitholder Approvals and Voting Support

A special resolution of each Existing Starlight Fund must be passed by at least (i) 66 2/3% of the votes cast by Existing

Starlight Fund unitholders present in person or represented by proxy at the applicable security holder meeting voting as a single

class, and (ii) subject to receipt of a discretionary exemption from the Ontario Securities Commission ("OSC"), a majority

of the votes attached to the Existing Units voted by disinterested unitholders at each meeting pursuant to Multilateral Instrument

61-101 – Protection of Minority Security Holders in Special Transactions ("MI 61-101") voting as a single class, as

further described below. The Campar special resolution must also be passed by at least (i) 66 2/3% of the votes cast by the

shareholders present in person or represented by proxy at the Campar meeting, and (ii) a majority of the votes attached to the

shares voted by disinterested shareholders pursuant to MI 61-101.

MI 61-101 requires approval of the Arrangement to be received from a majority of the votes attached to the Existing Units voted

by disinterested unitholders voting separately on a class-by-class basis at each of the Existing Starlight Fund's meetings.

However, Starlight, on behalf of the Existing Starlight Funds, has applied to the OSC for exemptive relief on the basis that, among

other reasons (i) each Existing Starlight Fund's governing limited partnership agreement provides that unitholders vote as a single

class unless the nature of the business to be transacted at the meeting affects holders of one class of units in a manner

materially different from its effect on holders of another class of units, and Starlight, as manager of each Existing Starlight

Fund, and the general partner of each Existing Starlight Fund have determined that the Arrangement does not affect holders of one

class of Existing Units in a manner materially different from its effect on holders of another class of Existing Units of that

Existing Starlight Fund; (ii) as the relative returns (and, accordingly, the number of Fund No. 5 units to be received on exchange

of Existing Units of each class of each Existing Starlight Fund) are to be determined in accordance with the terms established in

the governing limited partnership agreement of each Existing Starlight Fund that were set at the time of each such issuer's initial

public offering when investors selected their preferred class and purchased their Existing Units, the interests of the holders of

each class of Existing Units of each Existing Starlight Fund are aligned in respect of the Arrangement, (iii) the board of the

general partner of each Existing Starlight Fund has received a fairness opinion, (iv) the board of the general partner of each

Existing Starlight Fund believes that providing a class vote would provide disproportionate power to a potentially small number of

unitholders of classes of each Existing Starlight Fund which would not be appropriate and (v) to the best of the knowledge of

Starlight and the general partner of each Existing Starlight Fund, there is no reason to believe that any Existing Starlight Fund's

unitholders of any particular class would not approve the Arrangement. There can be no assurance that the requested relief will be

granted by the OSC.

Pursuant to MI 61-101, the following Existing Units and shares beneficially owned by interested securityholders will be excluded

from the majority vote of disinterested unitholders:

|

Existing Starlight Funds /

Campar

|

Number of Excluded

Units

|

Percentage of

Excluded Units

|

|

Starlight U.S. Multi-Family Core Fund

|

861,699

|

17.91%

|

|

Starlight U.S. Multi-Family (No. 2) Core Fund

|

624,974

|

18.46%

|

|

Starlight U.S. Multi-Family (No. 3) Core Fund

|

568,330

|

10.81%

|

|

Starlight U.S. Multi-Family (No. 4) Core Fund

|

411,200

|

6.72%

|

|

Campar

|

11,350,000

|

20.64%

|

Concurrently with the execution of the arrangement agreement, D.D. Acquisitions Partnership, an entity controlled by

Daniel Drimmer, and each of the other directors and officers of each of the Existing Starlight Funds

and Campar, as well as certain additional unitholders of the Existing Starlight Funds and shareholders of Campar, have entered into

voting and support agreements pursuant to which each has agreed to vote those units owned in each of the Existing Starlight Funds

and those shares owned in Campar in favour of the Arrangement. In connection with the voting and support agreements, 18.78%

of Starlight U.S. Multi-Family Core Fund unitholders, 19.36% of Starlight U.S. Multi-Family (No. 2) Core Fund unitholders, 11.60%

of Starlight U.S. Multi-Family (No. 3) Core Fund unitholders, 7.40% of Starlight U.S. Multi-Family (No. 4) Core Fund unitholders

and 62.27% of Campar shareholders have agreed to vote IN FAVOUR of the Arrangement.

