The market snapped its three-day losing streak Monday in a very convincing manner, but Tuesday opened with caution still the

watchword.

Yesterday’s financial-led rally ran into today’s earnings from Bank of America Corp (NYSE: BAC) and Goldman Sachs Group Inc (NYSE: GS), which look like a mixed bag. Futures trading pointed to a possible lower open

across the board.

From a broad standpoint, the market continues to give off cautionary signs, including five-month highs in gold, a continued

rally in bonds, a drop in oil prices, and another move upward in the volatility index. European and Asian stocks were mostly lower.

Geopolitical and policy news could continue to take the forefront in coming days even as earnings keep pouring in.

BAC delivered earnings that exceeded Wall Street’s expectations for both top- and bottom lines. Trading revenue, a closely

watched metric, came in strong. But GS disappointed, failing to meet expectations on either earnings per share or revenue. And its

trading results in the quarter looked flat to lower. Shares of GS fell in pre-market trading. It was a little surprising to see GS

fall short of expectations on equity trading revenue, because other banks did well in that category and it tends to be GS’s

strength.

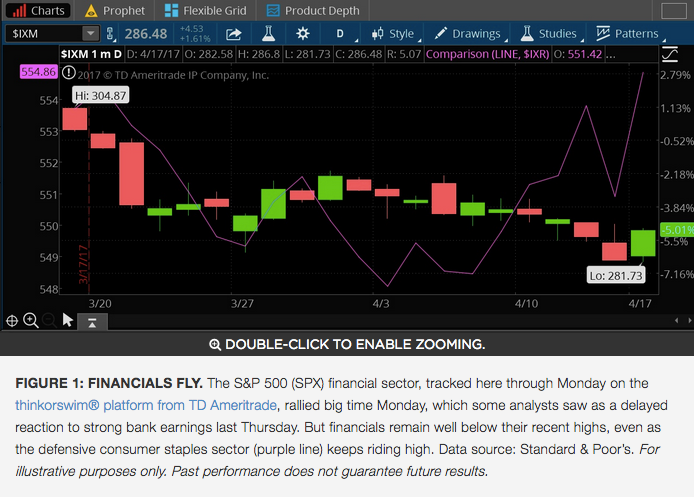

The mixed earnings from BAC and GS came after Monday’s hefty financial rally, in which the sector jumped 1.6% to easily take the

checkered flag among all sectors for the day. JPMorgan Chase & Co. (NYSE: JPM) and Citigroup Inc (NYSE: C) — both of which reported strong earnings last Thursday before the holiday weekend —

were two of sector’s leading performers, but the whole sector benefited in part from their tailwind and also from a slight recovery

in 10-year Treasury yields.

Keep in mind, however, that yields remain well under recent highs near 2.6%, and are below what had seemed like solid technical

support at 2.3%. Yields might continue to struggle as long as geopolitical tensions remain high, though those tensions seemed to

ease somewhat over the weekend and Monday before floating back up into the mix again early Tuesday. North Korea may be the top

geopolitical hot spot, but remember it’s not the only place people are watching.

The first round of voting in the French election is this coming weekend, and polls remain close. A strong showing by the

far-right candidate or by another candidate on the far left could potentially make investors nervous, bringing back memories of

last year’s Brexit vote. And in England, stocks fell sharply Tuesday after British Prime Minister Theresa May called for an early

general election.

Banks weren’t the only companies reporting earnings late Monday and early Tuesday. The first major tech company to report was

Netflix, Inc. (NASDAQ: NFLX), which beat

analysts’ estimates on earnings and matched on revenue. Subscribership is one of the keys to assessing NFLX, and the numbers looked

kind of weak, though the company said it expects improvement in coming months. Shares were up just a touch in pre-market

trading.

And United Continental Holdings Inc (NYSE: UAL) — which recently flew through some turbulence on the public relations side— had a

pretty smooth landing with its Q1 earnings, beating expectations on top and bottom lines.

From an economic data standpoint, housing numbers this morning are really the key statistics of the week. Housing starts fell

sharply in March, but permits for new homes climbed, the government said.

Look at the Bright Side

If recent market weakness has any silver lining, it may be that some signs point to oversold conditions, according to Sam

Stovall of CFRA. Stovall notes that through April 13, only 30% of the 148 sub-industries in the S&P Composite 1500 were trading

above their 10-week, or 50-day, moving averages. While this may be an indication of recent weakness, Stovall says, it may also be

viewed as a source of near-term optimism, since it implies that the market may be oversold. Though past isn’t prologue, since the

end of 1995, whenever the 1500 had 30% or fewer of its sub-industries trading above their 10-week average, the 1500 rose in price

1.5%, 2.7% and 3.5% in the subsequent 3, 6, and 9 weeks, Stovall says.

Earnings Wednesday Put Consumers In Focus

From here on, every day will bring a long list of key earnings reports, and tomorrow puts the focus on consumers with reports

from eBay Inc (NASDAQ: EBAY) and

American Express Company (NYSE: AXP). Keep in

mind that AXP’s earnings disappointed Wall Street the previous quarter, and last month’s declining retail sales and consumer price

index (CPI) readings also raise questions about how well credit card companies performed. EBAY’s stock has also been on the rise,

so we’ll see if investors’ optimism was justified, at least on a quarterly basis. More consumer-related companies are on tap later

this week, including Philip Morris International Inc. (NYSE: PM) before the open Thursday and Visa Inc (NYSE: V) after the close that same day.

Flip a Coin

Chances of a Fed rate hike by June are around 56%, according to Fed funds futures. That’s up a bit from late last week, when

odds fell to around 40%, but still low compared to a few weeks ago, when hawkish signals from the Fed seemed to indicate very

strong odds of a second hike in 2017. There was a flurry of Fed speakers in late March after the Fed’s last meeting, but that’s

quieted down a bit. Still, tomorrow afternoon brings the Fed’s Beige Book release, which could provide some insight into what Fed

officials see going on economically in their districts. Their observations might take on a little more importance than usual this

time around, because they could shed some light on why recent economic data, especially on the retail side, hasn’t been

stronger.

© 2017 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.