"The only ASX listed company producing high value lithium chemicals for the growing battery and industrial

market"

BRISBANE, Australia, Oct. 27, 2017 /PRNewswire/ --

SEPTEMBER QUARTER 2017 KEY POINTS1

OLAROZ LITHIUM FACILITY (ORE 66.5%) 2

- Production through the September quarter was 2,135 tonnes of lithium carbonate with consecutive increases month on month as

brine concentration and evaporation rates increased

- Production has continued to increase in October, and is on track to achieve budget of 1,220 tonnes for the month.

Production has averaged 44 tonnes per day (90% of design) over the past week as brine concentration continued to rise in line

with modelling

- The Company reiterates guidance for the full year of 14,000 tonnes of lithium carbonate with production split approximately

45/55 between the first and second halves with record production expected in the December quarter at a production cost of

<US$4,000/tonne

- Sales revenue for the September quarter is US$23.2 million on total sales of 2,072 tonnes of

lithium carbonate

- Average FOB price received up 5% quarter on quarter (QoQ) to US$11,190/tonne with higher

priced contracts reflecting firmer market conditions. Prices are expected to continue to exceed US$11,000 per tonne FOB in the December FY18 quarter with market conditions remaining tight

- Cash costs (on cost of goods sold basis) were US$4,987/tonne as a result of lower production

volumes in July and August and increased soda ash unit costs caused by the impact of bad weather in June

- Gross cash margins remained strong at US$6,203/tonne and are expected to increase as costs

reduce to previous levels with increased production rates, and normalised soda ash costs and consumption

- SDJ SA (SDJ) made a payment of US$14 million (100% basis) to Mizuho

Bank against the project finance facility. The Mizuho loan balance has now been reduced by US$47 million over the last two years

- A review of the Olaroz pond system by a team of experts from the Chilean office of multinational engineering group GHD Pty

Ltd found there were no design faults that would prevent overall plant production of 17,500 tonnes per year. The team

comprised five professionals covering all aspects of pond design and operations with collectively over 75 years of pond design

and operating experience. This review refutes misinformation and market commentary suggesting the need for substantial

capital to rectify the Olaroz pond system

- Submissions have been made to the Japanese government for substantial subsidies and rebates relating to construction costs

of the 10,000 tonne per annum battery grade lithium hydroxide plant, a response to this submission is expected in November

BORAX ARGENTINA

- Overall sales volume in the September quarter was 8,543 tonnes (11,398t last quarter). This follows the strategic exit of a

loss making, high volume mineral product line for the Agricultural market in Brazil

- Sales of refined higher product value borates (decahydrate, pentahydrate, anhydrous and DOT) were up 26% on volume compared

to the previous corresponding period

- The average sales price increased by approximately 20% with the change in product mix

- The Tincalayu Expansion Project feasibility study (from 30,000 tonnes to 120,000 tonnes decahydrate equivalent and 40,000

tonnes of Boric Acid) is 90% complete with the various components undergoing internal review

ADVANTAGE LITHIUM AND CAUCHARI

- Advantage Lithium (ORE 35%) announced results from 48 hours of pump tests at drill hole CAU10 with an average lithium grade

of 682 milligrams per litre (mg/l) and a Mg/Li ratio averaging 2.1:1. Sampling from the CAU09 rotary hole averaged 662 mg/l

lithium with a Mg/Li ratio of 2.2:1. These concentrations are significantly above the resource grade

CORPORATE

- As at 30 September 2017, Orocobre Group had US$46.6 million of available cash after providing

funding for a working capital build at Borax Argentina

- The Company executed agreements with Lithium X Energy Corp. for the sale of Diablillos tenements for cash and shares with a

value of approximately US$2m and a 1% net revenue based royalty on future production.

The shares have been issued and the cash component will be received in this quarter

OLAROZ LITHIUM FACILITY

For more information

on Olaroz please click here

The Olaroz Lithium Facility is located in the Jujuy province of Argentina. Together with partners, Toyota Tsusho Corporation

(TTC) and Jujuy Energia y Mineria Sociedad del Estado (JEMSE), Orocobre is now operating the first large scale

lithium chemicals brine based facility to be commissioned in approximately 20 years.

Olaroz produces high quality lithium carbonate chemicals for both the battery and industrial markets. It is the only

operation in the world with an integrated purification circuit that permits it to produce, if desired, 100% battery grade lithium

carbonate (+99.5%) on site.

The Olaroz Lithium Facility joint venture is operated through Argentine subsidiary Sales de Jujuy S.A. The effective equity

interests are: Orocobre 66.5%, TTC 25.0% and JEMSE 8.5%.

