The OPEC production cut agreement capped off a constructive year for the global oil & gas industry in 2016. After dipping below

$30/bbl in early

2016, WTI crude oil prices now seem to be stabilizing above $50/bbl.

That’s certainly good news for American oil &

gas industry workers. After laying off thousands of employees throughout the downturn, Halliburton Company

(NYSE: HAL) recently announced it is hiring once again at its Odessa, Texas, location.

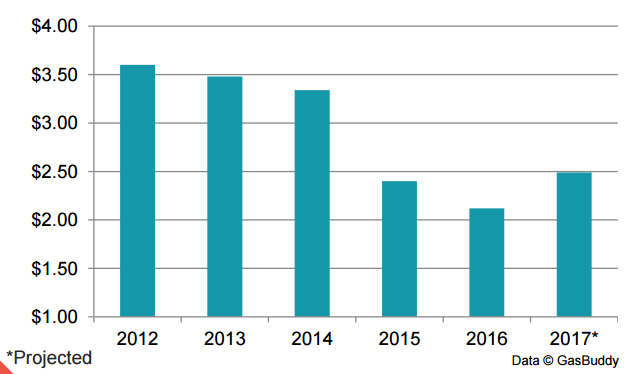

Unfortunately, American drivers are already witnessing the downside to rising oil prices. According to GasBuddy’s brand new 2017

Fuel Price Outlook report, U.S. drivers should expect gasoline prices in the $2.60 range by summer 2017.

Gas Prices, Demand And A Strong Economy

While Americans may be disappointed with higher prices at the pump, GasBuddy said a strong U.S. economy is one key driver of

gasoline demand.

“A healthier economy with higher employment; real growth from fulltime positions for heads of households, not part-time

positions for minimum wage earners; and, meaningful increases in measures such as the labor participation rate, earnings and

savings would likely raise fuel consumption and gas prices together,” the report read.

Overall, GasBuddy is projecting an average 2017 U.S. gas price of $2.49. That price represents a 36-cent uptick from 2016 after

four consecutive years of declining gas prices.

In the past year, the United States Oil Fund LP (ETF) (NYSE: USO) is up 4.1 percent and the United States Gasoline Fund, LP (NYSE:

UGA) is up 4.6 percent.

Disclosure: The author is long HAL.

© 2017 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.