(TheNewswire)

September 26, 2017 / TheNewswire / Vancouver, British Columbia;

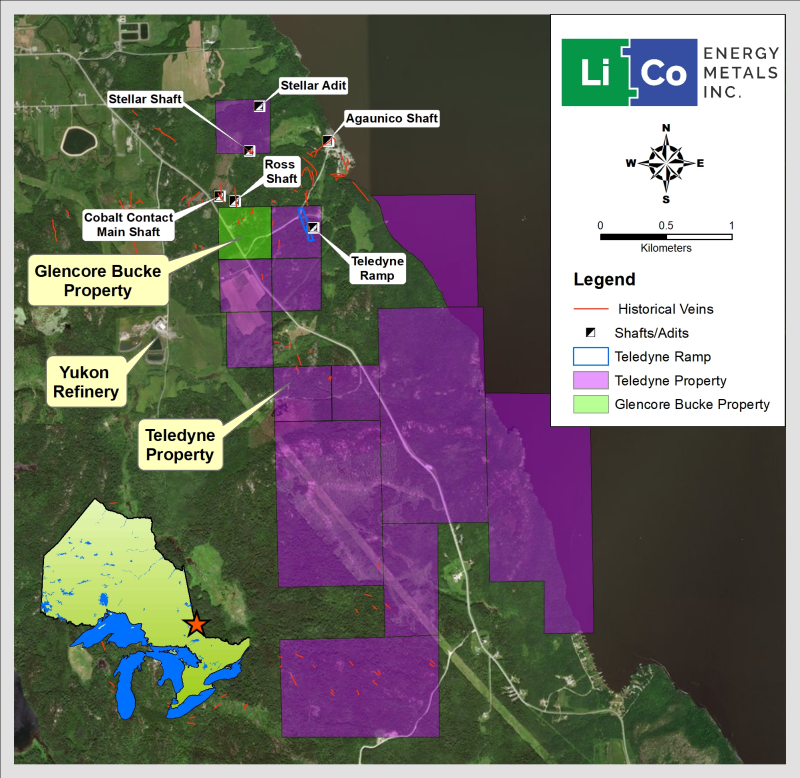

- LiCo Energy Metals Inc. (“the Company“ or “LiCo”) TSX-V: LIC; OTCQB: WCTXF is pleased to announce the commencement of its Phase 1

diamond drilling program on both its Teledyne and Glencore Bucke Cobalt Properties situated in Bucke and Lorrain Townships,

6 km east-northeast of Cobalt, Ontario, as originally announced on September 12th, 2017. The drill program has commenced and

the Company expects to drill upwards to a combined 3,500 m on the Glencore Bucke and Teledyne Properties. The drilling is

being conducted by an experienced diamond drill contractor, Chenier Drilling Services Ltd.

The Teledyne and Glencore Bucke Properties are managed by Joerg Kleinboeck, P.Geo. (LiCo’s QP), and supervised

by Mr. Dwayne Melrose, Director and Head of the Technical Advisory Board of LiCo. “The goal of this drilling program

will be to confirm the results of historical drilling on the properties and to further expand the resource potential up and down

dip and along strike. Drilling will commence on the Glencore Bucke Property for the initial 1,200 m of the drill program.

While we await assays, we will shift the drilling over to Teledyne to complete five or six holes totaling 1,000 m” states Mr.

Melrose.

Historically, Teledyne Canada Ltd. completed 36 diamond drill holes totaling 3,323.3 m on the Glencore Bucke

Property, and a combined 28 surface and underground diamond drill holes totaling 3,160.8 m on the Teledyne Property.

Diamond drilling completed by Teledyne Canada Ltd. on the Glencore Bucke Property delineated two zones of

mineralization measuring approximately 150 m and 70 m in length. The most significant results include 2.12% Co over 1.01 m in

diamond drill hole T-18, 0.62% Co over 2.74 m in diamond drill hole T-23, 0.66% Co over 0.73 m, 1.68% Co over 0.46 m in diamond

drill hole T-30, and 0.36% Co, 41 oz/t Ag over 0.58 m in diamond drill hole T-37 (Bresee, 1982). The historical reported

intersections represent core lengths, and not true widths.

Based on the surface diamond drill program completed in 1981 by Teledyne Canada Ltd, a historical

resource of 75,000 tons at an average grade of 0.45% Co, 3.0 oz/t Ag was estimated (Linn, 1983). The resource estimate

is a historical estimate as defined by National Instrument 43-101. There was been no review of the methods and results of

this historical resource estimate by a Qualified Person. No attempt was made to reconcile the historical resource

calculations as reported by Teledyne Tungsten. LiCo is not treating the historical resource estimate as a current mineral

resource or mineral reserve.

Diamond drilling by Teledyne Canada Ltd. on the Teledyne Cobalt Property encountered two zones of cobalt/silver

mineralization extending from the boundary of mined zones at the Agaunico Mine in a north-south direction. Historically, the

Agaunico Mine produced 4,350,000 lbs. of cobalt and 980,000 oz. of silver during the mining boom of the early 1900’s

(Cunningham-Dunlop, 1979). In 1979, Teledyne completed 6 surface diamond drill holes totaling 1,281.1 m. In 1980,

Teledyne completed a 700 m long production decline designed to reach the mineralization encountered in their recently completed

surface diamond drill program. A total of 22 underground diamond drill holes totaling 1,879.7 m were completed. Both

the surface and underground drilling programs indicated the presence of significant cobalt mineralization extending from the

past-producing Agaunico Mine onto the Teledyne Cobalt Property for a strike length of 152.4 m. In addition, the drill program

encountered a second zone with a strike length of 137.2 m. The most significant results included 0.644% Co over 16.9 m in

diamond drill hole UT-2, 0.74% Co over 8.7 m in diamond drill hole UT-3, and 2.59% Co over 2.4 m in diamond drill hole UT-18

(Bresee, 1981). The historical reported intersections represent core lengths, and not true widths.