PRODUCTION, SALES AND OPERATIONAL UPDATE

PRODUCTION AND SALES

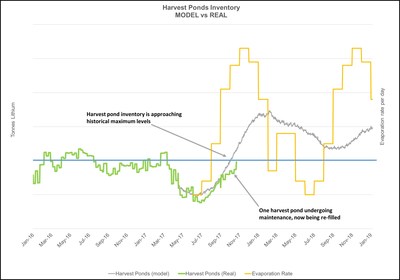

Production for the quarter was 2,135 tonnes. As in the previous quarter, operations continued to be impacted by slow

evaporation rates related to winter weather conditions and the finalisation of the pond rebalancing process previously

disclosed. Since early September, evaporation rates have increased significantly resulting in increased brine

concentration, increased harvest pond inventory and increasing production rates as feed brine concentration has risen. This trend

has continued into October as discussed later in the report.

Sales revenue for the quarter was US$23.2 million on total sales of 2,072 tonnes with average

sales prices up 5% to US$11,190/tonne3. Operating costs (on a cost of goods sold

basis) were US$4,987/tonne, up 17% QoQ due to lower production levels and the impact of higher soda

ash unit costs. As reported on 22 June 2017, bad weather in NW Argentina resulted in Olaroz

procuring alternative sources of soda ash during June and July at significantly higher than normal cost. The soda ash costs

resulted in higher inventory unit costs being carried forward into July which combined with lower production months of July and

August resulted in higher costs for the September quarter. Lower unit costs from higher production rates in the month of

September are carried forward with inventory into October.

|

Metric

|

September

quarter 2017

|

June

quarter 2017

|

Change QoQ (%)

|

|

Production (tonnes)

|

2,135

|

2,536

|

-16%

|

|

Sales (tonnes)

|

2,072

|

2,566

|

-19%

|

|

Average price received (US$/tonne)

|

11,190

|

10,696

|

5%

|

|

Cost of sales (US$/tonne) 4

|

4,987

|

4,279

|

17%

|

|

Revenue (US$M)

|

23.2

|

27.4

|

-15%

|

|

Gross cash margin (US$/tonne)

|

6203

|

6417

|

-3%

|

|

Gross cash margin (%)

|

55%

|

60%

|

-8%

|

Five days of plant planned maintenance was brought forward to this quarter to minimise the impact later in the year when daily

production rates are expected to be higher. Costs are expected to decrease to <US$4,000/tonne in

the December quarter as brine concentration and production increases.

Gross cash margins for the quarter remained strong at US$6,203/tonne with the increase in sales

prices partially offsetting the increase in costs. Overall gross operating margins remain strong at 55%. SDJ remains

strongly operating cashflow positive.

OPERATIONAL UPDATE

During the quarter the Olaroz operations recorded the production of a cumulative 20,000 tonnes of lithium carbonate since

operations commenced in 2015. This milestone is testament to the operational team at Olaroz who have relentlessly pursued

operational excellence in developing the first new brine operation in 20 years. These development and operating skills

provide an on-going competitive advantage for Orocobre in the multi-phase development of Olaroz.

Over the September quarter the focus has remained on pond management both from the perspective of inter-pond brine transfer

and operational controls and monitoring. The design and upgrade for the improved transfer and pumping system required the

installation of six new pumps, remote monitoring systems and additional water cleaning lines for a revised capital cost of

US$2.7m. This program is mostly complete and the final two pumps are expected to be installed

in the first weeks of November in time for increased evaporation rates which will necessitate increased inter-pond brine

transfers.

As noted in February, the process of re-establishing the correct inventory profile (volume and concentration) would take

approximately six months, this is now complete and concentrations across the entire pond system are now approaching steady state

conditions. With increasing brine concentration, the production rate and recovery have risen, and reagent consumption rate

has decreased. Production during October is on track to deliver the budget of 1,220 tonnes for the month the same as

produced in July and August combined. In the last seven days production has averaged 46 tonnes per day (96% of design) and

record production is expected for the December quarter. The Company reiterates guidance for the full year of 14,000 tonnes

with production split approximately 45/55 between the first and second halves of the financial year.

The chart below shows the seasonality of average evaporation rates and the historical and forecast harvest pond inventory

profile. The harvest pond inventory continues to increase generally in line with expectations and is approaching maximum

historical levels. The deviation through October was due to one harvest pond being taken out of circuit for maintenance

works to recover brine storage capacity which had been reduced by the secondary liming process which occurs on the brine feed to

that pond. Last week the pond was brought back into circuit and it is now being re-filled. The primary and

intermediate ponds are showing very good correlation to modelling. The Company is encouraged that the measured data across the

pond system is much as predicted from the pond evaporation and production model.

