Overall, first-quarter earnings have been pretty positive and many CEOs struck an optimistic tone discussing outlooks for the

remainder of 2017. Two industrial bellwethers, General Electric Company (NYSE: GE) and Honeywell International Inc. (NYSE: HON), just beat Wall Street analyst expectations on Friday and credit card companies

American Express Company (NYSE: AXP) and

Visa Inc (NYSE: V) also reported strong

results—some are taking that as a sign that consumer confidence could be translating into consumer buying. Next up in Q1,

Eli Lilly and Co (NYSE: LLY), Lockheed

Martin Corporation (NYSE: LMT), and

Caterpillar Inc. (NYSE: CAT) report before

market open on April 25.

Eli Lilly & Co. Earnings: New Arthritis Drug in Focus

LLY recently suffered a setback when approval for the company’s new arthritis drug, co-developed with Incyte

Corporation (NASDAQ: INCY), faced delays from the

FDA. LLY and INCY disagreed with the FDA’s findings in a company press release and are confident the drug will still be approved in

the future. Despite the company’s confidence in the drug, LLY stock dropped about 5% in trading the day the news came out. Even

with that drop, it’s still up a little over 11% on the year, outperforming the S&P 500 (SPX) and some of its pharma peers:

Merck & Co., Inc. (NYSE: MRK), Pfizer

Inc. (NYSE: PFE), and Johnson &

Johnson (NYSE: JNJ).

For Q1, LLY is expected to report earnings of $0.96 per share on revenue of $5.28 billion, according to consensus third-party

analyst estimates. Earnings per share are expected to increase just over 15% and revenues are expected to increase about 8.5%

compared to the same quarter a year ago.

The options market has priced in just under a potential 2.5% share price move in either direction around the earnings release,

according to the Market Maker Move indicator on the thinkorswim platform. At the monthly May expiration,

short-term options trading for calls has been active at the 87.5 strike price and puts have been active at the 80 and 82.5 strikes.

The implied volatility sits at the 15th percentile, much lower than normal.

Note: Call options represent the right, but not the obligation, to buy the underlying security at a predetermined price over

a set period of time. Put options represent the right, but not the obligation to sell the underlying security at a predetermined

price over a set period of time.

Lockheed Martin (LMT) Earnings: Bring F-35 Costs Down

LMT had been in the presidential spotlight lately due to the cost of its F-35 stealth fighter jet program. The company worked

with President Trump, who called the jet “overtly expensive”, to reduce expenses and bagged a multi-billion dollar Department of

Defense order for 90 of the jets. LMT’s aeronautics division accounted for roughly 40% of its sales in the last quarter.

Heading into earnings, shares are just off their 52-week high of $274.57 hit on March 20. LMT is expected to report earnings of

$2.76 per share on revenue of $11.26 billion for the first quarter, according to consensus third-party analyst estimates. In the

last three quarters, the company has beat earnings expectations by $0.21 to $0.41 per share.

The options market has priced in about a potential 2.75% share price move in either direction around the earnings release,

according to the Market Maker Move indicator on the thinkorswim platform. At the monthly May expiration,

short-term options trading for calls and puts have been active at 270 strike price. The implied volatility sits at the 48th

percentile.

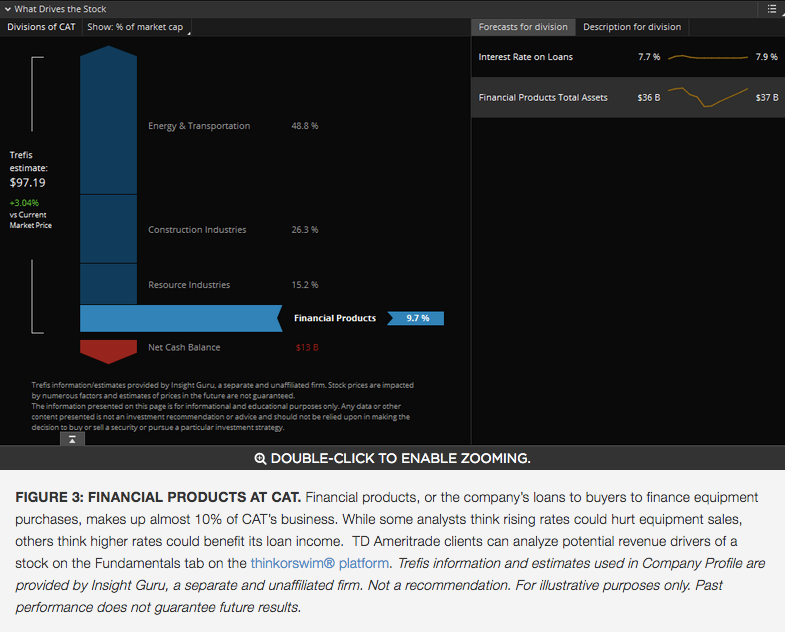

Caterpillar Earnings: Turnaround in Global Growth?

CAT has been hard hit in recent years by a slowdown in global growth and a major drop in commodity prices. Revenues declined 18%

in 2016 and CFRA analysts expect another decrease of 2% in 2017 before returning to 5% growth in 2018.

To combat the downturn in certain business segments, management has focused on aggressively cutting costs and restructuring,

including laying off 10% of its workforce in 2016. Those restructuring costs are expected to negatively impact EPS by as much as

$0.60 in fiscal 2017, bringing the full-year EPS expectation to $2.30 at the midpoint of its sales and revenues outlook, according

to last quarter’s earnings press release. Last quarter, the company lowered its top-line guidance for 2017 by $500 million due to

the strengthening of the U.S. dollar.

For the first quarter, CAT is expected to report earnings of $0.62 per share on revenue of $9.36 billion, according to consensus

third-party analyst estimates. That’s the lowest estimate for earnings and revenues in the past 8 quarters with earnings per share

declining about 7.5% and revenue dropping just over 1% compared to Q1 2016.

The options market has priced in just over a potential 3.5% share price move in either direction around the earnings release,

according to the Market Maker Move indicator on the thinkorswim platform. Short-term options trading for calls has

been active at the 96.5 strike price and puts have been active at the 93 strike—just over and under the stock’s $94.32 Friday

close. The implied volatility sits at the 51st percentile.

For more earnings coverage, check out what might be expected when

McDonald's Corporation (NYSE: MCD)

The Coca-Cola Co (NYSE: KO), and

Chipotle Mexican Grill, Inc. (NYSE: CMG)

report

earnings tomorrow. Later in the week, tech titans Amazon.com, Inc. (NASDAQ: AMZN), Alphabet Inc (NASDAQ: GOOG) (NASDAQ: GOOGL), Microsoft Corporation (NASDAQ: MSFT) and Intel Corporation (NASDAQ: INTC) report after market close on Thursday.

© 2017 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.