In the event that any of the above approvals of unitholders from each of the Existing Starlight Funds or the Campar shareholders

is not obtained, the arrangement agreement will be terminated and the Arrangement will not proceed. Completion of the

Arrangement is also subject to the approval of the TSX Venture Exchange, approval by the Court, and the satisfaction or waiver of

the other conditions specified in the arrangement agreement.

Subject to obtaining TSX Venture Exchange and Court approval and the satisfaction or waiver of all other conditions specified in

the arrangement agreement, if unitholder approvals from each of the Existing Starlight Funds and the approval of Campar

shareholders are obtained at each respective meeting, it is anticipated that the Arrangement will be completed in mid-October 2016.

Board Recommendation

In connection with the Arrangement, the independent members of each board of directors of the general partner of each of the

Existing Starlight Funds (the "Boards") and the independent director of Campar were required to approve the transaction. In

connection with such approvals, each of the Boards retained Origin Merchant Partners as its independent financial advisor to

provide advice. Origin Merchant Partners has provided an opinion to each of the Boards stating that, and based upon and subject to

the assumptions, limitations and qualifications therein, the Arrangement is fair, from a financial point of view to the unitholders

of each of the Existing Starlight Funds (other than Daniel Drimmer and Evan

Kirsh and their respective affiliated entities). Based on the fairness opinions, the reasons set out above and other

considerations, the directors of the general partner of each of the Existing Starlight Funds and the directors of Campar have

unanimously concluded (with Daniel Drimmer declaring his interest and refraining from consideration

and voting in the case of each of the Existing Starlight Funds and with Daniel Drimmer and

Martin Liddell declaring their interest and refraining from consideration and voting in the case of

Campar) that the Arrangement is in the best interests of each of its respective Existing Starlight Funds (and unitholders of each

of the Existing Starlight Funds) and Campar and, accordingly, have each unanimously approved the Arrangement and related matters

and each unanimously recommends that security holders vote IN FAVOUR of the Arrangement and related matters.

Management Information Circular and Meeting Date

Full details of the Arrangement, including detailed information on the implications for holders of the different classes of

Existing Units in the Existing Starlight Funds and shareholders of Campar as well as procedures to submit proxies and other related

materials relating to Fund 5, can be found in the joint management information circular that will be mailed to unitholders and

shareholders in early September. The management information circular will also be viewable on each Existing Starlight Fund's and

Campar's profile at www.SEDAR.com as well as at www.starlightus.com.

The Boards of the Existing Starlight Funds and Campar's board of directors have selected the close of business (Toronto time) on September 6, 2016 as the record date for each special meeting.

Accordingly, unitholders of the Existing Starlight Funds and shareholders of Campar as at the close of business (Toronto time) on September 6, 2016 will be eligible to vote at the

special meetings. Proxy forms must be received by Equity Financial Trust Company, at 200 University Avenue, Suite 300, Toronto, Ontario M5H 4H1 Attention: Proxy Department or by fax to (416) 595-9593, prior to 10:00 a.m. (Toronto time) on October 4, 2016. It

is anticipated that the special meeting of each Existing Starlight Fund and Campar will take place on October 6, 2016, and that the Arrangement will be completed in mid-October 2016.

About the Existing Starlight Funds and Fund 5

Each of the Existing Starlight Funds and Fund 5 is a limited partnership formed under the Limited Partnerships Act

(Ontario) for the primary purpose of indirectly acquiring, owning and operating a portfolio of

diversified income producing rental properties in the U.S. multi-family real estate market.

About Campar

Campar is a capital pool company incorporated on August 20, 2014 pursuant to the Business

Corporations Act (Ontario). The principal business of Campar is the identification and

evaluation of assets or businesses with a view to completing a qualifying transaction. On August 25,

2016, Campar received conditional approval from the TSX Venture Exchange for its qualifying transaction, which Campar

expects to close on or about September 30, 2016.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture

Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release includes certain statements which may constitute forward-looking information within the meaning of Canadian

securities laws, including, but not limited to, statements or information relating to the successful completion of the Arrangement

and Offering and timing thereof, target IRR, future dispositions of properties, the benefits of the Arrangement, including the

earning of stable returns, future cash distributions and increases in property values, the performance of the U.S. sun-belt rental

real-estate markets, the ability of security holders and Fund 5 to defer taxes, the first year implied AFFO payout ratio, the

meeting date for each special meeting and receipt of the requested relief from the OSC. Such forward-looking information, in some

cases, can be identified by terminology such as "may", "will", "would", "expect", "plan", "anticipate", "believe", "intend",

"target", "potential", "continue", or the negative thereof or other similar expressions concerning matters that are not historical

facts.