Bathymetric surveys are complete and data is being analysed. The Company does not expect any significant changes to

inventory levels or production guidance from this work, as such brine inventory levels will be reported at half and full year

results.

Prior to pond management issues and a constraint of feedstock, the purification circuit has achieved a maximum throughput rate

of 43 tonnes per day (tpd) and run consistently at 35-40 tpd (73-83% of nameplate). Hydrocyclones have been installed and

are operational, these are expected to allow the purification circuit to achieve nameplate capacity of approximately 48 tonnes

per day over the coming months.

The primary circuit runs consistently above nameplate capacity with a maximum achieved throughput of 66 tpd, some 35% above

design rate of 48 tpd.

Carbon dioxide recovery

Carbon dioxide is used at the Olaroz lithium facility in the production of battery grade lithium carbonate. It is currently

sourced from near Buenos Aires, Cordoba and Mendoza and

transported up to 1,800 kilometres by truck. Consequently, it is a significant component of reagent costs and the Company

is installing CO2 recovery systems on various parts of the purification circuit to recover CO2 from the

production process.

Results from a engineering studies and a trial plant over the last year have demonstrated that recovery of up to 50% of total

CO2 is possible, and orders have now been placed for provision and installation of permanent equipment. Capital

expenditure on this project is expected to be less than US$2M. The CO2 plant is

supplied as a package by a specialist manufacturer in Europe.

Installation and operation of the permanent CO2 recovery equipment is expected in the June Quarter 2018.

Third party review of pond design

A review of the Olaroz pond system by a team of experts from the Chilean office of multinational engineering group GHD Pty Ltd

who collectively have more than 75 years of pond design and management experience has been completed. The review concluded that

there were no design faults that would prevent overall plant production of 17,500 tonnes per year. Since February the Company has

spent US$2.7 million on the addition of pumps and monitoring systems, and considers this work is

now effectively complete and has achieved the aim of adding robustness to the pond system. Misinformation and market commentary

suggesting the need for substantial capital to rectify the pond system is incorrect.

MARKET AND SALES

Total volume of lithium carbonate sold in the September quarter was 2,072 tonnes. Lithium carbonate prices increased 5%

to US$11,190/tonne (FOB) for the quarter. The price achieved for the quarter is a result of higher

pricing in short term contracts compared to last quarter.

Since operations commenced Olaroz has developed a strong customer base of >70 customers who have tested and accepted the

high grade Purified and Prime products. The Purified product regularly tests at 99.9% lithium carbonate and is sold to

battery and cathode end users. The Prime product regularly tests at 99% lithium carbonate and is sold to a variety of

technical and industrial end users. Neither of these products require any additional processing for their respective

markets and uses.

LITHIUM MARKET

Analysis by Orocobre determined that demand for lithium continued to grow at a rate which supply struggled to meet.

Leading into the quarter, existing brine producers including SQM, Albemarle, and FMC confirmed ambitious expansions amounting to

approximately 100kt LCE additional supply by 2020. However, no significant new supply from the majors is thought to have

entered the market during the quarter, resulting in sustained market tightness.

Australian hard rock projects continued to steadily ramp-up following what Chinese import data showed was a slow start to the

year. Supply of spodumene concentrate from Mt Marion & Mt Cattlin was quickly absorbed by Chinese conversion plants

which otherwise rely on scarce domestic production and/or imported lithium carbonate. Key downstream processors are slowly

moving to meet growing market demand with expansions announced by Tianqi, Ganfeng, Albemarle, Yahua, Ruifu, General

Lithium. However, while those expansions would double the current installed conversion capacity it will require over

US$2.5Bn 5 capital (Company Announcements, Asian Metals). Security of supply

remains a concern with a number of capital guarantees and offtake agreements proposed to finance projects.

The shift toward partnerships between raw material suppliers and compounders/processors that occurred in 2016 appears to have

stretched further downstream with battery and car manufacturers eager to secure future raw material supply needed to meet

electric vehicle targets. It seems likely that this form of disintermediation will continue with Volvo, Volkswagen, Jaguar

Land Rover and BMW all announcing plans to have completely electrified vehicle fleets in the future.

Car manufacturers have been encouraged to accelerate EV expansion plans with growing awareness of future raw material supply

bottlenecks and the continued implementation of regulation requiring the switch to electric vehicles. China continues to develop new policy with the recent proposition of a point system in July similar to that

employed in California which penalizes internal combustion drivers and subsidises EV

manufacturers and owners (Industrial Minerals). The European Union has also announced plans to form a consortium that seeks

to address the lack of battery cell manufacturing capacity which may impact the speed new EV's can come to market.

