Randy Binner of FBR Capital Markets has downgraded Metlife

Inc (NYSE: MET), Hartford Financial Services

Group Inc (NYSE: HIG) and Maiden Holdings,

Ltd. (NASDAQ: MHLD) to Market Perform, saying the

risk/reward for these stocks have become less attractive after the election rally.

Following Donald Trump’s win, Binner said, on average, life

names have climbed 15 percent, property/casualty have risen 11 percent and mortgage insurers have advanced 7 percent.

The rally was attributed to the higher rate environment, potential benefit from a lower corporate tax rate and the benefit of

deregulation.

Insurance Rally Specifics

“In general, our analysis indicates that insurance

stocks have factored in many of these potential benefits. The challenge, of course, is that yields could again move lower, and

tax reform and deregulation are not certain,” Binner wrote in a note.

On Metlife, Binner said his analysis shows shares efficiently discounting spread, tax and deregulation factors post-election,

while the upcoming spin catalyst and associated buyback are now better priced into shares.

On Hartford, the post-election rally has put shares close to FBR’s $47 price target, while Maiden shares jumped 17 percent

despite seen only marginally benefiting from higher rates.

“Given its Bermuda domicile, the name does not see much potential tax benefit, nor a benefit from deregulation. MHLD is trading

at 92 percent of its five-year min/max P/E valuation,” Binner continued.

Under-Discounted Stocks

The analyst said the following stocks have under discounted the benefit of the post-election environment:

-

AFLAC Incorporated (NYSE: AFL).

-

Allstate Corp (NYSE: ALL).

-

AmTrust Financial Services Inc (NASDAQ: AFSI).

-

MGIC Investment Corp. (NYSE: MTG).

-

NMI Holdings Inc (NASDAQ: NMIH).

-

Progressive Corp (NYSE: PGR).

-

Radian Group Inc (NYSE: RDN).

-

Travelers Companies Inc (NYSE: TRV).

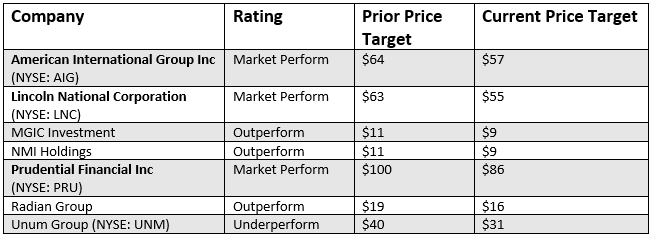

Analyst's Changes

Further, Binner raised the price targets of the following companies.

Latest Ratings for AFL

| Date |

Firm |

Action |

From |

To |

| Oct 2016 |

Credit Suisse |

Initiates Coverage on |

|

Underperform |

| Sep 2016 |

Wells Fargo |

Assumes |

|

Market Perform |

| Aug 2016 |

SunTrust Robinson Humphrey |

Maintains |

|

Neutral |

View More Analyst Ratings for

AFL

View the Latest Analyst Ratings

© 2016 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.