Based on the surface and underground diamond drill programs completed between 1979 and 1981 by

Teledyne Canada Ltd, a historical resource of 100,000 tons at an average grade of 0.45% Co, 0.6 oz/t Ag was estimated (Linn, 1983).

The resource estimate is a historical estimate as defined by National Instrument 43-101. There was been no

review of the methods and results of this historical resource estimate by a Qualified Person. No attempt was made to

reconcile the historical resource calculations as reported by Teledyne Tungsten. LiCo is not treating the historical resource

estimate as a current mineral resource or mineral reserve.

The drilling will be conducted as part of LiCo’s flow thru financing and work commitments for the Glencore Bucke

Property.

Click Image To View Full Size

About LiCo Energy Metals : https://licoenergymetals.com/

LiCo Energy Metals Inc. is a Canadian based exploration company whose primary listing is on the TSX Venture

Exchange. The Company's focus is directed towards exploration for high value metals integral to the manufacture of lithium ion

batteries.

Glencore Bucke Cobalt Project, Cobalt, Ontario : The Company has

entered into a property purchase agreement to acquire a 100% interest from Glencore Canada Corporation (subsidiary of Glencore plc)

in the Glencore Bucke Property, situated in Bucke Township, 6 km east-northeast of Cobalt, Ontario, subject to

a back-in provision, production royalty and off-take agreement. Strategically, the Glencore Bucke Property

consists of 16.2 hectares and sits along the west boundary of LiCo’s Teledyne Cobalt Project. The Property covers the

southern extension of the #3 vein that was historically mined on the neighbouring Cobalt Contact Property located to the north of

the Glencore Bucke Property. Diamond drilling in 1981 on the Glencore Bucke Property delineated two zones of mineralization

measuring 150 m and 70 m in length.

Ontario Teledyne Cobalt Project:

The Company has an option to earn 100% ownership, subject to a royalty, in the Teledyne Project located near

Cobalt. Ontario. The Property adjoins the south and west boundaries of claims that hosted the Agaunico Mine. From 1905

through to 1961, the Agaunico Mine produced a total of 4,350,000 lbs. of cobalt and 980,000 oz. of silver. A significant portion of

the cobalt that was produced at the Agaunico Mine located along structures that extended southward onto property currently under

option to LiCo Energy Metals.

Chile Purickuta Lithium Project:

The Purickuta Project is located within Salar de Atacama, a salt flat encompassing 3,000 km2, being about 100

km long, 80 km wide and home to approximately 37% of the worlds Lithium production. The salar possesses a very high grade of

both Lithium (1,840mg/l) and Potassium (22,630mg/l and is close to power, labour, communications, transportation and other

infrastructure. The property of 160 hectares is enveloped by a concession owned by Sociedad Quimica y Minera (“SQM”) and

lies, significantly, within a few kilometers of the property of CORFO (the Chilean Economic Development Agency) where its leases to

both SQM and Albermarle’s Rockwood Lithium Corp Together these two companies have combined production of over 62,000 tonnes of LCE

(Lithium Carbonate Equivalent) annually making up 100% of Chile’s current lithium output. The unique characteristics of Salar

de Atacama make finished lithium carbonate easier and cheaper to produce than any of its peer group globally.

Purickuta is a smaller exploitation concession rather than a large exploration concession thereby accelerating

the task of taking the project to production once a measured reserve can be established. Currently, the Chilean government

retains ownership of lithium separate from other minerals and thus production can only proceed upon receipt of a special lithium

operation contract know as a “CEOL”. In the future, it will be necessary for LiCo and partner to negotiate a production

contract with CORFO concurrently with completing any positive feasibility study. “Chile, which has one of the world's most

plentiful supplies of lithium, is pushing ahead with new policies to develop those reserves”. (Reuters Jan 2, 2017).

Nevada Dixie Valley Lithium Project:

The Company has an option to acquire a 100% interest, subject to a 3% NSR, on a large lithium exploration

project at the Humboldt Salt Marsh in Dixie Valley, Nevada. The geologic setting and presence of lithium in active geothermal

fluids and surface salts in Dixie Valley match characteristics of producing lithium brine deposits at Clayton Valley, Nevada and in

South America.

Nevada Black Rock Desert Lithium Project:

The Company has entered into an option agreement whereby the Company may earn an undivided 100% interest,

subject to a 3% NSR, in the Black Rock Desert Lithium Project in southwest Black Rock Desert, Washoe County, Nevada.

The Company is planning an exploration programs on a number of its properties over the next several months.

The technical content of this news release has been reviewed and approved Joerg Kleinboeck, P.Geo., an independent consulting

geologist and a qualified person as defined in NI 43-101.

On Behalf of the Board of Directors

Tim Fernback, President & CEO

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in

the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Disclaimer for Forward-Looking Information:

This news release may contain forward-looking statements which include, but are not limited to,

comments that involve future events and conditions, which are subject to various risks and uncertainties. Except for statements of

historical facts, comments that address resource potential, upcoming work programs, geological interpretations, receipt and

security of mineral property titles, availability of funds, and others are forward-looking. Forward-looking statements are not

guarantees of future performance and actual results may vary materially from those statements. General business conditions are

factors that could cause actual results to vary materially from forward-looking statements.

Copyright (c) 2017 TheNewswire - All rights reserved.