Investors got hit with a truckload of earnings and economic data Friday morning, and may spend much of today deciding what it

all means. Big bank earnings, retail sales, inflation: You name it; we have it to discuss.

In a nutshell, strong earnings from Bank of America Corp(NYSE: BAC) and JPMorgan Chase & Co. (NYSE:

JPM) reinforce what we’ve been talking about. We

expected trading to be better due to the post-election rally, and that’s reflected in the numbers from these two big companies.

Wells Fargo & Co(NYSE: WFC), which relies less on trading than BAC and JPM, didn’t perform as

well.

And retail sales, which rose 0.6% in December, look like a bit of a disappointment, especially considering recent increases in

consumer sentiment. Wall Street analysts had been expecting a 0.7% rise. Automobile sales led the way, but that was something we

knew going in. It looks like holiday shopping perhaps was a little disappointing.

The markets are holding steady in the early going, and any rally could be on hold until we hear from more companies. There may

be more emphasis on what the banks say on their earnings calls, as we wait to hear CEOs’ economic outlooks for 2017.

Let’s look at the earnings numbers. At BAC, earnings jumped to 40 cents a share from 27 cents a year earlier, above the Wall

Street consensus of 38 cents a share. However, adjusted revenue of $20.22 billion was below the consensus estimate of $20.85

billion. Trading revenue rose 11% to $2.91 billion, with fixed income leading the way. Additionally, BAC committed to re-purchasing

additional shares, and cited “strong client activity” in Q4, a sign that the post-election rally may have delivered a trading

volume bump.

JPM beat consensus estimates for both earnings and revenue. The company reported fourth-quarter earnings of $1.71 per share on

revenue of $24.333 billion after adjustments. Pre-earnings estimates from Wall Street had been for $1.44 per share on revenue of

$23.949 billion, according to a consensus estimate from Thomson Reuters.

WFC earnings per share of 96 cents came in short of the average $1 estimate. However, EPS looked pretty decent after

adjustments. The company also missed expectations on sales, and the stock fell in pre-market trading.

The Producer Price Index (PPI) for December rose 0.3%, as expected. Core PPI was a bit above expectations.

Though most eyes may be on bank earnings, retail sales, and PPI today, don’t forget there’s a bit more data scheduled later,

including November business inventories and the University of Michigan’s first read on January sentiment. Also, watch for the

weekly crude oil rig count from Baker Hughes, as it’s shown 10-straight weeks of increases and U.S. oil production has climbed.

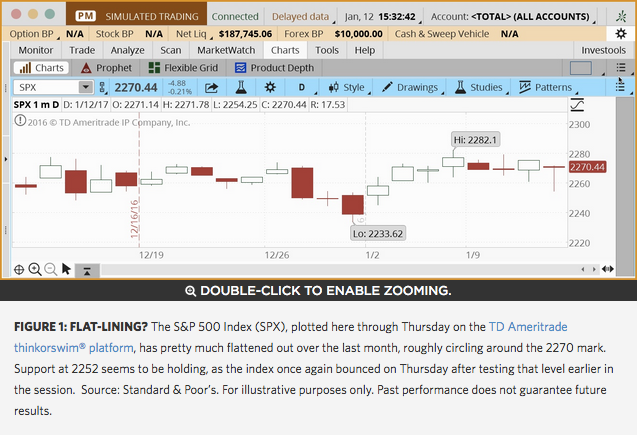

From a technical perspective, Thursday’s action seemed somewhat positive for the S&P 500 Index (SPX), though it finished

lower on the day. Early on, the SPX had tumbled down toward long-term technical support in the 2252 area, but bounced back solidly

by the end of the session. Sometimes a bounce off support signals technical strength that can filter into coming sessions. The

choppy action might have reflected a bit of consolidation ahead of key earnings and data on Friday.

Volatility Finally Shows Its Face

After starting the year at its lowest levels for January in 10 years, the VIX finally broke out on Thursday, climbing 9% at one

point to above 12 before retreating pretty dramatically by the end of the day. Perhaps it’s a sign that investors are starting to

build in a chance for bigger market moves in the coming days. Additionally, the CBOE/CBOT U.S. Treasury Note Volatility Index,

which has also been sinking lately, popped up a little. The volatility came after President-elect Donald Trump’s press conference

on Wednesday, and ahead of a slew of data and earnings Friday. Perhaps the market is waking up a little, as a lot is going on right

now.

Bond Yields Retreat

Since we’re on the subject of Treasuries, it’s worth noting that 10-year Treasury yields fell Thursday to their lowest level

since late November. The morning low of 2.31% was down from highs of around 2.6% last month. Rates had been rising on hopes that

the new administration could spark the economy with new spending and tax initiatives, but evidently some market participants were

disappointed that Trump didn’t spend much time on those subjects at Wednesday’s press conference. Rates had also climbed as the

market factored in the Fed’s plans for three rate hikes this year, and Philadelphia Fed President Patrick Harker said in prepared

remarks Thursday that three rate hikes are appropriate.

More Bank Earnings On Tap

Got your fill of bank earnings today? Well, you have a three-day weekend to recuperate, then it’s back to the races Tuesday and

Wednesday. Markets are closed Monday for the Dr. Martin Luther King, Jr. holiday, but then Morgan

Stanley (NYSE: MS) is scheduled to

report first thing Tuesday, followed by Citigroup Inc (NYSE: C) and Goldman Sachs Group Inc (NYSE:

GS)

on Wednesday. And banks won’t be all. Several other big companies are on tap next week, including General Electric

Company (NYSE: GE), Netflix,

Inc. (NASDAQ: NFLX) and

International Business Machines Corp. (NYSE: IBM). Everyone, start your engines! But first, have a nice long weekend.

© 2017 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.