Benzinga recently had a chance to speak with Leav Graves, founder of SamurAI, about the

advantages long-term options buyers have over equity ETF buyers. SamurAI is devoted to building artificial intelligence technology

that can help professionals integrate option

trading into their portfolios.

Graves said option buying gets a bad rap because too many traders don’t properly account for risk. He also noted the time value

decay in short-term options can be difficult to overcome.

“Because it is really hard to time the market, buying options for the long-term gives you two much-needed benefits: It reduces

the exposure to loss due to time decay, and it gives the position a longer time to bear fruit,” Graves told Benzinga.

An Example

Graves provided one simple illustration of the power of buying long-term options over buying one of the most popular equity

market ETFs, the SPDR S&P 500 ETF Trust (NYSE: SPY).

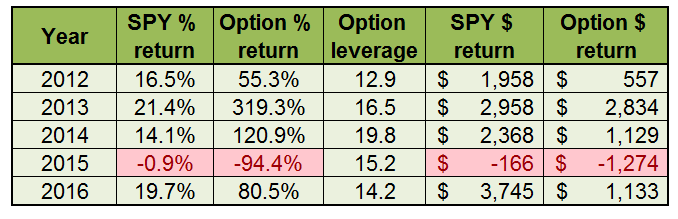

The table below includes the annual returns of the SPY ETF (dividends included) and the returns generated from buying

at-the-money SPY call options one year out and rolling prior to expiration.

“When analyzing the table, we can see that options generated much higher return in percentages and provided high leverage (15.6

on average),” Graves explained.

Of course, the horrendous -94.4 percent return in 2015 highlights the importance of another key aspect of the strategy.

“When buying options, it is easy to lose 100 percent of the money you invested. This is why the risk management is being done by

leaving part of the portfolio in cash and not compounding the return,” Graves added.

By not compounding returns, traders using the strategy above are capping annual losses at 100 percent while annual gains are

theoretically unlimited. For example, when the SPY gained 21.4 percent in 2013, Graves’ simple option strategy delivered a 319.3 percent

return.

© 2017 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.