By their nature, forward-looking statements and information involve known and unknown risks, uncertainties and other factors

that may be general or specific and which give rise to the possibility that expectations, forecasts, predictions, projections or

conclusions will not prove to be accurate, that assumptions may not be correct and that objectives, strategic goals and priorities

may not be achieved. A variety of factors, many of which are beyond the control of the Existing Starlight Funds, Fund 5 and Campar,

affect the operations, performance and results of such issuer's and their respective businesses, and could cause actual results to

differ materially from current expectations of estimated or anticipated events or results. The reader is cautioned to consider

these and other factors, uncertainties and potential events carefully and not to put undue reliance on forward-looking information

as there can be no assurance that actual results will be consistent with such forward-looking information. These risks

include, but are not limited to, the risk of failure to satisfy the conditions to completion of the Arrangement and the Offering,

the risk that the anticipated benefits of the Arrangement may not be realized, including as concerns regarding the performance of

the U.S. sun-belt rental real-estate markets and risks related to the availability of suitable properties for purchase by Fund 5,

the risk of not receiving the requested relief from the OSC, the availability of mortgage financing for properties, and general

economic and market factors, including interest rates, business competition and changes in government regulations or in tax laws.

For more information on risks relating to the Arrangement and risks relating to Fund 5, read the management information circular

that will be mailed to unitholders and shareholders in mid-September.

Information contained in forward-looking statements are based upon certain material assumptions that were applied in drawing a

conclusion or making a forecast or projection, including the perceptions of management of the Existing Starlight Funds, Fund 5 and

Campar of historical trends, current conditions and expected future developments, as well as other considerations that are believed

to be appropriate in the circumstances, including the following: the inventory of multi-family real estate properties; the

availability of properties for acquisition and the price at which such properties may be acquired; the availability of mortgage

financing and current interest rates; the extent of competition for properties; the population of multi-family real estate market

participants; assumptions about the markets in which Fund 5 will operate; the ability of the manager of Fund 5 to manage and

operate the properties; the global and North American economic environment; foreign currency exchange rates; and governmental

regulations and tax laws.

These forward looking statements are made as of the date of this news release and, except as expressly required by law, the

Existing Starlight Funds and Campar undertake no obligation to update or revise publicly any forward-looking statements, whether as

a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the

occurrence of unanticipated events.

Non-IFRS Measures

AFFO is not a measure defined under International Financial Reporting Standards as prescribed by the International Accounting

Standard Board. Details on non-IFRS financial measures, including AFFO, are set out in each Existing Starlight Fund's management's

discussion and analysis for the period ended June 30, 2016 available on each Existing Starlight

Fund's profile at www.sedar.com and will also be available in

the management information circular of Fund 5 which will be available at www.sedar.com and www.starlightus.com.