Currently cell manufacturing is dominated by Japanese firms like Panasonic and NEC, Korea's LG and Samsung and China's BYD and CATL.

New and varied forms of collaboration between Government and industry provides greater certainty that short- and long-term

demand for lithium can only grow and push EV penetration rates to over 5% p.a. by 2020. It is the Company's expectation

that any new lithium supply to enter the market during this time will be quickly absorbed, keeping prices above US$10,000 per tonne FOB in the short term.

LITHIUM HYDROXIDE PLANT

UPDATE ON PROGRESS

Olaroz industrial grade lithium carbonate and locally sourced Japanese lime have been used as feedstock for testing of process

design to produce lithium hydroxide by two specialised engineering firms. The test work demonstrated that a very high-quality

lithium hydroxide could be produced from Olaroz lithium carbonate using a customised process. The test work has also

highlighted opportunities to reduce lithium losses during conversion from carbonate to hydroxide.

Contract negotiations are continuing with the two engineering firms to determine the preferred contractor. The selection

criteria for choice of engineering contractor includes turn-key commissioning and personnel training with process, product

quality and performance guarantees.

Capital and operating costs have been supplied by one of the engineering firms during the September quarter. Information from

the second firm is expected in November.

Discussions with TTC are well advanced to determine the optimal joint venture structure for ownership and operation of the

hydroxide facility.

Submissions have been made in September to Japanese National and Provincial governments for development permits and subsidies

for capital costs and results from the submission are expected by the end of November. If successful, the subsidy support

could amount to up to 50% of total capital costs for construction of a lithium hydroxide plant.

Subject to joint venture approvals and finalisation of financing and permitting, construction is likely to commence in June

quarter 2018 with commissioning 12 months later. Orocobre does not anticipate the need to raise equity capital for this

project.

EXPANSION STUDY FOR OLAROZ

The Phase 2 expansion investment decision remains dependent on achieving Phase 1 design production rates and the expansion

being funded without further equity capital (i.e. funded by project finance and Phase 1 operating cashflow). Sustainable

production rates are expected to be achieved during the current summer period (southern hemisphere) and construction is therefore

likely to commence in the first half of 2018.

REVISED SCOPE OF PHASE 2 EXPANSION STUDIES

On 15 December 2016, Orocobre announced the results of scoping studies into the expansion of

Olaroz and the proposed doubling of production at a cost of US$190 million including US$25 million contingency. Subsequently, these plans have been simplified to remove the purification

circuit from the incremental production. The resultant product mix is 17,500 tonne per annum Battery Grade lithium carbonate

(>99.5%) from the existing purification circuit and 17,500 tonne per annum Industrial Grade lithium carbonate (avg. 99.0%)

which will provide feedstock for the planned lithium hydroxide plant in Japan.

This simplified strategy results in lower capital expenditure of approximately US$160 million

including a US$25 million contingency and lower implementation risk as the project is based around

a simple duplication of bores, ponds and primary circuit of Phase 1 at Olaroz. The full cost of the pond system contained within

the total capital expenditure estimate for Phase 2 is US$75 million.

Multinational engineering firm, GHD has been appointed to oversee engineering design studies for the Olaroz Phase 2

expansion.

Key permits have been received for water extraction, additional bores and new ponds from the Jujuy Provincial Government for

the expansion.

Plant layout and pond design is being finalised and soil tests have been completed over the new pond area. Flowsheets,

mass balance, an equipment list and design criteria have also been completed. Six layout options for the Li2CO3 plant and three

options for the liming plant are currently being considered and the preliminary design for the road, pump stations, piping and

electricity lines to new extraction bore holes were completed.

BORAX ARGENTINA

The current focus for Borax Argentina has been to restructure its business to deliver sustainable operational and financial

performance. This is resulting in a change in product mix as described below and an improvement in average pricing. During these

changes it has been necessary for Orocobre to provide financial support of US$2.4 million over the

quarter for the build of working capital.

OPERATIONS

Sales volumes in the September quarter 2017 were 8,543 tonnes of combined product, a reduction from the previous quarter

following the strategic exit of a loss making, high volume mineral product line for the Agricultural market in Brazil. A decision was made to exit this business as it was no longer commercially attractive. Borax has

been managing out of this supply arrangement during the quarter and a project is underway to develop a new product that delivers

improved value to customers and the business.

During the quarter production rates of refined products continued to increase month on month (up 26% compared to the previous

corresponding period) with record production achieved at Tincalayu and the Boric Acid plant at Campo Quijano. Costs are expected

to decrease as these unit production benefits are realised.

