With Memorial Day ushering in the unofficial beginning of summer, gas prices are set to rise. The peak summer driving season is

typically a period when gas prices see an uptick due to the increase in demand. If a recent prediction by the American Automobile

Association, or AAA, comes true, Americans may have to brace for higher gas prices this long weekend amid the Markets' observance

of Memorial Day Monday.

Volume To Hit 12-Year High

A release from the AAA said about 39.3 million Americans

will travel 50+ miles this Memorial Day weekend, beginning Thursday and celebrated through Monday, when the Markets are closed.

The number represents a 1-million increase from last year and marks the highest Memorial Day travel volume since 2005.

"The expected spike in Memorial Day travel mirrors the positive growth seen throughout the travel industry this year," said Bill

Sutherland, AAA senior vice president of travel and publishing.

"Higher confidence has led to more consumer spending, and many Americans are choosing to allocate their extra money on travel

this Memorial Day."

Source: AAA

Means Of Travel

AAA forecasts 34.6 million Americans will hit the road, traveling by cars, an estimate up roughly 800,000 from 2016. The number

of travelers by car also represents a 12-year high and has been up for three straight years now. However, auto's share of travel

will slip 0.3 points to 88.1 percent. Meanwhile, air travel is set to see a 5.5 percent spike to 3 million, marking the fourth

straight year of growth.

Demand Up, Gas Prices To Follow Suit

AAA's survey, in partnership with IHS Markit, revealed that U.S. drivers may have to cough up the highest gas prices since 2015.

AAA expects travelers to be undeterred by higher gas prices.

Car rental companies could make a killing, as the AAA survey suggests more Americans are planning to rent cars for the holiday

weekend. Quoting data from Hertz Global Holdings, Inc (NYSE: HTZ), AAA said Friday could be the busiest day for car rental pick-up.

Favorable Economic Milieu

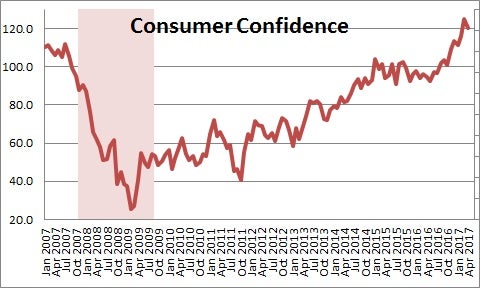

Consumers are brimming with confidence — a necessary precondition for spending decisions. Conference Board's survey showed that

consumer confidence rose to the highest level in 16 years in March before cooling off slightly in April.

Despite the downtick in April, confidence levels are still elevated, especially as President Donald Trump's election

raised hopes of a domestic economic revival through the protectionists and stimulatory policies promised during the campaign

trail.

Source: Numbernomics

In 2016, personal consumption expenditure rose at a fairly robust clip of 3.1 percent, although spending slowed in the first quarter to a 0.3 percent pace. Notwithstanding

the first-quarter slowdown, spending trends are fairly encouraging. The job market, which provides the wherewithal to spending has

also been showing good health.

End Of Easy Gas Prices?

Nationwide gas prices have cooled off since late April, falling from $2.43-a-gallon levels to below $2.33 levels by mid-May.

Since then, prices have begun ticking up. Currently, gas prices are around $2.355 a gallon.

However, AAA's forecast signals a spike in the coming days. AAA expects drivers to pay the highest Memorial Day gas prices since

2015.

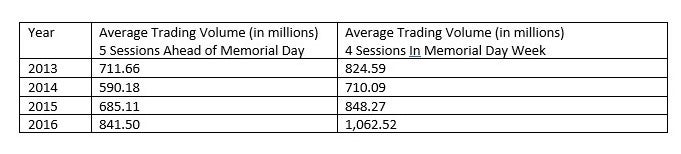

Trading Volume In Run Up To Memorial Day Weekend

Also noteworthy heading into the long weekend are the anemic trading volumes in the run up to Friday. Data over the past four

years show NYSE daily trading volumes remained anemic in the five sessions in the run up to the Memorial Day weekend. However,

volumes begin to pick up in the abbreviated week beginning the Tuesday after Memorial Day.

Apart from bracing for increased travel and higher gas prices, traders in the stock market may also have to prepare themselves

for light trading volumes.

Get ready for long drives and shelling out more dollars for gas, while also working on strategies to trade the low volume market

profitably.

Related Links:

Analyst: So Long,

Cheap(er) Gas Prices

Mondays

Are In Fact Good For Something: Gas Prices Are Usually Lower

© 2017 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.