PGIM: Pensions need to fully incorporate longevity risk in their portfolio decisions

The dramatic rise in life expectancy has improved human well-being but future longevity uncertainty also poses a real challenge

to pension funding levels that plan sponsors will need to proactively manage, PGIM said today in a new report. PGIM, among the world’s top 10 asset managers with more than $1 trillion in assets under management, is the

global investment management businesses of Prudential Financial, Inc. (NYSE:PRU).

This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20161116005539/en/

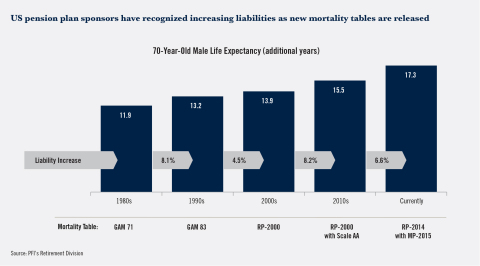

According to 2015 data from the Society of Actuaries, as longevity has improved, U.S. pension plan sponsors have

seen corresponding increases in their liabilities. For example, as a 70-year-old male's longer life expectancy is periodically

recognized in mortality tables, the associated liabilities increase significantly, with a 6.6% increase associated with the most

recent updates in 2014 and 2015. (Photo: Business Wire)

The report, Longevity and Liabilities: Bridging the Gap, highlights that longevity risk has often taken a backseat to

investment and interest rate risk. The underestimation of human life spans by forecasters and the potentially sharp unanticipated

increases in longevity resulting from medical breakthroughs, such as anti-aging genetic treatments, poses a real risk to pension

funding levels. This risk is compounded by the “lower for longer” interest rate environment that has burdened plan sponsors with

low discount rates.

“We have had a century of underestimating actual longevity experience,” said Taimur Hyat, PGIM’s chief strategy officer. “These

annual forecasting errors can compound over time to be quite significant. Understanding, quantifying the true magnitude and

responding to the challenge of longevity risk is an important step for plan sponsors.”

"We evaluated the potential impact of further increases in life expectancy on liability values and found that longevity risk can

be significant for certain plan profiles," said Karen McQuiston, head of PGIM’s Institutional Advisory and Solutions team. “We

would encourage plan sponsors to incorporate these potential dynamics into their risk management processes and recommend that plan

sponsors measure and manage longevity risk, inflation risk, and interest rate risk in an integrated framework."

While changes in longevity can materially affect the pension liabilities of all sponsors, the impact is magnified for pension

plans with cost of living adjustments or inflation indexation, including many U.S. public pensions and U.K. public and corporate

plans. In total, unmanaged longevity risk has the potential to worsen a plan’s risk profile, reduce funded status and lead to

unforeseen costs.

PGIM suggests taking a three-pronged approach to managing longevity risk:

- Develop a robust framework to understand the problem: Plan liabilities should be evaluated on

the richest set of longevity information available. Given the uncertainty around the timing and magnitude, asset-liability

analyses should be stress tested based on different longevity improvement scenarios.

- Assess the investment and protection actions that can dampen the impact of longevity risk: In

many cases assets, already straining to keep up with liabilities, must work even harder. It may be worth re-evaluating the

portfolio’s allocation to growth assets, including real estate, private assets, diversified equity, and higher yielding fixed

income. At the same time, plans will want to address the longer duration of their liabilities as their retiree pension payments

stretch further into the future than initially assumed, looking both at ways to lengthen duration or find synthetic

solutions.

- Evaluate the case for potential risk transfer actions: No investment strategy fully insulates

against future longevity risk. Some plan sponsors may consider fully hedging against longevity-driven uncertainty by using

longevity insurance or pension risk transfer for a portion of their plan.

PGIM’s latest paper builds on insights in A Silver Lining: The Investment Implications of an Aging World, which describes investment opportunities arising

from an aging global population.

To download a copy of the paper, please visit www.PGIM.com\longevity

About PGIM

PGIM’s businesses offer a range of investment solutions for retail and institutional investors around the world across a broad

range of asset classes, including fundamental equity, quantitative equity, public fixed income, private fixed income, real estate

and commercial mortgages. Its businesses have offices in 16 countries across five continents and had more than $1 trillion in

assets under management as of Sept. 30, 2016. PGIM is the global investment management businesses of Prudential Financial, Inc.

(NYSE:PRU).

For more information, please visit www.pgim.com

About Prudential Financial, Inc.

Prudential Financial, Inc. (NYSE:PRU), a financial services leader, has operations in the United States, Asia, Europe and Latin

America. Prudential’s diverse and talented employees are committed to helping individual and institutional customers grow and

protect their wealth through a variety of products and services, including life insurance, annuities, retirement-related services,

mutual funds and investment management. In the U.S., Prudential’s iconic Rock symbol has stood for strength, stability, expertise

and innovation for more than a century. For more information, please visit http://www.news.prudential.com/

Prudential Financial, Inc., of the United States is not affiliated in any manner with Prudential plc, a company incorporated in

the United Kingdom.

MEDIA:

Mayura Hooper, 973-367-7930

mayura.hooper@prudential.com

View source version on businesswire.com: http://www.businesswire.com/news/home/20161116005539/en/