COMBINED PRODUCT SALES VOLUME BY QUARTER

|

Previous Year Quarters

|

|

Recent Quarters

|

|

December 2015

|

10,078

|

|

December 2016

|

8,767

|

|

March 2016

|

8,006

|

|

March 2017

|

9,672

|

|

June 2016

|

9,274

|

|

June 2017

|

11,398

|

|

September 2016

|

11,940

|

|

September 2017

|

8,543

|

TINCALAYU EXPANSION STUDY

A study commenced in Q2 CY16 to evaluate a potential expansion of the Tincalayu refined borates operation from its current

production capacity of 30,000 to 100-120,000 tonnes per annum and an integrated 40,000 tonne boric acid plant.

It is anticipated that the potential expansion will significantly increase efficiencies in the production of refined borates

at Tincalayu and contribute provide a step change improvement in unit costs. Approvals have been received for a new gas pipeline

to supply the expanded plant and initial cost estimates are under review.

The study is 90% complete with the various components undergoing internal review.

MARKET CONDITIONS

Market conditions remain challenging, however there are positive signs of economic recovery in South

America, with a recent press article in "MercoPress" forecasting a 10% sales and output growth in the automotive sector in

Brazil for 2018.

The continued focus on production efficiencies and product mix is required to cushion the effect of market pricing remaining

at the bottom of the price cycle.

In addition to price pressure the operations are seeing Argentine inflation of costs which are exceeding devaluation of the

Argentine Peso. Calendar year 2017 has seen inflation of 17.5% while the Peso has only devalued by 8.9%.

SAFETY AND COMMUNITY

SAFETY MILESTONES

The Olaroz site has recently achieved a significant milestone of 330 days of operation without a lost time injury (LTI).

At Borax, the Sijes mine site achieved two years without a LTI, Campo Quijano achieved one year without a LTI and Tincalayu

achieved six months without a LTI.

SHARED VALUE PROGRAM AND COMMUNITY

During the quarter Richard Seville (MD and CEO) was invited to join an Advisory Council with

CEADS (Argentine Business Council for Sustainable Development), an organization of which Orocobre is a member. This role

will further establish Orocobre's position as a leading and responsible lithium producer. http://www.ods.ceads.org.ar/

Sales de Jujuy and Borax Argentina received recognition for their commitment and contribution to academia in professional

practices and internships. A ceremony was held at the School of Engineering of Universidad Nacional de Salta with

representatives from both companies, the University and public officials.

Training and support has been provided in the fields of Chemical Engineering, Industrial Engineering, IT, Human resources,

Laboratory and Electromechanical services.

Orocobre group companies also collaborate with Universidad Católica de Salta; Siglo XXI, Universidad Nacional de Córdoba,

Universidad Nacional de San Juan and other international educational institutions.

SDJ General Manager Cristian Saavedra presented at the Seminar on Renewable Energy and

Sustainable Mining in Jujuy, providing an update on characteristics of the lithium process, the current demand in world markets,

the expansion of the Olaroz plant to meet such demand and the contribution to the development of communities. Other participants

included Miguel Soler, Secretary of Mining, Sandra Giunta, UNJu

representative at CIDMEJu and Franco Mignacco, President of EXAR.

ADVANTAGE LITHIUM

As previously announced, Orocobre completed the sale of a suite of exploration assets to Advantage Lithium Corp (TSV:AAL) in

the March 2017 quarter. AAL remains well funded having raised C$20,000,000 capital in February 2017. Orocobre holds 46,325,000 (35%) of the

issued shares of AAL and 2,550,000 warrants exercisable at C$1.

Orocobre retains a 50% interest in the Cauchari Project of Jujuy province in NW Argentina and

AAL has the right to increase its interest to a total of 75% by the expenditure of US$5,000,000 or

production of a Feasibility Study. AAL also took a 100% interest in five other lithium properties that were previously held by

Orocobre totalling 85,543 hectares.

Initial drilling results

During the quarter, Advantage Lithium advised of initial test results from drilling and testing at the Cauchari Salar.

Initial results from the first set of composite brine samples from hole CAU10 in the SE sector of Cauchari (see hole location

in Figure below) have returned an average lithium grade of 678 milligrams per litre (mg/l) with sample results ranging from 585

to 724 mg/l lithium and Mg/Li ratios averaging 2.1:1. These concentrations are significantly higher than the resource grade.

Hole CAU10 is part of a two phase program totalling 17 holes which will lead to a scoping study. Three drill rigs are engaged

on this program.

Sampling from the CAU09 rotary hole averaged 662 mg/l lithium with a Mg/Li ratio of 2.2:1 and geological logging of CAU07

indicated high quality sand and gravel units similar to the most productive units at Olaroz. Drilling is continuing.

