Viridian Capital Advisors, one of the

world’s top financial and strategic advisory firms for the cannabis industry, publishes two reports every week. One tracks the

performance of its Cannabis

Stock Index, and the other one traces the most recent investment

and M&A activity in the marijuana space.

Deal Flow

For the first week of the year, ended January 6, Viridian registered seven capital raises, six M&A transactions and one

dual-listing. “Deal tracker was a little slow after New Year's, which was expected,” analyst Harrison Phillips explained. “We saw

two raises close, both were small debt raises,” he added, referencing KAYA HLDGS INC COM USD0.001 (OTC: KAYS)’s $150,000 raise and United Cannabis Corp (OTC:

CNAB)’s $35,000 raise.

“What was good news is that there were numerous announcements related to M&A deals that are currently in negotiation,” the

expert continued. On the one hand, Sylios Corp (OTC: UNGS) announced the record date for the spinoff of

its wholly owned subsidiary, the Greater Cannabis Company, LLC. In addition, ML Capital Group Inc (OTC: MLCG)

said it intended to acquire Spanish Peaks Scrumpdelicacies, “a venture-backed producer of cannabis-infused edibles based in

Colorado.”

“There is continued deal flow and we [Viridian Capital Advisors] expect there to a slowdown in closing around New Years; but,

the number of announcements was good,” Phillips concluded.

The Stock Market

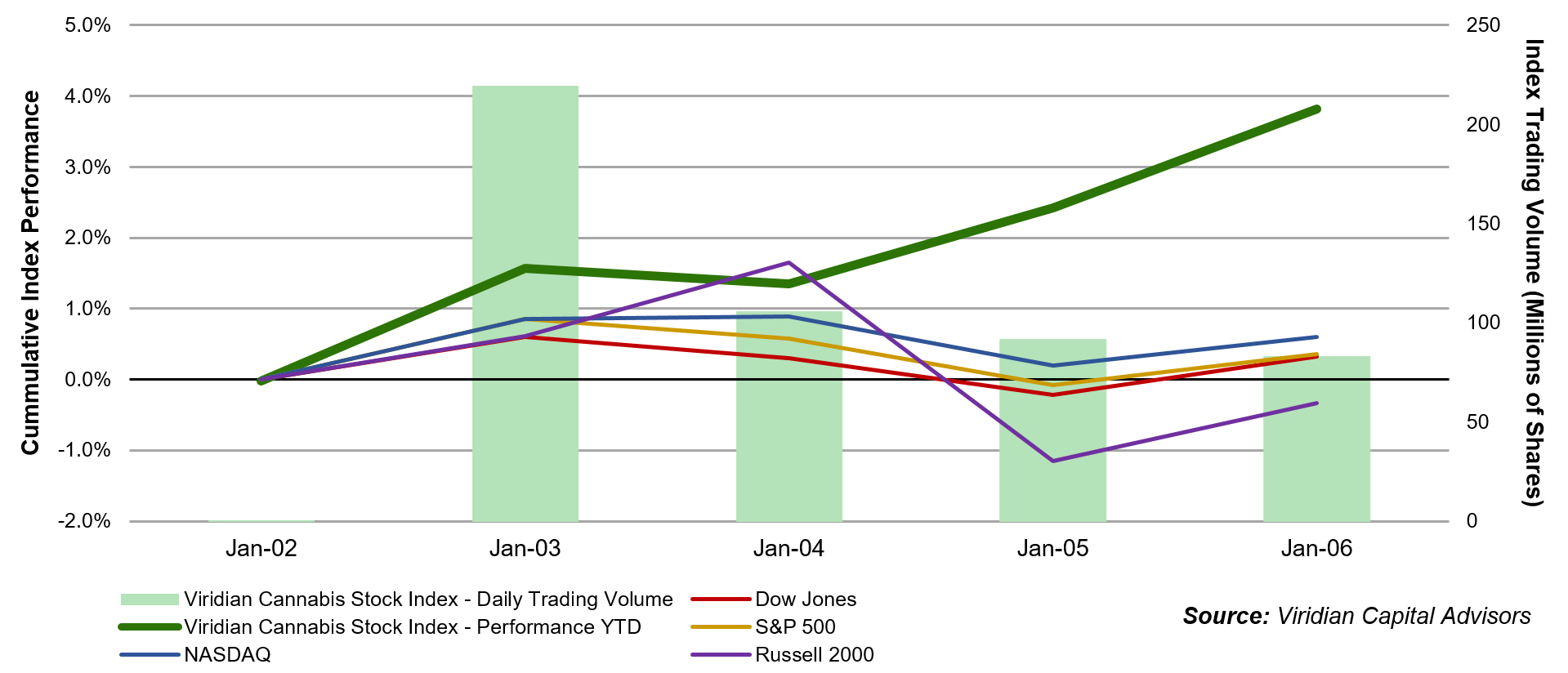

Moving on to the equity market, the Viridian Cannabis Stock Index gained 3.8 percent in the first week of 2017.

“If you look at the Index chart, you see on January 3rd there was a lot more volume than the rest of the week. There's something

called the January Effect, which is, particularly on small-cap stocks, people sell on the year-end, so they can take their tax

losses on to the next year's tax payment. So, what they do is sell on the last trading day of the year, carry over that tax loss,

and then re-buy on the first day of the year,” Phillips expounded.

“There seems to be a little bit of selling on January 4, but the index kept going up either because people didn't re-buy

entirely on the first day [of the year] or there was just continued movement upward in these cannabis stocks,” he added.

As per Viridian’s report, the firm anticipates the Index will “experience increased volatility in the coming week or two as the

process for the appointment of Jeff Sessions for U.S. Attorney General proceeds.”

© 2017 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.