Exchange Values and Total Distribution Increase1

|

Fund

|

Initial

Investment

per Unit

|

Value of

Unit at

Exchange

|

Exchange

Ratio

|

Initial

Annual

Distribution

|

Implied Fund5

Pro Forma

Annual

Distribution

|

Increase in

Annual

Distribution

|

Yield on

Initial

Investment

|

|

Starlight U.S. Multi-Family Core Fund

|

|

Class A - CDN$

|

$10.00

|

$23.73

|

2.3728x

|

$0.70

|

$1.54

|

120.3%

|

15.42%

|

|

Class C - CDN$

|

$10.00

|

$25.03

|

2.5031x

|

$0.77

|

$1.63

|

111.5%

|

16.27%

|

|

Class F - CDN$

|

$10.00

|

$24.47

|

2.4468x

|

$0.75

|

$1.59

|

111.5%

|

15.90%

|

|

Class I - CDN$

|

$10.00

|

$23.72

|

2.3717x

|

$0.73

|

$1.54

|

111.5%

|

15.42%

|

|

Class U - US$

|

$10.00

|

$18.32

|

1.8325x

|

$0.70

|

$1.19

|

70.2%

|

11.91%

|

|

Starlight U.S. Multi-Family (No. 2) Core Fund

|

|

Class A - CDN$

|

$10.00

|

$24.15

|

2.4148x

|

$0.70

|

$1.57

|

124.2%

|

15.70%

|

|

Class C - CDN$

|

$10.00

|

$25.69

|

2.5694x

|

$0.70

|

$1.67

|

138.6%

|

16.70%

|

|

Class F - CDN$

|

$10.00

|

$25.07

|

2.5073x

|

$0.70

|

$1.63

|

132.8%

|

16.30%

|

|

Class D - CDN$

|

$10.00

|

$24.23

|

2.4228x

|

$0.70

|

$1.57

|

125.0%

|

15.75%

|

|

Class U - US$

|

$10.00

|

$19.08

|

1.9082x

|

$0.70

|

$1.24

|

77.2%

|

12.40%

|

|

Starlight U.S. Multi-Family (No. 3) Core Fund

|

|

Class A - CDN$

|

$10.00

|

$17.47

|

1.7466x

|

$0.70

|

$1.14

|

62.2%

|

11.35%

|

|

Class C - CDN$

|

$10.00

|

$18.65

|

1.8649x

|

$0.70

|

$1.21

|

73.2%

|

12.12%

|

|

Class F - CDN$

|

$10.00

|

$18.19

|

1.8193x

|

$0.70

|

$1.18

|

68.9%

|

11.83%

|

|

Class D - CDN$

|

$10.00

|

$17.58

|

1.7584x

|

$0.70

|

$1.14

|

63.3%

|

11.43%

|

|

Class U - US$

|

$10.00

|

$14.08

|

1.4076x

|

$0.70

|

$0.92

|

30.7%

|

9.15%

|

|

Starlight U.S. Multi-Family (No. 4) Core Fund

|

|

Class A - CDN$

|

$10.00

|

$13.27

|

1.3275x

|

$0.70

|

$0.86

|

23.3%

|

8.63%

|

|

Class C - CDN$

|

$10.00

|

$14.13

|

1.4130x

|

$0.70

|

$0.92

|

31.2%

|

9.18%

|

|

Class D - CDN$

|

$10.00

|

$13.33

|

1.3333x

|

$0.70

|

$0.87

|

23.8%

|

8.67%

|

|

Class E - US$

|

$10.00

|

$12.87

|

1.2874x

|

$0.70

|

$0.84

|

19.6%

|

8.37%

|

|

Class F - CDN$

|

$10.00

|

$13.79

|

1.3788x

|

$0.70

|

$0.90

|

28.0%

|

8.96%

|

|

Class H - CDN$

|

$10.00

|

$13.08

|

1.3081x

|

$0.50

|

$0.46

|

-8.4%

|

4.58%

|

|

Class U - US$

|

$10.00

|

$12.80

|

1.2802x

|

$0.70

|

$0.83

|

18.9%

|

8.32%

|

|

_______________________________

1 Assumes an effective exchange rate of CDN$1.30 to US$1.00. The effective exchange rate that will be used

to calculate the actual exchange ratios will be determined based on the simple average of the noon rates of exchange posted

by the Bank of Canada for conversion of U.S. dollars into Canadian dollars for the three business day period ending on the

third business day prior to the effective date of the Arrangement.

|

|

2 The exchange ratios for a particular class of Existing

Units for a particular Existing Starlight Fund is determined to be the quotient equal to: (i) the net equity value (which

is based on the aggregate appraised value (as determined by an independent appraiser) of the properties owned by the

applicable Existing Starlight Fund less the applicable "carried interest" of each Existing Starlight Fund) of such Existing

Starlight Fund allocable to such class, calculated on the basis of the corresponding "proportionate class interest"

definition set out in the applicable Existing Starlight Fund limited partnership agreement (provided that in the case of

units other than class E units of Starlight U.S. Multi-Family (No. 4) Core Fund and class U units of any Existing Starlight

Fund, the value is converted into Canadian dollars using the effective exchange rate) divided by the total outstanding

units of such class, divided by (ii) the issue price of the corresponding class of units of Fund5 (being US$10.00 in the

case of Fund5 class E units and Fund5 class U units and CDN$10.00 in the case of all other classes). The exchange ratio for

Campar is equal to (i) Campar's equity value (which is based on 80% of the appraised value of the San Antonio, Texas

property to be contributed by Campar) divided by the number of outstanding shares of Campar, divided by (ii)

CDN$10.00.

|

|

SOURCE Starlight U.S. Multi-Family (No. 5) Core Fund

Image with caption: "Internal Rate of Return (CNW Group/Starlight U.S. Multi-Family (No. 5) Core Fund)". Image available at:

http://photos.newswire.ca/images/download/20160906_C2823_PHOTO_EN_765522.jpg

PDF available at: http://stream1.newswire.ca/media/2016/09/06/20160906_C2823_PDF_EN_765990.pdf