Senior Technical Appointments

Advantage Lithium also strengthened its technical capability with the addition of Andy Robb as

Technical Advisor and Frits Reidel as a consulting Independent Qualified Person. Andy has held

significant technical and management roles with companies such as BHP Billiton and AMC Consulting. Andy was VP South America and

Project Director for Enirgi Group Corporation where he had responsibility for over 200 Operational and Project staff and was

instrumental in the completion of the NI43-101 compliant Definitive Feasibility Study for the Rincon lithium brine project

located in Salta.

Fritz and his team at FloSolutions have vast experience in brine resource evaluation, salt-lake exploration, hydrogeology,

drilling methods, well construction, and testing gained from working on numerous projects such as Olaroz, Cauchari (Lithium

Americas) and Maricunga.

Drill Hole Location and Details

|

Exploration Hole

Number

|

Total

Depth (m)

|

Installed

Depth

(m)

|

Assay

Interval

(m)

|

Lithium

(mg/l avg)

|

Potassium

(mg/l avg)

|

Drilling

method

|

Coordinates Gauss

Kruger Argentine Zone3

Posgar Datum

|

Elevation

mean sea

level (m)

|

Azimuth

|

Dip

|

|

|

|

|

|

|

|

Easting

|

Northing

|

|

|

|

|

CAU10

|

429

|

340

|

50-340

|

678

|

6,516

|

Rotary

|

3,425,530

|

7,379,295

|

3,900

|

0

|

-90

|

|

CAU09

|

400

|

400

|

60-400

|

662

|

6,137

|

Rotary

|

3,423,775

|

7,377,806

|

3,900

|

0

|

-90

|

|

CAU07

|

275

|

Not installed

|

Awaiting Results

|

Diamond

|

3,421626

|

7,385,385

|

3,930

|

0

|

-90

|

|

*Planned Coordinates - not confirmed by surveying at date of

release

|

CORPORATE AND ADMINISTRATION

DIABLILLOS

Subsequent to the end of the quarter, Orocobre announced the execution of agreements with Lithium X Energy Corp.

(TSXV:LIX) (OTCQX: LIXXF) ("Lithium X") in respect of tenure held by Orocobre subsidiaries, Borax Argentina S.A.

("Borax") and South American Salars S.A. ("SAS") at the Salar de Diablillos.

Lithium X through its wholly-owned subsidiary, Potasio Litio de Argentina S.A. (PLASA) will

acquire 2,700 hectares of tenements from Borax over which Lithium-X currently holds usufruct rights for the extraction of lithium

brines. Lithium-X will also acquire a further 700 hectares owned by SAS which had been excluded from the Advantage Lithium

transaction (ASX release 28 March 2017). These tenements will be consolidated into the PLASA project, Sal de los Angeles (SDLA) in Salta Province, Argentina.

Under the agreement:

- PLASA acquires mineral title to the Borax and SAS tenements

- PLASA grants a usufruct right in favour of Borax over the Borax tenements in relation to the extraction of surface ulexite

mineralisation

- PLASA agrees to pay to Borax US$250,000 and to issue 650,000 common shares of Lithium X to

Borax or its nominee

- PLASA acquires the SAS tenements for consideration of US$750,000 payable to Orocobre upon

certain conditions being met by SAS

- PLASA and Borax agree to cancel the existing 1.5% Mine Mouth Royalty6 on the Borax held tenements, in

consideration of a 1% Net Revenue Royalty over the entire SDLA project, and

- Orocobre and PLASA mutually release each other from any potential or existing claims due to past activities by either

party.

FINANCE

VAT

VAT refunds continue to be received on a timely basis and during the quarter approximately US$4.1M was received by SDJ.

Post the end of the quarter, July's VAT presentation of ~US$1.5M was approved and such funds

received whilst the August presentation has been submitted for approval.

CASH BALANCE, DEBT POSITION AND STANDBY LETTERS OF CREDIT

As at 30 September 2017, Orocobre Group had available cash of US$46.6

million and net debt of US$68.4 million. During the quarter, approximately US$2.4 million was provided to Borax Argentina to support a build of working capital. Corporate costs

were US$1.8 million and US$0.8 million was paid as a deposit for a

property acquisition. Further details of the acquisition will be provided upon completion of the transaction.

SDJ made a finance payment to Mizuho Bank in September 2017 of

approximately US$14 million including principal and interest thereby reducing the outstanding

principal on this facility to US$144.9M (Original facility US$191.9M).

INFLATION VERSUS DEVALUATION

The AR$/US$ exchange rate weakened by 4% during the quarter from AR$16.63/US$ at 30 June

2017 to AR$17.31/US$ at 30 September 2017 whilst inflation for the same period was 5.7%.

When looking at specific periods such as the calendar year to 30 September, devaluation of the AR$ against the US$ was 8.9%

versus inflation of 17.5%. This resulted in 8.6% higher than expected US$ costs for ARS peso denominated expenses for the period,

resulting in higher costs at Borax Argentina and to a much lesser extent, SDJ. The effect of inflation and devaluation over time

generally shows that they cancel each other out.

ANNUAL GENERAL MEETING

The Company will hold its Annual General Meeting at 9am AEST on 24 November at L23, 480 Queen

Street, Brisbane. A Notice of Meeting has been released through the ASX with explanatory notes, however the following is

provided as further explanation of the increase in the Remuneration Pool for Directors fees.

Resolution 6 proposes to increase the Directors fee pool by A$250,000 in order to provide scope

for the addition of new Directors to the Board and an increase for existing Directors whose fees have not been increased since

2014. It is the view of the current Board, that as the Company executes the proposed growth strategy the Board may require

additional Directors with an expanded variety of skills and experience. This resolution will provide suitable scope for

remuneration of those new Directors.

FOR FURTHER INFORMATION PLEASE CONTACT:

Andrew Barber

Investor Relations

Manager

Orocobre

Limited

T: +61 7 3871

3985

M:+61 418 783

701

E: abarber@orocobre.com

ABOUT OROCOBRE LIMITED

Orocobre Limited is listed on the Australian Securities Exchange and Toronto Stock Exchange (ASX:ORE) (TSX:ORL), and is

building a substantial Argentinian-based industrial chemicals and minerals company through the construction and operation of its

portfolio of lithium, potash and boron projects and facilities in the Puna region of northern Argentina. The Company has built,

in partnership with Toyota Tsusho Corporation and JEMSE, the first large-scale, greenfield brine based lithium project in

approximately 20 years at the Salar de Olaroz with planned production of 17,500 tonnes per annum of low-cost lithium

carbonate.

The Olaroz Lithium Facility has a low environmental footprint because of the following aspects of the process:

- The process is designed to have a high processing recovery of lithium. With its low unit costs, the process will result in

low cut-off grades, which will maximise resource recovery.

- The process route is designed with a zero liquid discharge design. All waste products are stored in permanent impoundments

(the lined evaporation ponds). At the end of the project life the ponds will be capped and returned to a similar profile

following soil placement and planting of original vegetation types.

- Brine is extracted from wells with minimum impact on freshwater resources outside the salar. Because the lithium is in

sedimentary aquifers with relatively low permeability, drawdowns are limited to the salar itself. This is different from halite

hosted deposits such as Salar de Atacama, Salar de Hombre Muerto and Salar de Rincon where the halite bodies have very high near surface permeability and the drawdown cones can

impact on water resources around the Salar affecting the local environment.

- Energy used to concentrate the lithium in the brine is solar energy. The carbon footprint is lower than other

processes.

- The technology developed has a very low maximum fresh water consumption of <20 l/s, which is low by industry standards.

This fresh water is produced by reverse osmosis from non-potable brackish water.

- Sales de Jujuy S.A. is also committed to the ten principles of the sustainable development framework as developed by The

International Council on Mining and Metals. The Company has an active and well-funded "Shared Value" program aimed at the long

term development of the local people.

The Company continues to follow the community and shared value policy to successfully work with suppliers and the employment

bureau to focus on the hiring of local people from the communities of Olaroz, Huancar, Puesto Sey, Pastos Chicos, Catua, Susques,

Jama, El Toro, Coranzulí, San Juan and Abrapampa. The project

implementation is through EPCM (Engineering, Procurement and Construction Management) with a high proportion of local involvement

through construction and supply contracts and local employment. The community and shared value policy continues to be a key

success factor, training local people under the supervision of high quality experienced professionals.

TECHNICAL INFORMATION, COMPETENT PERSONS' AND QUALIFIED PERSONS STATEMENTS

The Company is not in possession of any new information or data relating to historical estimates that materially impacts on

the reliability of the estimates or the Company's ability to verify the historical estimates as mineral resources, in accordance

with the JORC Code. The supporting information provided in the initial market announcement on 21/08/12 continues to apply and has not materially changed. Additional information relating to the Company's

Olaroz Lithium Facility is available on the Company's website in "Technical Report – Salar de Olaroz Lithium-Potash Project,

Argentina" dated May 113, 2011 which was prepared by John Houston, Consulting Hydrogeologist,

together with Mike Gunn, Consulting Processing Engineer, in accordance with NI 43-101.

CAUTION REGARDING FORWARD-LOOKING INFORMATION

This news release contains "forward-looking information" within the meaning of applicable securities legislation.

Forward-looking information contained in this release may include, but is not limited to, the completion of commissioning, the

commencement of commercial production and ramp up of the Olaroz Lithium Facility and the timing thereof, the cost of construction

relative to the estimated capital cost of the Olaroz Lithium Facility, the meeting of banking covenants contained in project

finance documentation, the design production rate for lithium carbonate at the Olaroz Lithium Facility, the expected brine cost

and grade at the Olaroz Lithium Facility, the expected operating costs at the Olaroz Lithium Facility and the comparison of such

expected costs to expected global operating costs, the estimation and conversion of exploration targets to resources at the

Olaroz Lithium Facility, the viability, recoverability and processing of such resources, the potential for an expansion at the

Olaroz Lithium Facility and the outcome of studies currently being undertaken into the proposed expansion at Olaroz and

elsewhere, the capital cost of an expansion at the Olaroz Lithium Facility; the future performance of the relocated borax plant

and boric acid plant, including without limitation the plants estimated production rates, financial data, the estimates of

mineral resources or mineralisation grade at Borax Argentina mines, the economic viability of such mineral resources or

mineralisation, mine life and operating costs at Borax Argentina mines, the projected production rates associated with the borax

plant and boric acid plant, the market price of borate products whether stated or implied, demand for borate products and other

information and trends relating to the borate market, taxes including recoveries of IVA, royalty and duty rate and the ongoing

working relationship between Orocobre and the Province of Jujuy, TTC and Mizuho Bank.

Such forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause actual

results to be materially different from those expressed or implied by such forward-looking information, including but not limited

to the risk of further changes in government regulations, policies or legislation; the possibility that required concessions may

not be obtained, or may be obtained only on terms and conditions that are materially worse than anticipated; that further funding

may be required, but unavailable, for the ongoing development of the Company's projects; changes in the scope and focus of

studies currently being undertaken with respect to the expansion of the Company's production facilities, fluctuations or

decreases in commodity prices and market demand for product; uncertainty in the estimation, economic viability, recoverability

and processing of mineral resources; risks associated with weather patterns and impact on production rate; risks associated with

commissioning and ramp up of the Olaroz Lithium Facility to full capacity; unexpected capital or operating cost increases;

uncertainty of meeting anticipated program milestones at the Olaroz Lithium Facility; general risks associated with the further

development of the Olaroz Lithium Facility; general risks associated with the operation of the borax plant or boric acid plant;

the potential for an expansion at the Tincalayu operations and the outcome of studies currently being undertaken into the

proposed expansion at Tincalayu a decrease in the price for borates resulting from, among other things, decreased demand or an

increased supply of borates or substitutes, as well as those factors disclosed in the Company's Annual Report for the year ended

June 30, 2017 filed at www.sedar.com .

The Company believes that the assumptions and expectations reflected in such forward-looking information are reasonable.

Assumptions have been made regarding, among other things: the timely receipt of required approvals and completion of agreements

on reasonable terms and conditions; the ability of the Company to obtain financing as and when required and on reasonable terms

and conditions; the prices of lithium, potash and borates; market demand for products and the ability of the Company to operate

in a safe, efficient and effective manner. Readers are cautioned that the foregoing list is not exhaustive of all factors and

assumptions which may have been used. There can be no assurance that forward-looking information will prove to be accurate, as

actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should

not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking

information, except in accordance with applicable securities laws.

1All figures presented in this report are unaudited

2All figures 100% Olaroz Project basis

3Note: Orocobre reports price as "FOB" (Free On Board) which excludes additional insurance and freight charges

included in "CIF" (Cost, Insurance and Freight or delivered to destination port) pricing. The key difference between an FOB

and CIF agreement is the point at which responsibility and liability transfer from seller to buyer. With a FOB shipment, this

typically occurs when the goods pass the ship's rail at the export port. With a CIF agreement, the seller pays costs and assumes

liability until the goods reach the port of destination chosen by the buyer. The Company's pricing is also net of TTC

commissions.

The intention in reporting FOB prices is to provide clarity on the sales revenue that flows back to SDJ, the joint venture

company in Argentina.

4Excludes royalties and head office costs

5Assumes capital intensity of Tianqi Kwinana plant US$400M for 24ktpa LCE conversion

plant.

6Mine Mouth Royalty is calculated as revenue less all costs incurred from the point of brine extraction.

View original content with multimedia:http://www.prnewswire.com/news-releases/orocobre-limited-quarterly-report-of-operations-for-the-period-ended-30-september-2017-300544696.html

SOURCE Orocobre Limited